TABLE OF CONTENTS

- What is an Umbrella Company?

- Why Do Contractors Choose Umbrella Companies?

- What Should I Look for in Terms of Compliance?

- Why FCSA and Professional Passport Matter?

- How Does an Umbrella Company’s Fee Structure Work?

- How Often Will I Get Paid, and What Payment Methods Do Umbrella Companies Use?

- Do Umbrella Companies Provide Insurance Coverage?

- What Statutory Benefits Should I Expect from an Umbrella Company?

- How Important is Customer Service in an Umbrella Company?

- How Can I Find Reviews on the Best Umbrella Companies?

- What Are Some Red Flags to Watch Out For?

- Key Takeaways: Making Your Decision

- Simplify Your Contracting Journey with PamGro

If you’re a contractor in the UK, managing taxes, payroll, and compliance can be a real headache. That’s where an umbrella company steps in, taking the stress out of managing these details so you can focus on your work. From handling tax deductions and insurance to keeping your IR35-compliant, an umbrella services company simplifies things, saving you time and potential hassle with HMRC.

With contracting on the rise, the number of umbrella companies has skyrocketed. Suddenly, you’re faced with countless options, each claiming to be the best. So how do you choose the right one? Which company will offer the highest take-home pay, solid support, and peace of mind?

This guide will walk you through everything you need to know to make an informed choice, from understanding fee structures to ensuring compliance. Let’s dive into the essentials and find best umbrella companies UK that aligns with your goals and keeps things running smoothly

What is an Umbrella Company?

An umbrella company works as a bridge between contractors and their clients or recruitment agencies, providing a hassle-free way to manage payroll, taxes, and compliance.

For contractors who take on multiple projects or shorter contracts, partnering with an umbrella company uk means no more juggling invoices, worrying about HMRC compliance, or staying on top of payroll tasks. Instead, all you need to do is submit your timesheets, and they handle the rest. This process ensures you get paid on time while also maintaining compliance with UK tax laws like PAYE (Pay-As-You-Earn) and IR35.

Why Do Contractors Choose Umbrella Companies?

For many contractors, an umbrella company offers simplicity and compliance. By handling tax deductions, the tax and National Insurance contributions, and statutory benefits like sick pay, they streamline the financial and administrative side of contracting, making them an appealing choice. You also gain access to employment benefits, meaning you can work contract-to-contract without sacrificing stability.

If you’re new to contracting, signing up with an umbrella company is a brilliant way to ease into the industry with professional support. Ultimately, working with an umbrella company is about balance—keeping your earnings maximized and your stress minimized.

One final benefit of umbrella company employment, for many at least, is the effect it has on your IR35 status. The legislation targets those who falsely position themselves as sole traders or limited company contractors to avoid paying Income Tax and NICs, when they should be classed as employees. As an umbrella employee, though, you don’t need to worry – you’re outside IR35.

Key Benefits of Working with an Umbrella Company

Working with an umbrella company offers you the following:

- Simplified Tax Process: Umbrella companies calculate and withhold taxes on your behalf, ensuring compliance.

- Steady Pay and Benefits: They manage payroll and provide statutory benefits like holiday pay, sick pay, and maternity/paternity leave.

- Reduced Administrative Burden: Say goodbye to self-assessments and focus on your contract work.

