Key Takeaways – Top EOR Companies in India

- EORs enable fast, compliant hiring in India without setting up a legal entity.

- Local compliance, payroll, and tax regulations are fully managed by the EOR.

- India-focused providers like PamGro offer more personalized and cost effective support.

- Global platforms are best for automation and scale.

- Choosing the right EOR depends on your hiring volume, tech needs and regional focus.

TABLE OF CONTENTS

- What is an EOR and How Does It Work?

- Benefits of Using an Employer of Record in India

- How EOR Works

- Key Services Provided by an EOR

- EOR vs Other Employment Solutions

- How to Choose an Employer of Record Service Company

- Top EOR in India: 9 Best Employer of Record Companies

- Top 9 Employer of record (eor) in India Comparison

- Things to Consider When Working with an EOR

- Employment Contracts and Compliance

- EOR for International Employees

- Payroll and Taxation

- Conclusion

- FAQs about EOR Services in India

Hiring in India without a legal entity is becoming increasingly common for global companies. The solution? Partner with an Employer of Record (EOR). These employer of record service companies allow you to onboard talent compliantly, manage payroll and tax without the administrative hassle of setting up shop. Companies expanding into India have lower operating costs compared to other markets making it an attractive destination for global hiring.

In this guide we rank the top EOR in India based on service quality, compliance strength, pricing and client experience. Whether you’re expanding or just exploring India as a talent hub, these top employer of record companies will help you execute seamlessly.

What is an EOR and How Does It Work?

An Employer of Record (EOR) is a third party organization that employs talent on your behalf. While you manage the employee’s day to day responsibilities, the EOR handles all compliance, payroll and HR obligations. Employer of record services provide a one stop solution for companies hiring in India by managing employment compliance, payroll, legal contracts and statutory benefits.

In India this includes:

- Drafting compliant employment contracts, ensuring a written employment contract that meets Indian labor law compliance requirements

- Managing payroll and local taxes (TDS, PF, ESI), including employee state insurance as part of mandatory statutory contributions

- Ensuring compliance to labor laws, leave policies and other compliance requirements

- Administering statutory and optional benefits

EORs manage the entire process of hiring, onboarding, payroll and compliance requirements for Indian employees, ensuring seamless and compliant employment management.

Using an EOR means you can have a presence in India without setting up a subsidiary or branch office. EORs help you manage compliance and payroll as per Indian regulations, reducing legal risks and administrative burdens.

Benefits of Using an Employer of Record in India

- Faster Market Entry: Hire in days not months.

- Lower Costs: Avoid legal, accounting and operational costs tied to entity setup.

- Regulatory Compliance: Stay up to date with India’s changing labor laws.

- Focus on Core Functions: Outsource administrative tasks.

- Attract Top Talent: Offer benefits and employment stability from day one, backed by robust employee management and support systems.

Employee management and local benefits through an EOR leads to higher employee satisfaction for Indian employees.

How EOR Works

An employer of record (EOR) acts as the legal employer for your workforce in India, taking on all legal and administrative responsibilities so you can focus on your core business. In practice this means the EOR becomes the official employer of your Indian employees, handling everything from hiring and onboarding to payroll and compliance with Indian labor laws.

When a company wants to hire employees in India but doesn’t want to set up a local entity, it partners with an EOR through a service agreement. The EOR then manages the entire employment lifecycle—drafting compliant employment contracts, ensuring compliance to Indian employment law and managing payroll, taxes and statutory benefits. The client company retains control over the employees’ day to day work and performance while the EOR ensures all legal and HR obligations are met.

For example a global company expanding into India can use an EOR to quickly hire local talent. The EOR becomes the legal employer, ensuring compliance to all relevant labor laws, managing payroll and providing statutory benefits, while the company directs the employees’ daily tasks. This eliminates the need to set up a local entity and navigate India’s complex labor laws, allowing for faster and compliant market entry.

Key Services Provided by an EOR

EOR services in India are designed to simplify the hiring process and ensure compliance to local labor laws. Here are the key services an EOR provides to companies looking to hire and manage employees in India: The Indian workforce produces over 2.8 crore graduates annually, many specializing in IT and creative fields, providing a vast talent pool for companies to tap into.

- Payroll Management: The EOR handles all aspects of payroll management, including accurate salary payments, tax deductions and payroll taxes. This ensures employees are paid on time and in compliance with Indian tax regulations.

- Compliance Management: EORs ensure compliance to all local labor laws, including drafting of written employment contracts, adherence to Income Tax Act, Employees Provident Fund, Employees State Insurance Act and other statutory requirements. This comprehensive compliance management helps companies avoid legal and financial risks.

- Benefits Administration: EORs manage employee benefits like health insurance, provident fund contributions, paid maternity leave and other statutory and optional benefits. This allows companies to offer competitive benefits packages to attract and retain top talent.

- Employee Onboarding: From drafting employment contracts to background checks and orientation, EORs streamline the onboarding process for new hires, ensuring a smooth start for every Indian employee.

- Termination Management: EORs handle employee terminations as per Indian labor laws, managing notice periods, severance payments and exit documentation to ensure compliance and minimize risk.

By leveraging these services, companies can hire employees in India, comply with all local regulations and provide employee experience without the administrative burden of managing these processes internally.

EOR vs Other Employment Solutions

When expanding into India, companies looking to hire talent have several employment solutions to choose from. Here’s how an employer of record (EOR) compares to other options:

- Professional Employer Organization (PEO): A PEO offers payroll, benefits and HR support but typically requires the client to set up a local entity in India. While PEOs can help with compliance, they do not act as the legal employer which can leave companies exposed to local labor law risks.

- Local Entity: Setting up a local entity (subsidiary or branch office) gives companies full control over hiring and operations. However, this approach involves significant time, cost and expertise to navigate Indian regulations, tax compliance and ongoing statutory filings.

- Independent Contractors: Hiring independent contractors may seem flexible but it can expose companies to misclassification risks under Indian employment law. Contractors are not entitled to statutory benefits and companies may face penalties if local authorities determine the relationship should be classified as employment.

Why Choose an EOR?

- Cost Savings: EORs eliminate the need for costly entity setup and ongoing administrative overhead, offering a streamlined cost cost-effective solution for companies looking to hire in India. EOR pricing can save companies 60-75% of entity establishment costs.

