Key Takeaways – EOR UK: Your Guide to UK Hiring.

-

UK Compliance Sorted: EORs navigate complex UK employment laws, tax, and payroll.

-

Fast UK Market Entry: Hire UK talent quickly, no need for a local legal entity.

-

Core Business Focus: EORs manage UK HR admin, letting you focus on growth.

-

Access UK Talent: Easily and compliantly tap into the skilled UK workforce.

-

Reduced Risk: EORs act as the legal employer, mitigating your UK employment liabilities.

-

Local Expertise: Benefit from an EOR’s deep understanding of UK-specific benefits and practices.

TABLE OF CONTENTS

- Step-by-Step: How to Hire Through an Employer of Record in the UK

- How Much Does It Cost to Use an EOR in the UK?

- Hiring in the UK

- Employee Benefits and Compensation in the UK

- What are the risks of Employee Misclassification in the UK?

- Case Study: A US Tech Company’s Success with a UK EOR

- Hire in the UK with PamGro’s Compliant EOR Solution

- FAQs about hiring through an EOR in UK

Expanding your business into the UK, potentially through an employer of record uk, is a smart move, especially for your global expansion plans with its business friendly environment, diverse and highly skilled talent pool and English being the main language. This makes the UK an attractive destination for companies, especially those based in the US and Canada looking to go international.

Foreign employers can start their expansion through global hiring by hiring British contractors and managing international payments. But if you want to hire full time employees you will need to either set up a local entity in the UK or engage an Employer of Record (EOR).

While Companies House—the UK government agency responsible for company registration—has simplified the business registration process, setting up your own entity requires a deep understanding of UK employment and tax laws. Mistakes can lead to complications with His Majesty’s Revenue and Customs (HMRC).

Alternatively, partnering with Employer of Record (EOR) record services allows you to manage administrative tasks and navigate British payroll, tax and compliance requirements. Through EOR services you can start hiring and working with employees in the UK quickly and compliantly.

An Employer of Record (EOR) simplifies the hiring process in the UK by acting as the legal employer for your employees. EOR services handle the administrative tasks associated with hiring, allowing companies to focus on core business operations.

Step-by-Step: How to Hire Through an Employer of Record in the UK

Step 1: Choose Between a UK EOR and a Legal Entity

When hiring UK employees you have two main options:

- Legal Entity in the UK: Setting up your own entity involves registering with local authorities, enrolling in the PAYE (Pay As You Earn) scheme, determining your Corporation Tax obligations and consulting with local experts to ensure compliance with UK tax and labour laws.

- UK EOR: An Employer of Record acts as a third party service that employs workers on your behalf. This means you don’t need to set up your own entity. EORs handle all legal requirements including payroll, contracts, benefits, tax calculations and compliance with UK laws.

Step 2: How to Choose the Best Employer of Record for Your Business

Several EOR providers such as PamGro, Papaya Global and Rippling offer services to help you hire, pay and manage UK employees. When choosing a platform consider the services you need and your plans for global expansion.

Key factors to consider:

- Entity Ownership: Does the EOR have its own legal entity in the UK?

- Onboarding Services: Do they offer full onboarding for new employees?

- Global Payroll Solutions: Can they manage payroll across multiple countries?

- Compliance Expertise: Do they have a track record of ensuring compliance with local laws?

Step 3: How to Hire and Onboard Your UK Employees

Once you’ve chosen an EOR the onboarding process for your new employees begins.

- Right to Work Verification: Ensure each new employee has the legal right to work in the UK. This can be verified through passports, visas or other relevant documentation. Keep copies of these documents in the employee’s file as required by UK law.

Read More: Demonstrate Your Right To Work Check in the UK

- HMRC Notification and PAYE Enrollment: Notify HMRC of the new hire and enroll the employee in the PAYE scheme to ensure tax and National Insurance deductions are made. You’ll need:

- Full name

- Date of birth, address and gender

- Start date

- Previous employment details

- National Insurance number

- Tax code

- Student loan status

- Year-to-date pay and tax contributions

Much of this information can be obtained from the employee’s P45 form which details their tax and salary information from their previous employer, including their annual salary.