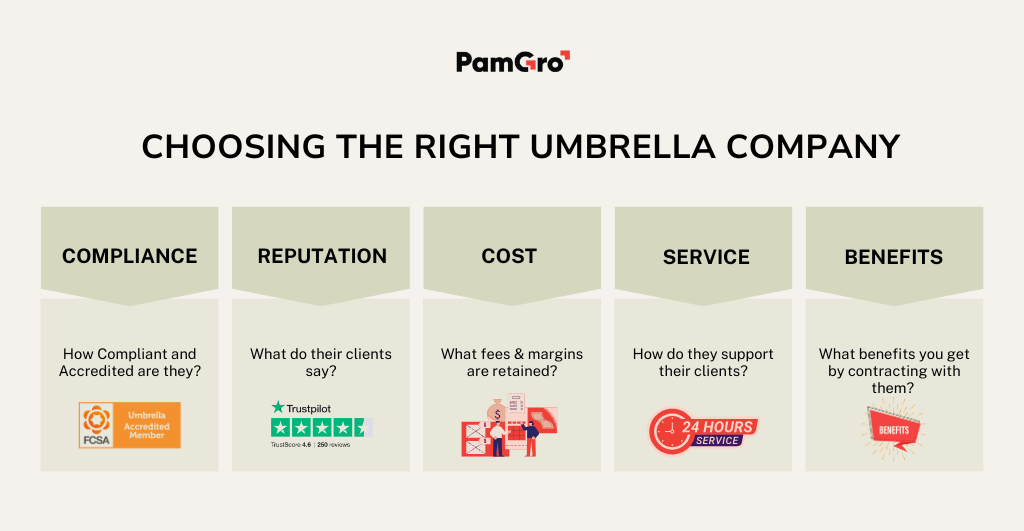

What Should I Look for in Terms of Compliance?

Compliance is a must when choosing an umbrella company. Without it, contractors could face unexpected penalties from HMRC or, worse, issues with their earnings. The simplest way to confirm compliance is to check for accreditations from trusted bodies like the Freelancer and Contractor Services Association (FCSA) or Professional Passport.

They aren’t just badges; they’re proof that the umbrella company follows strict standards for payroll transparency, its income tax, management, and contractor support.

Why FCSA and Professional Passport Matter?

An FCSA or Professional Passport membership demonstrates that the umbrella company meets the industry’s top standards, providing contractors with peace of mind and keeping them compliant with HMRC regulations. By selecting an accredited company, you’re opting for security, accountability, and a trustworthy partner in handling your financial and administrative needs.

How Does an Umbrella Company’s Fee Structure Work?

One of the first things to consider in an umbrella company is its fee structure. The company’s charges can impact your take-home pay, so understanding the details is needed to make an informed choice.

- Fixed Fees: Many companies charge a fixed fee weekly or monthly, which is obvious and simplifies budgeting. A fixed fee is usually deducted before tax calculations, meaning you might see some tax savings.

- Percentage Fees: Some companies may charge a percentage of your earnings, which can seem attractive at first but may become costly, especially for higher salary brackets. Even with potential caps, percentage-based fees can take a larger portion of your income over time.

Also, you should be cautious of hidden charges. Some companies may add fees for services like same-day payments, onboarding, or administrative tasks. These hidden costs can add up, so it’s best to ask upfront about any extra charges to avoid surprises.

How Often Will I Get Paid, and What Payment Methods Do Umbrella Companies Use?

Getting paid reliably and without delay is essential for contractors. Here’s what you need to know about payment schedules and methods used by umbrella companies:

- Payment Frequency: Weekly or Monthly?Most companies offer payment on a weekly or monthly basis, depending on your contract terms. Weekly payments are the best choice for contractors with short-term projects, offering continuous cash flow.Meanwhile, monthly payments may be suitable if you prefer to align with traditional payroll cycles.

- Payment Methods: Faster Payments and BACSA good umbrella company in the UK usually uses Faster Payments or BACS (Bankers’ Automated Clearing Services) to transfer your wages, ensuring that payments reach your account quickly after timesheets are approved.Faster Payments allows money to arrive on the same day as the payment run and is available 24/7.

- Avoiding Payment DelaysFor a smooth payment process, check if there are any bottlenecks in the timesheet approval process. Ideally, the company should offer easy online submission of timesheets with minimal hoops to jump through, allowing for efficient payroll processing.

- Beware of Non-PAYE SchemesSince you’re an employee of the umbrella company, your income should go through PAYE (Pay As You Earn), meaning taxes, National Insurance and other deductions are handled according to HMRC regulations.Some companies may offer “tax-efficient” alternatives, such as splitting payments or using offshore schemes, but these methods can lead to penalties if they don’t comply with HMRC standards. Always opt for PAYE-based payment to avoid potential issues down the line.

Do Umbrella Companies Provide Insurance Coverage?

