Key Takeaways

- EOR (Employer of Record) is used for hiring full-time employees internationally.

- AOR (Agent of Record) is designed for managing independent contractors compliantly.

- EOR becomes the legal employer and handles payroll, taxes, and benefits.

- AOR ensures contractor classification and local compliance without becoming the employer.

- Use EOR when building long-term teams in new countries without a local entity.

- Choose AOR when engaging short-term experts, freelancers, or project-based talent.

- EOR supports structured employment, onboarding, and employee benefits.

- AOR provides flexibility while mitigating misclassification and legal risks.

- EOR is ideal for scaling global teams; AOR suits decentralized, flexible workforces.

- Picking the right model depends on your workforce mix, compliance needs, and growth goals.

In today’s global workforce, companies are no longer confined by borders. Whether you’re hiring full-time employees or independent contractors, you’ll likely encounter two important acronyms: EOR and AOR. Understanding the difference isn’t just a legal technicality—it can shape how you expand, manage risk, and stay compliant. This guide breaks down everything you need to know about aor vs eor, helping you decide which model suits your growth plans best.

What is an Employer of Record (EOR)?

EOR stands for Employer of Record, and it’s a service model where a third party becomes the legal employer of your workers on behalf of the client company. While you still manage their day-to-day tasks, the EOR handles payroll, taxes, benefits administration, compliance, and more.

In business terms, an EOR enables companies to hire talent in other countries without setting up a legal entity. It’s particularly valuable for companies looking to hire employees globally, facilitating compliance, payroll, and administrative tasks for global expansion, remote teams, or fast-growing startups.

EOR = Employer of Record. It’s your compliance and HR partner in new markets, managing employment-related tasks such as payroll, taxes, and compliance with local labor laws.

EOR Services Typically Include:

- Onboarding and contracts

- Payroll and benefits

- Tax withholding and filings

- Tax deductions

- Compliance with local employment laws

- Risk mitigation around worker classification

What is an AOR (Agent of Record)?

AOR means Agent of Record. While it may sound similar to an EOR, its focus is quite different. AOR services center around engaging independent contractors, not full-time employees. It’s an intermediary that ensures contractors are properly vetted, paid, and classified.

Additionally, AOR services help businesses manage independent contractors, ensuring compliance with local regulations and minimizing the risk of penalties associated with contractor misclassification.

In a business context, an AOR acts as the compliance backbone for engaging freelancers. It doesn’t employ workers; instead, it ensures your company follows labor laws and mitigates compliance risks for contractor engagements, emphasizing the importance of contractor compliance.

AOR = Agent of Record. Think of it as your co-pilot for managing a non-employee workforce and minimizing misclassification risks.

AOR Services Typically Include:

- Contractor onboarding and agreements

- Tax documentation (like W-9s or 1099s)

- Insurance verification

- Payment facilitation

- Ensuring compliance with worker classification rules

- Managing tax filings

EOR vs AOR: Key Differences

While both EOR and AOR models simplify complex administrative tasks, they’re built for different kinds of workforces. Choosing between them depends on the type of worker you’re engaging – full-time employees and their employee benefits, or independent contractors—and your long-term goals. Understanding the distinctions in the aor vs eor debate is crucial for businesses, especially those expanding globally, to ensure legal adherence and operational efficiency.

Let’s break down the key differences that define the EOR vs AOR decision.

1. Employment Relationship

- An EOR becomes the official legal employer. It takes full responsibility for your employee’s payroll, taxes, and compliance. While you manage day-to-day work, the EOR carries the legal weight and full employment responsibilities, which can result in higher costs due to its extensive service offerings, especially in global employment management.

- An AOR, by contrast, doesn’t employ anyone. Instead, it acts as an intermediary between your business and the independent contractor, ensuring documentation and compliance are handled correctly. An AOR typically has lower costs because it does not take on full employment responsibilities, making it a better fit for startups and small businesses

2. Type of Worker Managed

- EOR services are designed for full-time or long-term employees who require access to benefits, local protections under employment laws, and structured payroll. EORs take on full employment responsibilities, making them suitable for businesses needing comprehensive employee management.

- AOR services cater to freelancers and contractors. They focus on correctly classifying workers and making sure engagements follow applicable labor laws and tax standards.

3. Legal Structure and Entity Needs

- With an EOR, you don’t need to set up a legal entity or establish local entities in each country where you hire. The EOR assumes that role, letting you scale globally without bureaucratic friction.

