TABLE OF CONTENTS

- What is Holiday Allowance in the Netherlands?

- How Much Holiday Allowance Do You Get?

- How Holiday Allowance is Calculated?

- When is the Holiday Allowance Paid in the Netherlands?

- Is Holiday Allowance Taxable in Netherlands?

- Vacation Days vs. Holiday Allowance

- Holiday Allowance for Expats and Part-Time Workers in the Netherlands

- Can You Spend Your Holiday Allowance on Anything?

- Holiday Allowance When Leaving a Job

- Maximize Your Benefits with PamGro’s Seamless Payroll Solutions

- FAQs

If you work in the Netherlands, you are legally entitled to receive holiday allowance, known locally as vakantiegeld or vakantiebijslag. This payment is separate from your base salary and forms a mandatory part of Dutch employment compensation.

Under the Wet minimumloon en minimumvakantiebijslag (Minimum Wage and Minimum Holiday Allowance Act), employers must pay employees at least 8% of their gross annual salary as holiday allowance. It is not a discretionary bonus and it is not optional.

In this guide, you will learn what the legal minimum is, how holiday allowance in the Netherlands works, when it is paid, whether it is taxable, and what happens if your employment ends.

What Is Holiday Allowance (Vakantiegeld) in the Netherlands?

Holiday allowance is an additional payment and a statutory benefit equal to at least 8% of your gross annual salary. This money is provided by Dutch employers to support employees financially during vacation periods, although there is no requirement to spend it on travel.

The money is intended to help employees plan vacations, cover holiday expenses, or serve as extra income for other financial needs.

Unlike bonuses or profit-sharing schemes, holiday allowance is not performance-based. It accrues automatically over the course of employment and is usually paid once per year, typically in May or June.

It is important to distinguish holiday allowance from other payments. It is separate from your monthly wage, separate from end-of-year bonuses, and separate from a 13th month salary. It is also taxed under a special wage tax rate known as bijzonder tarief

What is the Legal Minimum Holiday Allowance Percentage in the Netherlands?

The legal minimum holiday allowance in the Netherlands is 8% of the employee’s gross salary or gross wage (the total gross amount earned before taxes and deductions), as required under the Wet minimumloon en minimumvakantiebijslag.

This 8% is calculated on the employee’s gross amount, which includes the gross salary or wage (including overtime but excluding most benefits) earned during the accrual period, typically from June to May.

Certain collective labour agreements (CAO) may provide a higher percentage. For example, temporary agency workers covered by the ABU CAO receive 8.33%. However, if no CAO applies, the statutory minimum remains 8%.

The percentage itself does not vary based on working hours, it always applies to the employee’s gross earnings.

Is Holiday Allowance Mandatory in the Netherlands?

Yes, holiday allowance in the Netherlands is mandatory.

Dutch law requires employers to pay at least 8% of an employee’s gross wages as holiday allowance. This statutory obligation applies broadly to employees working under an employment contract, regardless of whether they are full-time, part-time, or on a temporary contract.

In some sectors, the applicable collective labour agreement (CAO) provides a higher percentage. For example, under the ABU Collective Labour Agreement (ABU CAO) for temporary agency workers, holiday allowance is set at 8.33% instead of 8%.

This higher percentage applies only if the employer falls under the ABU CAO. If no collective agreement specifies otherwise, the statutory minimum remains 8%, as established under Dutch civil law.

If an employer fails to pay holiday allowance, enforcement action may follow through the Netherlands Labour Authority (Nederlandse Arbeidsinspectie). Employees may also claim unpaid holiday allowance for up to five years.

There are limited exceptions. If an employee earns more than three times the statutory minimum wage, there is no statutory obligation for the employer to pay holiday allowance if both employer and employee provide written consent to reduce or eliminate it. In other cases, if an employer does not pay separate holiday allowance, the total salary must be at least 108% of the statutory minimum wage. Any deviation from the standard holiday allowance arrangement must always be based on written consent, ensuring the agreement is formally documented.