- Compliance Management: EORs provide guidance and ensure compliance to all local labor laws, reducing legal and financial risks.

- Flexibility: EORs allow companies to scale up or down quickly, adapt to changing business needs without long term commitments.

- Local Expertise: EORs bring in-depth knowledge of Indian labor laws, tax regulations and HR best practices, helping companies navigate the Indian market with confidence.

For global companies expanding into India, partnering with an EOR offers a unique combination of local expertise, compliance assurance and operational efficiency, making it the preferred choice for managing employees in multiple countries without the burden of setting up local entities

How to Choose an Employer of Record Service Company

Before choosing a provider, consider how to identify the best employer of record for your needs by evaluating them on:

- Compliance Expertise: Do they know Indian labor law in and out?

- Onboarding Speed: How fast can they onboard employees?

- Pricing Transparency: Are fees flat, usage-based or bundled with markups?

- Platform and Tech: Is there a dashboard or self-serve portal?

- Support Model: Do they offer localized HR support or only ticket-based systems?

Top EOR in India: 9 Best Employer of Record Companies

India’s talent market has made it one of the top destinations for companies looking to expand cost-effectively and compliantly. EORs have become the preferred mode for hiring employees in India without setting up a local legal entity. EORs take on the burden of compliance, benefits administration, payroll processing and HR management so foreign companies can stay agile and focused. Plus, India has a large English speaking population which makes it even more attractive for global businesses.

Each of the following nine providers offers a unique combination of global infrastructure and India specific expertise. From automation-heavy platforms to India first firms focused on high-touch support, this curated list reflects a range of capabilities suitable for startups, SMEs and large multinationals.

We have evaluated these employer of record service companies across three dimensions:

- Compliance and Local Expertise: Proficiency in Indian labor law, taxes and HR protocols, including expertise in the Industrial Disputes Act for resolving employment conflicts and disputes.

- Platform and Technology: Quality of tools, integrations and ease of use

- Pricing and Transparency: Fair, predictable cost structures without hidden fees. Here’s a detailed breakdown of the top EOR in India, to help you choose the best fit for your business: India’s time zone provides a strategic advantage for companies, so they can ensure continuous productivity for global customer service. This makes EOR services even more valuable for businesses operating across multiple time zones.

Here’s a curated list of the top EOR companies in India, each bringing a distinct blend of global reach and local expertise to support businesses of all sizes.

1. Multiplier

Overview

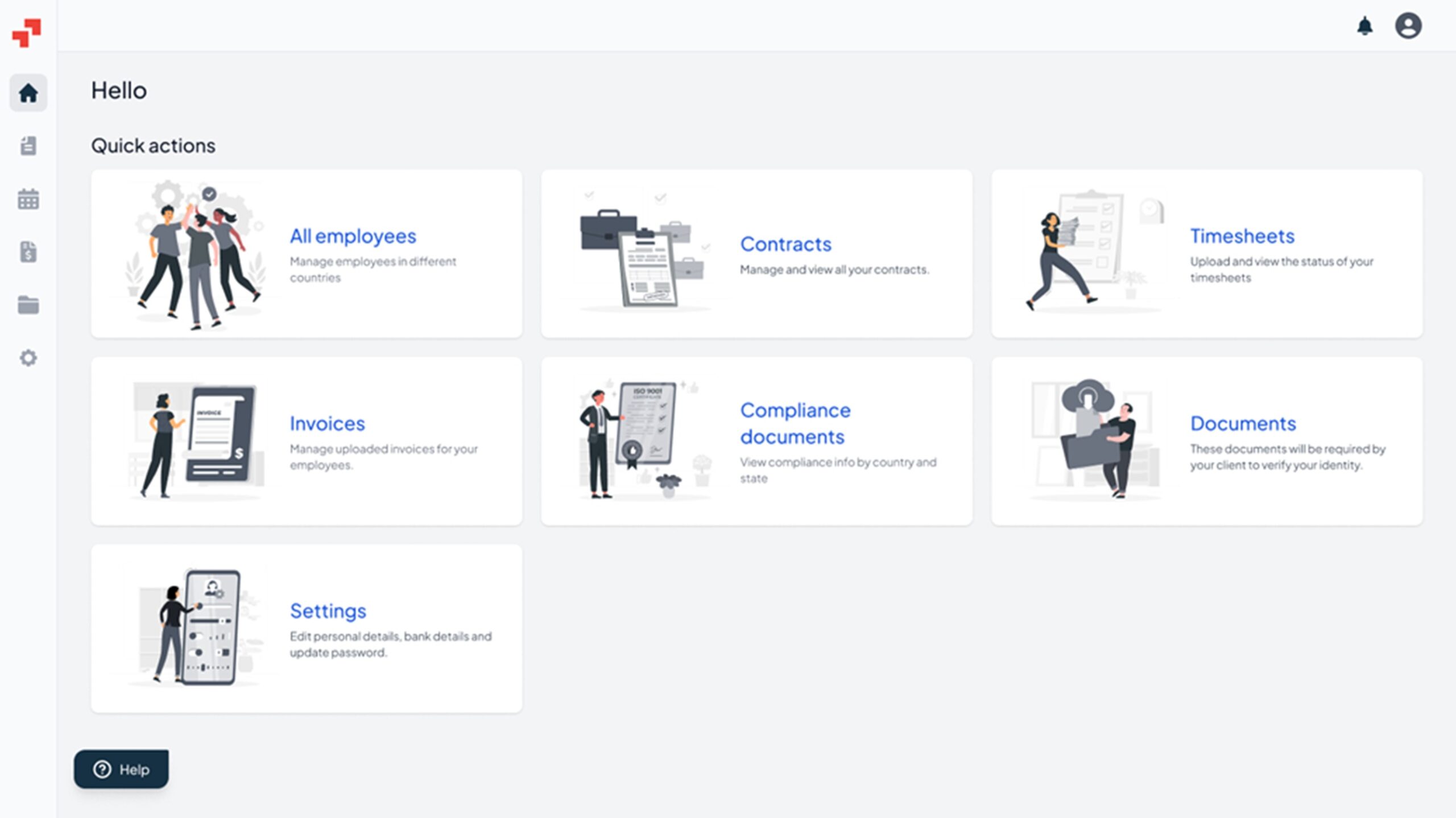

Multiplier serves over 150 countries and has a strong presence in India. Its platform is designed for speed and automation, perfect for tech-driven companies looking to scale fast in compliant markets.

