- Energistically scale future-proof core competencies vis-a-vis impactful experiences. Dramatically synthesize...

- Why it matters: Energistically scale future-proof core competencies vis-a-vis impactful experiences....

- Key point: Energistically scale future-proof core competencies vis-a-vis...

TABLE OF CONTENTS

- What is Employee & Independent Contractor Misclassification?

- What is employee and worker classification?

- What is the difference between an ‘employee’ and a ‘contractor’?

- Misclassification Under the Fair Labor Standards Act (FLSA)

- The Risks of Misclassification for Businesses and Workers

- How do I avoid employee misclassification as an employer?

- How to Calculate Employee Misclassification?

- How to Correct Employee Misclassification?

- Ensure accurate worker classification with PamGro

- FAQs

Every business aims to cut costs, but increasingly, companies are misclassifying workers as independent contractors to evade legal obligations, including paying eligible benefits, minimum wages, and employee security and medicare taxes.

In 2020, a study by the National Employment Law Project revealed that 10–30% of employers were misclassifying their workers.

This misclassification has cost millions of workers substantial amounts in lost wages and benefits, and the US government has missed out on billions in tax revenue.

The impact of this practice goes beyond financial losses, creating an unfair labor market where honest workers are denied their rights, and responsible employers face an uneven playing field.

As the gig economy grows and more people take on project-based work, it’s become increasingly important for both workers and employers to understand the difference between contractors and employees.

This article will explore the key characteristics of employees and independent contractors, discuss the consequences of misclassification for businesses and workers, and offer guidance on how to avoid these errors.

By raising awareness and encouraging compliance with labor laws, we can work towards a more transparent, accountable, and fair business environment.

What is Employee & Independent Contractor Misclassification?

