Employee Cost Calculator - Poland [2026]

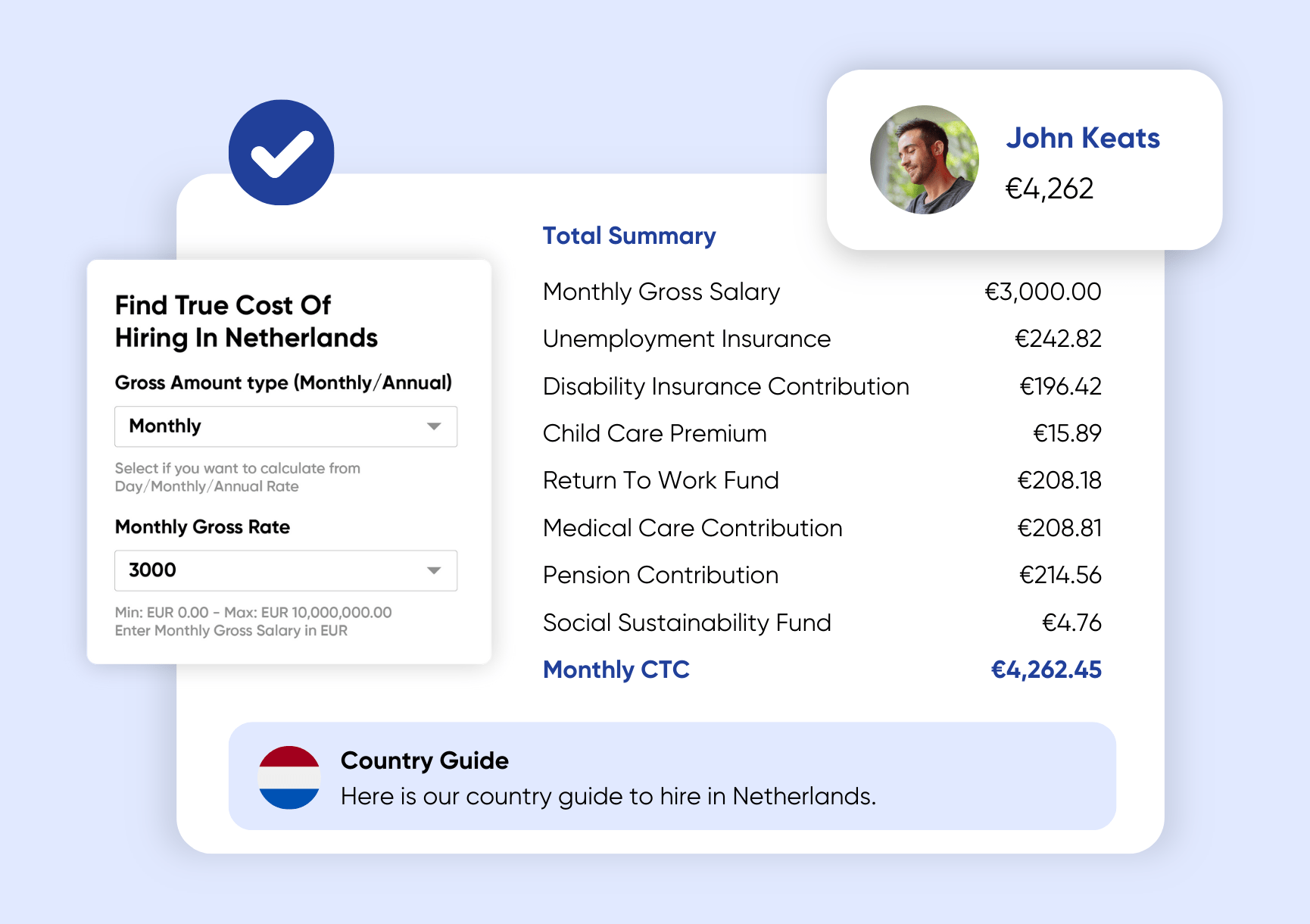

Our Employee Expense calculator simplifies this complicated process by providing a detailed breakdown of all employment-related costs.

Whether hiring full-time employees or contractors, this employment cost calculator Poland ensures you have a clear picture of the financial investment involved.

How to Use the Cost-to-Hire Calculator: Step by Step

Step 1: Choose the Gross Salary Payment Frequency

Select the Monthly or Annual frequency to align with your payroll schedule.