Features:

- Real-time compliance monitoring, including minimum wage adherence

- Centralized employee lifecycle management

- Multi-country benefits administration, with health benefits support

- Contract creation in minutes with legal templates

- Support for female employees, including maternity leave and workplace protections

2. PamGro

- Ideal For: Companies that prioritize local compliance, affordability and personalized HR service.

- Pricing: £150 per employee/month, one-month deposit, no onboarding or exit charges

Overview

PamGro focuses only on the Indian market, so they have in-depth knowledge of local labor laws, statutory requirements and HR best practices. They offer customized solutions with personal support and transparent pricing.

Features:

- Full local HR lifecycle support from onboarding to exit, including minimum wage compliance

- TDS, PF, ESI compliance with proactive audit readiness

- Employee benefits including insurance, health benefits and paid leave

- No hidden fees or markups

- Dedicated support for female employees, covering maternity leave and legal protections

Estimate how much an employee really costs. Use our free Employee Cost Calculator India to determine the total employment cost in India.

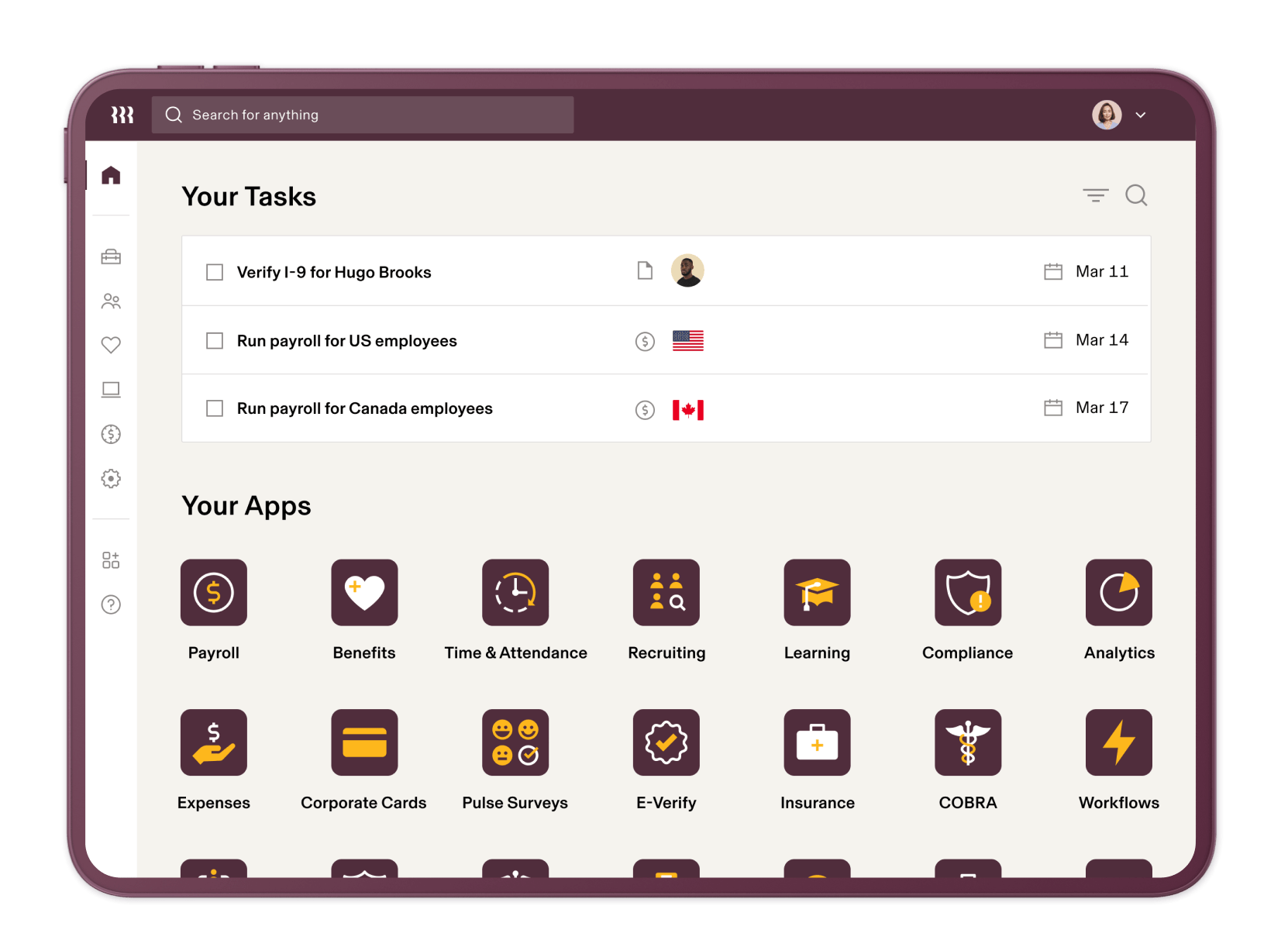

3. Rippling

- Ideal For: Enterprises that want EOR as part of an all-in-one employee operations suite.

- Pricing: Starts at $599 per employee/month.

Overview

Rippling is a unified workforce management platform that integrates HR, IT and finance functions. Its EOR in India is best suited for tech-native companies that need deep automation and cross-functional control.

