As small and medium-sized businesses look to expand globally and engage in global employment, managing human resources across borders can become increasingly complex. Between employment laws, payroll regulations, benefits, and tax compliance, growing your team in new countries can be overwhelming. This is where Employer of Record (EOR) and Professional Employer Organization (PEO) services come into play. By efficiently handling administrative tasks such as onboarding, payroll setup, and compliance, these services help streamline hiring and improve overall workforce management.

But which model is right for your client business? In this guide, we break down the differences between EOR and PEO services, so you can make the best decision for your business growth.

What is a PEO?

A Professional Employer Organization (PEO) is a third-party service provider that enters into a co employment arrangement with your company. This means that the PEO acts as a co employer, sharing certain employer responsibilities, such as payroll, benefits, compliance, and HR support. However, your company still retains control over the day-to-day management of your employees.

PEOs are ideal for companies that already have a legal entity in a specific country and are looking to outsource the operational side of HR while maintaining strategic control over hiring and business decisions.

How much does a PEO cost?

The cost of working with a PEO can vary depending on your company’s size and the services you need. Typically, PEOs charge either a percentage of your total payroll, which includes the employee’s salary, or a flat monthly fee per employee. While this setup may suit companies looking to outsource HR functions, it’s important to weigh the cost against your actual business needs.

PEOs can be a significant investment, and in some cases, they may not be the most efficient choice—especially for companies exploring international expansion. That’s why it’s crucial to understand exactly what a PEO offers and to compare it with other options, like EORs, before committing

Why Do Businesses Use PEOs?

Companies often turn to PEOs to streamline administrative workloads, gain access to robust employee benefits, and ensure HR compliance.

Statistics show that businesses using PEOs grow faster, see less employee turnover, and have a lower risk of going out of business compared to those that don’t.

Here are some of the key benefits a PEO can provide:

- Cost efficiency: By reducing turnover, minimizing HR overhead, and helping avoid costly legal missteps, PEOs can lead to long-term savings.

- Comprehensive HR support: From processing payroll to administering benefits and staying compliant with tax regulations, a PEO can handle a range of essential HR duties, including HR administration. Some PEOs even offer services beyond basic HR administration, such as data analytics to enhance workforce insights.

- Risk management: PEOs help companies manage workplace risks through safety protocols and workers’ compensation support.

- Attractive employee benefits: With access to large-group benefit plans, businesses can offer better perks that attract and retain top talent.

That said, PEOs only operate in regions where you already have a legal entity—meaning they’re not suitable if you want to quickly hire in a new country.

What types of businesses can benefit from PEO services?

PEOs are often a strong fit for small and midsize businesses that want to offload HR functions through hr outsourcing without building an in-house team. For growing companies with limited resources, partnering with a PEO offers the advantage of enterprise-level HR services without the overhead.

However, choosing the right PEO is crucial. The ideal partner will understand your company’s long-term goals and support your growth strategy. Before deciding, consider the following:

- The specific needs of your workforce

- The PEO’s reputation and pricing structure

- Their commitment to customer service

- Whether their technology aligns with your business processes

What is an EOR?

An Employer of Record (EOR) is a company that legally employs workers on behalf of another business. An EOR service includes different types of EOR service providers, each offering unique advantages for global expansion. With an EOR, the third party becomes the legal employer, managing everything from onboarding, payroll, taxes, compliance, and even employment contracts, allowing you to hire international employees more easily.

EORs are the perfect choice for businesses that want to quickly hire employees in a new country without setting up a local entity. It’s a turnkey solution for international hiring that reduces risk and ensures compliance with local laws.

Benefits of EOR Services

EOR services offer numerous advantages for companies looking to expand their operations globally. One of the primary benefits is the ability to hire employees in foreign countries without the need to establish a local entity. This allows businesses to quickly enter new markets and access global talent without the extensive setup and registration processes typically required.

EORs assume legal liability for employment-related matters, significantly reducing the risk of non-compliance with local employment laws and regulations. Additionally, EORs provide comprehensive benefits administration, payroll processing, and compliance support, enabling companies to focus on their core business activities. By partnering with an EOR, businesses can ensure that they remain compliant with local employment laws while offering attractive benefits packages to their international employees.