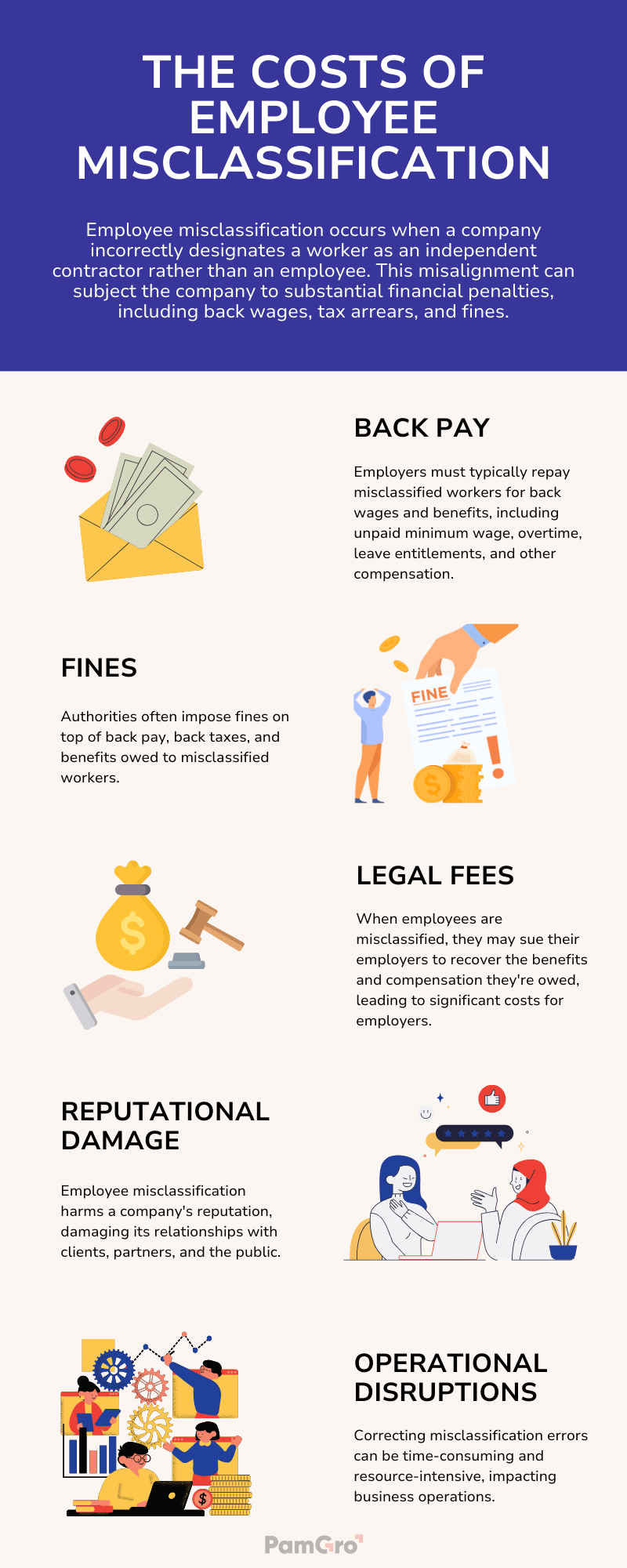

Employee misclassification occurs when a company incorrectly designates a worker as an independent contractor rather than an employee. This misalignment can subject the company to substantial financial penalties, including back wages, tax arrears, and fines.

According to the U.S. Department of Labor, misclassification costs the U.S. economy an estimated $7 to $8 billion annually.

While misclassification can be unintentional, the repercussions remain significant, affecting both the business and the worker.

How does employee misclassification happen?

Worker misclassification can arise from a genuine misunderstanding of the differences between employees and independent contractors or due to the unfamiliarity with the process of hiring remote workers.

OR

Some employers intentionally misclassify workers to take advantage of both worlds. By classifying workers as contractors, they avoid paying taxes and insurance, and the employment terms can be more flexible, often favoring the company. It’s easier to terminate contractors, and payroll is simplified since there’s no need to account for benefits or social contributions.

The blurred lines between employees and contractors:

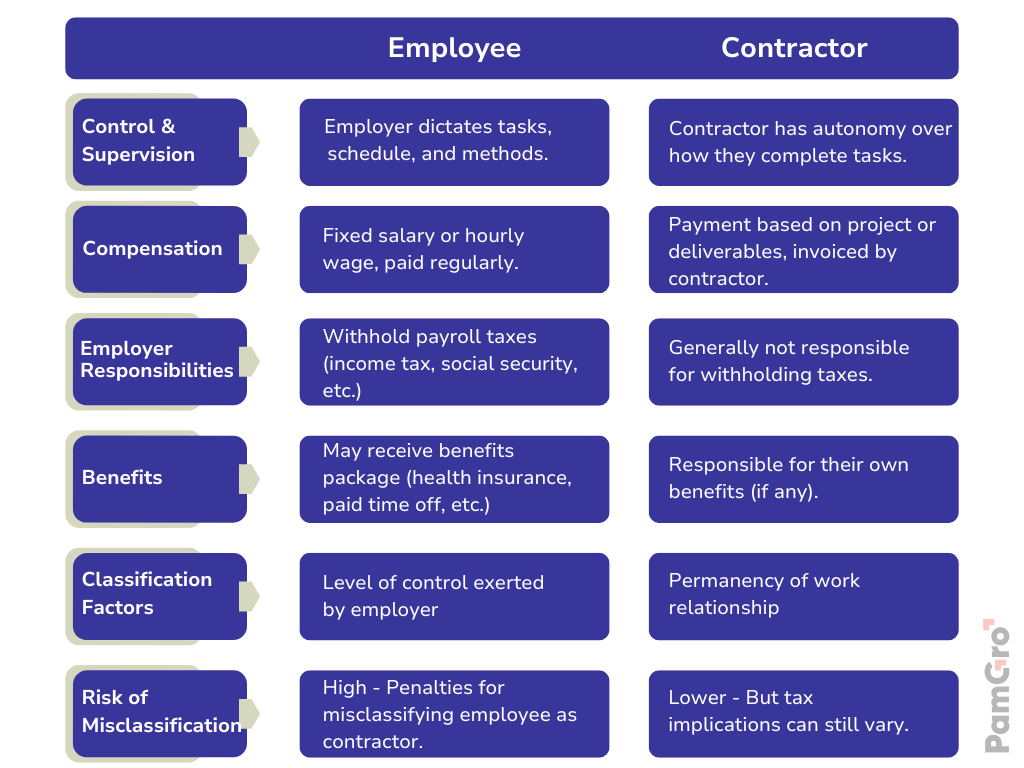

The distinction between employees and contractors can be nuanced, particularly in the context of the gig economy and project-based work. Factors such as the level of control exerted by the employer, the nature of the work relationship, and the financial arrangements can all influence the classification. It is crucial to carefully evaluate these factors to avoid misclassification.

Correctly classifying workers is essential for ensuring compliance with labor regulations and safeguarding the rights of employees.

What is employee and worker classification?

