TABLE OF CONTENTS

- What is an Independent Contractor Agreement (ICA)?

- Why use an Independent Contractor Agreement?

- When Do You Need an Independent Contractor Agreement?

- What should be included in an Independent Contractor Agreement?

- U.S. Laws Governing Independent Contractor Agreements

- Negotiating and Customizing the Independent Contractor Agreement

- Best Practices for Managing Independent Contractor Agreements

- Termination of an Independent Contractor Agreement

- Renewing an Independent Contractor Agreement

- Independent Contractor Agreements with PamGro

- FAQs

In today’s gig economy, more and more businesses are turning to independent contractors for their specialist skills and flexibility. But it’s crucial to have a clear, legally binding agreement in place to avoid misunderstandings or disputes down the line. That’s where an Independent Contractor Agreement comes in.

An independent contractor agreement is a formal, legally binding document that outlines the terms of engagement between a company and an independent worker. It ensures that both parties know their roles, responsibilities, and pay.

This guide will take you through everything you need to know about Independent Contractor Agreements— why they’re essential, the key components, how to draft one effectively, and the laws that govern them.

What is an Independent Contractor Agreement (ICA)?

An Independent Contractor Agreement (ICA) is a formal contract between a business and a self-employed individual. It outlines the scope of work, payment terms, and responsibilities and provides legal protection for both parties. This is important for distinguishing independent contractors from employees, explicitly clarifying that the parties involved are not in an employer-employee relationship, especially in terms of legal and tax compliance.

For businesses, an ICA reduces the risk of costly legal penalties and tax issues, while contractors can rely on the agreement to clarify payment terms and project expectations. In essence, an ICA is essential for fostering a precise and professional relationship in any contractual engagement.

Why use an Independent Contractor Agreement?

Using an Independent Contractor Agreement (ICA) is essential for both businesses and contractors for several reasons:

- Clears up Roles and Expectations: An ICA outlines the project scope, deadlines, responsibilities, and services provided, so there’s less chance of disputes. It also helps with communication and ensures both parties are on the same page.

- Protects Your Interests: A contractor agreement protects both parties by putting it in writing. If there’s a dispute about the scope of work or payment, the agreement is the reference point for resolution.

- Tax Compliance: The IRS requires businesses to distinguish between employees and independent contractors. Misclassification can result in big penalties. An ICA defines the contractor’s status so both parties can handle taxes properly.

- Minimizes Misclassification Risks: Misclassifying a worker as an independent contractor instead of an employee can result in hefty fines and legal trouble. An ICA protects against this by stating the nature of the relationship and the contractor’s responsibilities.

- Payment Terms: The agreement should outline payment structures, such as milestones or lump sums. This level of detail helps both parties stay on track financially and reduces payment disputes.

When Do You Need an Independent Contractor Agreement?

An independent contractor agreement (ICA) is necessary in many situations when businesses hire contractors for specialized services or projects. Here are some critical times when an ICA is important:

- Project-Based Work:Whenever you’re hiring a contractor for a specific project with defined deliverables, an Independent Contractor Contract is required. It keeps everyone on the same page with timelines, responsibilities, and expectations. That reduces the chance of misunderstandings and disputes down the line.

- Long-Term Contracts:For long-term engagements, an ICA helps outline the terms of the relationship. This includes payment schedules, performance expectations, and ownership of intellectual property (IP) created during the contract. Get those terms in writing upfront to avoid future headaches.

- Specialized Services:When hiring contractors with specialised skills or consulting services, a signed ICA is required to define the scope of work. It protects against scope creep—where the project’s requirements go beyond the original agreement—and IP ownership rights.

- Multi-Client Projects:Contractors working with multiple clients should have separate agreements for each project. An ICA sets specific terms for priorities, deadlines, and resource allocation to reduce the chance of conflicts between projects.

What should be included in an Independent Contractor Agreement?

Writing a good independent contractor agreement document (ICA) is crucial so both parties know what they are getting into. An explicit agreement will prevent misunderstandings and protect both the hiring company and the contractor. Here’s what to include:

- General Info About the Parties:

Start with the full legal names, addresses, and contact information for both the hiring company and the independent contractor. This will identify both parties and make communication easier throughout the project.

- Scope of Work and Deliverables:

This should outline the specific services the independent contractor will perform. Make sure to include deliverables, milestones, and deadlines. Clearly defining these will prevent scope creep (where the project expands beyond the original agreement) and ensure both parties are on the same page about what’s required.

