As an EOR (Employer of Record), we understand the importance of clarifying the distinction between a sole proprietor and an independent contractor. Both terms are often used to describe self-employed individuals, but there are key differences that business owners and entrepreneurs should be aware of.

This blog will delve deeper into the meanings of “sole proprietor” and “independent contractor,” discuss the business structure, advantages and disadvantages of each, and provide insights into when one might be more suitable than the other.

What is a Sole Proprietor?

A sole proprietorship is the simplest form of business ownership, where an individual operates a business without forming a separate business entity or legal entity.

A sole proprietorship is a single-person business that isn’t registered as a corporation or LLC with the state or federal government or IRS. If you earn income from such a business, you’re considered a sole proprietor.

The IRS treats your business income as personal income, making you personally liable for any business debts. Additionally, you must pay self-employment taxes (Social Security and Medicare) and income taxes through quarterly estimated payments. This structure offers flexibility and ease of setup but also carries significant risks.

Examples of sole proprietors include:

- Freelance writers or graphic designers

- Florists

- A local artist

- Web designers

- Food truck operators

Key characteristics of a sole proprietor:

- Unlimited personal liability: The proprietor’s personal assets are at risk for business debts and liabilities.

- Taxation: Business income and expenses are reported on the individual’s personal income tax returns, simplifying the tax process.

- Control: Complete control over business operations and decisions.

- Business licenses and permits: Requirements vary by location but are generally less complex than for other business structures.

- Scaling: Growth can be limited due to the owner’s capacity and financial resources.

Example: A freelance graphic designer who operates their own business without forming a separate business entity is typically a sole proprietor.

Do sole proprietors get a 1099 in US?

Sole proprietors typically do not receive a Form 1099-NEC, which records compensation received by non-employees. As self-employed individuals, they generally don’t have employers, so 1099 forms are common among those running their own businesses.

Unlike other self-employed individuals, sole proprietors usually do not get this form, though some long-term clients might provide one. Sole proprietors typically track their own business expenses and file their own taxes.

What is an Independent Contractor?

An independent contractor is a self-employed individual or self employed person who provides services to clients or businesses under a contract. They are not considered employees and have more autonomy in their work.

An independent contractor provides services for others without being an employee, often in creative or technical fields like design or IT. Payment is based on hours worked or jobs completed, with no payroll taxes withheld unless subject to backup withholding.

At year-end, you receive 1099-NEC forms from each client, detailing your income, similar to an employee’s W-2 form. As you’re not an employee, you’re responsible for your income tax, paying self-employment and income taxes, just like a sole proprietor.

Key characteristics of an independent contractor:

- Contractual relationship: The relationship between the contractor and the client is defined by a contract outlining the scope of work, payment terms, and other conditions.

- Autonomy: Contractors have significant control over how they perform their work, including work hours, methods, and tools.

- Multiple clients: Contractors often work for multiple clients simultaneously.

- Taxes: Contractors are responsible for their own taxes, including self-employment taxes and estimated quarterly payments.

Advantages of independent contracting:

- Flexibility and independence in work arrangements.

- Potential for higher earnings due to lack of overhead costs (average earnings can be 20-30% higher than traditional employees).

- Avoidance of employer-related taxes and benefits.

Disadvantages of independent contracting:

- Lack of employee benefits such as healthcare, retirement plans, and paid time off.

- Income fluctuations based on project availability.

- Potential for misclassification as an employee, leading to tax penalties and back payments.

Example: A freelance writer who works for multiple clients on various projects is typically an independent contractor.