Step 2: Enter the gross salary amount

Enter the amount for the role based on the selected payment frequency.

Step 3: Enter Your Details

Provide your Name, Phone Number, and Email Address to receive your personalized report.

Step 4: Calculate

Click “Calculate” to generate a detailed breakdown of costs, including:

- Monthly Gross Salary

- Unemployment Insurance

- Disability Insurance Contribution

- Child Care Premium

- Return to Work Fund

- Medical Care Contribution

- Pension Contribution

- Social Sustainability Fund

- Monthly CTC

Note: You can calculate the cost to hire an employee in Poland monthly or annually in real-time by selecting an option or adjusting the value. The calculator will instantly display the updated amount.

Overview of Employment Costs in Poland in 2026

Are you hiring in Poland? Like in every country, Poland incurs additional costs associated with employing workers beyond their gross salary; these expenses may include social security contributions and employee capital plans.

| Cost Type | Amount (PLN) | Percentage |

| Employer’s Perspective | ||

| Gross Salary | 5,500.00 | – |

| Retirement Insurance Contribution | 536.80 | 9.76% |

| Disability Pension Contribution | 357.50 | 6.50% |

| Accident Insurance | 91.85 | 1.67% |

| Labour Fund | 134.75 | 2.45% |

| FGŚP | 5.50 | 0.10% |

| Total Employment Cost (total employer cost Poland) | 6,626.40 | – |

| Employee’s Perspective | ||

| Net salary (what the employee gets in their bank account) | 4,078.81 | – |

| Retirement Insurance Contribution | 536.80 | 9.76% |

| Disability Pension Contribution | 82.50 | 1.50% |

| Sickness Insurance | 134.75 | 2.45% |

| Health Insurance Contribution | 427.14 | 7.76% |

| Income Tax (Advance on PIT) | 240.00 | – |

| Gross Salary (for reference) | 5,500.00 | – |

Employment Costs in Poland – Employment Contract

Hiring an employee in Poland involves more than just paying their salary. Employers are required to cover additional costs, including social insurance contributions. Here’s a quick breakdown of these contributions:

- Retirement Insurance: 9.76% of the gross salary.

- Disability Pension Contribution: 6.50%.

- Labour Fund: 2.45%.

- Fund of Guaranteed Workers’ Allowance (FGŚP): 0.10%.

- Accident Insurance: 1.67% (standard rate; may vary by business type).

In total, employers contribute an additional 20.48% of the gross salary for each full-time employee.

Additional Costs to Consider:

- Medical check-ups required by law.

- Compensation for overtime work.

- Payment during periods of employee incapacity.

- Maintaining accurate employee records.

It’s important to note that not all the gross salary goes directly to the employee. Deductions are made for:

- Retirement Insurance: 9.76%.

- Disability Pension: 1.50%.

- Sickness Insurance: 2.45%.

- Health Insurance: 9.00%.

Example: Employment Costs for Minimum Salary in Poland in 2025

The minimum gross salary for full-time employees in Poland sets a baseline for compensation. As of January 1, 2025, the minimum wage has increased to 4,666 PLN per month, applicable to all full-time employees regardless of their experience level. Employers must account for additional costs beyond the gross salary, which include mandatory social contributions. For a gross minimum wage of 4,666 PLN, the employer’s costs broken down as follows:

| Cost Type | Amount (PLN) | Percentage of Gross Salary |

| Retirement Contribution | ~455.40 | 9.76% |

| Disability Pension Contribution | ~303.29 | 6.50% |

| Accident Insurance Contribution | ~77.92 | 1.67% |

| Labour Fund Contribution | ~114.33 | 2.45% |

| Fund of Guaranteed Workers’ Allowance (FGŚP) | ~4.67 | 0.10% |

Total Employer Cost:

With these contributions, the total employment cost for an employer hiring at the minimum salary level is approximately 5,621.59 PLN.

What are the Taxes for Employers and Employees in Poland?

