What is an Employer of Record (EOR)? The Complete 2025 Guide

In today’s fast-paced global economy, expanding into new markets and hiring international talent is no longer optional—it’s a necessity. But navigating international employment laws, tax compliance and setting up a local entity in another country is a minefield. Enter: Employer of Record services (EOR services).

An Employer of Record (EOR) is a third-party organisation that becomes the legal employer for your international employees. EOR services allow companies to hire employees in foreign countries without having to establish a local entity. From payroll taxes and benefits to local employment laws and HR services, an EOR provider ensures compliance and streamlines international hiring. Managing international employees involves a lot of administrative burden including payroll, tax compliance and other HR responsibilities. A third-party service provider, specifically an Employer of Record (EOR), takes away these burdens, so companies can focus on growth while ensuring legal compliance and efficient operations.

This 2025 guide covers everything you need to know about EOR, from how they work to how they support global expansion.

TABLE OF CONTENTS

- What is an Employer of Record (EOR)?

- How Does an Employer of Record Work?

- Why Use EOR Services?

- EOR vs PEO: What’s the Difference?

- Why Use Employer of Record Services?

- Common Use Cases

- Why PamGro is the trusted partner for EOR Services?

- What to look for in an EOR Provider?

- EOR Cost Breakdown

- Countries Where EOR is Common

- Additional Benefits of EOR Services

- The Role of EOR in Global Payroll and HR Services

- How EOR Enables Hiring in Countries Without Local Entities

- Frequently Asked Questions

- Bonus FAQ’s

- Final Thoughts

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a company that employs workers on behalf of another business. The EOR handles all formal employment tasks such as payroll, tax compliance, employee benefits, ensuring local labour laws and managing legal responsibilities associated with employing international teams.

EORs also manage employee data securely, adhering to data protection regulations such as GDPR, and provide clients access to this data through secure software systems. For companies expanding internationally, EOR services are a must-have. They eliminate the need to set up a local entity in each country while still allowing legal employment. Plus EOR services allow businesses to hire international employees without having to pay registration fees or meet local entity requirements.

EOR allows companies to:

- Hire employees in countries without a physical presence

- Pay employees compliantly under local laws

- Provide payroll benefits and employee benefits

- Minimise compliance risk and tax penalties

How Does an Employer of Record Work?

Here’s how an EOR service typically works:

- You identify and hire international employees.

- The EOR provider becomes the legal employer.

- You manage daily work responsibilities; the EOR manages legal employment.

- The EOR ensures compliance with labour laws, handles payroll taxes, manages payroll and issues contracts aligned with local employment laws.

An EOR acts as a buffer between your company and potential regulatory pitfalls across borders. The client company retains operational control, while the EOR provider assumes all legal obligations. Ensuring global HR compliance is key to navigating the complexities of international hiring and avoiding fines and legal issues.

Why Use EOR Services?

EOR services are ideal when:

- Expanding into new markets

- Hiring remote international employees

- Testing markets before setting up a local entity

- Ensuring compliance payroll with foreign country tax and employment laws

- Hiring employees overseas without needing a local business entity

- EOR services are often necessary for companies testing new markets before making long-term commitments, allowing for agile hiring strategies

Whether you’re a startup looking to access global talent, or an enterprise streamlining your global payroll, EOR provides the flexibility and compliance backbone you need. Plus EORs take full responsibility for managing tax obligations, ensuring compliance with employment laws.

Looking To Hire International Talent Without A Local Entity?

EOR vs PEO: What’s the Difference?