How EOR Works

An Employer of Record (EOR) acts as the legal employer of record for a company’s international employees, managing all aspects of employment, including hiring, payroll, benefits administration, and compliance with local labor laws. The EOR assumes full legal liability for the employees, thereby reducing the risk of non-compliance and employment-related disputes for the client company. By partnering with an EOR, companies can access global talent, expand into new markets, and establish a presence in foreign countries without the need to set up a local entity.

EORs typically offer a range of services, including payroll processing, benefits administration, and compliance support, ensuring that companies remain compliant with local employment laws and regulations while focusing on their core business activities.

Read More: What is an Employer of Record (EOR)? The Complete 2025 Guide

What types of businesses can benefit from EOR services?

- Businesses with limited resources and/or HR expertise

- Startups

- Businesses that want to expand internationally and build a global team employment contracts

- Companies with remote workers and distributed teams

- Tech companies (especially those that want to expand into new markets)

- Companies with temporary or project-based workers

- Global consulting firms and professional services

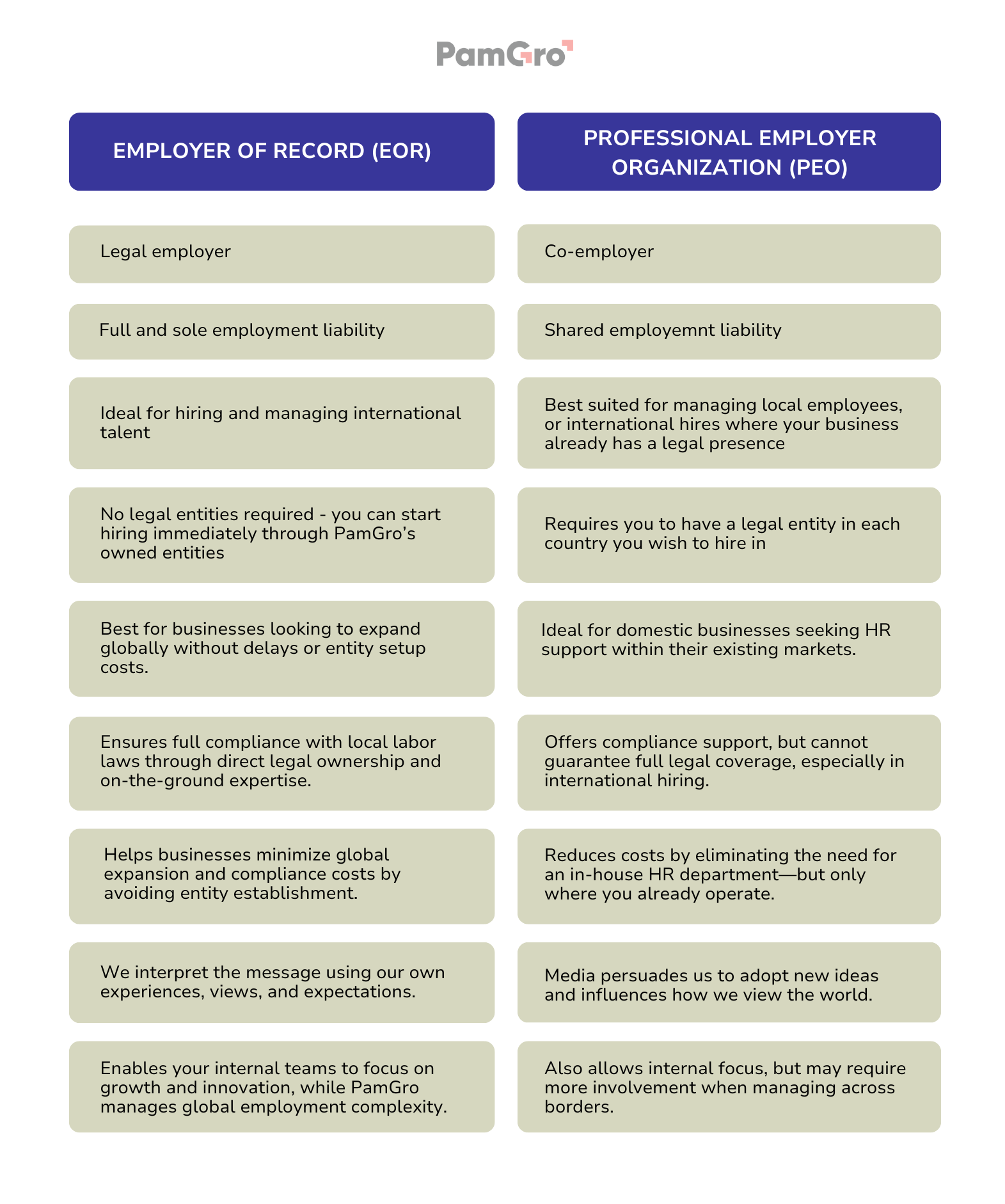

PEO vs EOR: Key Differences

Business Structure:

Structurally, a PEO forms a co-employment relationship with your business, where you remain the official employer but share responsibilities like payroll and compliance with the PEO as co employers. This allows you to maintain authority over strategic HR decisions, even as you hire workers through the PEO. An EOR, however, acts as the legal employer on your behalf in regions where your business lacks a legal entity, giving you access to local expertise while relieving you of direct employment obligations.

Risk:

While EORs take more control and responsibility off your shoulders, PEOs share responsibilities, giving co employer and you more involvement in the payroll process.

Scale:

When it comes to scale, PEOs are typically better suited for businesses with established operations and a full-time workforce. Many PEOs require a minimum number of employees to access their benefits and services. EORs, on the other hand, offer unmatched flexibility, making them ideal for companies testing new markets or needing to hire a small number of employees without long-term commitments or headcount thresholds. EORs also excel in managing global employees, assisting businesses with payroll, tax compliance, and benefit administration for employees and contractors located worldwide.

Company Scope:

