Employers, brace yourselves—rising payroll costs are on the horizon, and the impact could be more substantial than expected. Navigating this shift requires strategy, not just reaction.

From April 2025 the UK government is increasing Employers’ National Insurance (NI) contributions. Whether you’re a growing startup, established company or large business, this means one hard truth – more costs per employee. With margins already tight for many businesses, this increase in employers’ NI contributions will force some tough choices.

Will businesses absorb the extra cost or will it mean higher prices, hiring freezes or even job cuts? Can companies find ways to mitigate the impact without stalling growth? The reality is ignoring this isn’t an option – businesses that don’t prepare now will be scrambling when the new National Insurance rates for 2025 come in.

Rising employer NIC costs are inevitable, but they don’t have to derail your business. With the right approach, you can turn this challenge into an opportunity—staying compliant while keeping costs under control. In this guide, we’ll break down exactly what’s changing, how it impacts your bottom line, and the 6 smartest ways to navigate these shifts without compromising growth. Let’s dive in.

What is NIC?

Employers’ National Insurance Contributions (NICs) are an obligatory payroll tax for UK-based businesses to pay on employee earnings. NICs play an essential part in funding State Pension, National Health Service (NHS) services and welfare benefits; providing financial support for individuals in need.

Employers are responsible for paying National Insurance Contribution taxes as an addition to wages; the exact amount depends on government-set thresholds and contribution rates which are reviewed every year. National Insurance Contribution taxes apply to most employees regardless of full-time, part-time or temporary status as long as their earnings surpass certain thresholds.

Employers’ National Insurance(NI) Contributions represent an essential cost for businesses, as any increase directly impacts payroll expenses and annual profits. With an anticipated hike starting from 2025, companies will need to devise financial strategies in order to effectively manage these additional expenses.

Understanding how NICs function is key for employers looking to plan ahead, ensure compliance, and minimize financial strain caused by these contributions.