Features:

- Seamless integration with 500+ apps and payroll tools

- Device and identity management for remote teams

- Full compliance tracking for Indian labor regulations, including minimum wage and Industrial Disputes Act expertise

- Health benefits administration for employees

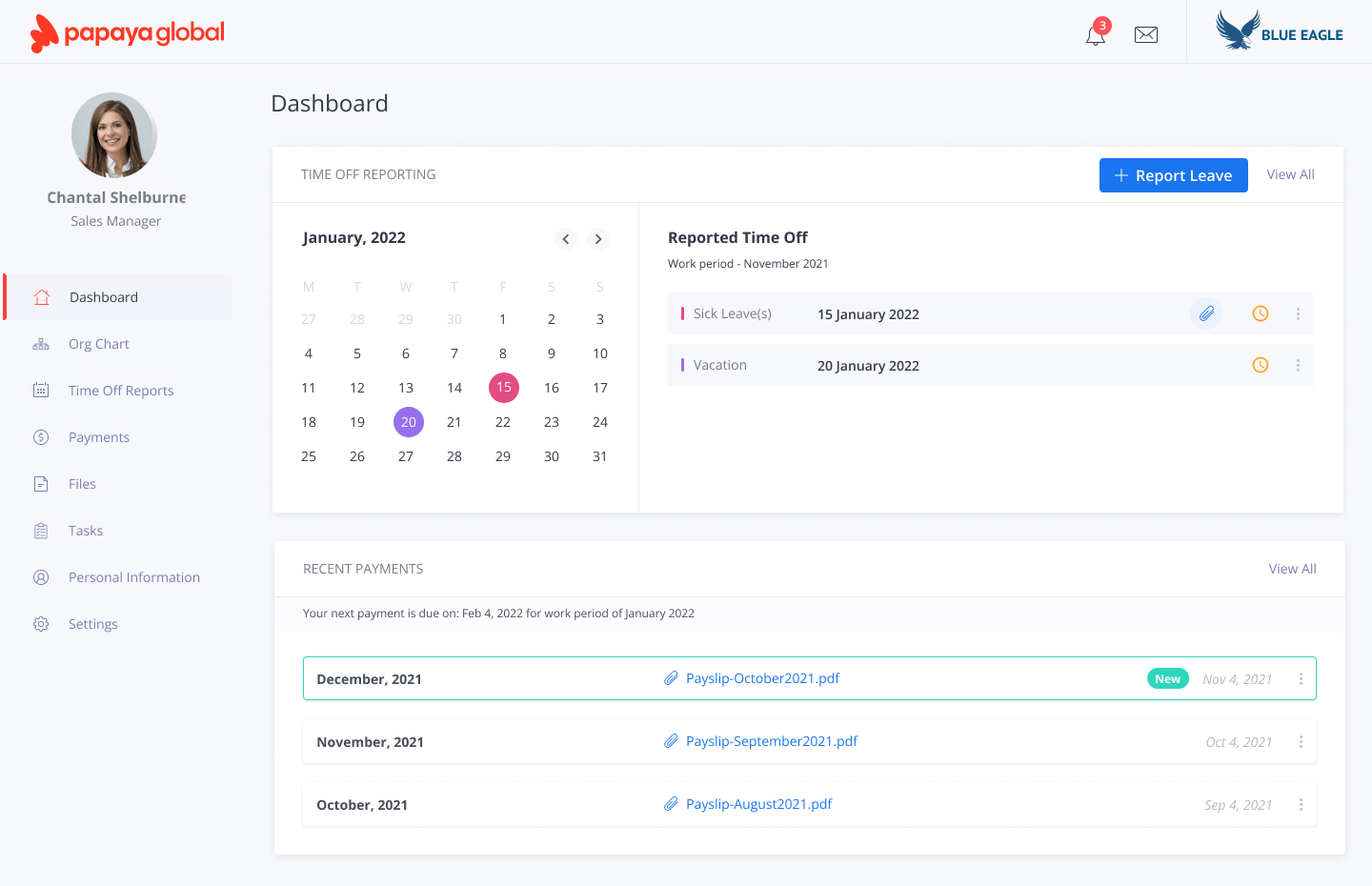

4. Papaya Global

Overview

Papaya Global offers EOR, global payroll and workforce analytics through one platform. Its India coverage includes tax filings, salary disbursement and regulatory compliance support.

Features:

