KEY TAKEAWAYS

Poland has become the outsourcing hub of Europe due to low personnel costs and strong economy. It was the only European country that did not go into recession during the 2008-2009 global financial crisis – a proof of its economic stability and good governance.

Why Hire in Poland?

Skilled workforce

Poland is the 6th most populous EU member state and has an exceptional workforce with high education levels, strong work ethic and entrepreneurial spirit. 58% of tertiary educated adults in Poland have a master’s degree – a perfect ground for sourcing top talent.

Krakow and Warsaw produce 40,000 and 59,000 graduates annually respectively. These cities have a rich talent pipeline and allow companies to partner with universities to attract and engage candidates before they hit the job market.

Poland has one of the lowest unemployment rates in the EU, so it’s a competitive market for skilled workers. The war in Ukraine and global trends have driven inflation in Poland, so disposable income and investment have been impacted. To attract top talent, foreign companies may need to offer competitive salaries and benefits.

Developed Economy

Poland is in the center of Europe so it’s a natural hub for companies looking to expand their regional operations. As the 6th largest EU economy by GDP, the country is growing steadily and that means better job opportunities and competitive salaries.

This growth has also created a thriving labor market so Poland is an attractive destination for skilled workers looking for better quality of life and career prospects.

Diverse ecosystem with Good Living Environment

Poland is a multicultural and inclusive environment. Influenced by various cultures and traditions it’s perfect for global talent. With modern infrastructure, comprehensive healthcare, affordable housing and education Poland is a great place to live and work.

Its cities have a vibrant social scene with many bars, restaurants and entertainment options – making relocation even more appealing to foreign professionals.

Poland EOR vs. Legal Entity

Should you hire Polish employees through an EOR or set up your own entity? This depends on your company’s resources, size and plans to scale.

- Legal entity in Poland. Setting up a legal entity from scratch usually requires registration with local authorities, opening a local bank account and consulting with local experts to ensure compliance with Polish tax and labor laws including the Polish Social Insurance Institution. Poland’s National Labour Inspectorate takes all labor complaints seriously. There are many steps in this process and mistakes can result in delays to get up and running.

- Polish EOR. An EOR is a third-party service that operates as an employer on your behalf—meaning you don’t need to set up your own entity. As well as allowing you to hire full-time Polish employees, a Polish employer of record service can handle all the legal requirements for complying with EU and Polish laws for payroll, term contracts and benefits. EOR services also include calculating and withholding taxes at the correct tax rate, onboarding and managing employees and running payroll.

Read also:

How to hire employees in Poland through an employer of record (EOR)?

If you decide to use an employer of record to hire employees in Poland, here are a few steps you should take before making the final call:

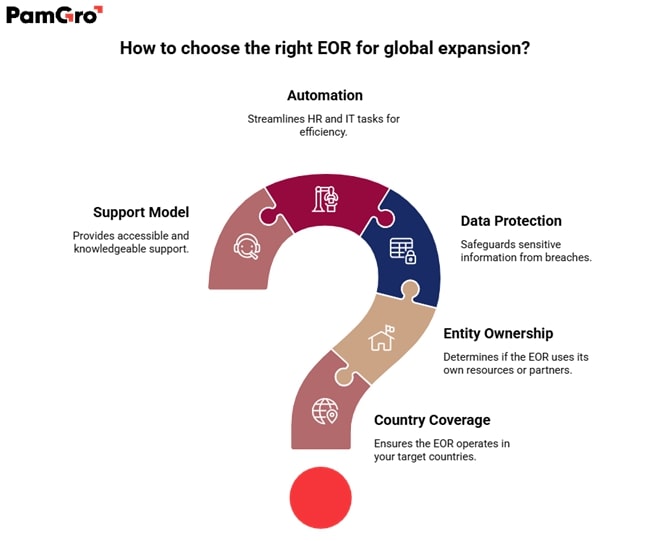

Step 1: How to choose the best EOR for your business

Before you choose a platform, you should consider the services you will need and how much you plan to grow your global hiring presence.

- Is the EOR active in the countries in which you need to hire?

The first and perhaps most obvious consideration when choosing an EOR for global expansion. - Does the EOR own its own entities in the countries it services?

If the EOR does not own the entities, it means they are partnering with a local or third-party provider. - How does the EOR protect your sensitive and confidential information?

It’s crucial that your EOR has the right data protections in place and secure technology that eliminates potential disclosures of private information. - Does the EOR offer automated solutions?

You may want to look for an EOR that automates the busy work like onboarding and benefits enrollment and other common HR and IT tasks. - What is the EOR’s support model?

