The Ultimate Guide to Global Payroll Management

TABLE OF CONTENTS

- What is Global Payroll and how does it worK?

- What are the challenging aspects of global payroll?

- Are there any benefits to using global payroll?

- What responsibility does global payroll holds

- What are the different types of global payroll providers?

- What is a Global PEO?

- How do you ensure payroll compliance with local labor laws?

- When should you outsource global payroll?

- Tips when choosing your International Payroll Provider

Amidst the ever-evolving landscape of international business, the management of a global workforce has become an intricate ballet of precision and compliance. At the heart of this intricate dance lies global payroll, a multifaceted discipline that traverses geographical boundaries, currencies, and intricate legal frameworks. In this article, we embark on a journey to explore the complexities and nuances that make up the world of global payroll. From the formidable challenges that businesses face in this realm to the manifold benefits that arise from its effective management, we will delve deep into the heart of global payroll, shedding light on its essential role in the modern global economy.

In this comprehensive guide, we will explore what global payroll is, how it works, its challenges, its benefits, and its responsibilities. We’ll also delve into different types of global payroll providers, payroll compliance with local labour laws, and when to consider outsourcing global payroll. Finally, we’ll provide five essential tips for choosing the right international global payroll provider.

What is global payroll and how does it work?

Global payroll involves managing and processing employee compensation and payroll taxes, and complying with labour laws across multiple countries and regions. It involves calculating and disbursing salaries, handling tax deductions, and ensuring compliance with local, regional, and international regulations. Global payroll involves a complex network of tasks, including:

1. Gathering and maintaining employee data:

Collecting and maintaining accurate and up-to-date employee information is crucial for payroll processing.

2. Multi-currency calculations:

Converting salaries, bonuses, and deductions into various currencies as needed for different regions.

3. Compliance with tax laws:

Calculating and withholding income tax, social security contributions, and other deductions in accordance with local regulations.

4. Timely payment:

Ensuring employees are paid accurately and on time, considering different pay frequencies and payment methods.

5. Reporting and record-keeping:

Generating reports for tax authorities and maintaining payroll records for auditing purposes.

What are the challenging aspects of global payroll?

The sheer diversity of tax laws, labor regulations, and reporting requirements across different countries can be an intricate web to unravel. Moreover, currency fluctuations, data privacy concerns, and the need to adapt to varying cultures and languages further compound the complexity.

In this intricate landscape, precision is not merely a virtue but a necessity, as even the slightest error can lead to compliance issues, legal complications, or disgruntled employees. Therefore, working with global payroll demands a meticulous approach and a keen understanding of the multifaceted challenges it presents. Managing global payroll comes with several challenges, which includes but is not limited to:

- Complex regulations: Navigating diverse and ever-changing tax laws, labour regulations, and reporting requirements in different countries.

- Currency fluctuations: Dealing with currency exchange rate fluctuations when converting salaries or making international payments.

- Data security and privacy: Safeguarding sensitive employee data and ensuring compliance with data protection laws like GDPR.

- Integration with HR systems: Coordinating global payroll with HR systems and ensuring data accuracy and consistency.

- Communication barriers: Overcoming language and cultural barriers when interacting with local authorities and employees in different regions.

Looking To Hire Foreign Talent Without A Local Entity?

Are there any benefits to using a global payroll?

Adopting a global payroll solution is like discovering a world of possibilities. The benefits aren’t just numerous, they’re life-changing. It simplifies your operations. With global payroll, you’ll easily manage everything from employee compensation to taxes and compliance. You’ll no longer have to worry about navigating complex tax laws across multiple countries. It’ll ensure you’re paying your employees on time and accurately. Your employees will be more satisfied with their job. Global payroll also helps you save money.

Centralizing control makes you less likely to make mistakes and risk legal penalties. Let’s dive into some of the several benefits global payroll process management offers:

- Compliance: Compliance with local labour laws and tax regulations reduces legal risks and penalties.

- Cost efficiency: Streamlining payroll processes and reducing errors can save costs.

- Enhanced accuracy: Minimizing payroll errors ensures employees are paid correctly and on time, boosting morale and productivity.

- Centralized control: Gaining centralized oversight of global payroll operations facilitates reporting and auditing.

What responsibilities do global payrolls hold?

The Global Payroll teams manage payroll processing, compliance, and labor law compliance across multiple jurisdictions. Their mission is to make sure employees are paid correctly and on time while navigating complex currency conversions and privacy laws. Their attention to detail reduces compliance risks, minimizes mistakes, and helps to create a more productive and happier global workforce.