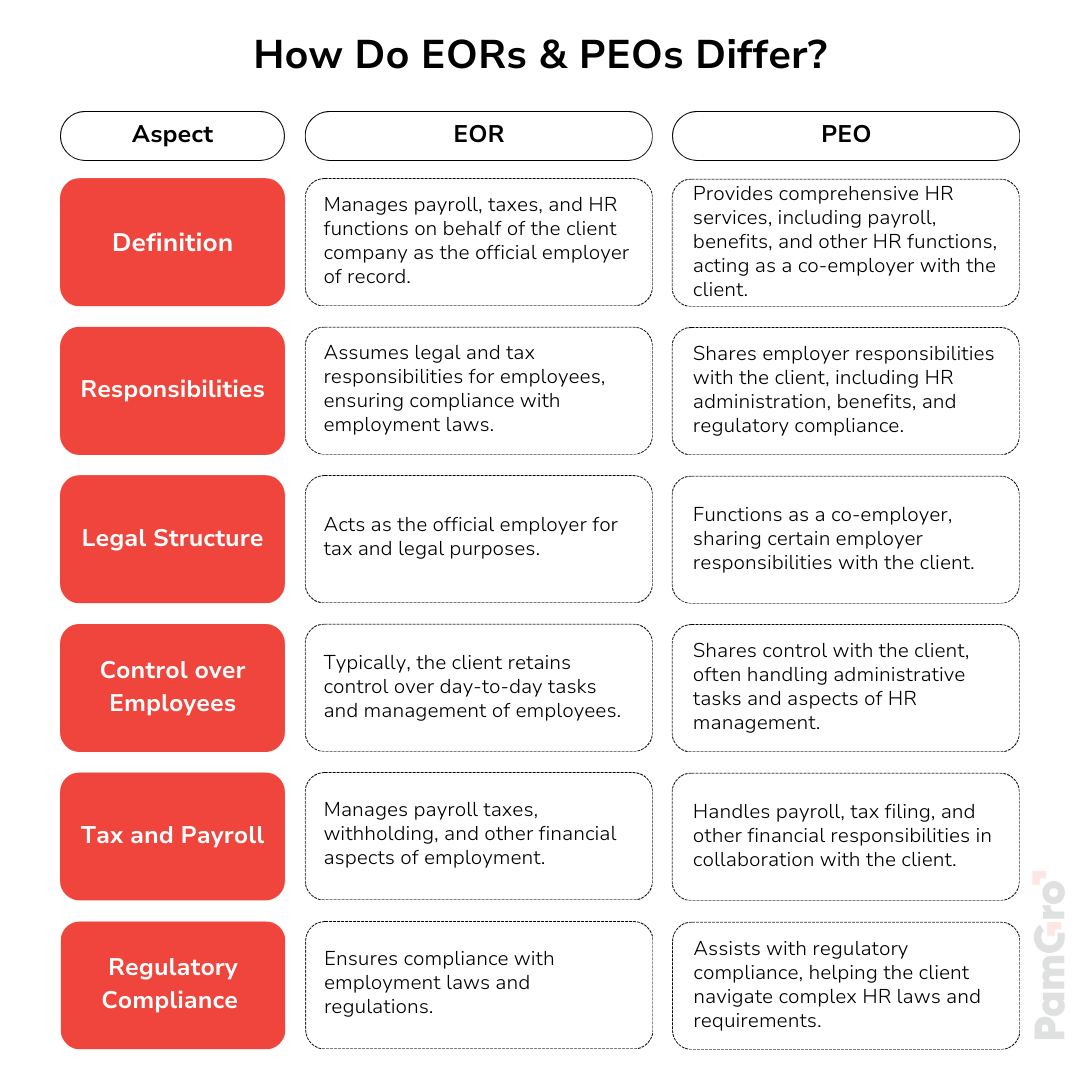

Though often used interchangeably, EOR and PEO are not the same. A professional employment organization (PEO) offers domestic HR and workforce management services through a co-employment model, while an EOR manages global workforce compliance liabilities. A Professional Employer Organization (PEO) cannot hire in countries where the company does not have a local entity, unlike an EOR.

When operating internationally, especially in countries without local infrastructure, an EOR service offers a more scalable solution.

Why Use Employer of Record Services?

- Global Expansion: Enter new markets without entity setup

- Tax Compliance: Avoid penalties with payroll taxes and filings

- Compliance: Follow local labor laws effortlessly

- Access Global Workforce: Hire international employees seamlessly, navigate local employment laws

- Reduce Costs: Eliminate local legal teams overhead, use an Employer of Record solution to streamline HR and compliance

Why PamGro Is the Trusted Partner for Employer of Record (EOR) Services?

When it comes to scaling globally, the right EOR partner doesn’t just ensure compliance—it becomes a competitive advantage. PamGro is that partner. With industry-leading certifications, cutting-edge infrastructure, and a truly global reach, PamGro sets a new standard in Employer of Record services.

1. Certified, Compliant, and Built for Scale

PamGro operates to the highest standards of employment compliance, ensuring ethical practices, financial transparency, and exceptional care for contractors and employees. We are also ESG certified, reflecting our commitment to environmental, social, and governance best practices across our operations and partnerships.

Moreover, PamGro holds multiple labour leasing licences including AÜG, SNA, and more—ensuring we operate within the highest legal frameworks across Germany, Switzerland, and other key markets.

2. Zero Onboarding and Offboarding Fees

Unlike many other EOR providers, PamGro charges zero onboarding or offboarding fees. Whether you’re hiring one specialist or an entire team, you won’t face unexpected costs at the start or end of the employee lifecycle. This transparent pricing structure makes it easier for businesses to forecast and scale globally with confidence.