- Employment Contract: Provide a contract of employment outlining key working conditions. An EOR can help with localising and distributing legally compliant employment agreements covering things like probationary periods, working hours, minimum wage, benefits and termination policies.

- Employer Responsibilities: Be aware of your obligations:

- National Insurance Contributions: Employers pay 13.8% on all wages above £758 per month.

- Pension Contributions: Auto-enrolment in a company pension scheme with a minimum employer contribution of 3% and employee contribution of 5%.

- Tax Brackets: Tax brackets vary between Scotland, Wales, England and Northern Ireland.

EORs provide employee benefits administration, ensuring that employees receive their entitlements.

Step 4: Run Payroll

Once you have all the necessary information and employment contracts in place the EOR will manage payroll, including paying employees, filing payroll taxes, ensuring employees are paid in GBP and all required taxes are withheld, which are essential components of employment costs. EOR services can automate payroll processing and ensure accurate payments in GBP. This includes:

- National Insurance

- Income tax

- Pension schemes

Note some EORs use third party vendors for payroll which can lead to slower processing times

How Much Does It Cost to Use an EOR in the UK?

The cost of using an Employer of Record in the UK varies depending on location, billing period, services required, and the number of employees employed through the EOR. There may be surcharges and minimum employee requirements.

Remember EOR fees and statutory benefits are only a part of the total cost of employment (TCE) which includes contributions mandated by local labour, payroll and tax laws.

Newer providers may offer lower rates but may compromise on compliance, security and service quality. Established providers may charge higher fees but offer better compliance and service standards. Avoid partner dependent providers that may have hidden fees.

Need help making that decision?

Hiring in the UK

Hiring in the UK requires a good understanding of uk employment laws, guidelines and regulations. Although there are cultural similarities with countries like the US, UK labour laws are different.

UK employment law outlines guidelines for holiday entitlement, notice periods and disciplinary practices. It also has a minimum wage that varies with age and has strict anti-discrimination laws.

Non-compliance can result in severe penalties including fines and potential dissolution of the business. So it’s essential to ensure either you or your EOR partner can manage employee benefits and salaries in compliance with local labour laws. Partnering with an EOR can help mitigate risks associated with hiring foreign workers, including misclassification and non-compliance.

Employment Contracts and Agreements in the UK

In the UK, an employment agreement is mandatory and must be adhered to throughout the employment period.

While contracts don’t need to be in writing, employers must provide a document detailing the main conditions of employment, comprising a principal statement and a wider written statement.

Principal Statement (provided upon employment):

- Employer’s name

- Employee’s name, job description and start date

- Salary details

- Working hours and days

- Holiday entitlement

- Work location

- Contract length

- Probation period and conditions

- Additional benefits

- Training requirements

Wider Written Statement (provided within two months of employment):

- Pension schemes

- Collective agreements

- Non-compulsory training rights

- Disciplinary and grievance procedures

Labour Law Compliance in the UK

UK workers are protected by a comprehensive set of employment benefits and rights, including provisions for public holidays encompassing various acts, regulations, common law principles, and local employment law. In the UK, employees are entitled to a minimum of 28 days of holiday if they work a standard five-day week.

Key protections include:

- Equality Act: Prohibits discrimination based on age, race, gender or other protected characteristics. All British employees are protected by the Equality Act, which prevents employers from using discriminatory practices.

- Health and Safety: Employers must have liability insurance to cover workplace injuries.## Working Hours in the UK

Employees can’t work more than 48 hours a week unless they opt out in writing.