- Compensation and Payment Terms:

Define how the contractor will be paid. Include payment rates, frequency (hourly, per project, or milestone-based), and method of payment (bank transfer, check, etc.). A clear payment schedule will help both parties manage expectations and reduce the chance of disputes.

- Reimbursement Policies:

Specify how expenses incurred by the contractor during the services will be reimbursed. This may include guidelines for submitting expense claims and what documentation is required (e.g., receipts). Clear reimbursement policies will protect both the contractor and the hiring company from financial miscommunication.

- Employment Benefits and Liability Exclusion:

Make sure to state that the independent contractor is not entitled to employee benefits (health insurance, retirement plans, paid time off, etc.). This clause will clarify the nature of the relationship and limit the hiring company’s liability for injuries or damages related to the contractor’s work.

- Termination Clause:

State the circumstances under which either party can terminate the agreement. Include the notice period for termination and any penalties for early termination. This will ensure both parties know their options for ending the contract if needed.

- Indemnification Clause:

This will require the contractor to pay the hiring company for any losses or damages caused by the contractor’s actions or inactions. This is key to protecting the business from financial liabilities from the contractor’s work.

- Dispute Resolution:

Include a section that states how disputes will be resolved. Options may include mediation, arbitration, or litigation. Clearly outlining the process for resolving conflicts will save both parties time and money if issues arise during the contract’s term.

- Compliance with Laws:

The contractor will comply with all applicable laws, regulations, and industry standards during the services. This compliance will protect both parties from legal issues arising from non-compliance.

- Severability:

If any part of this agreement is found to be unenforceable or illegal, the remaining provisions will still apply. This will ensure the overall agreement remains valid even if one part is invalid.

- Governing Law:

State which state’s laws will govern this agreement. This is important for any legal issues that may arise.

- Waivers:

Include a clause that says if one party waives some rights or remedies, it does not affect any other rights or remedies under this agreement. Additionally, a waiver of one breach does not imply a waiver of any subsequent breach. This will maintain the integrity of the contractual obligations.

- Liability Insurance:

Require the contractor to have liability insurance to cover any liabilities from their work. This will protect the hiring company from the financial consequences of the contractor’s actions.

- Professional Capacity and Warranties:

The contractor will confirm their professional status and warranty the services. This will add another layer of protection for the hiring company.

- Intellectual Property Protection:

State who owns and has rights to any intellectual property created during the contract. This is especially important for companies that have proprietary information or products.

- Confidentiality (NDA Clause):

Make sure the contractor agrees to keep confidential sensitive information. This will protect the company’s trade secrets and proprietary information during and after the engagement.

- Non-Compete Agreement:

Consider including a clause that prevents the contractor from engaging in activities that could harm the company’s interests during and after the contract term. However, be careful not to make the clause too restrictive, as it may not be enforceable in some states.

U.S. Laws Governing Independent Contractor Agreements

In the United States, various federal and state laws govern the relationship between independent contractors and employers. Understanding these regulations is essential for businesses to avoid potential liabilities and penalties associated with misclassification. Here are the key statutes and considerations:

- Internal Revenue Service (IRS) Regulations:The IRS plays a critical role in determining whether a worker is classified as an employee or an independent contractor. Factors such as the degree of control exercised by the employer, the worker’s independence, and their integration into the employer’s operations are evaluated. The IRS uses standard law rules, focusing on three main areas: behavioral control, financial control, and the relationship between the parties.

- State-Specific Labor Laws:Many states have enacted additional laws that govern the classification of independent contractors, often imposing stricter criteria than federal regulations. For example:

- California Assembly Bill 5 (AB5): This law implements the ABC test, which requires that a worker must meet all three criteria to be classified as an independent contractor.

- New York Labor Law Article 25: Similar in intent, this law outlines specific conditions under which workers can be classified.

- Massachusetts Independent Contractor Law: Known for its strict criteria, it also employs the ABC test to determine classification.

- Penalties for Misclassification:Misclassifying an employee as an independent contractor can result in significant financial consequences, including back taxes, fines, and potential lawsuits. Workers misclassified as contractors often miss out on benefits such as minimum wage, overtime pay, and unemployment insurance.

