Employee Cost Calculator - Australia [2026]

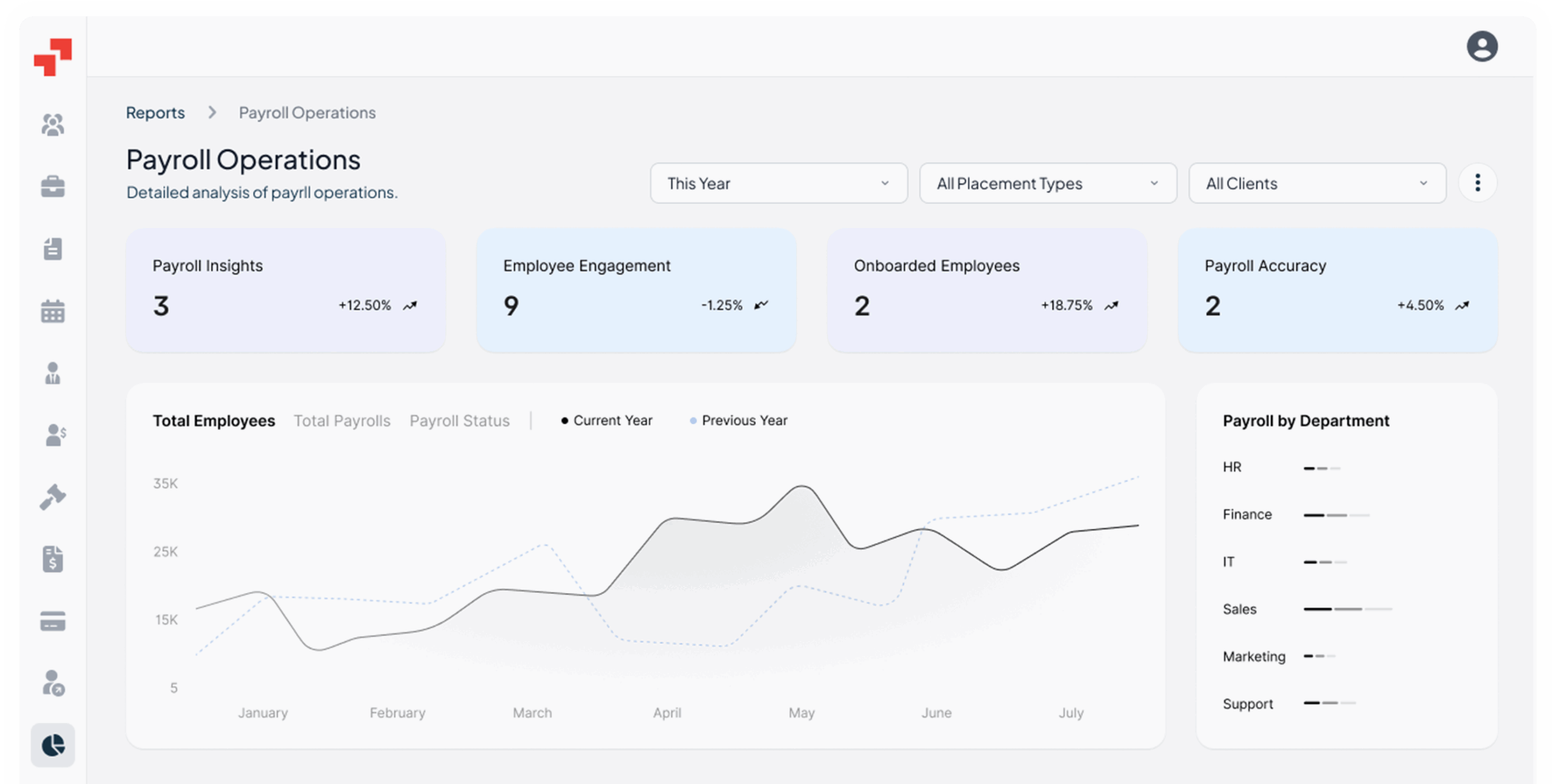

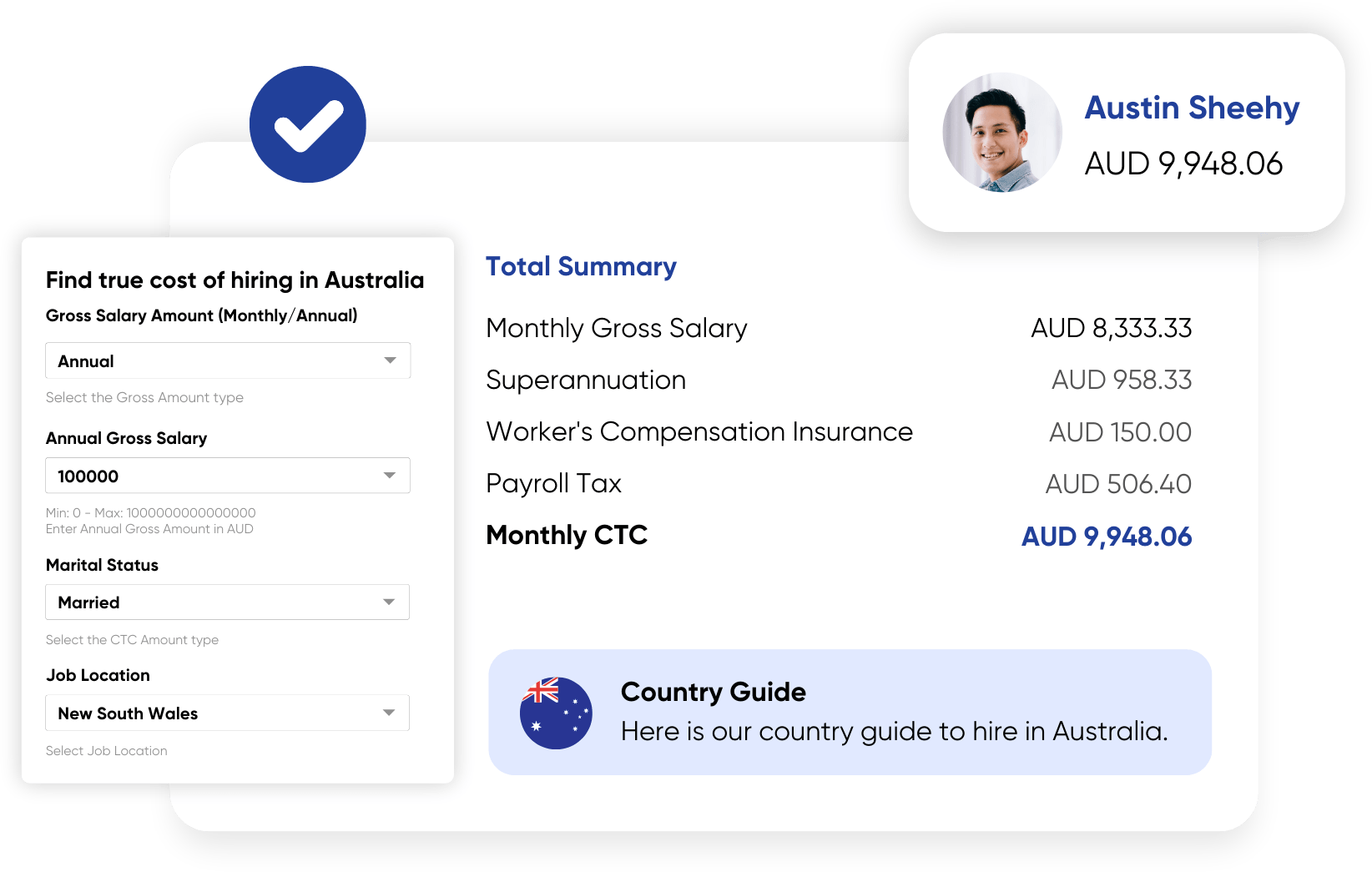

Our Employee Expense calculator simplifies this complicated process by providing a detailed breakdown of all employment-related costs.

Whether hiring full-time employees or contractors, this employment cost calculator Poland ensures you have a clear picture of the financial investment involved.