- Headcount and cost reporting

- Transparent employment models for contractors and FTEs

- Integration with existing HR systems and ERPs

- Minimum wage and health benefits compliance

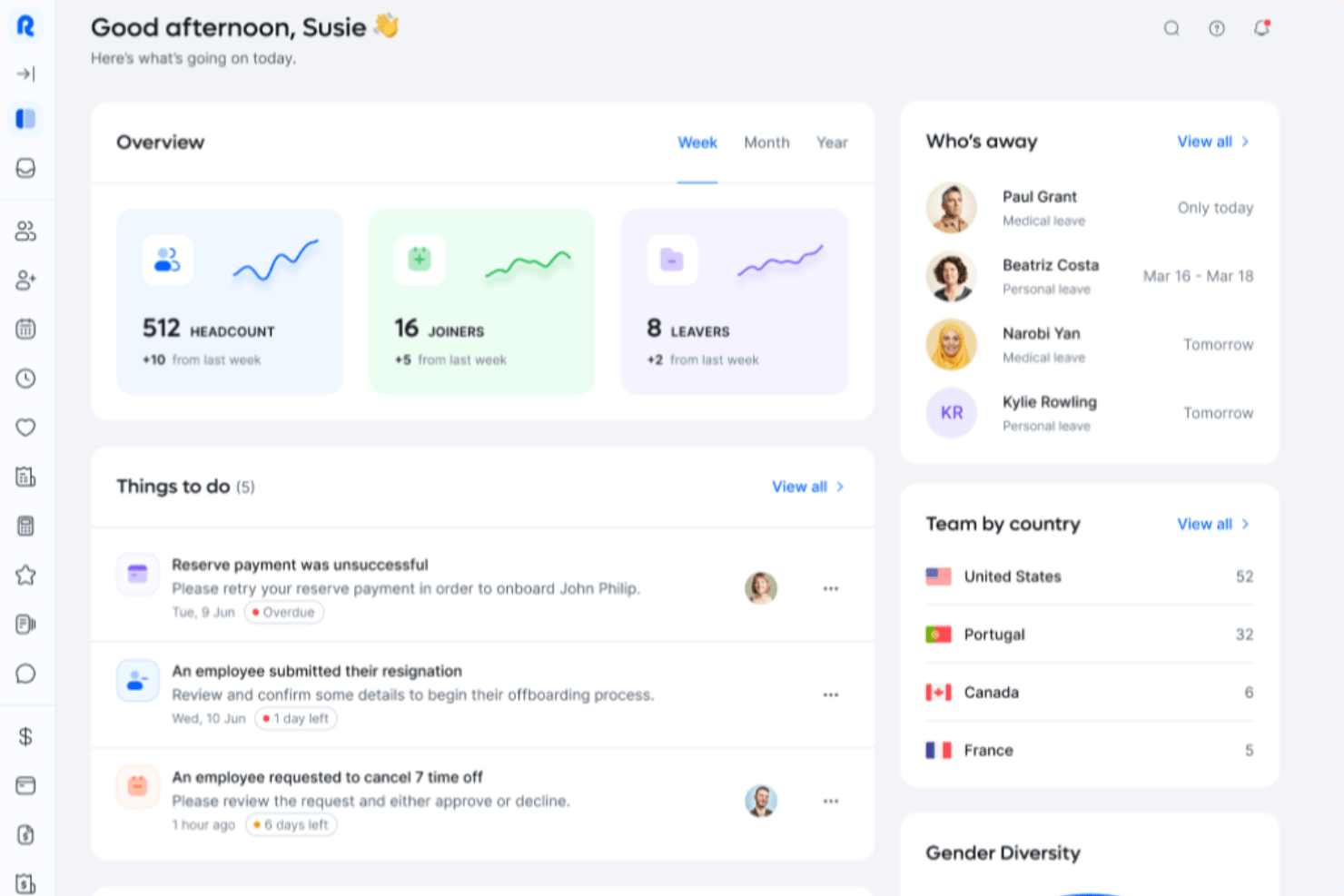

5. Remote

Overview

Remote focuses on legal security, data protection and ethical employment practices. It ensures IP ownership, local contracts and employer liability insurance for Indian hires.

Key Features:

- In-house legal team for every region, Industrial Disputes Act expertise

- Customizable benefits for the Indian market, health benefits

- Advanced security standards, GDPR-level protection

- Support for female employees, maternity leave and workplace rights

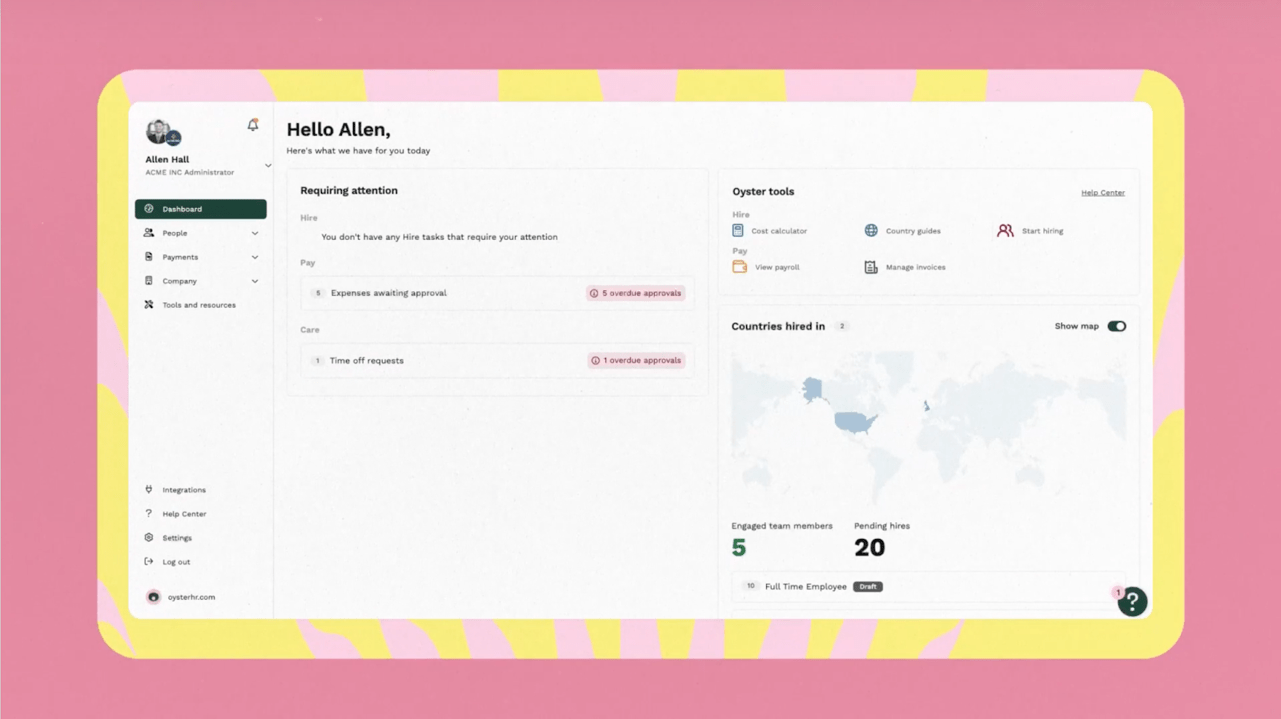

6. OysterHR

Overview

Oyster is for remote-first companies looking to hire globally with purpose. Its India coverage includes compliance workflows and access to a knowledge base for international HR.

Key Features:

- Employee experience tools for engagement and retention

- Localized knowledge library and HR templates, minimum wage and Industrial Disputes Act compliance