- Employee Classification Rules:The criteria for classifying workers vary between federal and state laws. While the IRS uses standard law rules to assess control and independence, many states employ the ABC test, which is more stringent. Under this test, a worker must be:a. Free from control and direction by the hiring entity.b. Engaged in work outside the usual course of the hiring entity’s business.c. Working in an independently established trade, occupation, or business

- Recent Developments:The U.S. Department of Labor (DOL) has also made updates regarding independent contractor classification, moving towards an “economic reality” test that considers the worker’s control over their work and potential for profit or loss

For more detailed insights, you can refer to the IRS website and state labor department resources.

Negotiating and Customizing the Independent Contractor Agreement

When creating a independent contractor agreement, you need to negotiate terms that work for both parties. While templates/sample of independent contractor agreements are a good starting point, customizing the independent contractor agreement documentttt) to your partnership is key. This means negotiating payment structures, project timelines, and the scope of work for entire agreement. Flexibility in these negotiations will ensure a win-win while still obtaining the legal protections you need.

Additional Steps for Hiring Independent Contractors

In addition to signing the ICA, organizations must follow these administrative steps to comply with applicable law, tax and regulatory requirements:

- File Required Tax Papers: Businesses must file tax documents, such as Form 1099-NEC, for payments to independent contractors.

- Keep Accurate Records: Keep records of payments, expenses, and other relevant information for income tax reporting.

- Comply with Local Laws: Organizations must comply with local laws governing independent contractor arrangements, including labor classification and tax withholding laws.

Best Practices for Managing Independent Contractor Agreements

Managing independent contractor agreements requires careful attention to detail and a thorough understanding of the terms and conditions. Here are some best practices to consider:

- Clearly define the scope of work and services to be provided.

- Establish a payment structure and schedule.

- Protect intellectual property and confidentiality.

- Include exclusivity clauses and non-compete agreements, if necessary.

- Regularly review and update the agreement to ensure compliance with changing laws and regulations.

- Consider using a contract management tool to streamline the process and reduce administrative burdens.

By following these best practices, you can ensure that your independent contractor agreements are comprehensive, effective, and compliant with relevant laws and regulations.

Termination of an Independent Contractor Agreement

You can terminate an ICA for many reasons, such as project completion, breach of contract, or mutual consent. Always follow the termination provisions in the agreement and give the other party written notice. This keeps the relationship professional and minimizes the risk of disputes or legal issues.

Renewing an Independent Contractor Agreement

Renewing or updating an independent contractor agreement is necessary when the scope of the project, terms, or other circumstances change. When renewing free independent contractor agreement, consider:

- Review and Update Terms: Ensure that the agreement’s language matches your current business needs and the law.

- Open Communication: Have open discussions with the independent contractor about any issues or changes.

- Confirm Mutual Understanding: Before finalizing the renewal, make sure all parties understand and agree to the updated terms.

In a Nutshell

In summary, an ICA is more than just a legal formality. It’s a critical tool that sets clear expectations, protects legal rights, and builds effective working relationships between businesses and independent contractors. By covering the scope of work, payment, termination, and compliance with laws, companies can reduce the risks of contractor relationships.

For companies looking to hire independent contractors, investing the time and resources to craft a comprehensive and legally binding independent contractor agreement that formally establishes the details will give you peace of mind. By following best practices and keeping the lines of communication open with contractors, you’ll build strong relationships that will lead to mutual success.

