⚡ Key Takeaways

-

Permanent Establishment (PE) Risk arises when international business activities create a taxable presence in a foreign country, triggering unexpected tax liabilities.

-

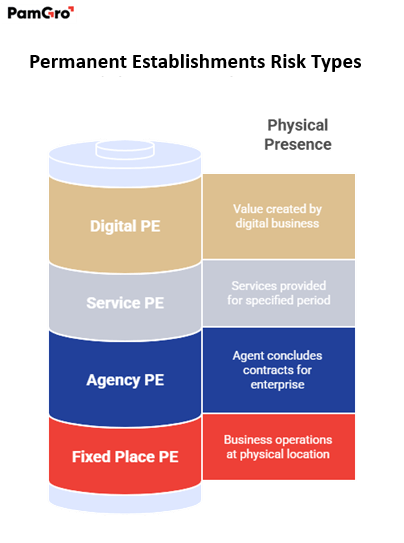

Types of PE include fixed place, agency, service, and digital PEs—each with distinct triggers based on physical presence, authority, duration, or digital footprint.

-

Modern Triggers like remote work, contract authority, and user engagement have expanded PE exposure beyond traditional office setups.

-

High Stakes: Unmanaged PE risks can lead to corporate tax obligations, penalties, interest, and heavy compliance burdens.

-

India and US Spotlight: Both countries have strict PE enforcement, with India especially aggressive in taxing digital and service-based foreign companies.

-

PE Risk Mitigation requires proper structuring, documented operations, ongoing monitoring, and expert EOR partners like PamGro to ensure full compliance without setting up a legal entity.

In today’s global economy, businesses operate across multiple jurisdictions to find new markets and opportunities. But this expansion brings complex tax implications that can catch companies off guard. One of the biggest challenges is permanent establishment risk, a concept that can turn a simple business activity into a big tax liability overnight. Understanding and managing permanent establishment risk is critical for any organization with international operations, as the consequences of oversight can be millions in unexpected taxes, penalties and compliance burdens.

The rise of digital business models, remote work arrangements and cross-border service delivery has made permanent establishment determinations more complex than ever. What was once a simple business activity can now trigger tax obligations in foreign jurisdictions, making it essential for business leaders and local tax authorities to understand this critical aspect of international tax law.

What is Permanent Establishment Risk?

Permanent establishment (PE) is a threshold concept in international taxation that determines when a foreign business has sufficient presence in a country to be taxed on its local profits. Permanent establishment risk arises when a company’s activities in a foreign jurisdiction may inadvertently create a taxable presence, subjecting the business to local tax laws and local corporate income tax.

The concept of permanent establishment is the cornerstone of international tax treaties and domestic tax laws worldwide. It sets the minimum level of economic activity before a country can tax a foreign enterprise’s business profits. This threshold protects businesses from being taxed in every country where they do minimal activities while ensuring countries can tax substantial business operations within their borders.

How does permanent establishment work?

The determination typically involves analyzing the nature, extent and duration of business activities within a jurisdiction. Tax authorities look at whether these activities, including installation projects, are more than just preparatory or auxiliary functions and whether they create a sufficient nexus to justify taxation.

The modern interpretation of PE has evolved significantly, especially with the OECD’s Base Erosion and Profit Shifting (BEPS) initiatives and the increasing digitalization of the global economy. Today’s PE determinations must consider virtual presence, digital services and the changing nature of corporate tax obligations in a connected world.

Types of Permanent Establishment Risks

Understanding the different types of permanent establishment risks is key to effective risk management. Each type has unique challenges and requires specific mitigation strategies.

Fixed Place of Business PE

The most common type of PE is when a business has a fixed place where it carries on its operations. This includes offices, branches, factories, workshops, warehouses or any other physical location used for business purposes. The key factors are physical presence, regular use and business activities carried on at the location.

Modern considerations go beyond traditional brick-and-mortar establishments. Home offices of employees, co-working spaces used regularly and even temporary installations can trigger permanent establishment if they meet the criteria of permanence and business purpose.

Agency PE

An agency PE arises when a person acts on behalf of a foreign enterprise and has the authority to conclude contracts in the name of that enterprise. This type of PE focuses on the relationship between the foreign company and its representative rather than physical presence.

The key test is whether the agent has and habitually exercises the authority to conclude contracts. Sales representatives, distributors with broad authority and certain service providers can create agency PE situations for their principals.