Details of the 2025 National Insurance Contributions (NICs) Increase

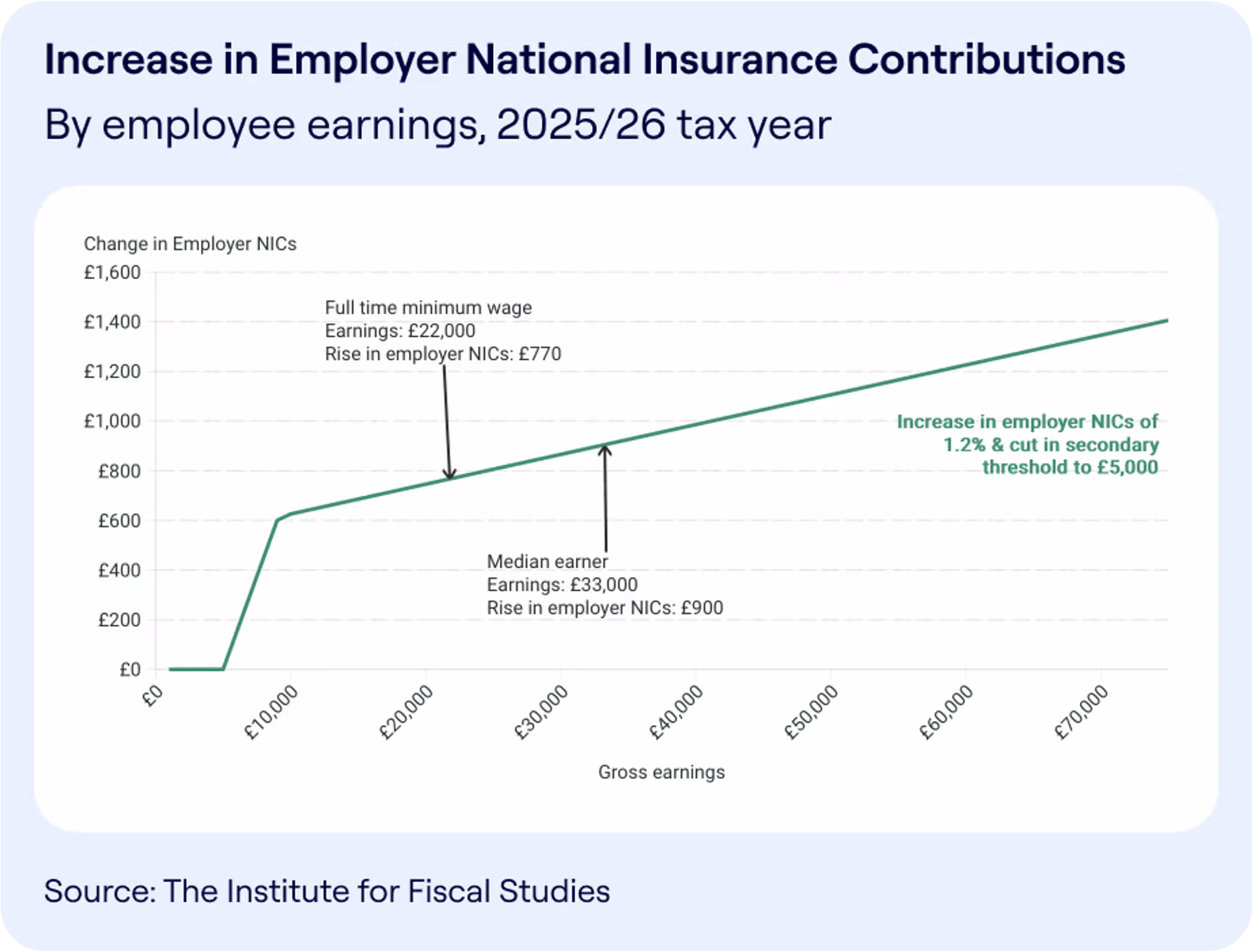

The UK government’s October 2024 budget introduced significant changes to Employers’ National Insurance Contributions (NICs), set to take effect from April 6, 2025. These changes aim to address a £22 billion budget deficit, but they also mean higher employment costs for businesses across all sectors.

Here’s what’s changing:

Higher Employer NICs Rate

- Current Rate: Employers pay 13.8% on employee earnings above the Secondary Threshold, which is currently £9,100 per year (£758 per month or £175 per week). This means NICs do not apply to earnings below this amount.

- New Rate (April 2025): The rate will increase to 15%, raising payroll costs for businesses.

Lower Secondary Threshold

- Current Threshold: Employers pay NICs on wages above £9,100 per year (£758 per month).

- New Threshold (April 2025): This will drop to £5,000 per year (£417 per month), meaning businesses will start paying NICs sooner, even on lower salaries

Changes to Employment Allowance

- Currently: Small businesses can claim a £5,000 Employment Allowance to reduce their NICs bill.

- From April 2025: The allowance will increase to £10,500, helping some businesses offset rising costs. However, this won’t fully compensate for the additional NICs for larger employers.

Why Larger Employers Won’t Benefit:

- The Employment Allowance is only available to businesses with an annual NICs bill below £100,000.

- Larger companies (with an annual NICs bill above £100,000) do not qualify and must pay the full increased NICs.

- Even for small businesses, the extra allowance may not fully cover the higher NICs costs due to the increased rate and lower threshold.

Financial Implications for Businesses

The increase in Employers’ National Insurance Contributions (NIC) is more than just another tax adjustment—it’s a fundamental shift in payroll expenses that could impact hiring, wages, and overall business operations. Whether you’re running a small business, a mid-sized company, or a large corporation, this change forces a rethink of cost structures other benefits and workforce strategies.

Higher Payroll Costs: More Than Just a Percentage Hike

At first glance, the increase may seem like a small percentage change, but when applied across an entire workforce, the numbers add up fast. Businesses with large employee bases or high staff turnover will feel the financial pinch the hardest.

- For small businesses – Hiring new employees becomes significantly more expensive, making workforce expansion difficult.

- For mid-to-large businesses – Rising payroll costs could lead to budget cuts in other areas, including employee benefits and bonuses.

- For industries with tight profit margins – Retail, hospitality, and manufacturing may struggle to absorb the additional cost without passing it on to consumers.

The Squeeze on Small and Medium Enterprises (SMEs)

While larger corporations may have the financial cushion to absorb the impact, SMEs—especially those relying on low-wage or part-time workers—will bear the heaviest impact.

- The lower NICs threshold means small businesses will start paying employer NICs on earnings as low as £5,000 per year as per 2025 (down from £9,100 in 2024), increasing payroll costs even for employees on modest salaries or part-time wages. This change disproportionately affects businesses that rely on lower-income workers, as they will now contribute more in NICs for staff who previously fell below the threshold.