In today’s rapidly changing global economy, the dependability and expertise of a global payroll team are essential for businesses looking to succeed on the global payroll services stage.

Global payroll professionals have diverse responsibilities, including:

- Data management: Collecting, storing, and maintaining employee data securely.

- Tax compliance: Calculating and withholding taxes according to local laws and remitting them to authorities.

- Reporting: Preparing and submitting payroll reports and tax filings accurately and on time.

- Employee support: Addressing employee queries, concerns, and issues related to payroll.

- Compliance monitoring: Staying updated on various countries’ labour laws and tax regulations changes.

What Are the different types of global payroll providers?

There are different types of global payroll providers, including:

- In-house teams: Companies may manage global payroll internally if they have the expertise and resources.

- Local payroll providers: Employing local payroll providers in each country or region can help ensure compliance.

- Global payroll providers: These companies manage payroll across multiple countries, offering comprehensive solutions.

- Global PEOs: Professional Employer Organizations (PEOs) can also handle global payroll and HR functions for companies expanding internationally.

What Is a Global PEO?

A Global PEO is a service provider that acts as the “employer of record” for a company’s foreign employees. A Global PEO takes over the legal and administrative burden of employing employees in a foreign country, including payroll management, tax compliance, human resources functions, employee benefits, and compliance with the labor laws and regulations in the country where the employees are employed.

A Global PEO helps companies enter new international markets faster, more effectively, and without the hassle of setting up a legal entity in every foreign country, making global expansion easier and less demanding on international workers.

How do you ensure payroll compliance with local labor laws?

It is absolutely crucial for any global business to prioritize payroll compliance with local labor laws. To achieve this, it is essential to conduct thorough research and stay updated with the labor regulations in every country where your business operates. Additionally, implementing a robust payroll software that can handle diverse legal requirements is vital.

Regular audits should also be conducted to identify and rectify any compliance discrepancies. Maintaining accurate and organized payroll records is of utmost importance, and seeking guidance from local legal or accounting professionals who are well-versed in regional labor laws is highly recommended.

By making compliance a top priority, you not only mitigate risks and avoid penalties, but also establish yourself as a responsible and law-abiding employer. This fosters trust and stability within your global workforce, ultimately contributing to the success of international employees and your business.

To ensure compliance with local labour laws, start with the following:

- Stay informed: Keep up-to-date with changes in labour laws and tax regulations in each country where you operate.

- Partner with experts: Work with local payroll providers or Global PEOs with local expertise.

- Invest in technology: Use payroll software that can adapt to local requirements and provide compliance checks.

- Regular audits: Conduct internal audits to ensure payroll processes align with local regulations.

When Should You Outsource Global Payroll?

Outsourcing your global payroll can be a game-changer for businesses looking to expand internationally. It brings a multitude of benefits, such as specialized expertise and improved efficiency. Global payroll providers are well-versed in navigating the intricate maze of tax regulations, labor laws, and reporting requirements across various countries. This expertise significantly reduces the chances of costly errors and compliance issues.

Furthermore, outsourcing allows businesses to centralize and streamline their payroll processes, freeing up valuable time and resources that can be better utilized for core operations. By partnering with a global team of payroll experts, organizations gain access to cutting-edge technology and industry best practices to ensure that their payroll systems are always up-to-date and fully compliant.

Ultimately, outsourcing global and international payroll services not only enhances accuracy and compliance but also provides a strategic advantage. It empowers businesses to focus on their global growth strategies with unwavering confidence. So, why not take advantage of this compelling idea and unlock the true potential of your international expansion?

To recap outsourcing global payroll services is a good idea when you are:

- Expanding internationally: Managing payroll in-house becomes more complex as your business grows across borders.

- Ensuring compliance: Outsourcing can mitigate compliance risks if you’re unfamiliar with local labour laws and regulations.

- Reducing costs: Outsourcing can be cost-effective compared to maintaining an in-house global payroll team.

- Focusing on core activities: Outsourcing payroll allows you to concentrate on your core business activities.

