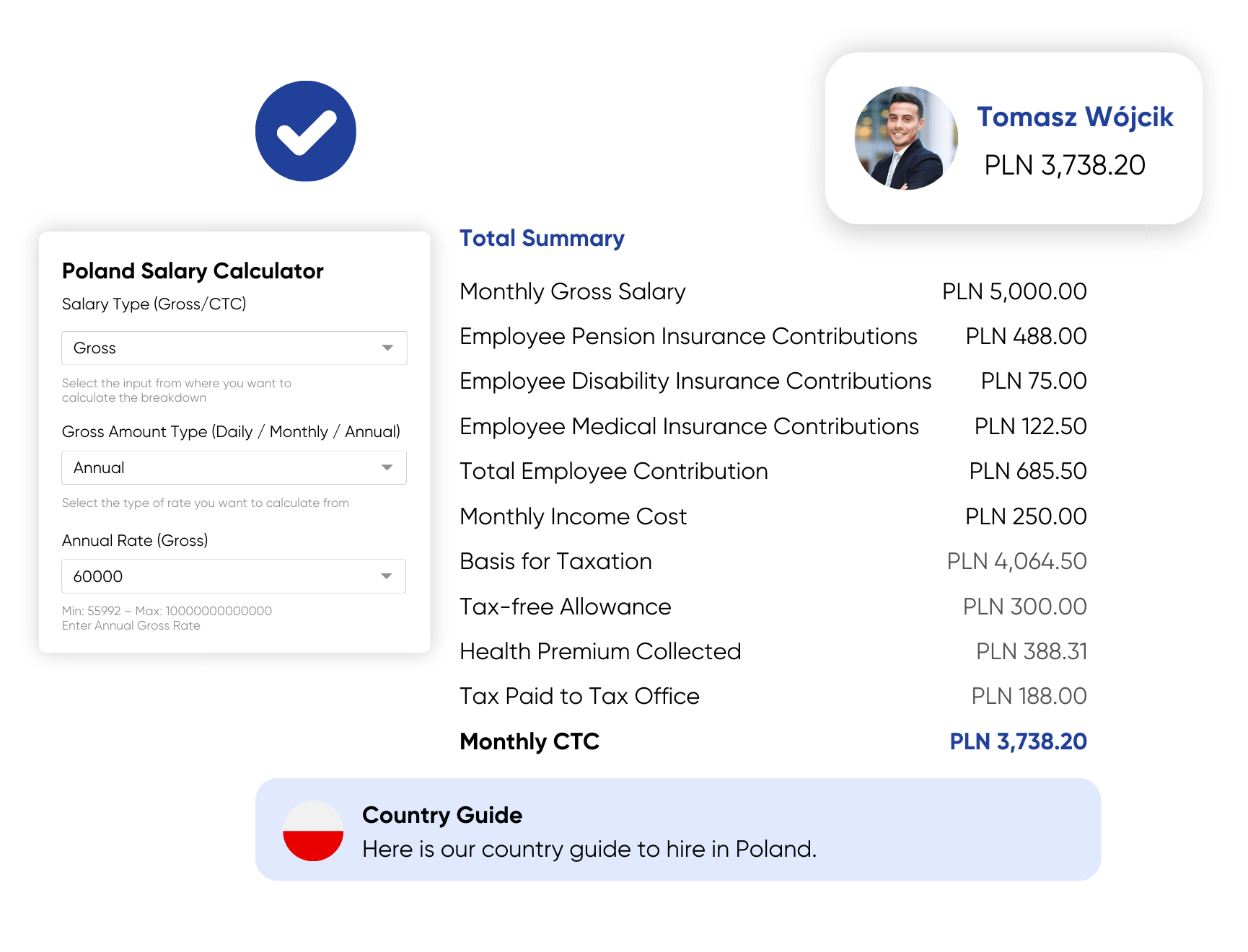

Salary Calculator for Poland [2026]

Calculate your Polish salary and deductions instantly. See net pay, Monthly Income cost, Tax free allowance, and more. Built for employees and contractors across Poland’s regions. Updated for 2025 tax regulations.

Salary Calculator - Poland [2026]

Calculate your Polish salary and deductions instantly. See net pay, Monthly Income cost, Tax free allowance, and more. Built for employees and contractors across Poland’s regions.

- If you are a Contractor

- If you are an Employer

Introduce Your Company and Earn Flat $500*

Refer them to PamGro and earn $500 when they onboard with us. It's that simple.

Expanding into Poland? You’re tapping into a vibrant talent pool and a growing economy—but remote hiring comes with its complexities. From navigating the salary calculator Poland to understanding gross vs net salary, deductions and legal nuances, it’s easy to get overwhelmed. The salary calculator allows you to easily calculate your net salary and deductions.

That’s where PamGro, your trusted Employer of Record (EOR), steps in. With our Poland salary calculator, you get instant clarity on compensation, accurate cost insights and full compliance—no local entity required.

To get the most accurate results, fill in all required fields in the calculator. The calculator provides instant results based on the data you enter. Each field includes a brief description of its meaning to help you understand what information is required. If you have a complex financial situation, consult an accountant for personalized advice. It’s also important to review relevant legal documents to fully understand Polish payroll regulations. Before taking any legal or financial actions based on the calculator’s output, seek professional advice. Whether you’re an employer budgeting for European expansion or an employee wanting to understand take-home pay, this tool is your launchpad to confident hiring in Poland.

1. What is the Average Salary in Poland?

According to official data from Poland’s Central Statistical Office, the average gross monthly salary in the enterprise sector was approx. PLN 9,056 (≈ €2,114) as of March 2025. Average salaries in Poland can vary significantly depending on the level of experience and education, with higher levels often leading to increased earnings.