- The Employment Allowance offers a small reprieve, but for SMEs , it won’t be enough to counterbalance the additional NICs burden.

For SMEs, this could mean:

- Delaying expansion plans or freezing hiring altogether.

- Increasing reliance on freelancers and contractors to reduce payroll taxes.

- Reducing employee benefits or perks to offset higher tax contributions.

The Domino Effect: Higher Prices & Consumer Impact

When operating costs go up, businesses don’t just absorb the loss—they pass it on. Consumers may soon see price hikes across various sectors, particularly in:

- Retail and e-commerce, where product costs are already influenced by inflation.

- Service industries, where increased labor costs lead to higher fees for customers.

- Hospitality and leisure, where businesses may introduce surcharges or reduce service quality to maintain margins.

This puts companies in a tough spot—“raise prices and risk losing customers or absorb costs and watch profits shrink.”

Competitive Disadvantages: UK vs. Global Markets

For businesses that operate internationally, the UK’s rising NICs may make offshoring or hiring overseas more attractive. With lower employment taxes in other regions, companies may:

- Shift roles to developing countries, especially in tech, customer service, and manufacturing.

- Increase reliance on remote global teams rather than UK-based employees.

- Explore automation and AI solutions to replace manual labor costs

Workforce Restructuring & Job Market Shifts

To navigate these financial pressures, businesses may have to rethink their employment structures:

- More part-time roles to keep individual salaries below NICs thresholds.

- Increased outsourcing of non-core functions to reduce payroll taxes.

- Exploring Employer of Record (EOR) services, which help companies hire international talent while avoiding excessive tax burdens.

Strategies to Mitigate Increased NIC Costs

In 2025 the rise in Employers’ National Insurance Contributions (NIC) set to push up payroll expenses, businesses must act strategically to minimize the financial impact. Companies with larger workforces—especially those relying on full-time employees will feel the strain the most.

To stay ahead, businesses need to rethink their workforce structures, explore cost-efficient employment models, and leverage smart tax strategies. Here’s how:

Workforce Optimization

- Restructure Employment Models

- Balancing full-time, part-time, and contract roles can help reduce NIC liabilities. Since employer NIC applies only to wages above the Secondary Threshold (£9,100 for 2024/25), adjusting pay structures strategically can lower costs.

- Flexible working arrangements, including part-time roles or job-sharing, can ease payroll expenses while maintaining productivity.

- Implement Salary Sacrifice Schemes

- Salary sacrifice arrangements—where employees exchange part of their salary for non-cash benefits like pensions, electric cars, or cycle-to-work schemes—reduce taxable pay, lowering both employer and employee NIC costs.

- Example: If an employee earning £40,000 contributes £3,000 to their pension through salary sacrifice, their taxable salary drops to £37,000, reducing NIC obligations for both the employer and the employee.

- Boost Efficiency Through Automation

- Investing in technology can help businesses maintain productivity with fewer employees, reducing overall NIC expenses.

- AI-powered scheduling, chatbots for customer service, and workflow automation tools can streamline operations and lower reliance on additional hires.

Leveraging Employer of Record (EOR) Services

- Outsource Payroll & Compliance

- An Employer of Record (EOR) manages payroll, tax deductions, and legal compliance, helping businesses navigate complex employment laws while reducing administrative burdens.

- This is especially useful for companies hiring remotely or expanding internationally, as EORs ensure compliance with varying tax and employment regulations.

- Reduce Employment Costs Through Shared Benefits

- EORs often provide access to cost-effective employee benefit schemes, helping businesses offer competitive perks without significantly increasing payroll costs.

- This can be a game-changer for attracting and retaining talent without bearing the full weight of rising NIC expenses.

- Enhance Workforce Flexibility

- Using an EOR allows businesses to scale their workforce up or down without committing to full-time contracts, offering a flexible and cost-efficient hiring model.

- This approach is particularly beneficial for startups, seasonal businesses, or companies hiring in multiple locations.

While the substantial increase in employer NIC will inevitably add financial pressure, businesses can take proactive steps to manage these costs.

By restructuring workforce models, leveraging tax-efficient payroll strategies, and partnering with an EOR, companies can maintain profitability while staying compliant with evolving regulations.