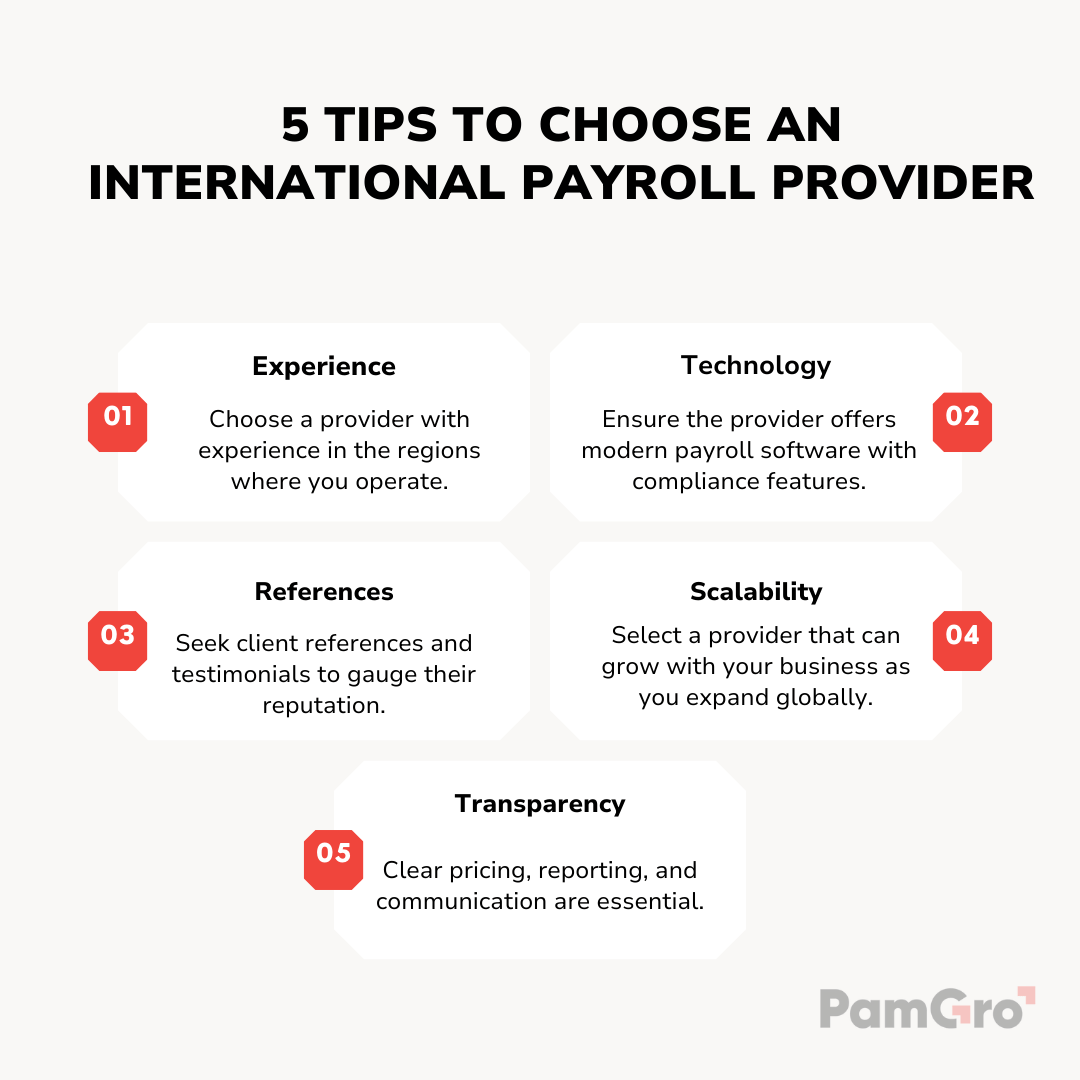

5 Tips When Choosing Your International Payroll Provider

When selecting an international payroll service provider, consider these five tips:

- Expertise: Choose a provider with experience in the regions where you operate.

- Technology: Ensure the provider offers modern payroll software with compliance features.

- References: Seek client references and testimonials to gauge their reputation.

- Scalability: Select a provider that can grow with your business as you expand globally.

- Transparency: Clear pricing, reporting, and communication are essential.

Managing global payroll is a complex yet essential aspect of international business expansion. Understanding its intricacies, challenges, and benefits is crucial for ensuring compliance, accuracy, and efficiency.

Whether you decide to handle global payroll in-house, work with local providers, or partner with a Global PEO, the key is to prioritize compliance, accuracy, and the well-being of your global workforce. By following these guidelines and considering the provided tips, you can successfully navigate the world of global hiring and payroll management.

Payroll Solutions Unrivalled since 15 Years