3. Employee-First Benefits: Pension & Salary Sacrifice

We don’t just support global employment—we elevate it. PamGro offers bespoke pension plans for employees in eligible countries, helping your workforce plan for the future while complying with local retirement requirements. In addition, we provide salary sacrifice schemes, allowing employees to make pre-tax contributions towards pensions, equipment, or other benefits—boosting retention and employee satisfaction.

4. Purpose-Built EOR Platform

PamGro is also a tech-driven EOR partner. Our proprietary platform streamlines the full contractor lifecycle—from onboarding and e-signature management to payroll, compliance checks, tax deductions, and timesheet approvals.

You’ll gain real-time access to employee records, compliance statuses, payroll history, and contract terms—all in one central dashboard. It’s EOR made modern.

5. Owned Entities + Global Network

With 14 self-owned entities and a trusted network spanning 150 countries, PamGro gives you the best of both worlds: direct control and flexibility. Our owned entities allow us to offer competitive pricing, faster onboarding, and stricter quality control, while our global reach ensures you can hire wherever your talent or business takes you.

6. Built for Companies Like Yours

Whether you’re an IT company, NGO, or a fast-scaling startup, PamGro adapts to your unique goals. Our EOR services are crafted to simplify complex employment regulations, support international hiring, and drive compliance payroll execution—without the red tape.

PamGro’s EOR services allow companies to:

-

Hire in countries without setting up a local entity

-

Ensure compliance with evolving employment laws and tax regulations

-

Pay employees compliantly with full visibility and control

-

Access premium employee benefits that attract and retain top international talent

🚀 Ready to scale your global workforce?

What to Look for in an EOR Provider

Before choosing an EOR company, consider:

- Country coverage

- Experience in international hiring

- Integration with existing HR systems

- Local legal and language expertise

- Data protection, GDPR compliance, data security

- Choose an EOR provider that owns its own local entities in the countries where you want to hire

Top-rated EOR companies offer local insight and ongoing HR support to reduce risk. They also offer competitive benefits packages which are crucial for attracting top talent in Europe’s regulated labor market.

EOR Pricing

EOR costs vary by:

- Country of employment

- Number of employees

- Contract type (full-time, part-time, contractor)

EOR costs depend on the provider, most EOR providers charge a percentage of the employee’s salary or a fixed monthly fee. This includes compliance payroll, local taxes and statutory benefits. PamGro EOR Services starts from just $149 Per Month Per Contractor

Knowing your projected global employment costs upfront is key. This helps client companies reduce administrative burdens and improve operational efficiency so they can scale globally better.

Hiring internationally without an EOR can expose companies to:

- Misclassification penalties

- Tax fines

- Breach of local labor laws

- Employee lawsuits

- Failed audits

With EOR, you mitigate these risks and each hire is legally protected. EOR services also help navigate complex tax laws to ensure compliance and avoid issues.

Related Read: How much does an Employer of Record Cost?

Countries Where EOR is Used

EOR is used in:

- USA

- Canada

- UK

- Brazil

- India

- Philippines

- Singapore

- Mexico

- Switzerland

- Vietnam

- Japan

- UAE

Each of these has complex employment laws which EOR allows companies to navigate without direct exposure. In Europe, collective bargaining agreements make employment terms even more complex, so EOR is essential for companies in Germany, France and the Netherlands.

More Benefits of EOR

Using a global employment platform through EOR offers more than compliance:

- Speed to market: hire in days, not months

- Reduced time-to-productivity for global hires

- Simplified employee benefits administration

- Local expertise in tax compliance

- Integration with HR tech stacks

- Support for international employees

EORs also mitigate permanent establishment risk by ensuring most activities managed through them do not trigger tax obligations except in specific situations like direct sales within the host country.

EOR in Global Payroll and HR Services

EOR simplifies global HR by:

- End-to-end payroll processing and managing payroll

- Localised benefits management

- Secure document storage

- Handling employee terminations according to local laws

It becomes an extension of your HR team, so you can build a global team that’s legally compliant. EOR services also ensure international HR compliance which is crucial for tax regulations, benefits administration and employment contract compliance across countries.

How EOR Enables Hiring in Countries Without Local Entities

One of the biggest advantages of EOR is the ability to hire in countries without establishing your own entity. This is important for:

- Market testing before expansion

- Freelancers or remote teams

- Pilot projects

- Flexible workforce scaling

EORs remove the legal and administrative hurdles so you can focus on strategy. Hiring internationally through EOR also ensures compliance with local labor laws and simplifies global employment.