- Nonprofit and impact hiring incentives

- Health benefits and support for female employees

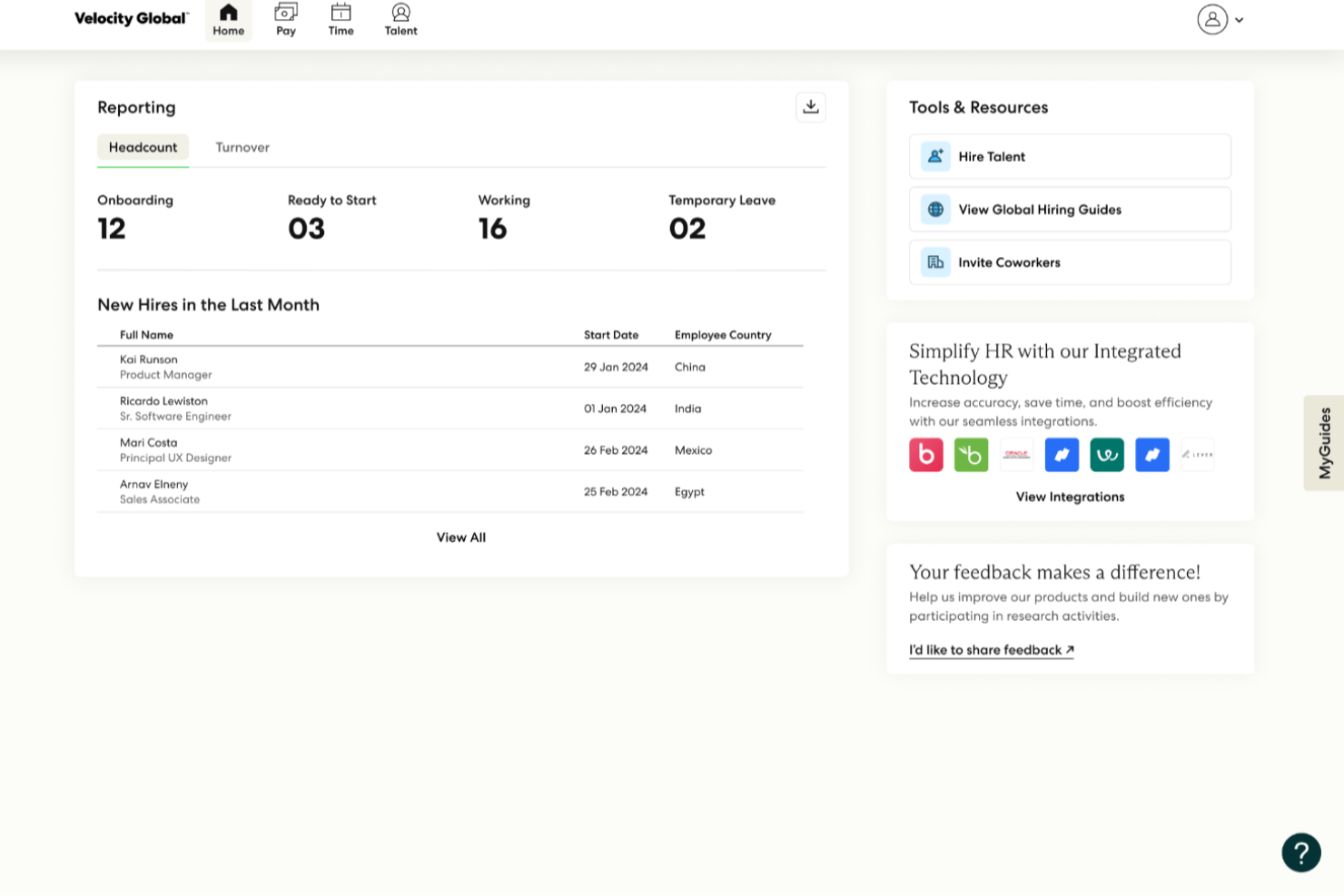

7. Velocity Global

- Ideal For: Enterprises scaling headcount in India and need structured governance.

- Pricing: Custom pricing based on services and volume.

Overview

Velocity Global supports large-scale hiring with strategic advisory and hands-on compliance services. Its India operations are led by legal experts and localized HR teams.

Key Features:

- Customized onboarding for large teams

- Visa and mobility support for expat hires

- Direct legal guidance and contract customization, Industrial Disputes Act expertise

- Health benefits and minimum wage compliance

- Support for female employees, maternity leave

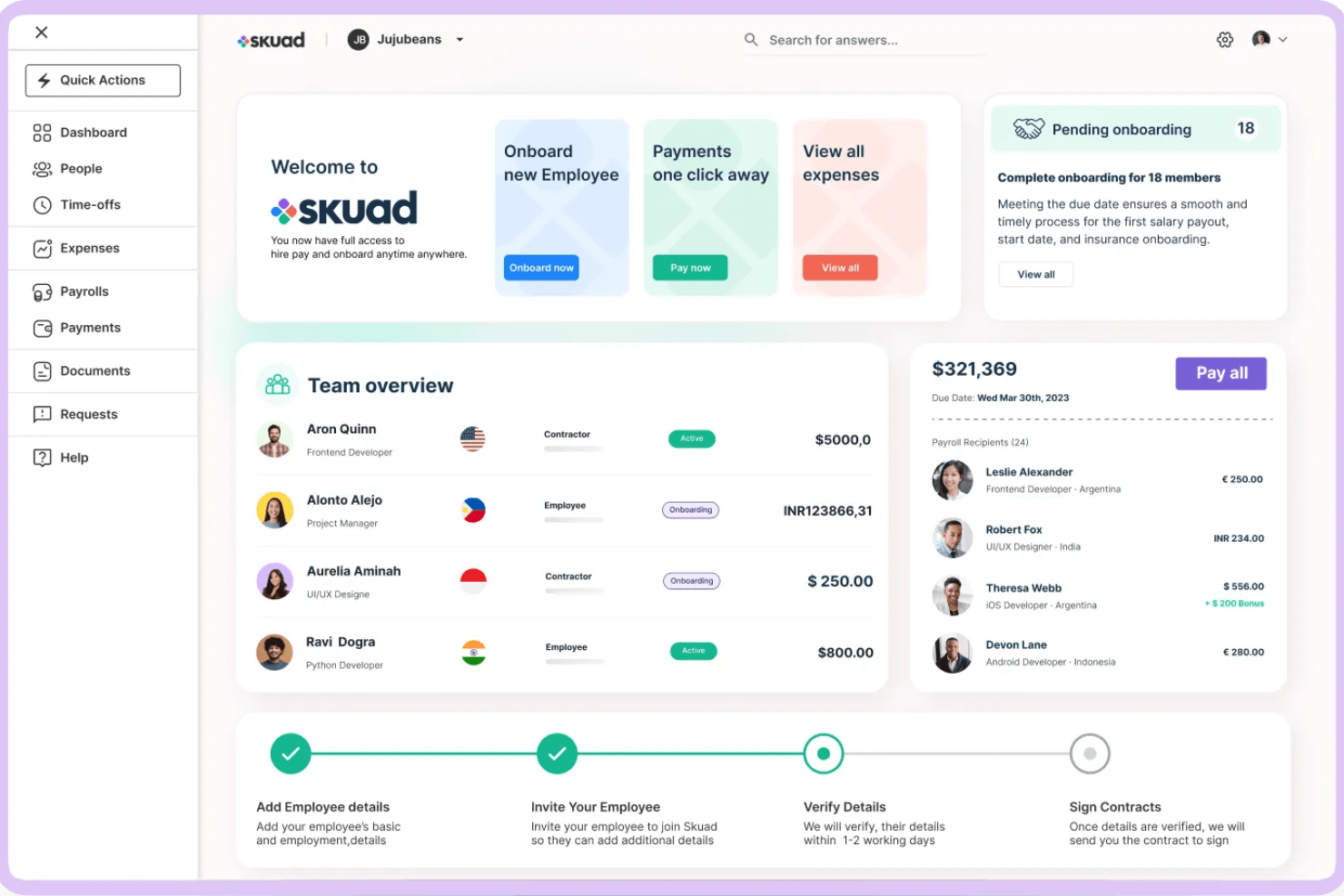

8. Skuad

- Ideal For: Startups and SMEs looking for low-overhead EOR solutions.