- An AOR doesn’t require you to establish an entity either, but since it doesn’t employ the worker, its responsibilities are limited to managing contractor-related risks and paperwork.

4. Compliance Responsibility

- An EOR handles full legal compliance across HR, payroll, tax, and benefits administration. It’s particularly valuable when navigating complex employment laws in foreign jurisdictions, ensuring all compliance requirements are met.

- An AOR ensures that your contractor engagements are properly documented and that your team doesn’t cross the line into accidental employment. This reduces risks around worker classification, which can be a major issue in audits or legal reviews.

5. Use Case Fit

- Choose an EOR when expanding into new markets and hiring long-term staff who need structured employment. This is particularly useful for global hiring, as EOR services help navigate local labor laws, compliance, and tax regulations, simplifying international recruitment.

- Opt for an AOR when working with short-term experts, consultants, or gig workers—especially across borders—where agility and classification accuracy matter more than full benefits.

6. Cost and Operational Impact

- EOR services tend to be more comprehensive, so they typically come with a higher cost. However, they offer significant time and cost savings by streamlining complex international hiring processes, managing compliance, and handling payroll, which buys peace of mind, reduces risk, and speeds up time to market.

- AOR services are leaner and more affordable, especially if you manage a large pool of independent contractors. They’re perfect for companies that prioritize flexibility over structure.

EOR vs AOR: Side-by-Side Comparison

| Category | EOR (Employer of Record) | AOR (Agent of Record) |

|---|---|---|

| What it means | EOR becomes the legal employer for your full-time workforce, providing comprehensive eor and aor services to navigate complexities | AOR acts as an intermediary for managing independent contractors, offering specialized eor and aor services |

| Worker type | Employees (permanent or long-term) | Freelancers, consultants, and project-based contractors |

| Legal structure | No need to establish a legal entity in new markets | No legal entity required; focuses on contractor engagement |

| Compliance focus | Ensures compliance with employment laws, taxes, and benefits administration | Ensures compliance with labor laws and worker classification for contractors |

| Payroll & benefits | EOR handles payroll, taxes, and payroll benefits for employees | AOR facilitates contractor payments and verifies documentation |

| Use case | Ideal for long-term hires and structured roles in new markets | Best for flexible, short-term or gig-based work |

| Risk management | Mitigates risks tied to employee misclassification, local laws, and global expansion | Helps avoid penalties from misclassifying contractors |

| Cost implication | Higher cost due to full-service offering | Lower cost; lean structure for managing contractors |

| Administrative scope | Full support across onboarding, HR, tax, and employee lifecycle | Limited to AOR services like onboarding, insurance checks, and tax forms |

Pros and Cons

Both EOR and AOR services offer strategic advantages depending on how you manage your workforce. However, each model comes with trade-offs. Here’s a deeper look at the benefits and limitations of each, so you can make a well-informed decision for your business.

| Criteria | EOR (Employer of Record) | AOR (Agent of Record) |

|---|---|---|

| Ideal For | Hiring full-time employees in new or global markets | Managing independent contractors for short-term or project-based work |

| Legal Status | Acts as the legal employer of record | Does not employ, acts as an intermediary for compliance and payment |

| Pros | – Enables hiring without a legal entity – Manages payroll, benefits, and taxes – Ensures compliance with employment laws – Handles worker classification – Ideal for long term hiring | – Cost-effective for contractor management – No need for a legal entity – Streamlines administrative tasks – Reduces risk of contractor misclassification – Highly flexible and scalable |

| Cons | – Can be more expensive due to full-service scope – Less flexible for short-term roles – May offer less customization in HR policies | – No benefits administration for workers – Limited to non-employee engagements – Potential legal risks if contractors are misclassified |

| Administrative Load | Low – EOR handles most HR, payroll, and compliance tasks | Low – Manages contractor onboarding, tax forms, and classification |

| Compliance Focus | Full compliance with labor laws for employees | Focuses on proper treatment of independent contractors |

| Cost Structure | Higher due to broader HR services and benefits administration | Lower and more flexible, ideal for startups and short projects |

| Scalability | Great for structured, steady global expansion | Best for dynamic, fast-changing teams or talent-on-demand |

Choosing the Right Model for Your Business

When it comes to deciding between EOR vs AOR, the right model depends entirely on how your business operates—and where it’s headed. Both offer distinct advantages, but their fit hinges on your team’s makeup, the markets you’re targeting, and how hands-on you want to be with workforce management. Additionally, factors such as tax compliance, worker classification, budget, and the long-term business objectives play a crucial role in determining the best choice for your organization.

