KEY TAKEAWAYS

EORs simplify global hiring, but legal and compliance risks still fall on your business.

Costs can escalate due to hidden fees, per-employee pricing, and currency fluctuations.

Loss of control over HR processes and employee relationships can impact operations.

Inconsistent employee experience may harm engagement and cultural alignment.

Data security and vendor dependence pose long-term operational and strategic risks.

Best for short-term needs — reassess regularly for long-term fit and scalability.

Expanding into new markets through an Employer of Record (EOR) can seem like the perfect shortcut to global growth—quick, compliant, and hassle-free. But beneath the surface, the EOR model isn’t without its challenges. While it offers a streamlined way to hire talent across borders, the reality is more nuanced.

Different countries have different rules, and what works well in the U.S. or Indonesia might cause regulatory friction in places like Germany, China, or Spain. If you’re not fully aware of the legal, tax, and cultural implications, a seemingly simple EOR setup could lead to compliance issues, reputational damage, or financial setbacks. In this guide, we’ll explore the key risks of using an EOR—and how to navigate them before they become costly mistakes.

5 Employer of Record Risks Every Global Business Should Know

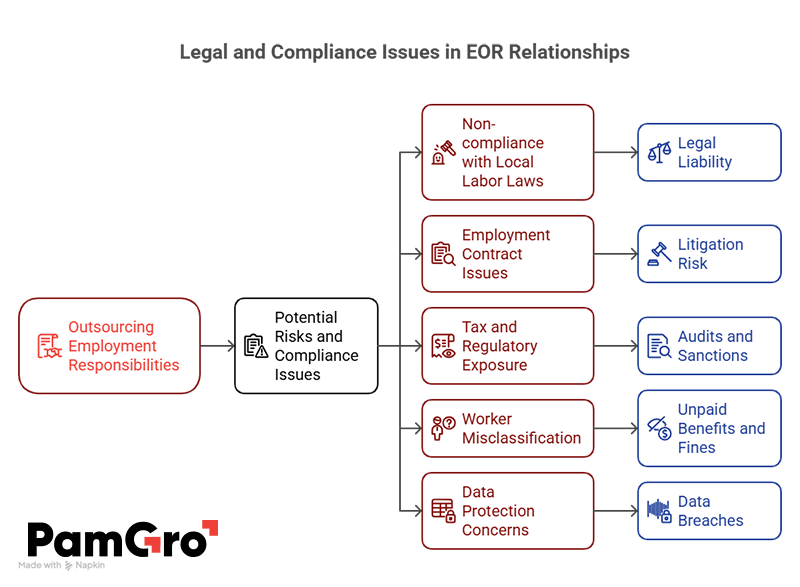

1. Legal and Compliance Issues

Working with an Employer of Record means handing over key employment responsibilities to a third party. While this simplifies global hiring for the client company, it also introduces potential risks and serious compliance risks. Plus, using an EOR allows companies to focus on core business activities by outsourcing HR and administrative functions.

Non-compliance with local labor laws

Every country has its own labor and employment laws. If an EOR provider fails to follow local regulations such as tax laws, working hour limits, minimum wage or termination policies, the legal liability often still falls on your company. Fines can include back pay, or restrictions on future business activities in that region.

Employment contract issues

Employment agreements must reflect local legal requirements. Mistakes like missing statutory benefits, improper termination clauses or vague job descriptions can expose your business to litigation. Contracts managed by EOR providers should be reviewed to ensure they’re bulletproof and up to date with current employment laws.

Tax and regulatory exposure

Even though the EOR is the legal employer, authorities may still look to the company directing day-to-day operations for compliance. Missteps in payroll taxes, social security, social contributions or benefits administration can trigger audits and sanctions under local tax regulations.

Worker misclassification

Misclassifying employees as contractors or vice versa, without considering their employment status, is a common risk. An EOR partner must clearly define worker status, including distinguishing between employees and independent contractors, to avoid falling foul of employment law. Misclassification can result in unpaid benefits, fines or forced reclassification with retroactive effect.

Data protection concerns

Your EOR will handle sensitive employee data. Weaknesses in data protection practices can lead to breaches, especially in regions with strict rules like the EU’s GDPR. Ensuring the EOR provider has robust data protection measures, strong data security protocols and clear data retention policies is key to protecting both employees and your business.

2. Financial Risks

Using an Employer of Record can simplify your global expansion but it also comes with hidden costs that businesses often overlook. These risks if unmanaged can reduce the value of EOR services and impact long-term profitability.

Hidden fees and lack of transparency

Not all EOR providers are upfront about their pricing and there can be hidden costs involved. Some may offer a low headline rate but include hidden charges for onboarding, offboarding, currency conversions or benefit administration. These unplanned administrative costs and expenses can quickly add up and strain your budget. Employer of Record models can also present financial risks related to currency fluctuations which may impact overall costs if not managed properly.