Since an umbrella company is technically your employer, they are required by law to have certain insurance policies in place to protect both you and the business. Here’s a breakdown of the essential coverages you should expect:

- Employers’ Liability Insurance (Required by Law)Every umbrella company is legally required to have Employers’ Liability Insurance. This policy protects you if you become ill or injured on the job, and it’s essential for meeting UK employment regulations. If an umbrella company lacks this coverage, they can face fines of up to £2,500 per day.

- Professional Indemnity InsuranceMost umbrella companies also include Professional Indemnity Insurance. This policy covers claims made against you for professional errors or omissions related to your services, offering valuable protection if your client faces a loss due to your advice or work.

- Public Liability InsurancePublic Liability Insurance is another common policy provided by umbrella companies. It covers any liabilities if a third party (such as a client or member of the public) experiences injury or property damage due to your work. Although not legally required, many end clients will expect this coverage as a standard.

Additional Coverage for High-Risk Roles

If you work in a high-risk industry, check if the umbrella company can provide any additional insurance options. Some policies may exclude niche occupations, so it’s worth confirming that your role is adequately covered.

What Statutory Benefits Should I Expect from an Umbrella Company?

Working through an umbrella company isn’t just about handling your payroll and taxes; it’s about getting a few perks that make contracting feel a bit more like a regular job. So, what benefits should you expect?

- Holiday Pay:Ah, holiday pay—the good stuff. An umbrella company owes you paid holidays, but how they handle it varies:

Rolled-Up Pay: Some add a little extra to each paycheck (usually 12.07%) to cover your holidays. You’ll get a bit more upfront, but you won’t have holiday pay saved up for when you actually want a break.

Accrued Pay: Others hold onto your holiday pay until you take time off. The catch? Be sure they’re transparent about it, as some companies keep unclaimed holiday pay at year-end.

The statutory leave entitlement is 28 days per year, but clarify how the umbrella company will manage this so you can plan accordingly.

2. Statutory Sick Pay (SSP): When the sniffs turn into something more serious, you’ll want to know that SSP has your back. With umbrella companies, you’re eligible for Statutory Sick Pay, which means you don’t have to worry about missing a paycheck if you’re out for a few days. Just check the details with your provider so there are no surprises if you need it.

3. Maternity and Paternity Leave: If you’re planning for family time, good news—umbrella companies offer maternity and paternity leave benefits. You’ll have some income support while you’re taking time off with your newborn or new family member.

4. What about Pensions? If you’re over the age of 22, working in the UK, and earning more than £10,000 a year, your umbrella company will automatically enroll you in a pension scheme. They’ll contribute at least 3% on top of your 5% minimum from your pay.

Don’t want it? No worries—you can opt out if it’s not for you.

How Important is Customer Service in an Umbrella Company?

Imagine you’re cruising along, knocking out projects, submitting timesheets, and all is good. But then—bam! —you hit a snag. Maybe there’s an issue with your pay, or you have a compliance question, and suddenly, you need help fast. This is where customer service becomes a make-or-break factor for your umbrella company experience.

1. Do They Offer a Dedicated Account Manager?

The best umbrella companies UK assign you a Dedicated Account Manager—someone who knows your account, your needs, and is ready to help at a moment’s notice. It’s like having a go-to ally in the company, making everything feel a lot less daunting.

2. What Support Channels Are Available?

Does the company offer support via phone, email, or live chat? The more ways you have to reach them, the better.

Ideally, you shouldn’t have to wait ages to get an answer. After all, when you need help, you need it now, not next week.

3. How Easy is it to Get Help?

Think of the practicalities here. Do they make you jump through hoops just to submit a question?

A good umbrella company makes it simple and quick to reach out for assistance. Check reviews on Trustpilot or Contractor UK forums—other contractors’ experiences will tell you a lot about how easy (or not) it is to get the support you need.

In the real world, having reliable customer service can be the difference between a smooth contracting journey and a stressful one. Don’t settle for less.

How Can I Find Reviews on the Best Umbrella Companies?