Penalties vary across the UK and can include:

- Repayment of owed money to employees

- Fines

- Public disclosure of non-compliance

- Imprisonment

Consulting legal experts or partnering with an EOR can help with compliance,

Payroll and Payroll Taxes in the UK

UK has a Pay As You Earn (PAYE) tax system where employers must comply with tax regulations by managing payroll, which includes deducting and remitting employment taxes to HMRC, ensuring that employees also pay taxes accordingly. Self-employed individuals and contractors handle their own tax reporting and payments. The standard Personal Allowance in the UK is £12,570, which may increase with claims for Marriage Allowance or Blind Person’s Allowance.

Employers must provide itemised payslips with:

- Deductions

- Hourly rates

- Hours worked

- Other relevant information

- Deductions

- Hourly rates

- Hours worked

- Other relevant information

Employees must be paid in British pounds regardless of the employer’s location.

Read More: UK Payroll: A Beginner’s Guide (2025)

Time Off and Leave Policies

In the UK, employees are entitled to a minimum of 28 days of paid annual leave, including bank holidays. This can be taken at any time during the year, but employers may have some control over when leave can be taken. Employees are also entitled to sick leave, maternity leave, and paternity leave.

The UK has a number of bank holidays throughout the year, including Christmas Day, Boxing Day, and New Year’s Day. Employers must ensure that they are providing their employees with the correct amount of leave and are following the correct procedures for requesting and approving leave.

Background Checks and Screening

Background checks and screening are an important part of the hiring process in the UK. Employers must ensure that they are conducting the correct checks and screenings to ensure that they are hiring the right candidates for the job. This can include checks such as DBS (Disclosure and Barring Service) checks, which provide an overview of a person’s criminal record. Employers must also ensure that they are following the correct procedures for conducting background checks and screenings, and that they are complying with UK employment laws.

Cultural Considerations and Diversity

The UK is a culturally diverse country, and employers must ensure that they are taking this into account when hiring and managing employees. This can include ensuring that the workplace is inclusive and respectful of all employees, regardless of their background or culture.

Employers must also ensure that they are complying with UK employment laws, such as the Equality Act, which prevents employers from using discriminatory practices based on age, race, gender, or any other protected characteristics. By taking cultural considerations and diversity into account, employers can create a positive and inclusive work environment that benefits all employees.

Employee Benefits and Compensation in the UK

UK workers are entitled to a national minimum wage that varies by age. As of 2023:

- 23+ (National Living Wage): £10.42

- 21-22: £10.18

- 18-20: £7.49

- Under 18: £5.28

UK has the National Health Service but employers often provide private healthcare for senior staff. Legally required benefits include:

- Holiday pay

- Maternity/paternity pay

- Sickness pay

- Pension contributions

Employers must auto-enrol employees in pension schemes with contributions from employer, employee and government. Employees can opt out if they choose. In the UK, pension schemes are legally required for all employers, and employees’ pensions are built with contributions from employees, employers, and the government. Additionally, employers must manage statutory sick pay to ensure compliance with UK employment laws.

Read more: UK Employee Benefits: Statutory to Standout Perks

Employee Termination and Severance Pay in the UK

In the UK, employees get protection against termination after 2 years of employment. Before this period, employers can terminate contracts at will. The UK has specific uk labor laws that protect employees during termination and termination notice periods are stipulated by law.

After 2 years, employers must have a “potentially fair reason” for dismissal such as:

- Employee conduct

- Capability or qualifications

- Redundancy

- Retirement

- Other justifiable reasons

Immediate dismissal is allowed for “gross misconduct”. Employees dismissed for other reasons are entitled to a notice period depending on their length of service.

Severance pay isn’t legally required but employers may offer it as a goodwill gesture to avoid disputes. If disputes arise, employees may seek resolution through an employment tribunal.

Risks of Employee Misclassification in the UK

In the UK, employment laws differ significantly between employees and independent contractors. So getting your workforce classification right is crucial to avoid legal or financial trouble.