It’s essential that your EOR has support staff that are easy to contact and experts in the regulations of the countries in which you are hiring.

Step 2: Hire and onboard your Polish employees

Once you’ve chosen an EOR that works in Poland, you can start the onboarding process by collecting the following information from your new employees:

- Name (matching the account where you’ll deposit their pay)

- Date of birth and date of hire

- Contact information, including their mailing address in Poland

- PESEL personal ID number

- NIP tax identification number

- Bank account information

- Amount to be paid in Polish złoty (PLN)

- ZUS ZUA: Form used to register for social security benefits

- ZUS ZZA: Form for state health care benefits

- ZUS ZCNA: Healthcare for family members of workers or self-employed persons

- Polish healthcare card (karty ubezpieczenia zdrowotnego or KUZ) information

- Medical exam

- Note that EU/EEA citizens don’t require a work permit for Poland

Next, you need to send out an employment agreement that outlines key working conditions such as type of work, position, location of work, hours, compensation, date work starts and probation or trial period. The Polish labor code requires employers to inform new hires about the rights and obligations of both parties (the employment contract) of the employment contract. Once you’ve collected a new hire’s information and both parties have signed employment agreements, an EOR will pay your Polish employees in złoty (PLN), while withholding taxes from salaries. This includes contributions to:

- Social security and retirement plans

- Health insurance

- Accident insurance

- Other voluntary entitlements (company pension plan)

In Poland, it’s common to issue employees with a monthly payslip, which may be in paper format or digital.

Curious if an EOR is the right fit for your global hiring plans?

Taxes in Poland

Using an Employer of Record (EOR) simplifies global hiring but it doesn’t eliminate risk. To protect your company and ensure compliance with local employment laws and regulations you need a proactive plan. Here are key strategies to reduce exposure when working with an EOR partner.

Employer Payroll Contributions

| Tax | Explanation |

|---|---|

| 9.76% | Retirement Pension (applied on salary up to 234,720.00 PLN annually) |

| 6.50% | Disability Fund (applied on salary up to 234,720.00 PLN)Employee Payroll Contributions |

| 0.67% – 3.33% | Accident Fund |

| 2.45% | Labor Fund |

| 0.10% | Guaranteed Employee Benefits Fund |

| 19.48% – 22.14% | Total Employment Cost |

Employee Payroll Contributions

| Tax | Explanation |

|---|---|

| 9.76% | Retirement Pension (applied on salary up to 234,720.00 PLN) |

| 1.50% | Disability Fund (applied on salary up to 234,720.00 PLN) |

| 2.45% | Sickness Fund |

| 9.00% | Health Insurance |

| 22.71% | Total Employee Cost |

Employee Income Tax

| Tax | Explanation |

|---|---|

| 0% | 0-30,000 PLN annually |

| 12.00% | 30,001 -120,000 PLN annually |

| 32.00% | Over 120,000 PLN annually |

Poland Employment Cost Calculator

Use our cost to hire calculator to understand what are all the employment costs you have to consider in Poland.

What are the risks of employee misclassification in Poland?

One of the most critical legal issues foreign employers face when hiring in Poland is worker misclassification. Under the Polish Labor Code, there is a clear legal distinction between employees and contractors, and treating one as the other—intentionally or accidentally—can result in serious financial and legal consequences.

Misclassifying a worker in Poland can expose your company to serious legal liabilities. If authorities determine that a contractor has been misclassified and should have been treated as an employee, the consequences may include:

- Fines ranging from 1,000 to 30,000 PLN

- Retroactive payments of up to five years’ worth of unpaid social security contributions

- Back pay for benefits, including overtime, holiday leave, and sick pay

Given the complexity and nuances of Polish labor laws, correctly classifying workers can be difficult without local HR expertise.

How an Employer of Record Can Help?

Partnering with an Employer of Record in Poland eliminates the risk of misclassification by ensuring that each worker is hired under the correct legal framework. An EOR acts as the legal employer on your behalf, managing compliance with Polish labor laws while you maintain control over day-to-day work and performance.

A trusted EOR can help your business:

- Ensure compliance with local employment and tax laws from day one

- Accurately classify workers as employees or contractors, based on Polish legal standards

- Handle payroll, benefits, and contracts according to Polish regulations

- Avoid legal disputes and penalties by staying fully aligned with labor laws

- Offer competitive, compliant benefits packages that attract and retain top talent

Soham wasn’t always an international employment guru. He began with a passion for numbers, surprising shopkeepers with his mental math skills.

At PamGro, Soham spearheads international expansion and EOR (Employer of Record) services, driving global business strategies and ensuring compliance across multiple regions.