TABLE OF CONTENTS

- What is Self Employment?

- What is an Umbrella Company?

- How Umbrella Company Payments Function?

- Understanding Taxation in an Umbrella Company

- What is a Limited Company?

- Payment Mechanism for Limited Company

- Tax Dynamics for Limited Companies

- Key Differences : Umbrella Company Vs Limited Company

- Pros and Cons

- When would an Umbrella Company be suitable?

- When would a Limited Company be suitable?

- IR35 Considerations

- Limited or Umbrella: Which is best for me?

- Conclusion

Embarking on a contracting career unfolds three primary avenues: establishing your own Limited company, embracing self-employment, or opting for the Umbrella company route. In this article, we concentrate on breaking down the details of the two main models: Umbrella employment and Limited Company formation. Each model boasts its own set of advantages and challenges, making it imperative to explore their differences thoroughly. This exploration aims to equip you with the insights needed to make a well-informed decision that aligns with your unique professional journey.

Exploring Self-Employment

Self-employment opens up a world of independence for contractors, allowing them to work autonomously. In this setup, contractors generate invoices using their name or a selected trading name, fulfilling all tax obligations at standard personal income tax rates. Despite not benefiting from the tax advantages associated with a Limited company, self-employment provides a straightforward structure and protects personal assets from potential losses, expenses, or legal claims.

To build on our exploration of contracting options, let’s further unravel the concept of an Umbrella company. This alternative becomes especially pertinent for those seeking simplicity and flexibility in their contracting endeavors.

As you start your journey on deciding between Limited and Umbrella companies, let’s dive into the realm of self-employment options.

What is an Umbrella Company?

An Umbrella company serves as a straightforward solution for contractors handling temporary contracts, commonly facilitated through collaboration with recruitment agencies. Contractors establish a comprehensive contract of employment with the Umbrella company, making it the singular employer even when managing multiple contracts.

This arrangement provides a streamlined experience for many contractors too, especially those delving into the market or managing short-term contracts. The Umbrella company acts as a supportive structure, handling administrative aspects and offering a straightforward process, allowing contractors to switch employers without complicated closure procedures. Under this employment model, the connection between clients, recruitment agencies, and contractors becomes seamless.

How Umbrella Company Payments Function: Unveiling the Process

Understanding the payment mechanism within an Umbrella company involves a structured process that ensures transparency and adherence to legal regulations. Here’s a breakdown of how payments work when you are associated with an Umbrella company:

- Contractual Engagement: The Umbrella company establishes a contractual relationship with either the end client or the recruitment agency through which it is providing your services. This agreement forms the foundation for the entire payment process.

- Invoicing the Client or Agency:Subsequently, the Umbrella company issues an invoice to the client or recruitment agency for the services rendered. This invoice includes the expenses for providing your services as an employee to carry out the assigned tasks.

- Cost Accounting:Upon receiving payment from the client or agency, the Umbrella company carefully manages its operating expenses. It includes various overheads associated with facilitating your employment, ensuring compliance, and delivering additional benefits.

- Profit Margin Allocation:Following the deduction of costs, the Umbrella company retains a calculated profit margin. This margin is essential for the sustenance and growth of the company, covering administrative expenses, investments in employee benefits, and other operational necessities.

- Salary Processing:The next step involves the processing of your salary. The Umbrella company calculates your net salary by considering income tax deductions, national insurance contributions, and any agreed-upon deductions such as student loan repayments or pension contributions.

- Income Tax and National Insurance Deductions:A portion of your salary is set aside for income tax and national insurance, ensuring compliance with tax regulations. This deduction is an integral part of the payment process and contributes to fulfilling your tax obligations.

By navigating this systematic approach, the Umbrella company facilitates a transparent and legally compliant payment structure. It ensures that your salary, after necessary deductions, is delivered to you in compliance with financial regulations, providing clear and stable financial transactions.

Read detailed guide: Beginner Tips For A First-Time Umbrella Company Contractor

Understanding Taxation in an Umbrella Company

The taxation process within an Umbrella company closely resembles that of a traditional permanent employee. In this structure, all applicable taxes are deducted directly at the source, ensuring simplicity and convenience. With each payment, the necessary tax details are promptly declared to HMRC, streamlining the overall financial process.

While the tax efficiency might not match that of a Limited company, the Umbrella structure prioritizes a hassle-free contracting experience. This straightforward approach to taxation reduces the administrative burden for contractors, making it a favorable choice for those who prioritize simplicity and ease in their financial affairs.

What is a Limited Company?