Recent high-profile cases such as Uber’s defeat in the Supreme Court and Deliveroo’s win in the Court of Appeals have made classification even more complex and inconsistent. These conflicting decisions only add to the difficulty of determining a worker’s status. Regularly consulting with legal experts is highly recommended to stay compliant.

If you misclassify your remote workers, your business could face:

- Penalties and fines – You may owe back taxes plus penalties and interest for late or incorrect payments.

- Unpaid wages and benefits – Businesses may have to pay workers back wages, holiday pay or other entitlements they missed due to misclassification.

- Legal disputes – Misclassification could lead to lawsuits or tribunal claims from individuals or groups affected.

To reduce the risk of misclassification, work with a reliable Employer of Record (EOR) like PamGro. Their compliance experts will guide you through worker classification and keep you compliant with UK employment laws.

Read more in their guide – The Expert Guide to Employee and Independent Contractor Misclassification

Case Study: A US Tech Company’s Success with a UK EOR

To see the benefits of a UK employer of record, consider this example of a US-based tech company. The company wanted to hire software developers in London but didn’t have the resources to set up a company. By working with a reliable employment partner and UK employer of record, like PamGro, they:

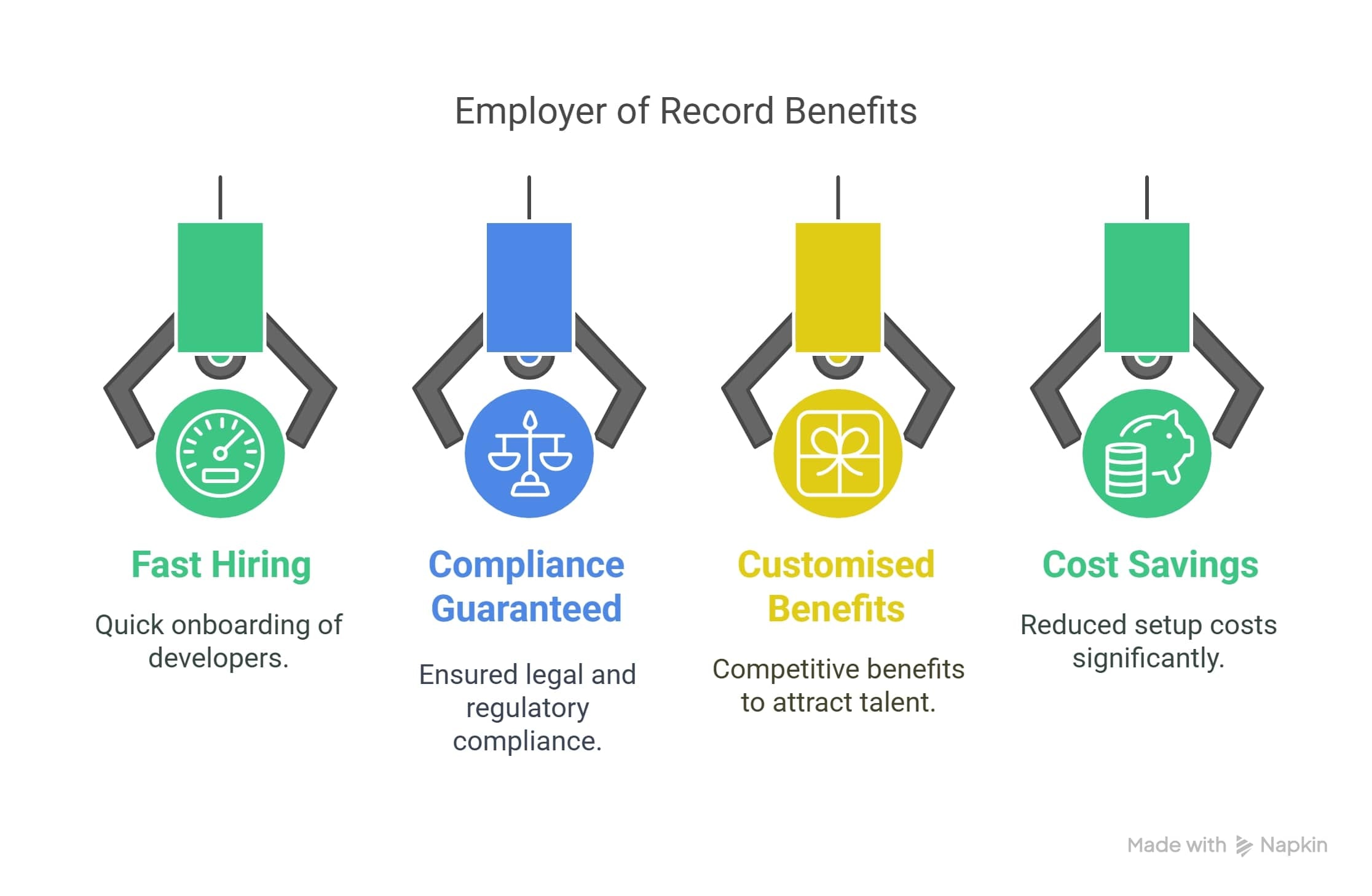

- Hired Fast: Onboarded five developers in two weeks to meet a project deadline.

- Compliance Guaranteed: The EOR ensured minimum wage, national insurance and pension compliance, no legal risks.

- Customised Benefits: Offered competitive payroll benefits, private health insurance and gym memberships to attract top talent.

- Cost Savings: Saved thousands in setup costs compared to setting up a local company. This shows how employer of record services UK can help US businesses succeed in the UK.

Hire in the UK with PamGro’s Compliant EOR Solution

Expanding into the UK? PamGro makes global employment and international hiring simple, fast and fully compliant. Our end-to-end EOR platform handles contractor onboarding, payroll and timesheet management—all with no onboarding or offboarding fees.

From $199 per person/month, PamGro offers one of the most cost-effective EOR solutions on the market. We provide customised salary sacrifice and pension plans, local contracts, GBP payroll and HR support in your employee’s time zone.