Employer Taxation in Poland

| Tax | Details |

| Tax Year-End | December 31 |

| Sales Tax (VAT) | 23% |

| Payroll Tax | None (no specific payroll taxes apply). |

| Corporate Tax | 19% (referred to as Podatek dochodowy od osób prawnych). |

Employee Taxation in Poland

| Tax | Details |

| Income Tax Rates | Based on annual taxable income (including a 4% solidarity surcharge): |

| • Up to PLN 85,528: 17% | |

| • Over PLN 85,528: 32% | |

| Filing & Payment Deadline | Tax filings are due by April 30 each year. Payments from Polish bank accounts are same-day. |

| EU-based payments are processed within 2 days; other international payments take 3+ days. | |

| Public Pension | Retirement age: 65 years (men), 60 years (women). |

| Health Insurance | 9% obligatory contribution, up to 7.75% deductible from the employee’s income tax. |

How to Hire Employees in Poland Without Any Hassles?

Hiring employees in Poland can be smooth when you know the proper steps and comply with local regulations. Here are the main ways to hire talent in Poland:

- Setting Up a Subsidiary Entity

Establishing a legal entity in Poland is an option but can be time-consuming and expensive. The organization responsible for company registration in Poland is the National Court Register (Krajowy Rejestr Sądowy – KRS). This approach is ideal for companies planning a long-term presence in the country.

- Using an Employer of Record (EOR) Service

Partnering with an EOR like PamGro eliminates the complexities of setting up a local entity. The EOR manages payroll, compliance, employee benefits, and more, allowing you to focus on your business growth.

- Comprehensive Support: PamGro handles the entire employee lifecycle, from hiring to retirement.

- Compliance Expertise: Our team ensures you adhere to Polish labour laws, including working conditions, remuneration, and timings.

- Streamlined Process: We simplify hiring in Poland, saving you time and resources.

Read More: Employer of Record in Poland

EOR Services in Poland

Expanding your business to Poland is hassle-free with Employer of Record (EOR) services. A Poland EOR solution allows you to hire and manage employees without setting up a legal entity, saving you time and money. With PamGro, you can streamline compliance, payroll, and administrative tasks while focusing on growth.

PamGro’s automated, technology-driven platform ensures efficient international expansion. Below are the general terms of our EOR services:

| General Terms | Details |

| Total Employer Liability | Approx. up to 22.14% of the invoice value. |

| Minimum Service Duration | 3 months. |

| Currency Accepted | Polish Zloty (PLN). |

| Required Documents | For Polish Citizens: ID proof, address, CV, bank details, and education certificates. |

| For Expatriates: Job details, qualifications, CV, passport, ID proof, bank details, photos, work permit. |

With PamGro’s local compliance expertise, we ensure full compliance with Polish labour laws while benefiting from seamless employee management.