Exchange rate volatility

When paying international employees in a foreign country through an EOR, currency fluctuations can impact your overall costs. If the provider doesn’t offer transparent FX handling or locks you into unfavorable rates you may end up paying more than anticipated over time.

Cost inefficiency for long-term or large-scale hiring

EOR services offer significant benefits and are priced on a per-employee basis. While that’s manageable for small teams or short-term engagements, it becomes expensive as headcount grows. For businesses planning long-term operations in a region, setting up a local legal entity might eventually be more cost-effective.

Overlapping liabilities

Even with an EOR in place your company may still be liable for certain financial obligations such as employee benefits, severance pay or tax back payments due to errors. Incorporating contractual safeguards in your agreements with the EOR can help mitigate these strategic risks. Shared responsibility between your business and the EOR means financial risks don’t disappear – they’re just redistributed.

Benefit mismanagement

Inaccurate handling of employee benefits – such as health insurance, pensions, insurance or statutory leave – can lead to compliance issues and financial penalties. If the EOR partner miscalculates or fails to meet mandatory employee benefits the financial burden often shifts back to your business.

Tax exposure

Errors in payroll processing, local tax deductions or failure to submit on time can lead to fines, interest charges and legal risks. Even though the EOR is the legal employer, tax authorities may still involve your company in enforcement actions especially if the business activities are seen as local.

3. Operational Risks

Using an Employer of Record (EOR) can simplify cross-border hiring but it also creates operational challenges that can impact overall business operations. These risks arise from handing over essential HR and administrative functions to a third party. However, using an EOR can improve operational efficiency through better hiring and employee management processes and avoid pitfalls such as poor employee management.

Loss of control over daily operations

When the EOR becomes the legal employer your company gives up direct control over certain employment related decisions which can impact your internal resources. While you manage tasks and responsibilities the EOR handles formal employment matters like issuing contracts, processing payroll and managing leave. This split can slow down decision making and create confusion especially in fast paced environments. On the other hand an EOR can help businesses attract and retain top talent in foreign markets by providing competitive employee benefits and compensation details.

Inconsistent employee experience

New employees onboarded through an EOR may have a different experience compared to those hired directly. This can lead to uneven benefit structures, discrepancies in communication and misalignment with company culture. Over time it may affect morale, engagement and retention especially for international employees who already face integration challenges.

Dependence on the EOR provider’s systems

EOR providers often rely on their own HR platforms for payroll, time tracking and compliance reporting. If an EOR’s services are outdated, difficult to use or incompatible with your internal tools it can disrupt workflows and cause inefficiencies. You also risk data gaps especially if information isn’t shared in real time.

Data security and privacy concerns

Outsourcing employment operations means sharing sensitive employee data and intellectual property with a third party. If the EOR provider lacks strong data protection measures or operates in countries with weak privacy laws your company could face data breaches or violations. These can lead to reputational damage and penalties under data protection regulations like GDPR.

Delayed issue resolution

HR teams struggle to resolve operational issues such as incorrect payslips, benefit disputes or local compliance queries – these take longer to resolve when handled through a third party. You also have limited visibility into the resolution process. If the EOR doesn’t have 24/5 support or local presence problems can escalate and impact employee satisfaction.

Misalignment with internal policies

EOR providers manage employment according to local law but may not fully understand your company’s internal policies or expectations which can hinder the development of a strong company culture. Without proper onboarding and communication this misalignment can result in inconsistent policy enforcement, confusion around roles and missed obligations.

4. Strategic Considerations

Choosing an Employer of Record isn’t just a compliance decision; it’s a strategic one that impacts long term business growth, workforce planning and ability to expand globally. If not carefully assessed the wrong EOR setup can limit flexibility, create dependency and misalign with core business objectives.

Scalability and long term fit

Experienced EOR services are ideal for entering new markets quickly or testing business activities without setting up legal entities. But if your headcount in a region grows or operations become more complex the per-employee cost of EOR services may become unsustainable. At this point setting up a local legal entity might be more efficient and give you more control.

Integration with business goals

A professional employer organization (PEO) acts as a co-employer, sharing employer responsibilities with your business while an EOR acts as a legal employer but isn’t embedded in your company’s vision or growth plans. This can lead to mismatches between how employees are managed and your company’s internal goals. For example if your business prioritizes employee development or long term retention relying on a third party for employment functions might not support those efforts effectively.

Cultural disconnect

EOR employees onboarded through an EOR may feel separate from the rest of your workforce. The EOR focuses on compliance not culture. Without intentional integration this can create a fragmented employee experience, limit engagement and reduce alignment with your company’s values and expectations.

EOR dependency and vendor lock-in

Some companies become too dependent on a single EOR provider especially in multiple countries. This creates risk if the provider’s service quality declines, their pricing changes or they fail to stay compliant. Exiting or switching EOR providers can be costly and disruptive especially when it involves transferring employment contracts across jurisdictions.