Other reliable sources point to slightly lower estimates—around PLN 8,673-8,962 in early 2025 —but either way, wages have been rising.

In specific professions (with salaries set by industry standards and official data):

- IT specialists (e.g. developers, data engineers): PLN 11,000-18,000

- Finance/healthcare roles: PLN 9,000-16,000

- Operations/logistics: PLN 6,000-11,000

Salary data is based on the Central Statistical Office and reflects the earnings of people across different regions and sectors.

Monthly Average Salaries by Czech Region (2025)

| Region | Avg Gross (CZK) | Avg Net (CZK) | Notes & Sources |

|---|---|---|---|

| Prague | 62,472 | ~47,660 | Avg gross in Q1 2025 (praguemorning.cz). Est. net assumes ~76% take-home rate. | |

| Central Bohemia | 49,005 | ~37,250 | Regional average from ISPV data (livingcost.org). |

| South Moravia (Brno) | 46,066 | ~35,070 | Q1 2025 average . |

| Plzeň | 46,581 | ~35,400 | ISPV 2024 data . |

| Hradec Králové | 47,928 | ~36,500 | From ISPV ranking . |

| Olomouc | 47,687 | ~36,300 | ISPV data . |

| Vysočina | 47,973 | ~36,600 | ISPV data . |

| Ústí nad Labem | 44,799 | ~33,500 | ISPV data . |

| Liberec | 44,622 | ~33,350 | ISPV data . |

| Moravian–Silesia (Ostrava) | 43,802 | ~32,750 | ISPV data . |

2. What is the Minimum Salary in Poland?

From 1 January 2025, the minimum gross monthly wage in Poland is PLN 4,666, with a minimum hourly rate of PLN 30.50. That represents an 8.5–10% increase over the previous year. The minimum wage was previously updated in July 2024. After mandatory deductions, that net amount is approximately PLN 3,511/month.

Employees in Poland are entitled to a statutory minimum of 20 or 26 paid leave days per year, depending on their length of service. Additionally, certain groups, such as employees under 26, may be exempt from some taxes or social security contributions, even when earning the minimum wage.

3. How is Net Salary Calculated and Paid in Poland?

Net salary is the actual take-home pay after deducting:

- Employee retirement contribution (9.76%)

- Disability insurance (1.5%)

- Sickness insurance (2.45%)

- Health insurance (9%) — health insurance contributions are deducted from the already calculated tax, not from the tax base.Deductions

- Income tax (17% up to PLN 120K; 32% above)

If the annual limit for pension and disability insurance is exceeded, further contributions are no longer deducted from the salary.

Employers handle these deductions monthly and transfer the net pay directly into the employee’s account. They also pay employer’s social contributions (~20%) on top of the gross salary.

4. Deductions in Poland

Your salary calculation must include statutory contributions with rates set by Polish law and updated periodically:

- Retirement (9.76%)

- Disability (1.5%)

- Sickness (2.45%)

- Health (9%)

- Income tax—17% up to PLN 120,000, then 32%

- Employer social contributions (~20%) on gross

These affect both net salary and total employer costs. Our Poland net salary calculator does this transparently—no guesswork.

5. Income Tax

Poland has progressive taxation:

- 17% on annual income up to PLN 120,000

- 32% above that

- Additional exemptions (e.g., certain people, such as those under 26, are exempt from income tax on employment income; specific industries may also qualify)

- Employers are responsible for monthly withholding, pensions (PIT-11) and annual statements

Non-compliance can result in penalties. PamGro’s EOR service takes care of it all—from withholding to statutory filings.

Using a Salary Calculator: Step-by-Step Guide

Using a salary calculator is much easier than navigating Polish payroll. Here’s a simple step-by-step guide to help you get the most out of this tool:

- Enter Your Gross Salary: Start by entering your total gross income—the amount stated in your employment contract before any deductions. This is the basis for all further calculations.

- Choose Your Contract Type: Select the type of contract (e.g., standard employment contract, B2B or mandate contract). Different contract types affect the way social security contributions and taxes are calculated.

- Add Personal Details: Some calculators may ask for additional information, such as your age, whether you’re eligible for tax exemptions (like under-26 relief), or if you participate in employee capital plans. These affect your tax rate and contributions.

- Review Deductions and Contributions: The calculator will apply the relevant rates for personal income tax, health insurance, pension insurance and other social security contributions. It will also consider the tax threshold and any reliefs or exemptions.

- See the Breakdown: Once you’ve entered your details, the tool will show you a clear breakdown of your salary:

- Net salary (take-home pay)

- Amounts paid for income tax, health contributions, pension and other social security contributions

- Employer’s total cost (if applicable)

Adjust and Compare: You can change the input values to see how changes in gross salary, contract type or participation in employee capital plans affect your net salary and deductions. Useful for salary negotiations or financial planning.

Using a salary calculator in Poland removes the guesswork from payroll, so you know exactly how your gross income is taxed and what you’ll actually get paid. It’s a tool for both employees and employers to stay informed, compliant and confident in their salary calculations.

Example Breakdown: PLN 10,000 Gross

Let’s go through a real example: PLN 10,000 gross salary.

Employee deductions:

- Retirement (9.76%) → PLN 976

- Disability (1.5%) → PLN 150

- Sickness (2.45%) → PLN 245

- Health (9%) → PLN 900

- Income tax (17%) → PLN 1,452

Total deductions: ~PLN 3,723

Net salary: ~PLN 6,277

Employer side (~20%):

- Additional contributions → ~PLN 2,000

Total cost to hire: PLN 12,000/month

These are the typical results from the salary calculator for a gross salary of PLN 10,000.

Check out our Global Hiring Guides

Calculate Your Exact Poland Take-Home Pay Instantly!

More Salary Calculators

United States

Germany

Netherlands