Global Team Management

In international business, managing a global team is key to success. An Employer of Record (EOR) is a complete solution for managing global teams, so all aspects of employment are taken care of. From payroll and benefits administration to local labor laws compliance, EOR takes care of the heavy lifting so you can focus on your core business.

Partnering with an EOR means your international employees are properly employed, paid and managed, reducing compliance risks. EORs provide ongoing support and expert guidance on local employment laws, tax regulations and other regulatory requirements. This ongoing support helps companies navigate the complexities of international employment and stay compliant with local laws and regulations.

By using the expertise of an EOR, companies can build and manage global teams with confidence knowing all legal and administrative responsibilities are being handled by professionals. This not only increases operational efficiency but also allows businesses to access international talent without the usual hurdles.

Foreign Entity

Establishing a foreign entity is often necessary for companies to create a permanent presence in a new market. However, this process can be complex, time-consuming and resource intensive. An Employer of Record (EOR) can help navigate these challenges by providing foreign entity solutions that streamline the setup and management of local entities.

EOR can assist with the entire process of setting up a local entity, from obtaining necessary licenses and permits to local tax compliance. They provide expert guidance on local labor laws, employment contracts and benefits administration so companies can navigate the complexities of international employment.

By partnering with an EOR, companies can ensure their foreign entity is properly set up and managed, minimizing compliance risks and administrative burdens. This allows businesses to focus on their strategy and operations while the EOR handles local compliance and regulatory requirements.

EOR Services and Benefits Administration

Managing employee benefits such as health insurance, retirement plans and other perks can be particularly challenging in an international context.

EORs handle benefits enrollment, premium payments and claims processing making the whole process seamless for the employer and the employee. They also provide expert guidance on local benefits laws and regulations so the benefits packages offered are competitive and compliant with local requirements.

By partnering with an EOR, companies can reduce administrative burdens associated with benefits management. EORs offer ongoing support and guidance so businesses can navigate the complexities of international benefits administration. This means international employees get the benefits they are entitled to, improving employee satisfaction and retention.

In summary, EOR services simplifies benefits management and ensures compliance with local regulations, a complete solution for international employment.

FAQ's

1. Is EOR legal?

Yes, EOR is fully legal and widely used by global companies.

2. Do I lose control over my employees?

No, you maintain full managerial control. The EOR only handles legal and administrative functions.

3. Can EOR services help startups?

Yes. EOR for startups means fast and compliant international growth.

4. Is EOR only for full-time roles?

No, it can cover contractors and part-time workers too.

5. What’s the difference between an EOR and a staffing agency?

EOR becomes the legal employer, or global employer, whereas staffing agencies just source talent. EORs may own legal entities in the countries they operate, which is crucial for meeting local employment laws and ensuring smooth business operations.

Bonus FAQ's

1. What is an Employer of Record?

An EOR is a third-party company that employs workers on your behalf in another country, leveraging a global network of wholly-owned entities to facilitate international hiring and operations.

2. What does Employer of Record mean?

It means a company that assumes all legal employment responsibilities, including payroll and compliance.

3. What does EOR stand for?

EOR stands for Employer of Record.

4. What is an EOR employee?

An EOR employee works for your company operationally but is legally employed by the EOR provider.

5. What is EOR in HR?

In HR, EOR means outsourcing HR and compliance to an external legal employer.

6. What does EOR check amount mean?

It’s a paycheck issued by the EOR to an employee, covering salary and benefits.

8. How much does an Employer of Record cost?

Varies by region and headcount but EOR pricing includes a management fee and payroll taxes.

9. What does an Employer do?

An employer hires, manages and compensates employees while ensuring legal compliance.

10. What does an Employer do?

An employer hires, manages and compensates employees while ensuring legal compliance.

11. Employer is the employer that owns or manages?

Correct. The legal employer is the one who owns or manages the employment contract and responsibilities.

An EOR allows businesses to manage compliance, payroll and HR tasks across borders without setting up local entities, simplifying the international hiring process.

Conclusion

Whether you’re a startup or an established business, international employment rules can be complicated. But with the right EOR provider, you can hire, manage and pay global employees—all while being compliant.

Employer of Record services are not a workaround—they are the future of international employment. As we head into 2025, more businesses are looking to build a global team without setting up foreign entities. An EOR provides a smarter, faster and safer path forward by offering the same services as Global Employment Organizations (GEOs).

EOR services ensures employment related legal safety and business continuity by reducing global HR complexity. With fast market entry, local hiring and total compliance payroll management, the EOR model helps businesses scale easily. Setting up a local presence through an EOR simplifies compliance with local employment laws and operations.

Hire in 150+ Countries Compliantly