Service PE

Many countries have specific provisions for service PE which arises when an enterprise provides services in a jurisdiction for a specified period, typically more than 183 days in a 12 month period. This type of PE captures consulting, technical services and other professional activities that may not otherwise be a fixed place of business, so companies must pay corporate taxes .

Service PE provisions have become more important as businesses provide more cross-border services, including digital services, consulting and professional support activities.

For eg: if your people work in India providing services for longer than a threshold (often 90 days under India DTAA), you’ve created a PE. It’s not just borderless work; it’s a tangible time-based footprint.

Digital PE

The rise of digital business models has led many countries to develop specific rules for digital PE. These provisions aim to capture the value created by digital businesses in markets where they have users but may not have traditional physical presence.

Digital PE rules vary by jurisdiction but generally consider factors such as user engagement, data collection and digital platform activities as potential PE triggers.

For eg: If you have a steady flow of Indian users or transactions (think millions of rupees or hundreds of thousands of users), you might trigger PE, even without a local office.

Permanent Establishment Risk Factors

Permanent establishment risk factors are various business activities and arrangements that can inadvertently create PE exposure. Understanding these triggers is key to proactive risk management.

Physical Presence Indicators

The presence of employees, contractors or facilities in a foreign jurisdiction is the most obvious PE risk factor. This includes permanent offices, temporary project sites, warehouses, manufacturing facilities and even home offices used by employees for business purposes.

Duration and nature of physical presence matters. Brief visits don’t create PE risk, regular presence or long term projects do. The threshold varies by jurisdiction, some countries apply PE status to activities exceeding specific time periods.

Business Activity Scope

The nature and extent of business activities in a jurisdiction directly impact PE risk. Activities that go beyond preparatory or auxiliary functions – such as sales, production or core business operations – are more likely to create PE exposure.

Modern interpretations focus on whether activities form an essential and significant part of the enterprise’s business as a whole. Simple support functions may not create PE risk, but decision-making activities or revenue-generating operations typically do.

Contractual and Decision-Making Authority

Location of key decision-making processes and contract negotiations can create PE risk, particularly in agency PE situations. When employees or representatives have authority to bind the company or make significant business decisions, PE risk increases substantially.

This factor has become more complex with remote work arrangements, as decision-making authority may be exercised from various locations, potentially creating unexpected PE exposure.

Technology and Digital Footprint

The increasing digitalization of business operations has created new PE risk factors. Server locations, data processing activities, user interactions and digital platform operations can all contribute to PE determinations under evolving international tax rules.

Many jurisdictions are developing specific rules to address digital business models, creating new compliance challenges for technology companies and digital service providers.

Permanent Establishment Risk in the United States

Permanent establishment risks in the US have unique considerations due to the country’s specific tax laws and treaty network. The United States applies PE concepts through its domestic tax code and foreign subsidiary bilateral tax treaties, creating a complex regulatory environment for foreign businesses.

US Domestic Law Considerations

Under US domestic law, foreign corporations are subject to US taxation on income that is “effectively connected” with a US trade or business. The concept of “engaged in trade or business in the United States” serves a similar function to PE in treaty contexts.

The US applies a relatively broad interpretation of what constitutes engaging in a trade or business, potentially capturing activities that might not constitute PE under treaty provisions. This creates particular risks for foreign companies with US operations, employees or business activities.

Treaty Protection and Limitations

The US has a vast network of tax treaties that provide PE thresholds and protections for foreign businesses. However, treaty benefits are not automatic and require proper qualification and documentation.

US permanent establishment risk increases when businesses fail to properly structure their operations or maintain adequate documentation to support treaty positions. Common issues include lack of substance in treaty-jurisdiction entities, improper attribution of profits and failure to keep required records.

State Tax Considerations

Beyond federal tax implications, US permanent establishment risk also applies to state tax obligations. Many states have nexus rules that can create tax obligations even when federal PE thresholds are not met.

State nexus rules vary greatly and are still evolving, especially with digital business models and remote work arrangements. This adds to the compliance burden for foreign businesses operating in multiple US states.

Permanent Establishment Risk in India

India permanent establishment risk has gained importance due to the country’s aggressive tax enforcement and evolving digital economy rules. India’s approach to PE determinations reflects its position as a major emerging market seeking to capture tax revenues from foreign businesses benefiting from its large consumer base.

Indian PE Provisions

India’s Income Tax Act has specific PE provisions that align with international standards but with domestic twists. The country has specific rules for business connections which can create tax obligations even without traditional PE.