The scope of services also differs. A PEO only operates in countries where your company already has a legal entity, meaning you remain responsible for local compliance, including business registration. An EOR, however, can operate on your behalf in countries where you don’t have a presence. They bring deep knowledge of local employment laws and handle the full range of HR functions, making them an excellent solution for international expansion without the overhead of establishing an entity

Costs:

Cost structures between the two models are similar, with both typically charging either a flat monthly fee per employee or a percentage of payroll. However, long-term costs with a PEO may be higher, especially when you factor in the costs of providing your own benefits, insurance, and handling payroll tax filing. EORs, in many cases, include these elements in their service packages, potentially resulting in a more cost-effective solution over time.

Get The Ultimate Playbook for US Tech Startups Looking to Expand in Europe

Europe awaits. But compliance, hiring, & market fit?

PamGro’s got you covered.

How Are PEOs and EORs Similar?

Despite their structural differences, PEOs and EORs offer many overlapping services, managing essential HR tasks such as:

- Payroll processing

- Benefits administration

- HR compliance support

- Assistance with tax filings

- Onboarding and employee support

Both models help companies reduce HR workload and mitigate the risks associated with employment law in different regions

What Works Better for International Employees: A PEO or an EOR?

If you’re expanding globally and don’t have a local legal entity, a PEO simply won’t be an option. This is where an Employer of Record (EOR) becomes essential. Unlike a PEO, an EOR allows you to legally employ full-time workers in a foreign country where you don’t operate an entity.

Some providers use the term “global PEO,” but if they require you to set up your own entity, they’re not offering true EOR services. A genuine EOR becomes the legal employer on your behalf—handling everything from employment contracts to payroll and compliance, while you maintain operational control over your team.

An EOR is typically faster to implement and more cost-effective, especially when hiring just a few employees in new markets. You get the same range of services—benefits management, HR support, tax compliance—but with the added advantage of not having to navigate local incorporation.

Ultimately, if you’re aiming for quick, compliant global expansion without the burden of entity setup, an EOR offers a more agile and scalable solution.

Key Considerations when deciding between a PEO and EOR

Choosing between a PEO and EOR depends on your company’s current structure and future plans, particularly in terms of managing HR-related tasks. Here are key questions to help you decide:

1. Do you own a legal entity in the country where the employee lives?

If your company doesn’t own a legal entity in the country where you want to employ full-time workers, an Employer of Record (EOR) is not just a convenient option—it’s your only compliant path forward. An EOR enables you to hire globally without the cost and complexity of setting up a local entity.