- Pricing: Cheaper than global competitors, by position and headcount.

Overview

Skuad is a global HR platform that enables companies to hire, manage, and pay international talent seamlessly through its Employer of Record (EOR) services operating across 160+ countries. Its India services are focused on lean compliance and flexible hiring.

Features:

- Quick onboarding workflows

- Basic payroll and compliance tracking, minimum wage adherence

- Talent engagement features like feedback modules

- Health benefits and support for female employees

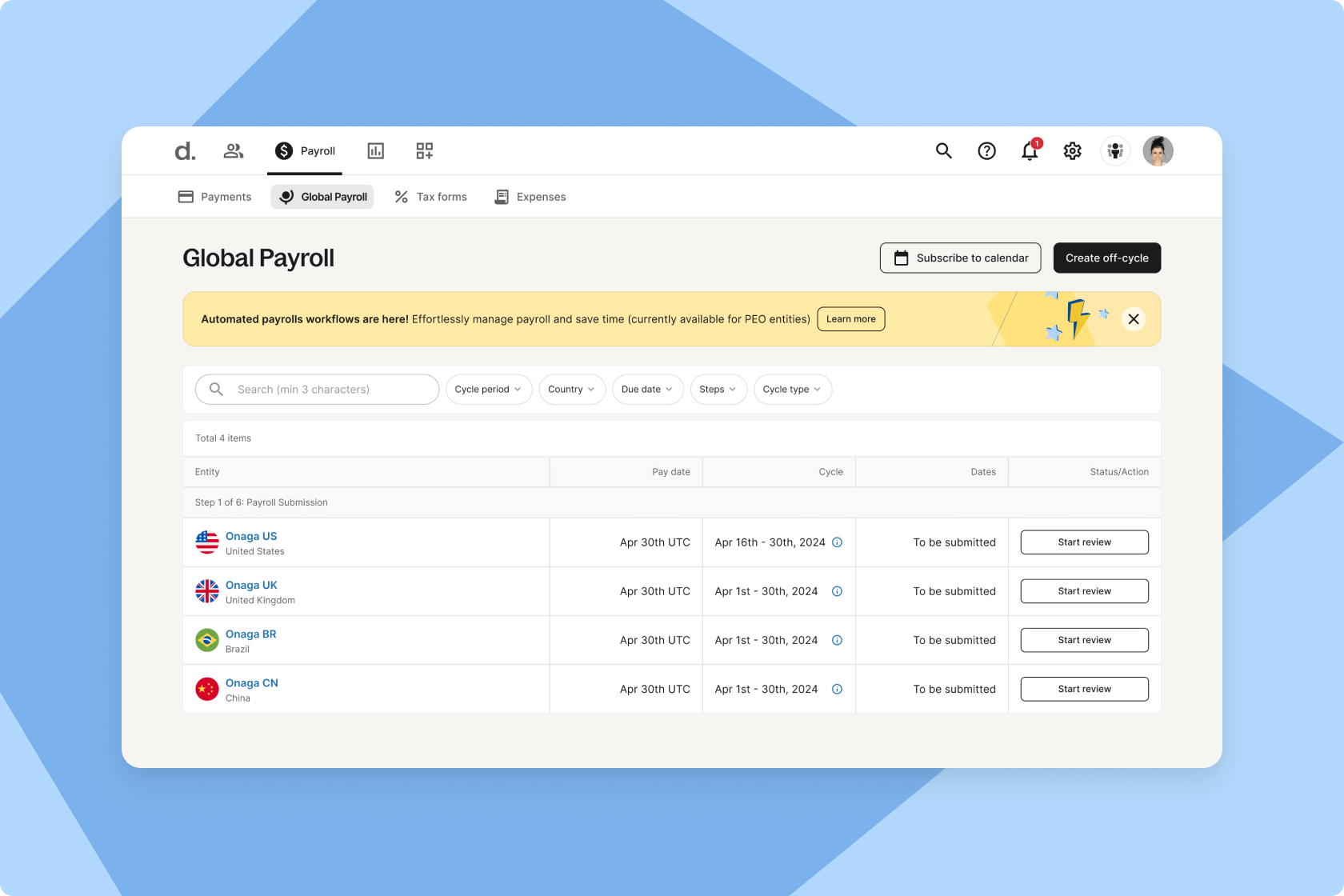

9. Deel

Overview:

Deel is one of the most popular EOR platforms with infrastructure in India. Its modular design, legal engine and rapid support makes it ideal for scale and simplicity.

Key Features:

- One-click contract generation and e-signing

- 24/7 support for clients and employees

- Access to global talent and visa sponsorship

- Minimum wage and health benefits compliance

- Dedicated support for female employees, maternity leave

Top 9 Employer of Record (EOR) in India Comparison:

| Provider | India Focus | Starting Price | Features | Best For |

| Multiplier | Yes | Custom | Multi-country compliance, automation, benefits | Tech-driven global companies |

| PamGro | Exclusive | £150/employee/month | India-first support, no setup fees, local compliance | Cost-conscious companies focused on India |

| Rippling | Yes | $599/employee/month | Unified HR + IT platform, 500+ integrations | Enterprises wanting integrated operations |

| Papaya Global | Yes | $650/employee/month | Workforce analytics, payroll + contractor options | Finance teams with global needs |

| Remote | Yes | $599/employee/month | IP protection, localized benefits, legal advisory | Mid-size companies focused on data security |

| Oyster HR | Yes | $499/employee/month | HR learning hub, social impact support | Remote-first, mission-driven companies |

| Velocity Global | Yes | Custom | Strategic onboarding, visa help, legal support | Large teams and enterprises in India |

| Skaud | Yes | Variable (lower tier) | Fast go-live, simple UI, payroll basics | Startups entering India |

| Deel | Yes | $599/employee/month | E-sign contracts, 24/7 support, visa pathways | Companies needing fast global setup |

Things to Consider When Working with an EOR

- Data Security: Ensure the provider complies with local data privacy laws.