India’s “significant economic presence” rules are a departure from traditional PE concepts, focusing on revenue thresholds and user engagement rather than physical presence. These rules impact digital businesses and e-commerce companies.

Recent Enforcement Trends

Indian tax authorities have become more aggressive in asserting PE claims against foreign companies, especially in the technology and digital services sector. The tax department’s focus on digital businesses reflects the growing importance of India’s digital economy.

The enforcement approach involves detailed scrutiny of business arrangements, employee activities and decision-making processes to establish PE exposure. Foreign companies operating in India face increasing compliance burden and audit risks.

Case Study: How Netflix’s ₹552M Tax Bill Exposes a Hidden Permanent Establishment Risk in India

The Netflix case is a great example of how permanent establishment risk can turn into significant tax liability. In a draft order, the tax authorities attributed an income of about 552 million rupees ($6.73 million) to Netflix’s Indian permanent establishment (PE) in the assessment year 2021-22, highlighting the financial implications of PE determinations.

The reasoning behind this is that Netflix has stationed some of its employees and infrastructure from the parent entity in India to support its streaming services. This has led to the creation of a permanent presence in India by the parent company, which in turn creates a tax liability.

The case shows how modern business arrangements, including employee secondments and infrastructure support, can create unexpected PE exposure. Netflix’s situation proves that even digital service providers can’t completely avoid physical presence considerations.

Global Implications

While the Netflix case is India specific, the implications are global. Here are the key takeaways for international businesses:

Need to structure international operations to minimize PE risk, especially when employees or infrastructure support cross border services. Need for comprehensive documentation and substance when claiming treaty benefits to avoid double taxation or arguing against PE status.

The evolving nature of PE determinations in the digital economy where traditional concepts need to adapt to new business models and revenue streams. The case also shows how tax authorities worldwide are getting smarter in identifying and pursuing PE claims against foreign businesses.

Business Operations Lessons

The Netflix case emphasizes the need for proactive PE risk management. Businesses need to review their international operations, employee arrangements and business structures to identify PE exposure.

The case also highlights the need for proper documentation and legal structuring when doing cross border business. Simple operational decisions like employee secondments or infrastructure sharing can have big tax implications if not managed properly.

What are the consequences of not managing permanent establishment risks?

The potential impacts extend far beyond simple tax obligations, creating cascading compliance and business risks that can severely impact operations and profitability.

Direct Tax Consequences

The primary consequence of unmanaged PE risk is exposure to local corporate income tax on profits attributable to the PE. This can result in substantial tax liabilities, particularly for profitable businesses with significant local operations.

Tax rates vary by jurisdiction, but corporate income tax rates of 20-30% are common, representing significant potential liabilities on attributed profits. The calculation of attributable profits can be complex and may not align with applicable tax laws, actual business operations or profitability.

Penalties and Interest

Beyond primary tax liabilities, businesses face potential penalties for failing to comply with local tax obligations. These penalties can be substantial, often calculated as percentages of unpaid taxes and accumulating over time.

Interest charges on unpaid taxes can compound the financial impact, particularly for businesses that discover PE exposure years after the relevant activities occurred. Some jurisdictions impose penalty rates that can exceed 20% annually.

Compliance and Administrative Burdens

PE status brings ongoing compliance obligations, including tax return filing, record-keeping and audit exposure. These can be a significant administrative burden and cost.

The compliance requirements go beyond tax return filing to include local accounting standards, documentation and regular reporting. This can require significant investment in local expertise and systems.

Reputational and Business Risks

PE disputes can be reputational risks, especially for listed companies that must disclose material tax controversies. Tax disputes can also impact business relationships and create uncertainty for customers and partners.

In extreme cases, tax authorities may restrict business operations or impose collection measures that can disrupt normal business. This operational risk can be particularly damaging for businesses with time sensitive operations or customer commitments.