Employee and worker classification determines a worker’s status according to local government regulations. Typically, workers are classified as either employees, which places more responsibility on the company, or as self-employed contractors.

Each country has its own definitions of employees and contractors for employment law and tax purposes. When a business hires someone, they must accurately classify the worker, complete the appropriate documentation, and comply with all relevant laws.

Employees receive more benefits and protections than contractors. Depending on the country, these benefits can include:

- Minimum wage

- Overtime pay

- Vacation time

- Family and medical leave

- Social security taxes or pensions

- Unemployment benefits

- Health insurance

- Safe workplace protections

- Termination protections

Payroll and reporting obligations also differ between employees and contractors. For employees, companies are responsible for withholding and sometimes matching payroll contributions, paying payroll taxes, and contributing to insurance programs.

Key Determinants of Worker Classification

Accurately classifying workers as employees or contractors requires a careful evaluation of several key factors:

- Behavioral control: The extent to which the employer directs or controls the worker’s work, including work schedules, methods, and tools.

- Financial control: The worker’s investment in the work, including the ability to profit or incur a loss, the provision of tools and equipment, and the method of payment (salary vs. invoices).

- Relationship between the parties: The nature of the working relationship, including the duration of the engagement, the provision of benefits, and the worker’s integration into the employer’s business operations.

It’s essential to note that no single factor is definitive, and the overall relationship between the parties must be considered holistically to determine the correct classification.

What is the difference between an ‘employee’ and a ‘contractor’?

Misclassification Under the Fair Labor Standards Act (FLSA)

The FLSA is a federal law in the US that sets standards for minimum wage, overtime pay, and other work-related issues to protect workers. It ensures that employees receive fair pay and safe working conditions. To maintain a lawful and ethical workplace, it’s crucial to understand and comply with the FLSA’s requirements to avoid legal issues.

Misclassification can occur when workers are incorrectly labeled as independent contractors instead of employees, or as exempt employees instead of non-exempt. If you misclassify employees as independent contractors or don’t pay them properly, you will be fined and required to pay back wages and damages under the FLSA. The Department of Labor (DOL) has the authority to investigate and enforce compliance with these regulations.

It’s also important for employees to understand their rights and classification under the FLSA so they can ensure they receive fair compensation and protection.

The Risks of Misclassification for Businesses and Workers

Misclassification carries significant risks for both businesses and workers.

For Businesses:

- Severe financial penalties: Hefty fines, back wages, interest, and penalties can severely impact a company’s bottom line. The average cost of misclassification per worker can range from $7,000 to $15,000, according to the American Payroll Association.

- Back wages and benefits: Misclassifying employees can lead to unpaid payroll taxes, including Social Security and Medicare taxes, and unemployment. Your company may face legal consequences for not providing benefits like retirement contributions and health insurance. Failure to withhold and remit taxes could result in IRS penalties, and you might also need to compensate workers for lost wages or benefits.

- Employee misclassification lawsuits: When employees are misclassified, they may take legal action against their employers to claim the benefits and compensation they’re entitled to. This can be very costly for employers, not just in terms of legal fees but also in potential damage to their reputation, as these cases often make headlines.

- Reputational damage: Lawsuits, negative publicity, and public scrutiny can erode trust and damage a company’s brand.

- Increased regulatory scrutiny: A history of misclassification can lead to heightened scrutiny from labor authorities, including audits and investigations.

- Operational disruptions: Correcting misclassification errors can be time-consuming and resource-intensive, impacting business operations.

For Workers:

- Loss of essential benefits: Denial of minimum wage, overtime pay, sick leave, unemployment insurance, and healthcare benefits.

- Tax burdens: Unexpected tax liabilities without the corresponding deductions and credits available to employees.

- Limited legal protections: Vulnerability to workplace discrimination, wrongful termination, and other labor law violations.

How do I avoid employee misclassification as an employer?

To mitigate the risks of misclassification, businesses should adopt a proactive approach that includes:

- Staying informed with legal laws:Familiarize yourself with both federal and local labor laws, including the definitions of employees and independent contractors under the Fair Labor Standards Act (FLSA) and equivalent laws in other countries. A clear understanding of these legal distinctions will help you make informed decisions when classifying workers and reduce the risk of misclassification.For example, rules regarding 1099 misclassification in the United States are different from rules governing IR35 in the United Kingdom.

