TABLE OF CONTENTS

- What is an Umbrella Company?

- What is Fixed Term Employment?

- Umbrella Solutions Vs Fixed Term Employment

- Pros and Cons of Umbrella Company

- Pros and Cons of Fixed Term Employment

- Which Works Best For You?

- Conclusion

- FAQs

Picture this: You, a skilled contractor, stand at the crossroads of your professional journey. The paths diverge into two distinct routes – one leading to the shelter of an Umbrella Company, and the other, the stability of a Fixed Term Employment contract. Each path holds its own promises and challenges, shaping the narrative of your contracting journey. Let’s embark on a journey through definitions, examples, and features, shedding light on the differences between Umbrella Solutions and Fixed Term Employment. As we navigate this terrain, consider which path aligns with your ambitions and aspirations.

What is an Umbrella Company?

An umbrella corporation is a company that employs freelance or temporary workers on behalf of a recruitment agency to fulfill specific job contracts. These intermediary organizations act as the official employer for these contractors, taking care of responsibilities like payroll processing and tax compliance. This setup enables agencies and clients to bypass the administrative complexities of directly hiring temporary staff, while still ensuring that contractors receive fair compensation and benefits.

Example:

Take Monica, for instance, an IT contractor. She secured a six-month contract through a recruitment agency. The chosen umbrella company facilitates the PAYE payroll services for Monica, serving as the intermediary between her and the end-hirer. This way, Monica gets paid on time, and the company that hired her doesn’t have to worry about the messy paperwork that comes with processing her payroll; a win-win.

Read detailed guide: What is Umbrella Company & How Does It Work?

Features of Umbrella Solutions:

1. Payroll Management:

Utilizing umbrella companies for payroll services results in efficient payment processing, reduced administrative tasks, and streamlined cross-border transactions.

2. Tax Deductions and Contributions:

Expertly handles income tax and National Insurance payments, relieving contractors from the complexities of tax-related matters. It also helps prevent potential errors and penalties.

3. Employee Benefits Provision:

Offers contractors statutory benefits such as holiday pay, sick pay, and pension deductions, enhancing their overall employment experience.

4. Legal Compliance Assistance:

Guides contractors through complex legal obligations, ensuring they follow all employment law and tax laws without any complications. Navigating regulatory requirements becomes more straightforward under umbrella companies’ guidance.

5. Domestic Focus:

Specialization in domestic markets empowers umbrella companies to focus on local operations, offering contractors specialized expertise within the specific operating jurisdiction.

6. Flexibility in Employment Model:

They are suited for individual contractors seeking temporary or short-term roles within a specific country, offering flexibility in their employment structures.

7. Simplified Payroll Processing:

Delegating administrative tasks, including payroll processing and invoicing, to umbrella companies lightens contractors’ workload and minimizes operational complexities.

8. Contractor Autonomy:

Empowers contractors to uphold their independence while gaining essential administrative support, presenting an appealing choice for those who value professional empowerment. It fosters self-management, growth opportunities, and networking connections for ambitious contractors.

What is Fixed Term Employment?

Fixed-term Employment is a solution to fill temporary skills or resource gaps, offering a predefined end date or task completion. Fixed-term contracts cater to various scenarios, from project-based employment to substitutes covering leaves or additional workers during peak seasons.

Example:

An employer hiring a specialist web designer for a site relaunch by bringing in extra staff for the busy Christmas period.

Features of Fixed Term Employment

1. Work Duration and Classification:

Precisely defines the employment duration and explicitly designates workers as fixed term employee, ensuring transparency in contractual agreements.

2. Job Description Clarity:

Clearly outlines job responsibilities, managing tasks for the short duration of an employment contract, ensuring a focused and goal-oriented approach. It also aids in driving productivity and efficiency during brief tenures.

3. Salary Structure:

Offers a fixed salary amount specified in the contract, ensuring stability and predictability for employees throughout the contractual period. In other words, it assures financial consistency and minimizes uncertainty for fixed-term employees.

4. Termination and Renewal Process:

Contracts end on predetermined dates with the option for renewal after specified period if agreed upon, offering flexibility in employment continuity.