With 14 own entities and coverage in 150+ countries, our global reach and in-depth local knowledge ensure your global team and UK hires stay fully compliant. Contact PamGro today to simplify your UK expansion.

Related Newsletter Insight

Stay updated with the latest global hiring and compliance changes.

Newsletter: 2025 UK NIC Increase – What Employers Should Know

FAQs about hiring through an EOR in UK

1. What is the difference between an EOR and PEO?

An Employer of Record (EOR) becomes the legal employer on your behalf, handling compliance, payroll and HR without requiring a local entity. A Professional Employer Organization (PEO) co-employs workers and requires your company to have a legal entity in the country. EORs are perfect for quick, compliant global expansion, simplifying your global expansion journey.

2. What are the employer costs for full-time employees in the UK?

UK employers must pay 13.8% National Insurance on wages above £758/month for UK-based employees, contributing to the employment relationship by contributing at least 3% to pension schemes and may face additional costs such as the Apprenticeship Levy. Employer costs vary depending on salary, benefits and statutory requirements.

Read More: Employer’s National Insurance Increase in 2025

Planning to hire in the UK? Whether it’s full-time employees or contractors, this Employer Cost Calculator gives you a clear view of the true costs involved.

UK Employment Cost Calculator

Use our cost to hire calculator to understand what are all the employment costs you have to consider in UK.

3. How are employees and contractors classified in the United Kingdom?

UK classification is based on control, integration and mutual obligation. Employees work under direct supervision with fixed hours and benefits; contractors work independently, control how work is done and use their own tools. Misclassification can lead to penalties, back pay and legal disputes—so seek expert advice or a EOR.

Ready to onboard and expand globally

Soham wasn’t always an international employment guru. He began with a passion for numbers, surprising shopkeepers with his mental math skills.

At PamGro, Soham spearheads international expansion and EOR (Employer of Record) services, driving global business strategies and ensuring compliance across multiple regions.