- Review the US Department of Labor’s “Myths about Misclassification”The Department of Labor offers a resource called “Myths about Misclassification,” which debunks common misconceptions about classifying employees and contractors. Reviewing this information will deepen your understanding of these working relationships and help you avoid common classification mistakes.

- Conducting Regular Audits of Working RelationshipsAssess the true nature of the working relationships in your organization by considering factors such as the duration of work, tax responsibilities, compensation, limitations, and subcontracting arrangements. Use this analysis to determine whether workers should be classified as employees or independent contractors.

- Developing Clear Contracts:Provide every worker with a written Statement of Work that clearly states whether they are classified as an employee or an independent contractor. By documenting the terms of the working relationship, both parties will have a better understanding of their roles, rights, and responsibilities, helping to ensure accurate classification.

- Regularly Review and Update Worker ClassificationsPeriodically review and update worker classifications to reflect changes in working relationships or shifts in labor laws. Staying informed about legal developments allows you to make necessary adjustments, including reclassifying workers, to keep your classification practices accurate and compliant.

- Consider Filing Form SS-8If you’re unsure about how to classify a worker, you can file IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. The IRS will assess the working relationship and determine the worker’s status, providing additional clarity and helping ensure proper classification.

Another effective strategy to prevent employee misclassification is to work with an Employer of Record (EOR). An EOR is a third-party entity that assumes legal responsibility for hiring workers on your company’s behalf, ensuring compliance with employment laws.

EORs are well-versed in the latest labor laws and regulations, helping global employers stay compliant across various jurisdictions. They ensure that employees are correctly classified according to local federal and state laws, significantly reducing the risk of misclassification.

How to Calculate Employee Misclassification?

Calculating compensation for employee misclassification can be complex and varies by country. However, regardless of location, you’ll typically need to compensate employees for any benefits and social contributions they missed out on due to being the misclassified workers.

If you discover that you’ve misclassified an employee, you can estimate the owed workers compensation by considering several factors:

- Duration of Misclassification: How long has the employee been misclassified?

- Current Compensation: What have you paid the employee during this period?

- Comparable Full-Time Earnings: What would someone in a full-time role with similar duties at your company typically earn?

- Company Benefits: What benefits would you usually offer to an employee of similar seniority?

- Employer-Paid Taxes: How much would you have paid in taxes on behalf of the employee?

- Employee Tax Responsibility: How much in taxes would the employee have been responsible for?

- Government Penalties: What are the local government’s guidelines for penalties related to misclassification?

It’s also crucial to consider whether you identified the misclassification yourself. If you did, you might avoid the most severe penalties and fines. However, if the government uncovered the issue or the employee filed a complaint, you could face the maximum penalties.

How to Correct Employee Misclassification?

If you discover worker misclassification, don’t simply terminate the relationship and hope the issue disappears. You’re still responsible for compensating the employee and the government for back taxes, benefits, and other employer contributions.

To correct the misclassification, you must address the issue by paying any owed back taxes, benefits, pension contributions, and fines. Attempting to end the relationship without resolving the matter can lead to more severe penalties, especially if the government views it as a deliberate violation.

Ensure accurate worker classification with PamGro

As the leading EOR in the industry, PamGro offers unmatched security and expertise for expanding your global workforce. We operate only in countries where we own local legal entities, ensuring local expertise and transparent pricing with no hidden fees.

If you’re worried about contractor misclassification, don’t let uncertainty hinder your growth. Partner with PamGro to manage contractors, streamline employee onboarding, and access comprehensive global HR services. Sign up today and let our experts support your business.

FAQs

1. What are the different employment contract types?

Various employment contracts include both permanent contracts and temporary contracts, employment contracts and internship contracts, as well as apprentice agreements and freelance contracts.

2. What is a full time contract and part-time contract?

A full-time employment contract defines how long an individual is allowed to work and his or her salary. Full-time contracts can last 35 hours or longer (extendable link). Under UK legislation, employees can only work 48hrs a week unless they specify otherwise in their employment contract itself.

Part time contracts are the same as full-time contracts but have the major differences in hours. A part-time employee is not able to work more than 40 hours a week. In the agreement an agreement must indicate a weekly work schedule, the time is outlined in the contract.

3. Why are Employment Contracts important?

Employment contracts safeguard the company from risks related to termination, liability, or legal risk for confidentiality breaches if the hired party fails to fulfill their documented responsibilities or meet expectations. They also help businesses adhere to federal and local regulations and clearly outline employee roles and expectations.

Payroll Solutions Unrivalled since 15 Years