5. Notice Period Exemption:

Eliminates the need for a minimum notice period too, highlighting the transient nature of the professional association and facilitating smooth transitions

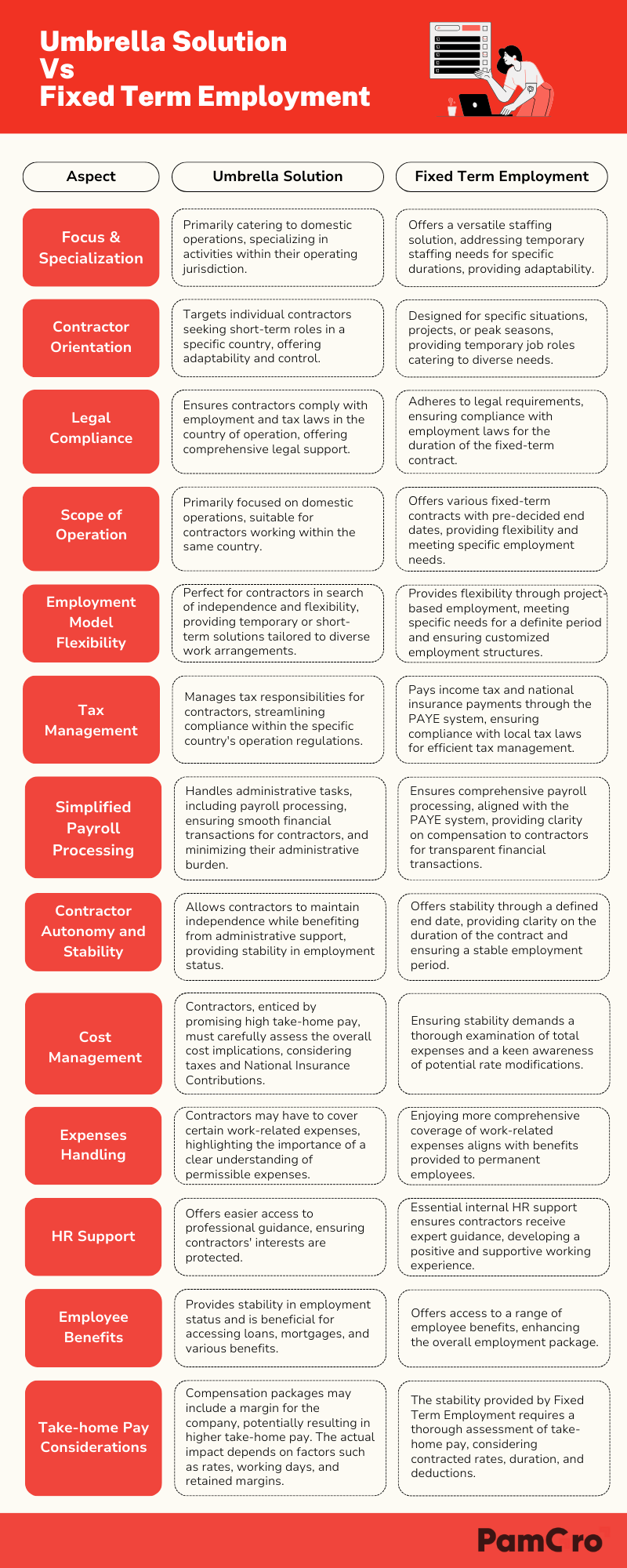

Umbrella Solutions vs. Fixed Term Employment

Diving into the realm of professional choices, uncover the subtle differences between Umbrella Solutions and Fixed Term Employment, exploring their functions and key considerations to pave a clearer path in your contracting journey.

1. Focus and Specialization:

- Umbrella Solutions: Primarily catering to domestic operations, these specialize in activities within their operating jurisdiction, ensuring a focused approach.

- Fixed Term Employment: Offering a versatile staffing solution, it addresses temporary staffing needs for specific durations, providing adaptability in employment.

2. Contractor Orientation:

- Umbrella Solutions: Targeting individual contractors seeking short-term roles in a specific country, umbrella companies offer adaptability and control over their employment structure.

- Fixed-Term Employment: Designed for specific situations, projects, or peak seasons, it provides temporary job roles catering to diverse needs.

3. Legal Compliance:

- Umbrella Solutions: Ensures contractors comply with employment and tax laws in the country of operation, offering comprehensive legal support.

- Fixed Term Employment: Adheres to legal requirements, ensuring compliance with employment laws for the duration of the fixed-term contract.

4. Scope of Operation:

- Umbrella Solutions: Ensures contractors comply with employment and tax laws in the country of operation, offering comprehensive legal support.