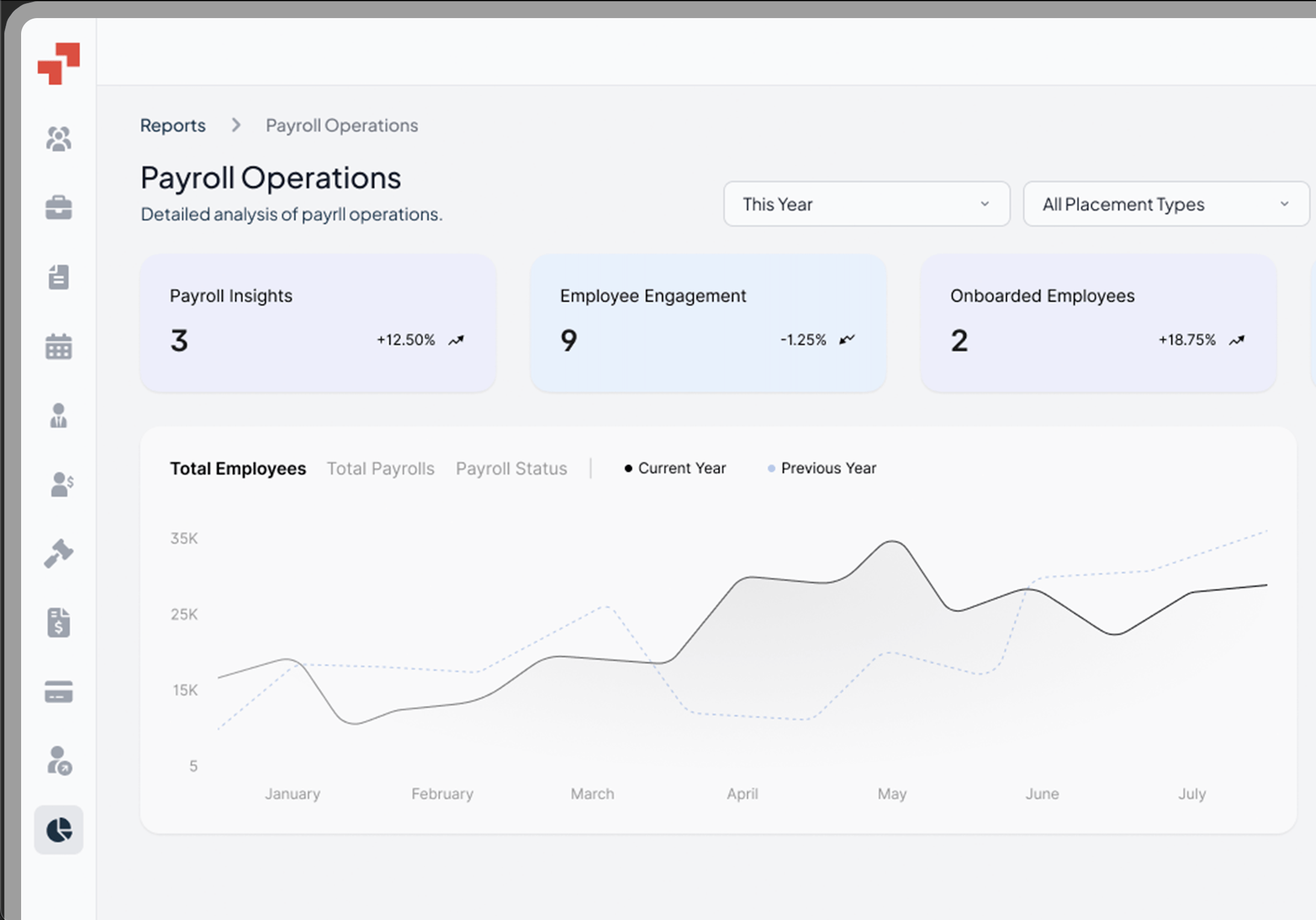

Independent Contractor Agreements with PamGro

Ready to simplify your hiring and ICA compliance? PamGro is here to help.

PamGro can help you produce tailored, fully-compliant agreements quickly and easily, allowing you to focus on choosing the right contractor for your business.

As an Employer of Record (EOR) provider, PamGro offers customized solutions for hiring, payroll, and compliance across multiple countries. With over 15 years of experience and a dedicated relationship manager for personal support, PamGro lets you focus on your business while we handle the rest.

FAQs

1. How do I create an Independent Contractor Agreement?

Here are the key steps to create an Independent Contractor Agreement:

- Specify the location.

- Describe the required service.

- Provide contractor and client details.

- Outline compensation.

- Define the terms of the agreement.

- Add any additional clauses.

- Include signing details.

2. What is an example of an independent contractor?

Professionals like doctors, lawyers, accountants, contractors, and auctioneers who offer services to the public are independent contractors.

3. Is an independent contractor a freelancer?

Yes, but independent contractors often work for a single client or long-term project, unlike freelancers who take on multiple clients.

Hire, Classify, and Pay Contractors - All in One Platform

Mukul Dixit is a Growth Marketing Associate with 7+ years of experience creating impactful content in Innovative Tech, SaaS, and HR. A curious explorer at heart, he’s always on the lookout for new cultures to experience, fresh music to vibe, and innovative business ideas to dive. Passionate about entrepreneurship and digital marketing, Mukul brings a creative edge to everything he does.