How to Use the Cost-to-Hire Calculator: Step by Step

Step 1: Choose the Gross Salary Payment Frequency

Select the Monthly or Annual frequency to align with your payroll schedule.

Step 2: Enter the gross salary amount

Enter the amount for the role based on the selected payment frequency.

Step 3: Select Your Marital status

Step 4: Select the Job Location You Want to Hire in Australia

Choose the job location based on your hiring needs and preferences to get accurate employee costs in Australia.

Step 5: Enter Your Details

Provide your Name, Phone Number, and Email Address to receive your personalized report.

Step 6: Calculate

Click “Calculate” to generate a detailed breakdown of costs, including:

- Monthly Gross Salary

- Superannuation

- Worker’s Compensation Insurance

- Payroll Tax

- Monthly CTC

Note: You can calculate the cost to hire an employee in Australia monthly or annually in real-time by selecting an option or adjusting the value. The free employee expense calculator will instantly display the updated amount.

Overview of Employment Costs in Australia in 2026

In Australia, employing staff involves additional costs beyond the gross salary, primarily due to mandatory superannuation contributions and income tax withholdings. Here’s an overview of the components of this employment cost calculator in Australia for the 2024–2025 financial year:

Employer’s Perspective

| Cost Type | Amount (AUD) | Percentage |

|---|---|---|

| Gross Salary | $5,500.00 | – |

| Superannuation Guarantee (SG) | $632.50 | 11.5% |

| Total Employment Cost | $6,132.50 | – |

Note: The Superannuation Guarantee rate is set to increase to 12% on July 1, 2025.

Source: Australian Taxation Office

Employee’s Perspective

| Cost Type | Amount (AUD) | Percentage |

|---|---|---|

| Gross Salary | $5,500.00 | – |

| Income Tax Withholding | $561.67 | – |

| Medicare Levy | $110.00 | 2% |

| Net Salary | $4,828.33 | – |

Income tax calculations are based on the 2024–2025 tax rates for Australian residents.

Source: Australian Taxation Office

Assumptions:

- Gross Salary: An example monthly salary of $5,500.00.

- Superannuation Guarantee (SG): Employers are required to contribute 11.5% of an employee’s ordinary time earnings to their superannuation fund.

- Income Tax Withholding: Calculated based on the Australian Taxation Office’s tax rates for the 2024–2025 financial year.

- Medicare Levy: A standard 2% levy on taxable income to fund Australia’s public health system.

Employers should be aware of these additional costs when budgeting for new hires in Australia. For accurate financial planning, use our cost to hire an employee calculator.

Employment Costs in Australia – Employment Contract

Hiring an employee in Australia involves more than just paying their gross salary. Employers are required to cover additional costs, including superannuation contributions. Here’s a quick breakdown of these contributions:

- Superannuation Guarantee (SG): 11.5% of the gross salary (as of 2024–2025).

- Workers’ Compensation Insurance: Rates vary depending on the industry and business type but are mandatory in all states.

- Payroll Tax: Applicable in some states/territories if the employer’s wage bill exceeds the threshold. Rates vary by jurisdiction.

In total, employers contribute an additional 11.5% or more of the gross salary depending on other obligations, such as workers’ compensation and payroll tax, for each full-time employee.

Additional Costs to Consider:

- Annual Leave and Leave Loading: Employees are entitled to 4 weeks of annual leave, and some awards include leave loading of 17.5%.

- Public Holidays: Paid days off as per state and federal holidays.

- Long Service Leave: Entitlements accrue based on tenure and vary by state.

- Compensation for Overtime: Depending on the award, agreement, or employment contract.

- Maintaining Accurate Employee Records: Mandatory under the Fair Work Act.

Employee Perspective – Deductions from Gross Salary

Not all the gross salary goes directly to the employee. Deductions are made for:

- Income Tax Withholding: Based on the Australian Tax Office (ATO) tax brackets.

- Medicare Levy: 2% of taxable income (standard rate).

Voluntary Superannuation Contributions: If the employee chooses to add extra to their superannuation fund.