Ask Yourself These Questions:

- Are you hiring full-time employees or independent contractors?

- Do you need to comply with local employment laws in a new country or a foreign country?

- Is your engagement short-term or part of a long term strategy?

- Are you looking to test new markets or scale quickly without setting up a legal entity?

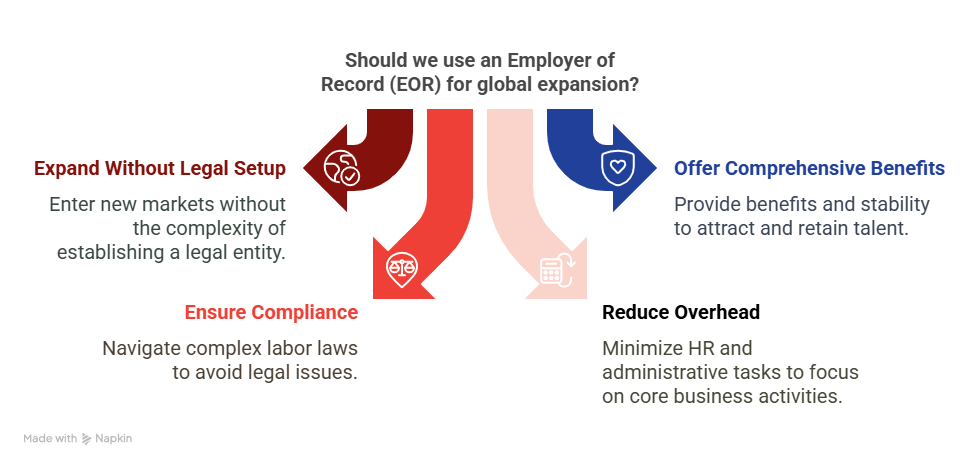

Choose an EOR if :

You’re expanding globally and plan to build a committed, full-time team. An Employer of Record acts as the legal employer, taking over payroll benefits, onboarding, worker classification, and local compliance. This is ideal if you want to manage employment contracts effectively:

- Enter new markets without legal setup.

- Offer benefits, health insurance, and stability to your team.

- Maintain compliance with complex labor laws.

- Reduce the overhead of HR and administrative tasks.

EORs give you the structure needed for sustainable, compliant global expansion while minimizing legal and financial risks.

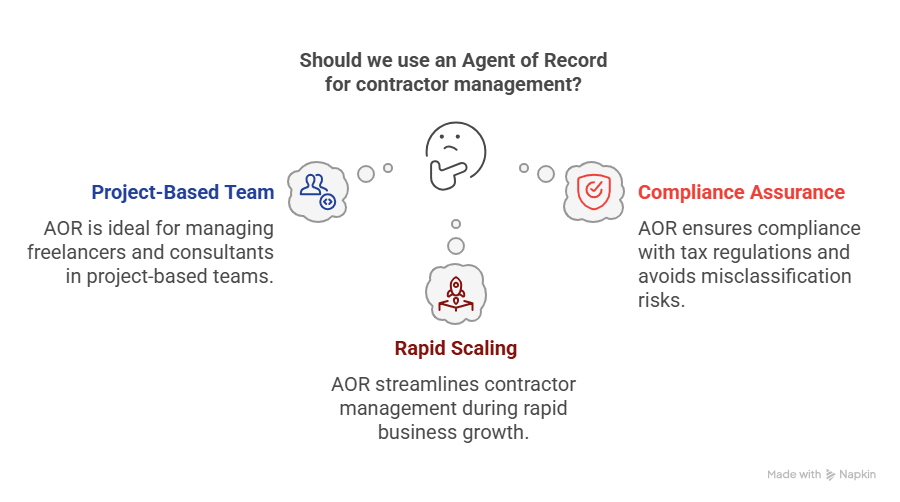

Choose an AOR if :

You work with freelancers, consultants, or independent contractors, and need a clean, compliant way to pay them. An Agent of Record ensures that all tax documents, worker classification, and agreements are managed professionally—without making them employees. AOR is the better route when:

- Your team is project-based or growing on-demand.

- You want to avoid misclassification risk and ensure compliance with tax regulations.