Limited control over employee relationships

An EOR or employers of record manages employment contracts, benefits and terminations. This limits your company’s direct influence on the employee relationship. In some cases – like performance management, disciplinary action or dispute resolution – you may find your options restricted by the EOR’s processes or local employment laws.

Mismatch with internal timelines

Some EORs move at a different pace than your internal HR or expansion teams. If you need to hire employees quickly or make rapid hiring decisions slow turnaround from the EOR can create delays in onboarding, payroll or compliance clearances affecting project timelines and deliverables.

Curious if an EOR is the right fit for your global hiring plans?

5. Risk Mitigation Strategies

Using an Employer of Record (EOR) simplifies global hiring but it doesn’t eliminate risk. To protect your company and ensure compliance with local employment laws and regulations you need a proactive plan. Here are key strategies to reduce exposure when working with an EOR partner.

Choose the right EOR provider

Not all EOR providers offer the same level of service, expertise or financial stability. Vet potential partners thoroughly. Look for providers with a strong track record in the countries you’re hiring in, deep knowledge of local labor laws and employment law and transparent communication around roles and responsibilities. Evaluate the EOR’s customer service responsiveness and support structure. Prioritize EOR partners with proven experience in data protection, employee benefits management and tax regulations.

Conduct regular compliance audits

Even though the EOR is the legal employer your company is still exposed to compliance risks and legal disputes. Review employment contracts, tax filings and benefit structures regularly to ensure alignment with local labor laws. Consult with legal counsel regularly to stay up to date on employment law changes in all active markets. Internal audits even annually can prevent costly surprises tied to non-compliance or legal exposure. EORs guarantee compliance with local employment laws and regulations so businesses can avoid legal issues and penalties.

Define roles and responsibilities clearly

Ambiguity between your company and the EOR creates gaps and key risks. Ensure your service agreement clearly outlines who does what – from employment contracts and payroll to disciplinary procedures and employee onboarding. Miscommunication leads to record risks especially when managing international employees across jurisdictions.

Maintain control over employee engagement

While the EOR handles employment on paper the records they provide can significantly enhance employee experience which is still your responsibility. Maintain regular communication with EOR-hired staff, align benefits and performance reviews with your internal policies and integrate them into your company culture. This reduces the risk of disengagement and high attrition.

Use data security best practices

Your EOR partner will access and manage sensitive employee information, offering various EOR benefits such as compliance management and streamlined HR functions. Ensure they follow robust data security protocols, with encryption, access controls and compliance with global data protection laws like GDPR. Request audits or reports on how employee data is stored, processed and protected.

Monitor financial exposure

Request transparent pricing breakdowns to avoid hidden charges and free up internal resources. Review exchange rate policies if you’re paying employees in multiple currencies. Confirm how payroll taxes, contributions and reimbursements are calculated. Track invoicing accuracy and escalate discrepancies immediately.

Employer of Record (EOR) Services: Pros and Cons at a Glance

| Category | Pros | Cons |

|---|---|---|

| Speed | Quick international hiring through employer of record services without setting up legal entities | Limited scalability for long-term growth |

| Compliance | Handles local labor laws, employment laws, and tax regulations | Non-compliance risks if provider lacks jurisdictional expertise |

| Administrative Burden | Offloads payroll, benefits, and employment contracts to a third party | Reduced control over employment policies and processes |

| Cost | Lower upfront cost compared to entity setup | Becomes expensive with growing headcount due to per-employee pricing |

| Risk Mitigation | Minimizes exposure to misclassification and tax penalties | Liability can still fall on your business if issues arise |

| Flexibility | Supports short-term or project-based international hiring | Dependence on the EOR provider may lead to vendor lock-in |

| Speed to Operate | Enables immediate business activities in new countries | Operational delays if the EOR lacks local responsiveness |

| Employee Experience | Provides standard benefits and payroll across countries | Cultural disconnect and inconsistent integration with internal teams |

| Data Security | Professional EORs implement data protection and security protocols | Risk of data breaches if provider has weak controls or operates in low-regulation environments |

| Exit Strategy | Easier to withdraw from a market without winding down an entity | Complex to transfer employees if switching EORs or moving to direct employment |

Conslusion:

EORs solve the big problems in global hiring – speed, compliance support, and access to international talent. But they’re not without issues. The core employer of record risks, loss of control, compliance gaps, and cultural disconnect can outweigh the benefits if not managed proactively. Businesses should treat EORs as short-to-mid-term solutions and review regularly if the model still fits growth, operational, and legal needs. Choose the right EOR partner, and maintaining oversight and a transition plan are key to avoiding costly mistakes.

Soham wasn’t always an international employment guru. He began with a passion for numbers, surprising shopkeepers with his mental math skills.

At PamGro, Soham spearheads international expansion and EOR (Employer of Record) services, driving global business strategies and ensuring compliance across multiple regions.