But not all EOR providers are created equal.

Many EORs rely on third-party vendors to deliver services abroad, meaning they don’t actually own the entities they operate through. This layered approach often leads to inflated costs, inconsistent service, and a fragmented experience for both you and your employees. With multiple parties involved, transparency is lost—and so is control over pricing and service quality.

At PamGro, we do things differently. We own and operate our own entities in 14 countries and maintain a trusted partner network spanning over 150+ countries. This allows us to offer direct service delivery, flat-rate pricing, and a consistent, premium experience for your global workforce—without hidden fees or third-party delays.

If you’re considering hiring independent contractors instead of full-time employees, you may think a PEO could work. While a PEO can support contractor engagements, it’s crucial to assess the nature of the role to avoid misclassification risks, which could lead to compliance issues and penalties.

Alternatively, you can choose to open your own entity. But this route comes with significant investments—thousands of dollars, months of setup time, and the added responsibility of managing local operations. Unless you plan to scale extensively in that specific market, the entity setup may not deliver the ROI you’re expecting.

On the other hand, if your company already owns a local entity, partnering with a PEO can be a smart move. A PEO works in a co-employment model, taking care of essential HR functions—such as payroll, health insurance benefits administration, and compliance—while you maintain control over day-to-day business decisions. It’s a great solution for companies that want to retain local presence without building an internal HR infrastructure.

2. How many employees do you want to hire?

For a large team, a PEO may be more cost-effective.

For a few employees or short-term hires, an EOR offers speed and flexibility, allowing companies to hire talent globally without the need to establish a local legal entity

3. Are you hiring full-time employees or contractors?

Both models can support either, but EORs tend to be more comprehensive for full-time employees, especially across borders. It’s important to note that while PEOs operate on a co-employment model, the term ’employee leasing’ has often been mistakenly used to describe PEO services, leading to confusion among employers and even in state legislation.

Choosing the Right Partner for Global Growth

Expanding your workforce across borders doesn’t have to be complicated or risky. Whether you’re navigating local labor laws, managing international payroll, or trying to onboard contractors compliantly, the right partner can make all the difference. While PEOs accredited by the Employer Services Assurance Corporation (ESAC) have met stringent financial and operational standards, providing assurance of their stability and ethical practices, EOR solutions like PamGro offer unmatched flexibility, speed, and peace of mind for companies looking to scale globally—without the overhead of entity setup.

PamGro’s EOR platform is built for modern businesses. With zero onboarding or offboarding fees, our streamlined platform allows you to onboard contractors and employees with ease. From timesheet management to payroll and compliance, everything is handled within one secure system. We’re equipped to support all labor leasing requirements—including SNA and AUG licenses—ensuring you meet the highest standards of compliance no matter where you’re hiring.

We’re more than just compliant—we’re certified. PamGro is proudly FCSA Accredited in the UK and ESG Certified, reflecting our commitment to ethical employment practices and sustainable operations. With bespoke salary sacrifice and pension plan options, we tailor benefits that attract top talent while meeting local regulations.

Our EOR services start at just $149 per contractor per month, offering a cost-effective way to scale your workforce while maintaining full legal and regulatory compliance. And with 14 self-owned entities and a trusted partner network in over 150 countries, you gain global reach with localized expertise—without sacrificing speed or quality.

PamGro is fully compliant and ready to help your business navigate the complexities of international hiring.

FAQs

1. Can I switch from an EOR to a PEO later?

Yes. Many companies use an EOR to enter a market quickly, and then transition to a PEO after setting up their own legal entity. Unlike a staffing agency, which connects companies with qualified workers for temporary or permanent roles and manages the recruitment process, an EOR is more suitable for global employment needs.

2. Are EORs and PEOs legal and compliant?

Yes. Reputable EOR and PEO providers stay up-to-date with local employment laws and regulations to ensure full compliance.

3. How much does it cost to use a PEO or EOR?

- PEO: Typically charges a percentage (2–12%) of gross payroll.

- EOR: Charges a flat monthly fee per employee (often $200–$1000 depending on services and location).

Hire the Best Talent, Anywhere