- You’re scaling quickly and need AOR services to streamline contractor management.

Hybrid Use is Also Possible :

Some companies benefit from using both models. For instance, they may use an EOR for key staff in a country while engaging an AOR for local consultants. This hybrid approach allows flexibility while staying compliant with local regulations across borders and roles. Additionally, EOR solutions simplify international employment by helping companies navigate legal and compliance complexities when expanding operations to new international markets, enabling them to focus on growth while ensuring compliance with local employment regulations.

Need help making that decision?

Common Misconceptions About EOR and AOR

Debunking Myths

There are several misconceptions about EOR and AOR. One common myth is that EORs and AORs are the same. While they both play a role in workforce management, their responsibilities and functions differ significantly. Understanding these differences is crucial to avoid potential legal risks associated with misclassifying employees and not adhering to local employment laws.

Clarifying Roles and Responsibilities

It’s important to understand the distinct roles and responsibilities of EORs and AORs. EORs assume the role of the legal employer, managing various employment related responsibilities such as legal and regulatory duties associated with hiring employees, particularly in foreign markets. This allows businesses to concentrate on their core operations. On the other hand, AORs act as intermediaries between businesses and independent contractors.

Industry Use Cases

The choice between EOR and AOR isn’t one-size-fits-all – it depends on the nature of your industry, how your teams operate, and your business model. For companies looking to expand their workforce globally, navigating the complexities of international markets is crucial. Below are real-world examples of how companies in different sectors use EOR services and AOR services to streamline hiring, maintain compliance, and scale with confidence.

| Industry | Best Fit | Why It Works |

|---|---|---|

| Tech & SaaS | EOR + AOR | Blend of full-time engineers + freelance specialists |

| Creative Agencies | AOR | Short-term, project-based teams needing agility and compliance |

| Healthcare & Life Sciences | EOR | Full-time regulated roles needing legal hiring and benefits administration |

| Consulting Firms | EOR + AOR | Varies by engagement type and geography |

| E-commerce & Retail | EOR | Long-term hiring in new markets for scaling operations |

| Media & Entertainment | AOR | Freelance-heavy industries needing streamlined compliance |

FAQs

1. What is an EOR and when should I use it?

An Employer of Record (EOR) is a third party that becomes the legal employer for your staff, handling payroll, benefits, taxes, and compliance. You should use an EOR when hiring full-time employees in a new country without setting up a local entity. This approach helps you navigate local labor laws and ensures compliance for global expansion.

2. How does an AOR help with contractor management?

An Agent of Record (AOR) specializes in managing independent contractors, ensuring proper classification, onboarding, and compliance with local regulations. The AOR acts as an intermediary, handling tax documentation and agreements, which helps reduce the risk of misclassification and legal penalties.

3. What are the main differences between EOR and AOR?

The EOR becomes the legal employer for full-time staff and manages all employment-related responsibilities, while the AOR focuses on compliance for independent contractors without becoming their employer. EOR is ideal for structured, long-term employment, while AOR is best for flexible, project-based workforces.

4. Is it possible to use both EOR and AOR services together?

Yes, companies often use both models to address different workforce needs. For example, an EOR can handle key full-time staff while an AOR manages local consultants or freelancers, providing flexibility and compliance across roles and regions.

5. Are EOR and AOR services cost-effective for startups?

AOR services are generally more affordable and flexible, making them ideal for startups managing a large pool of freelancers or short-term experts. EOR services may be more costly due to their comprehensive scope but are invaluable for businesses seeking structured employment and compliance in new markets.

6. Can I switch from using an AOR to an EOR as my business grows?

Absolutely. As your business scales and you transition from project-based teams to full-time employees, you can switch to an EOR. This ensures your new hires are compliant with local employment laws and receive the necessary benefits and support.

7. What compliance risks do EOR and AOR help mitigate?

EOR helps mitigate legal and financial risks tied to employee misclassification, tax compliance, and local labor laws for full-time employees. AOR reduces risks associated with contractor misclassification and ensures proper documentation and payment for independent contractors.

Ready to take your IT company global?

Unrivaled Payroll Solutions for 15 Years

Soham wasn’t always an international employment guru. He began with a passion for numbers, surprising shopkeepers with his mental math skills.

At PamGro, Soham spearheads international expansion and EOR (Employer of Record) services, driving global business strategies and ensuring compliance across multiple regions.