Example: Employment Costs for Minimum Salary in Australia in 2026

The minimum gross salary for full-time employees in Australia serves as a baseline for compensation. As of July 1, 2024, the national minimum wage has been set at $882.80 per week or approximately $45,745.60 per year (based on a 38-hour workweek). Employers must account for additional costs beyond the gross salary, including mandatory superannuation and other contributions.

Here’s a breakdown of employer costs for hiring at the minimum wage level:

| Cost Type | Amount (AUD) | Percentage of Gross Salary |

|---|---|---|

| Superannuation Guarantee (SG) | ~$5,260.74 annually | 11.5% |

| Workers’ Compensation Insurance | Varies by industry/state | ~2–3% (approx. $914.91) |

| Payroll Tax (if applicable) | Varies by state/Threshold | ~4–6% |

Total Employer Cost:

For a full-time employee earning the national minimum wage, the total employment cost will include:

- Gross minimum annual salary: $45,745.60

- Additional costs (superannuation + workers’ compensation): ~$5,260.74 + ~$914.91

- Total employer cost: ~$51,920+ annually (excluding payroll tax, if applicable).

Important Considerations:

- Superannuation Increases: The Superannuation Guarantee rate is legislated to rise to 12% by July 1, 2025.

State-Specific Variations: Payroll tax thresholds and workers’ compensation rates vary by state or territory.

What are the Taxes for Employers and Employees in Australia?

Employer Taxation in Australia

| Tax | Details |

|---|---|

| Tax Year-End | June 30 |

| Goods and Services Tax (GST) | 10% |

| Payroll Tax | Varies by state/territory, with rates ranging from 4.75% to 6.85% |

| Corporate Tax | 25% for small businesses (<$50M turnover), 30% for large corporations |

Employee Taxation in Australia

| Tax | Details |

|---|---|

| Income Tax Rates | Progressive rates based on annual taxable income: |

| – Up to $18,200: 0% (tax-free threshold) | |

| – $18,201–$45,000: 19% | |

| – $45,001–$120,000: 32.5% | |

| – $120,001–$180,000: 37% | |

| – Over $180,000: 45% | |

| Medicare Levy | 2% of taxable income |

| Filing & Payment Deadline | Tax filings are due by October 31 for individuals. |

| Superannuation Guarantee | 11% (rising to 12% by July 2025), funded by employers. |

Points to Note:

- Payroll Tax: This applies only if total wages exceed a certain threshold, which varies by state {e.g., $1.2M in NSW (New South Wales), $700,000 in NT(Northern Territory)}

- Medicare Levy Surcharge: Additional 1–1.5% surcharge for individuals without private health insurance, depending on income level.

Superannuation Access: Employees can typically access their superannuation at 65 years of age or upon meeting certain conditions.

How to Hire Employees in Australia Without Any Hassles?

Hiring employees in Australia can be straightforward when you follow the proper steps and comply with local regulations. Here are the main ways to hire talent in Australia:

- Setting Up a Subsidiary Entity

Establishing a legal entity in Australia is an option, but it can be time-consuming and costly. The Australian Securities and Investments Commission (ASIC) is responsible for company registration. This approach is ideal for businesses planning a long-term presence in the country.

Key steps include:

- Registering your business with ASIC.

- Obtaining an Australian Business Number (ABN) and Tax File Number (TFN).

- Setting up payroll systems and adhering to Fair Work Act requirements.

- Using an Employer of Record (EOR) Service

Partnering with an EOR like PamGro simplifies the hiring process in Australia by eliminating the need to establish a local entity. The EOR manages payroll, compliance, employee benefits, and more, allowing you to focus on scaling your business.

- Comprehensive Support: PamGro handles every aspect of the employee lifecycle, from hiring to termination.

- Compliance Expertise: Our team ensures full adherence to Australian labor laws, including modern awards, National Employment Standards (NES), and tax regulations.

- Streamlined Process: PamGro simplifies hiring in Australia, saving you time, resources, and unnecessary legal complexities.

Ready to make hiring in Australia hassle-free?