When it comes to choosing an umbrella company, independent reviews are your best friend. They give you an honest look at what you can expect beyond the company’s marketing promises. Here’s where to start:

- Trustpilot:Trustpilot is a popular choice for reading contractor reviews. Since reviews are verified, you can get an authentic feel for payment reliability, customer service, and overall satisfaction. Look for patterns—if multiple reviews mention issues with delayed payments or hidden fees, it’s probably not a coincidence.

- Contractor UK and Other ForumsCommunities like Contractor UK are filled with contractors sharing their experiences. These forums are treasure troves of firsthand advice and warnings about potential red flags. If a company has poor support or sketchy payment practices, you’re likely to find out here.

- Google Reviews:While Google Reviews might be less contractor-specific, they’re still valuable for spotting general issues with a company, like hidden charges or unresponsive support.

What Are Some Red Flags to Watch Out For?

When choosing an umbrella company, spotting red flags can help you avoid future hassles. Here are some signs to watch for:

- Unrealistically High Take-Home Pay PromisesBe careful if a company promises higher take-home pay than others. Often, non-compliant companies use tax avoidance schemes to make these claims, which could put you at risk of penalties from HMRC.

- Percentage-Based Fees and Hidden ChargesIf a company charges fees as a percentage of your income rather than a fixed rate, it could cost you more than you expect.Also, look out for hidden fees that aren’t immediately clear. Transparent, fixed fees are usually a safer choice.

- Tax Avoidance SchemesStay clear of companies that suggest “tax-efficient” payment structures, such as:

- Using third-party intermediaries for payments

- Promising you’ll keep more earnings than compliant firms

- Offering loans, annuities, or agreements with “non-taxable” elements

These setups can lead to hefty penalties, back taxes, and interest charges if HMRC investigates. For more details, read this guide: Disguised remuneration: tax avoidance scheme using capital advances, joint and mutual share ownership agreements (Spotlight 53)

- Complex Payment ChainsIf you’re paid through a third party in a complex payment chain, this could indicate a non-compliant arrangement. HMRC has started to name and shame tax avoidance schemes and their promoters, so if you come across any dubious setups, report them to HMRC to avoid being implicated.

Key Takeaways: Making Your Decision

Choosing the right umbrella company isn’t just a checkbox—it’s an investment in your contracting career. Here’s a quick rundown to help you make a confident decision:

- Prioritize ComplianceStick to FCSA accredited umbrella companies or Professional Passport. Compliance ensures your earnings are handled responsibly and within HMRC guidelines.

- Clarify FeesTransparent, fixed-fee structures are generally the safest bet. Watch out for hidden charges that can eat into your earnings.

- Secure Timely PaymentsLook for a company with a reliable payment schedule that aligns with your cash flow needs. Weekly or monthly, it’s crucial to know you’ll be paid on time.

- Verify Benefits and InsuranceEnsure the umbrella company offers essential statutory benefits and insurance coverage like Employers’ Liability, Public Liability, and Professional Indemnity Insurance.

- Customer Support and Reviews MatterGood support makes all the difference. A responsive team and positive reviews on platforms like Trustpilot or Contractor UK will give you peace of mind in your contracting journey.

Simplify Your Contracting Journey with PamGro

Choosing the right umbrella company is the foundation of a successful, stress-free contracting career in the UK.

PamGro prioritizes compliance, transparency, and dedicated support so you can focus on your work while we handle the complexities of payroll, taxes, and statutory employee benefits themselves.

With PamGro, you get a trusted partner ready to manage the administrative details that often make contracting challenging. From FCSA-accredited compliance to straightforward fixed-fee structures, we’re here to provide a reliable, compliant service that ensures your peace of mind.

Ready to enhance your contracting experience?

Get in touch with PamGro today and discover how we can streamline your contracting journey and maximize your earnings.

Make £100 for You & £100 for Your Friend

Mukul Dixit is a Growth Marketing Associate with 7+ years of experience creating impactful content in Innovative Tech, SaaS, and HR. A curious explorer at heart, he’s always on the lookout for new cultures to experience, fresh music to vibe, and innovative business ideas to dive. Passionate about entrepreneurship and digital marketing, Mukul brings a creative edge to everything he does.