How to Avoid Permanent Establishment Risk

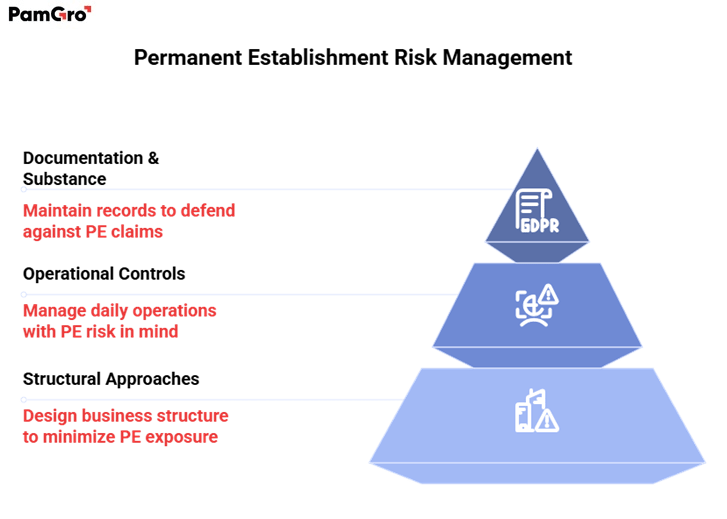

Permanent establishment risk requires a holistic approach combining business structuring, operational controls and monitoring. Effective PE risk management must be part of broader international expansion strategy.

Structural Approaches

The foundation of PE risk mitigation is proper business structure design. This includes careful consideration of legal entity structures, contractual arrangements and operational models to minimize PE exposure while achieving business objectives.

Key structural considerations are independent distributors rather than dependent agents, limiting local employee activities to preparatory or auxiliary functions and ensuring substance in intermediary entities.

Operational Controls

Day to day operations must be managed with PE risk in mind. This includes controlling employee activities, managing contract negotiation and signing processes and monitoring local business activities.

Effective operational controls require policies and procedures, training for relevant personnel and systems to monitor compliance with established thresholds and limitations.

Documentation and Substance

Proper documentation is key to defending against PE claims and supporting treaty positions. This includes evidence of business substance, documentation of decision making processes and preservation of records to support the intended tax structure.

The documentation requirements go beyond record keeping to include economic substance analysis, transfer pricing documentation and evidence to support the business rationale for chosen structures.

How to Mitigate Permanent Establishment Risks

Permanent establishment risks, a critical tax concept, involves implementing risk management frameworks that address existing exposure and future expansion plans. Effective mitigation requires ongoing attention and regular review.

Risk Assessment and Monitoring

Regular risk assessment is key to identifying PE exposure before it becomes a compliance issue. This includes monitoring business activities, employee movements and operational changes that could impact PE status.Risk assessment should be part of business planning, so PE considerations are addressed before new business strategies or operational changes are implemented.

Professional Advisory Support

Given the complexity of PE rules and their variation across jurisdictions, professional advisory support is usually required. This includes local tax expertise and international tax coordination to cover all bases.

Advisory support should go beyond compliance to include proactive planning, structuring advice and monitoring of regulatory changes that could impact PE exposure.

Treaty Planning and Optimization

Effective use of tax treaties can provide significant PE protection and mitigation opportunities. This requires understanding treaty provisions, qualification requirements and proper implementation of treaty benefits.

Treaty planning should consider current operations and future expansion plans to ensure chosen structures provide flexibility and protection for evolving business needs.

How PamGro Helps Global Companies Minimise PE Risk in India?

At PamGro, we work with global companies and fast scaling businesses to help them build teams in India, without the legal and tax complexities of creating a Permanent Establishment (PE).

As your Employer of Record (EOR) partner, we become the official legal employer of your team in India, so you can access talent, operate compliantly and scale without triggering PE risk.

Our PE Risk Management Framework

After supporting 100+ companies expanding into India, here’s how we keep you compliant and confident:

- Legal Employment Separation : We hire your team under PamGro’s local entity, keeping employment and compliance cleanly separated from your global HQ, limiting exposure to Fixed Place, Agency or Service PE.

- Smart Role Structuring : We define job scopes, reporting lines and work structures to ensure local teams stay outside PE-triggering activities like concluding contracts or revenue generation.

- Real-Time Compliance Monitoring : Our in-house legal and payroll specialists stay on top of every update from CBDT, GST, FEMA, labor law and international treaty guidelines so your structure stays ahead of audits.

- Documented PE Risk Audit Trail : We maintain defensible documentation for every client—contracts, classification, communication flow—to back up your non-PE status if questioned by tax authorities.

Ready to onboard and expand globally

Conclusion

Permanent establishment risk is one of the biggest challenges facing international businesses today. As global operations become more complex and sales activities grow, including those in the home country, tax authorities are getting smarter and the importance of PE risk management cannot be overstated.Build your team in India without PE risk.

Soham wasn’t always an international employment guru. He began with a passion for numbers, surprising shopkeepers with his mental math skills.

At PamGro, Soham spearheads international expansion and EOR (Employer of Record) services, driving global business strategies and ensuring compliance across multiple regions.