A Limited Company is a unique legal entity facilitating business operations. It engages in contracts directly with clients, ensuring that all ensuing profits and losses are associated with the company itself. This legal structure provides a clear separation between personal and business assets, safeguarding the owner’s wealth.

The Limited Company format often involves registering with Companies House, meeting regular reporting requirements, and paying Corporation Tax on profits. Establishing this distinct identity allows the company to enter into agreements, maintain its financial resources, and bear responsibility for its actions independently.

Payment Mechanism for Limited Companies: Maximizing Earnings and Claiming Business Expenses

As a limited company contractor, your payment process differs significantly from traditional employment structures. Here’s a breakdown of how the payment system works, providing you with the potential for increased earnings and the ability to claim various business expenses through your Personal Service Company (PSC).

- Corporate Taxation Advantage:Instead of the conventional Income Tax, Limited companies pay Corporation Tax on their profits. This distinction is crucial as it contributes to making this payment structure one of the most financially advantageous ways to work. The Corporation Tax rate is currently set at 19%, allowing for strategic financial planning.

- Salary and Dividends:Operating under a Limited company empowers you to pay yourself through a combination of salary and dividends. This flexibility allows for optimal utilization of diverse tax-free thresholds, providing you with higher net earnings compared to more traditional employment methods.

- Claiming Business Expenses:One of the standout benefits of the Limited company structure is the ability to claim a wide array of business expenses through your PSC. These expenses can include but are not limited to:

- Equipment: Reimbursement for tools, gadgets, and other work-related equipment.

- Mileage: Compensation for business-related travel, whether by car, public transportation, or other means.

- Business Trips: Costs associated with necessary travel for business purposes.

- Tax Efficiency and Financial Optimization: The ability to claim such expenses not only enhances your take-home pay but also significantly contributes to tax efficiency. By smartly handling your business expenses, you can reduce the amount of money that gets taxed, ultimately increasing your total earnings.”

- Professional Guidance:

While the benefits are substantial, navigating the intricacies of business expenses, tax planning, and financial optimization can be complex. Seeking professional advice, such as from experienced accountants specializing in contractor services, can ensure that you leverage these advantages effectively and in compliance with relevant regulations.

In summary, the payment mechanism for Limited companies stands out as a lucrative and flexible approach for contractors. The combination of corporate tax advantages, salary-dividend flexibility, and the ability to claim a variety of business expenses makes it a preferred choice for those aiming to optimize their financial outcomes while maintaining a compliant and professional business structure.

Tax Dynamics for Limited Companies

Limited companies navigate the tax landscape through Corporation Tax, calculated at a standard rate of 19% on annual profits. This financial planning involves directors strategically structuring their income with a combination of a basic salary, often maintained at a modest level and dividends. Noteworthy is the advantageous aspect that dividends remain exempt from National Insurance Contributions, contributing to substantial savings.

In addition to tax efficiency, this unique structure allows directors the flexibility to optimize their income distribution. Directors can smartly manage their earnings by combining salary and dividends, taking advantage of various tax-free allowances. This approach not only reduces tax obligations but also supports the company’s overall financial goals and benefits its stakeholders.

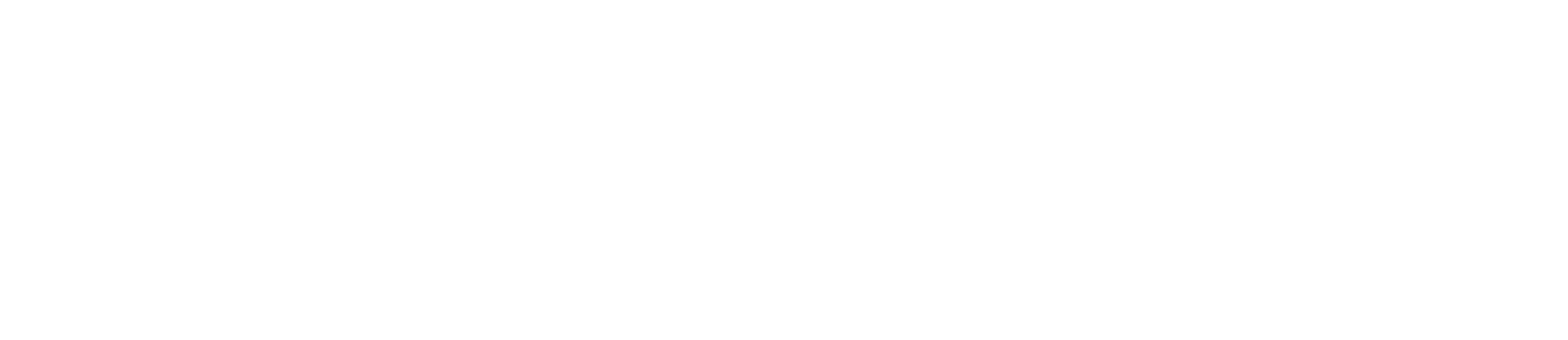

Key Differences : Umbrella Companies vs Limited Companies

| Aspect | Limited Company | Umbrella Company |

|---|---|---|

| Tax Efficiency | Highly tax-efficient; low salary, no NI on dividends. | Entire salary taxed via PAYE, less tax-efficient. |