Connect with PamGro today, and let us take care of the complexities while you focus on growing your business.

Employer of Record (EOR) Services in Australia

Expanding your business into Australia is seamless with Employer of Record (EOR) services. An EOR solution enables you to hire and manage employees without establishing a legal entity, saving you time and resources. With PamGro, you can streamline compliance, payroll, and administrative tasks while focusing on growth.

PamGro’s automated, technology-driven platform ensures efficient international expansion. Below are the general terms of our EOR services:

| General Terms | Details |

|---|---|

| Total Employer Liability | Approximately up to 25% of the employee’s gross salary, covering superannuation contributions, payroll tax, workers’ compensation insurance, and other statutory obligations. Rates may vary based on state regulations. |

| Minimum Service Duration | 3 months. |

| Currency Accepted | Australian Dollar (AUD). |

| Required Documents | For Australian Citizens: Identification proof, residential address, CV, bank details, and educational certificates. For Expatriates: Job details, qualifications, CV, passport, identification proof, bank details, photographs, and valid work permit. |

With PamGro’s local compliance expertise, we ensure full adherence to Australian labor laws while providing seamless employee management.

Read More: 10 Best EOR Companies in Australia

All-in-One Global Workforce Platform.

Manage global hiring, compliance, and payments with a single platform built for clients, contractors.

Check out some related resources

The Hidden Cost in Your Australia Hiring Budget—Is It Cause for Concern?

Employee Cost Calculator: Frequently Asked Questions (FAQs)

Ans: Employer costs in Australia typically include:

- Superannuation contributions (mandatory employer retirement contributions).

- Payroll tax (varies by state or territory).

- Workers’ compensation insurance.

- Other employment benefits such as annual leave, sick leave, and parental leave (if applicable).

Ans: Employment tax is calculated based on:

- The gross salary of the employee.

- Mandatory superannuation contributions (currently 11% of gross salary in 2025).

State-based payroll tax varies depending on the employer’s annual payroll threshold and state-specific rates.

Ans: Yes, employers are required to contribute to employees’ superannuation at a minimum rate of 11% of their gross salary (as of 2025). This contribution is mandatory for all employees earning over $450 in a calendar month.

Ans: On average, employers can expect to pay an additional 15%–20% of an employee’s gross salary. This includes superannuation, payroll tax (varies by state), and workers’ compensation insurance.

Ans: No, health insurance is not a mandatory cost for employers. However, many employers offer private health insurance as part of employee benefits packages to attract talent.

Ans: Yes, employment costs may vary depending on the type of contract:

- Full-time/part-time employees: Employers must pay superannuation, leave entitlements, and other benefits.

- Casual employees: No leave entitlements, but casual loading (typically 25%) applies.

Contractors: Employment costs are generally lower as contractors are responsible for their taxes and superannuation unless deemed an employee under Australian law.

Ans: Yes, the Australian government offers tax incentives, such as:

- JobMaker Hiring Credits for hiring eligible young workers.

- Research and Development (R&D) Tax Incentives for innovation-focused businesses.

- Payroll tax rebates in certain states for hiring apprentices or trainees.

Ans: Australia’s employment costs are higher compared to many Asian countries but lower than in countries like the United States and some European nations due to its relatively straightforward taxation system and competitive superannuation rates.

Ans: The calculator estimates the total employment costs, including:

- Gross salary.

- Superannuation contributions.

- Payroll tax.

- Workers’ compensation insurance.

- Other relevant benefits or statutory costs.

Ans: Yes, the true cost of employee calculator provides an estimate of workers’ compensation costs, which vary by industry and state, helping employers plan accordingly.

Ans: Yes, the total employment cost calculator factors in all direct and indirect costs, giving a clear picture of the total cost of employing an individual.

Ans: Small businesses can use the calculator to:

- Estimate annual employment costs.

- Budget for new hires.

- Evaluate the financial viability of expanding their workforce.

Ans: While the cost per employee calculator doesn’t directly suggest cost-saving measures, it provides transparency into labour cost components. Employers can use this information to optimize benefits, payroll structures, or tax strategies.