- Fixed Term Employment: Adheres to legal requirements, ensuring compliance with employment laws for the duration of the fixed-term contract.

5. Employment Model Flexibility:

- Umbrella Solutions: Perfect for contractors in search of independence and flexibility, providing temporary or short-term solutions tailored to diverse work arrangements

- Fixed-Term Employment: Provides flexibility through project-based employment, meeting specific needs for a definite period and ensuring customized employment structures

6. Tax Management:

- Umbrella Solutions: Manages tax responsibilities for contractors, streamlining compliance within the specific country’s operation regulations.

- Fixed Term Employment: Pays income tax and national insurance payments through the PAYE system, ensuring compliance with local tax laws for efficient tax management.

7. Simplified Payroll Processing:

- Umbrella Solutions: Handles administrative tasks, including payroll processing, ensuring smooth financial transactions for contractors, and minimizing their administrative burden.

- Fixed Term Employment: Ensures comprehensive payroll processing, aligned with the PAYE system, providing clarity on compensation to contractors for transparent financial transactions.

8. Contractor Autonomy and Stability:

- Umbrella Solutions: Allows contractors to maintain independence while benefiting from administrative support, providing stability in employment status.

- Fixed-Term Employment: Offers stability through a defined end date, providing clarity on the duration of the contract and ensuring a stable employment period.

9. Cost Management:

Exploring the Essentials: Costs, Expenses, HR Support, Employee Perks, and Your Take-Home Treasure!

- Umbrella Solutions: Contractors, enticed by promising high take-home pay, must carefully assess the overall cost implications, considering taxes and National Insurance Contributions.

- Fixed-Term Employment: Ensuring stability demands a thorough examination of total expenses and a keen awareness of potential rate modifications

10. Expenses Handling:

- Umbrella Solutions: Contractors may have to cover certain work-related expenses, highlighting the importance of a clear understanding of permissible expenses.

- Fixed-Term Employment: Enjoying more comprehensive coverage of work-related expenses aligns with benefits provided to permanent employees.

11. HR Support:

- Umbrella Solutions: Offers easier access to professional guidance, ensuring contractors’ interests are protected.

- Fixed Term Employment: Essential internal HR support ensures contractors receive expert guidance, developing a positive and supportive working experience.

12. Employee Benefits:

- Umbrella Solutions: Provides stability in employment status and is beneficial for accessing loans, mortgages, and various benefits.

- Fixed-Term Employment: Offers access to a range of employee benefits, enhancing the overall employment package.

13. Take-home Pay Considerations:

- Umbrella Solutions: Compensation packages may include a margin for the company, potentially resulting in higher take-home pay. The actual impact depends on factors such as rates, working days, and retained margins.

- Fixed-Term Employment: The stability provided by Fixed Term Employment requires a thorough assessment of take-home pay, considering contracted rates, duration, and deductions.

Which Works Best for You?

If this resonates with your needs..

- Ideal for managing multiple contracts simultaneously.

- Offers benefits and security of continuous employment.

- Suited for those likely to claim travel or subsistence expenses.

Umbrella Company employment is the right choice for you.

Read detailed guide: How Umbrella Companies simplify global payroll operations?

Alternatively, if this is something that sways your interest.

- Emphasizes valuable experience accumulation.

- Provides potential for higher earnings.

- Offers flexibility in job focus.

- Appeals to those seeking to avoid long-term commitments.

Fixed-term Employment might be the ideal fit.

Conclusion

As the paths unfold before you, consider the features, advantages, and drawbacks of each. Which path resonates with your contracting goals? Whether you choose the shelter of the Umbrella or the stability of Fixed Term Employment contracts, the decision marks a pivotal chapter in your professional journey.

FAQs

Is umbrella company better than limited company?

However, as an independent company the tax rate is higher and the company does less need to commit to contracting with umbrella companies. This is an easy and hassle free route.

How is a fixed-term contract different from a permanent contract?

Permanent workers work on a continuous basis called permanent employment. Currently, fixed-term employment agreements are subject to expiration. Fixed-term contracts can provide employees with comparable employment opportunities as a temporary employee, but fixed-term employees lack job security.

Can fixed term contracts become permanent?

It is possible that a FTC may be permanently established for a person unless there is no reason to do so.

Payroll Solutions Unrivalled since 15 Years