| Legal Duties | Directors have statutory and financial duties. | No legal duties beyond a taxpayer. |

| IR35 | Tax benefits lost if caught. | IR35 irrelevant, taxed as an ’employee.’ |

| Multiple Clients | Good for providing services to multiple clients. | Not ideal for working with several clients simultaneously. |

| Banking | Separate business bank account. | Personal bank account suffices. |

When would an Umbrella Company be suitable?

Choosing an Umbrella company means going for a more straightforward administrative process. It proves to be an excellent fit for individuals engaged in short or uncertain contract durations, providing a hassle-free approach to contracting. The simplicity of the Umbrella structure minimizes the administrative burden on contractors, making it particularly appealing for those exploring short-term opportunities or navigating uncertainties in the contracting landscape.

Moreover, the straightforward entry and exit process with an Umbrella company stands out as a critical advantage. This flexibility lets contractors easily switch between projects without the hassle of shutting down a Limited company. Umbrella arrangements are designed to be user-friendly, allowing individuals to easily adjust their work setups as per the evolving demands of their professional journey.

When would a Limited Company be suitable?

The suitability of a Limited company is contingent on various factors. It emerges as the most tax-efficient structure, allowing contractors to pay themselves a combination of salary and dividends. Additionally, it facilitates tax-free pension contributions through the company, offering an advantageous approach for long-term planning.

However, it comes with a higher administrative burden. While a specialist contractor accountant or accountants can assist in managing these responsibilities, contractors need to stay diligent in tracking income and expenses and providing necessary information for year-end accounts and tax returns.

IR35 Considerations

The impact of the Intermediaries Legislation (IR35) plays a significant role in the decision-making process. Since its launch in 2000, IR35 has been designed to prevent ‘disguised employment,’ where a worker transitions from a regular job to working as a contractor in a limited liability company while essentially functioning like an employee.

In April 2017, the rules got more complicated, and by April 2021, they extended to private sector contractors. In response, some clients banned limited company contractors altogether. The presence of IR35 may dictate the necessity of opting for an Umbrella company for specific contracts, highlighting the importance of staying informed and adaptable to legislative changes.

Read detailed guide: What is IR35? Implications for Contractors and Businesses

Limited or Umbrella Company: Which is best for me?

Choosing between an Umbrella and a Limited company is a decision that is closely connected to a contractor’s work style, personal preferences, and future aspirations. An Umbrella company provides a straightforward and low-administration approach, making it an ideal fit for individuals new to the contracting world or those embarking on short-term projects. However, for contractors with a vision of working concurrently with multiple clients and a desire for enhanced control over their own business and affairs, choosing the Limited company path seems more appealing.

When simplicity and minimal administrative burdens align with a contractor’s immediate goals, the Umbrella company shines. It’s user-friendly and flexible, making it an excellent choice for beginners in contracting or those handling short-term projects. On the other hand, the Limited company, prioritizing control and tax efficiency”, becomes a natural choice for seasoned professionals with a strategic eye on long-term growth and diversified client projects.

Conclusion

In the complex realm of contracting, making the right choice requires careful consideration. Whether you’re new to contracting or seeking a solution that fits your needs, Pamgro offers essential advice to help you confidently begin your contracting journey. Our dedicated team of friendly advisers stands ready to provide personalized guidance, ensuring you make an informed decision that aligns perfectly with your career goals.

Embarking on contracting is a significant step, and at Pamgro, we go beyond offering tips and tricks – we offer a supportive community to accompany you on your journey. Trust us to be your partner in navigating the intricacies of contracting, helping you not only initiate but also sustain a successful and fulfilling contracting career.

Make £100 for You & £100 for Your Friend

Mukul Dixit is a Growth Marketing Associate with 7+ years of experience creating impactful content in Innovative Tech, SaaS, and HR. A curious explorer at heart, he’s always on the lookout for new cultures to experience, fresh music to vibe, and innovative business ideas to dive. Passionate about entrepreneurship and digital marketing, Mukul brings a creative edge to everything he does.