How Businesses Are Responding to the NIC Increase?

The 2025 increase in Employers’ National Insurance Contributions (NICs) is placing significant financial pressure on businesses across various industries.

With rising employment costs, companies are reassessing their workforce structures, pricing strategies, and operational efficiencies. Here’s how different sectors are adapting.

Retail Sector: Managing Costs Amid Higher Payroll Expenses

Retailers, particularly those with tight profit margins, are taking strategic steps to absorb the increased NIC costs:

- Adjusting Pricing Strategies – Many businesses are implementing slight price increases to offset higher employer NICs while remaining competitive.

- Optimizing Workforce Structure – Some retailers are reducing part-time positions and focusing on full-time staff to minimize NIC expenses.

- Re-evaluating Perks & Expenses – Some businesses are scaling back on voluntary overtime, adjusting staff discount rates, or pausing certain incentives while ensuring core wages remain stable.

- Evaluating Employee Benefits – Some businesses are reassessing non-essential employee perks, such as staff discounts or overtime incentives, to balance rising costs.

Small and mid-sized retailers face the greatest challenge, with some reconsidering expansion plans or store operations to maintain profitability.

Manufacturing Industry( For Large Companies): Balancing Cost-Cutting and Workforce Stability

Manufacturers, already dealing with energy price volatility and supply chain constraints, now have to navigate the additional burden of increased employer NICs. Their response includes:

1. Workforce Adjustments

- Chile (2025): In early 2025, Chile’s Congress approved a significant reform to its private pension system, raising employer contributions from 1.5% to 8.5% over nine years. This increase prompted Chilean manufacturers to implement measures such as hiring freezes and restructuring job roles to control labor costs without resorting to immediate layoffs.

2. Automation and Process Efficiency

- Estonia (2024): With a social security tax rate of 33% in 2024, Estonian manufacturers increased investments in automation and process efficiencies. This approach helped reduce long-term labor costs and enhanced competitiveness in the global market.

3. Lobbying for Industry Support

- France (2024): Facing employer social security tax rates ranging from 25.25% to 35.7% in 2024, French industry bodies advocated for government relief measures to ease the financial burden on businesses. Their efforts led to the implementation of tax credits and exemptions, helping manufacturers manage increased operational costs.

4. Export Price Adjustments

- Spain (2024): In response to a social security tax rate of 30.40% in 2024, Spanish manufacturers revised their pricing strategies for international markets to maintain profitability. By adjusting export prices, they aimed to remain competitive while covering higher operational costs.

Conclusion:

The rise, in Employers’ National Insurance Contributions (NIC) is a moment, for businesses that cannot be overlooked or dismissed lightly.Elevated labor expenses might compel firms to reconsider their recruitment tactics,optimize plans and potentially amend pricing schemes.However this situation is not merely a hurdle—it presents an opportunity to cultivate resilience.

Taking steps can help businesses leverage this change in policy to their advantage. Enhancing workforce efficiency through automation and strategic financial management can mitigate the effects of these changes. Employer of Record (EOR) service providers such as PamGro offer flexibility in managing compliance issues and cost control. The crucial aspect is to adjust before feeling the pressure.

Change is something that will always happen no matter what. Dealing with challenges doesn’t always have to be difficult.

The successful businesses are not the ones that immediately get stressed out ; they are the ones that adapt to the situation instead. The real issue is not if NIC costs are increasing. It’s about how ready you are to manage the situation.

FAQ's

1. What are National Insurance Contributions (NICs) in the UK?

These are payments made by workers and employers to fund state benefits like pensions and healthcare.

2. How do I check my National Insurance Contributions (NICs) record?

You can check your NIC record on the UK government’s official website to see if you’re eligible for benefits like the State Pension.

3. What is the NIC increase in 2025?

From April 2025, employers in the UK will pay higher NICs due to an increase in contribution rates.

4.What is the deadline for voluntary contributions to NIC payments in the UK?

You have until April 5, 2025, to have eligible employers make voluntary NIC payments and fill gaps in your record for a better State Pension.

Unrivaled Payroll Solutions for 15 Years

Soham wasn’t always an international employment guru. He began with a passion for numbers, surprising shopkeepers with his mental math skills.

At PamGro, Soham spearheads international expansion and EOR (Employer of Record) services, driving global business strategies and ensuring compliance across multiple regions.