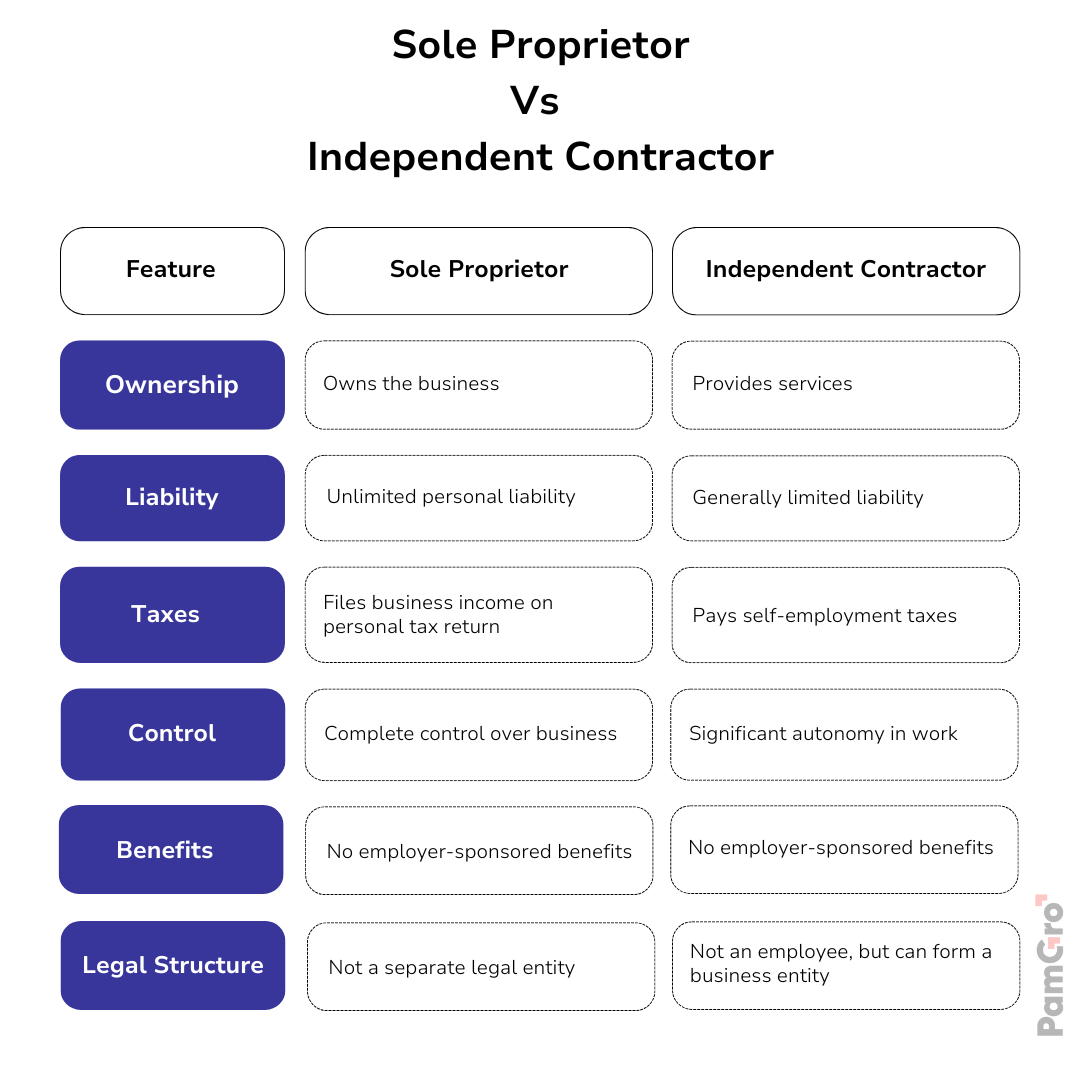

Independent contractor vs. Sole proprietor

How do sole proprietors and independent contractors pay taxes?

Sole proprietor

Sole proprietors report business income and expenses on their personal tax returns by attaching Schedule C, Profit or Loss from Business (Sole Proprietorship), to Form 1040 or 1040-SR. This allows them to report both personal and business taxes on a single return, saving time and money. However, there is no separation between business and personal finances, meaning creditors can target personal and business assets if debts aren’t paid.

In contrast, corporate business owners must file both personal and corporate tax returns, leading to double taxation: once on their salary and again on dividends from corporate profits. The advantage is that the owner’s personal assets are protected from third-party claims.

Independent Contractor

Taxation is crucial when deciding to work as an independent contractor. At year-end, independent contractors receive a 1099-MISC tax form from each customer and report the income on Schedule C of their 1040 form. They then transfer their Schedule C profit to Form 1040, Schedule SE, to calculate their total Federal Income Contribution Act (FICA) taxes.

While full-time employees pay only half of their Social Security and Medicare taxes, with employers covering the other half, independent contractors must pay the full amount themselves. This should be considered when budgeting business expenses.

Choosing the Right Structure

The decision between sole proprietorship and independent contracting depends on various factors, including the nature of your business, your risk tolerance, and your financial goals.

Consider sole proprietorship if:

- You are starting a small, low-risk business with minimal startup capital (approximately $30,000 or less).

- You have complete control over all aspects of the business.

- You are comfortable with unlimited personal liability.

Consider independent contracting if:

- You offer specialized services to multiple clients.

- You prefer flexibility and independence.

- You are willing to manage your own taxes and benefits.

It’s essential to consult with a tax professional or legal advisor to determine the most suitable structure for your business.

How Can an International Expansion Partner Help?

Global expansion partners like PamGro specialize in international business classification and can recommend the best business structure for your company and workers, regardless of location. They can also advise on the suitability of engaging workers as independent contractors. For more information, contact them today.

FAQ's

1. Is an independent contractor the same as a sole proprietor?

Independent contractors are not typically sole proprietors, but they can be in certain situations. If you own a business providing services under employment contracts, you would be both an independent contractor and a sole proprietor. However, in most cases, independent contractors are not sole proprietors.

2. Is it possible to be both a sole proprietor and an independent contractor?

You can be both a sole proprietor and an independent contractor. If you own a business and provide services to clients, you operate as a sole proprietor (by running your own business) and as an independent contractor (by offering services under client agreements).

For instance, As the owner of their own graphic design business, they are a sole proprietor. They are also an independent contractor because they negotiate contracts with each client who hires them for specific design projects. This setup allows them to manage their own small business, while providing tailored design services under individual client agreements.

3. How do sole proprietors and independent contractors differ from LLCs?

The key difference between self-employed individuals, like sole proprietors and independent contractors, and a Limited Liability Company (LLC) is registration. An LLC must register and thus gains greater liability protection, unlike self-employed individuals who bear full responsibility for business costs.

Typically, LLCs are operated by multiple people, while sole proprietors and independent contractors usually work alone. Consequently, LLCs are distinct from their owners, whereas self-employed individuals are directly tied to their businesses.

4. Do I Have to Pay Self-Employment Taxes?

Self-employment taxes cover Social Security and Medicare for self-employed business owners, including those earning 1099 income. Anyone with earned income in the U.S. must pay these taxes.

Employees pay through paycheck withholdings, but as a self-employed individual, you don’t have withholdings. However, you still need to pay these taxes based on your annual business net income, which is added to your other tax liabilities on your 1040 form.

Payroll Solutions Unrivalled since 15 Years