Read More: Top EOR Service Providers in Poland

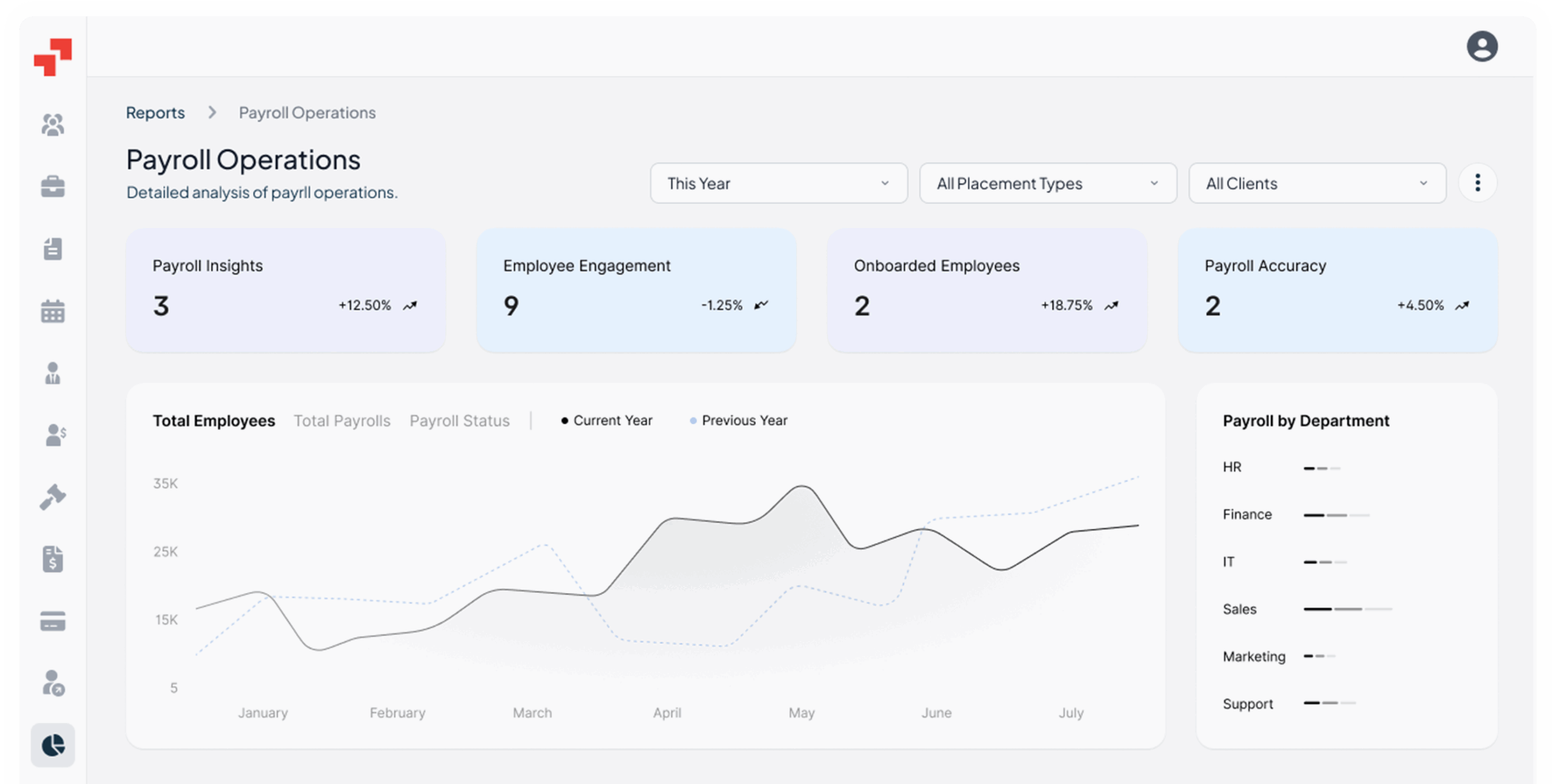

All-in-One Global Workforce Platform.

Manage global hiring, compliance, and payments with a single platform built for clients, contractors.

Check out our Global Hiring Guides

Uncover the True Cost of Hiring Problem in Poland!

Frequently Asked Questions

Ans: Employer costs in Poland include

- social security contributions,

- health insurance, and

- Corporate and sales taxes.

These are mandatory payments that businesses must make on behalf of employees.

Ans: Employment tax is calculated based on an employee’s salary, including

- Personal income tax,

- Social security, and

- Health insurance contributions.

Ans: Yes, employers must contribute to

- Social security,

- Covering pensions,

- Disability, and

- Accident insurance for employees.

Ans: The total social security contributions amount to approximately 19.21% to 22.41% of the employee’s gross salary, according to the Council of Ministers’ Regulation published on September 12, 2024. This includes:

- Employer’s Share: Approximately 19.21% to 22.41%, which covers pension, disability, and accident insurance.

- Employee’s Share: Around 13.71%, covering pension, disability, and sickness insurance.

The changes are primarily based on the regulations established by the Polish government, specifically under the Council of Ministers’ Regulation published on September 12, 2024.

Yes, health insurance is a mandatory cost for employers in Poland. Employers are required to contribute to health insurance, which is deducted directly from the employee’s salary at a rate of 9%.

Yes, the costs can vary depending on whether the contract is full-time, part-time, or temporary, with different contribution rates.

Yes, Poland offers tax relief for employers hiring specific groups or engaging in certain business activities like R&D or hiring young workers.

Poland’s employment costs are generally approx 65% lower than Western European countries, making it an attractive location

Employee expense calculator estimates the total cost of hiring an employee, including salary, benefits, taxes, and overhead expenses

Yes, it provides a breakdown of employment costs, helping businesses make informed decisions about compensation insurance

Yes, it factors in salary, benefits, payroll taxes, and indirect costs, giving a full picture of employee expenses.

Small businesses can use the calculator to estimate total annual costs, helping with more accurate hiring budgets.

The calculator provides a detailed breakdown of employment costs, helping businesses understand the components of labor expenses. While it doesn’t directly suggest ways to optimize costs, this transparency allows employers to analyze areas like taxes and benefits for potential adjustments.