- Customization Limits: EORs may not allow fully tailored employment agreements.

- Cultural Fit: Some global EORs lack localized support that understands Indian work culture.

- Dependency Risk: Heavy reliance on third-party service continuity.

Employment Contracts and Compliance

Employment contracts in India need to comply with various laws and regulations including Industrial Disputes Act, Shops and Establishments Act (applicable state-wise) and Employees’ State Insurance Act. EORs help international employers navigate this complexity.

- EORs provide employment contracts for each role with terms like compensation, notice period, statutory benefits and confidentiality.

- They ensure every employment agreement meets Indian labour laws reducing the risk of legal disputes or audits.

- EORs manage the entire employment lifecycle including onboarding, performance management support and compliant terminations, ensuring exit processes follow required protocols and documentation standards.

- During termination or layoffs EORs ensure due process under applicable labour acts including notice periods, severance payments and grievance resolution reducing liability for the employer.

EORs play a critical role in drafting and managing employment contracts to meet legal standards in India. They ensure all contracts are compliant with Indian labour laws and protect employer and employee interests.

- Written contracts include job role, compensation, notice periods and statutory entitlements.

- EORs stay updated with Industrial Disputes Act and Employees’ State Insurance Act.

- Termination procedures are handled professionally minimizing legal risk for the client company.

EOR for International Employees

EORs are used by companies to employ remote or cross-border workers, offering services beyond domestic hiring. Their value lies in ensuring compliance, maintaining payroll continuity and providing region specific benefits across multiple jurisdictions.

- In India EORs manage international payroll as per Indian taxation rules, deducting and remitting TDS, professional tax and other statutory obligations.

- They design competitive benefit plans including medical insurance, accidental coverage, paid maternity and paternity leave and voluntary allowances.

- EORs help international companies extend equal benefits to their Indian workforce and ensure alignment with local benchmarks.

- For clients with teams across regions EORs act as a single partner to coordinate multi-country compliance, payroll and HR support eliminating the need to engage separate providers in each country.

EORs manage international employees with focus on compliance, payroll and benefits.

- Payroll is processed as per Indian laws including mandatory deductions under Income Tax Act.

- Employees get localized benefit packages like health insurance and maternity leave.* EORs manage cross-border teams by handling multiple country tax frameworks and labour laws.

Payroll and Taxation

Payroll and taxation in India is a complex web of laws, deadlines and regional variations. EORs simplify this by taking complete ownership of payroll processing and statutory reporting ensuring accuracy and regulatory compliance.

- Payroll is processed monthly as per Indian standards covering gross-to-net calculations, professional tax, gratuity and statutory deductions.

- EORs manage deductions under Income Tax Act, Employees’ Provident Fund (EPF) and Employees’ State Insurance (ESI) and ensure timely deposits to government portals.

- Employees get digital payslips, Form 16 (for income tax filing) and assistance with year-end tax declarations.

- For employers EORs provide consolidated reports, real-time payroll dashboards and ongoing updates on changes in tax slabs or compliance requirements.

- Some EORs also offer tax planning support for employees by configuring allowances and reimbursements as per Indian tax-saving norms.

Managing payroll and taxation in India is complex and EORs simplify this with automated and compliant processes.

- They ensure timely and accurate salary disbursal in local currency.

- Tax deductions for income tax, professional tax and service tax are handled directly.

- EORs also provide tax documents like Form 16 and assist with employee tax optimization strategies.

Conclusion

Choosing the right EOR depends on your hiring goals, compliance requirements and budget. These top EOR companies offer different strengths in cost-efficiency, India specific expertise and global scalability. Whether you are a startup entering India or an enterprise growing your presence in the region, aligning with a reliable EOR partner can save time, reduce risk and ensure long term operational success.

Each of these top EOR in India providers meets core criteria of trust, expertise and service delivery. As the demand for employer of record companies grows these platforms will play a key role in helping companies scale across borders efficiently and compliantly.

Each of these top EOR in India providers meets core benchmarks in trust, expertise, and service delivery. PamGro nails it on all three:

- India-first EOR with fast, compliant onboarding

- Transparent pricing, zero fluff, and no hidden fees

No pitches. No BS. Just solid execution. If you’re hiring in India, PamGro gets it done quietly and correctly. PamGro stands out with its India-first focus and no-frills approach to EOR:

- 100% compliance with Indian labor laws and tax frameworks

- Fast onboarding without hidden fees or markups

- Dedicated local HR support from onboarding to exit

Need an EOR that understands India better than global bots? Try PamGro.

Ready to expand with ease? Book a call with PamGro today to see how EOR services can help you with your global hiring!

FAQs about Top EOR Services in India

1. What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a third-party organization that takes on the legal responsibilities of employing workers in a country where the client company does not have an entity. This includes managing payroll, compliance, contracts, benefits and tax filings.

2. How do EOR services work in India?

In India EORs hire employees on behalf of foreign companies ensuring full compliance with Indian labour laws. They manage statutory contributions like PF, ESI, professional tax and income tax deductions while the client manages day-to-day work responsibilities.

3. What are the benefits of using an EOR in India?

Faster market entry, reduced administrative burden, full compliance with Indian regulations, cost savings compared to setting up a subsidiary and access to skilled talent pool.

4. How do EORs manage employment contracts and compliance?

EORs draft local compliant contracts, manage tax filings and payroll, administer statutory benefits and ensure all employment practices are in line with Indian labour laws. A written employment contract is mandatory in India for legal clarity, compliance and to avoid disputes between employer and employee. They also help clients navigate changes in regulations.

5. What services do EORs provide for international employees?

For international employees EORs offer legal employment, visa support in some cases, local benefits package, payroll processing, tax compliance and employee support services.

Soham wasn’t always an international employment guru. He began with a passion for numbers, surprising shopkeepers with his mental math skills.

At PamGro, Soham spearheads international expansion and EOR (Employer of Record) services, driving global business strategies and ensuring compliance across multiple regions.