How much Holiday Allowance do you get in the Netherlands?

The amount of holiday allowance you receive depends on your gross earnings during the accrual period. The statutory rate is at least 8%, so your total holiday allowance equals 8% of your employee’s salary before taxes.

For example, if your regular salary is €40,000 gross per year, your holiday allowance would be €3,200 before tax.

If your gross monthly salary is €3,000, your annual salary would be €36,000, resulting in €2,880 in holiday allowance at 8%.

Holiday allowance is calculated on gross wages, not net salary, and is paid in addition to your regular salary. It does not typically include expense reimbursements, travel allowances, or profit-sharing payments.

If your employment ends, any accrued holiday allowance will be included in your last salary payment.

Depending on your employment agreement, the payment may be made as:

-

A lump sum in May or June

-

Monthly instalments added to your salary

The total annual amount remains the same regardless of payment structure.

Customer Success Story

See how a PEB company simplified global hiring and acquired talent across borders efficiently with PamGro

Is Holiday Allowance the same as a 13th Month Salary in the Netherlands?

No, holiday allowance is not the same as a 13th month salary.

Holiday allowance is required by law and must be paid at a minimum of 8% of gross wages. A 13th month salary, on the other hand, is not legally required. It is a contractual benefit that depends on the employer or the applicable CAO.

A 13th month salary may equal one additional month’s pay and is typically paid at the end of the year. Some employers offer both benefits, but they are legally distinct.

This distinction is important because many people searching for holiday allowance Netherlands also encounter references to 13th month salary Netherlands. The two should not be confused.

Who is entitled to Holiday Allowance in the Netherlands?

Most Dutch employees working under a Dutch employment contract are entitled to a minimum holiday allowance and statutory holiday entitlement, as protected by law. This includes full-time employees, part-time employees, temporary workers, zero-hour contract employees, and expats employed under Dutch labour law. All Dutch employees are entitled to a minimum level of paid leave and holiday allowance, regardless of contract type.

Holiday allowance accrues proportionally based on wages earned and the duration of employment. There is no minimum service period required to qualify.

Freelancers (ZZP’ers), independent contractors, and self-employed individuals are not automatically entitled to holiday allowance or statutory holiday entitlement because they do not work under an employment contract. They must account for vacation savings independently.

How is Holiday Allowance calculated in the Netherlands?

Holiday allowance in the Netherlands is calculated as a minimum of 8% of the gross wages earned during the accrual period, which usually runs from June to May. The payout is typically made in May or June.

If you earn a fixed monthly salary, the math is straightforward. For example, if your gross monthly salary is €3,000, your annual salary is €36,000. At 8%, your holiday allowance would amount to €2,880 for that year.

The percentage remains the same regardless of whether you work full-time or part-time. What changes is the earnings base.

In short:

- Minimum percentage: 8%

- Applied to gross wages

- Accrued monthly

- Paid annually (unless agreed otherwise)

- Calculated on a pro rata basis if you work only part of the year

Some collective labour agreements (CAO) specify 8.33%, particularly for temporary agency workers.

| Example Calculations | |

|---|---|

| Monthly salary | $ 5.000 |

| Monthly holiday allowance (8%) | $ 400 |

| Annual salary | $ 60.000 |

| Annual holiday allowance (8%) | $ 4.800 |

| Paycheck example if holiday allowance is paid on a monthly basis (12 instalments) | [$ 5.000 + $ 400] = $ 5.400, – monthly paycheck |

| Paycheck example if an employee receives the holiday allowance in one instalment in June: | [$ 5.000 + $ 4.800] = $ 9.800, – paycheck in June |

What is included in the Holiday Allowance Calculation?

Holiday allowance is calculated over gross wages, not just base salary. This is where many employees get confused.

In general, holiday allowance must also be calculated over:

-

Overtime payments

-

Commission

-

Performance-based wage components

-

Irregular working hours allowances

-

Paid-out leave entitlement

If overtime is part of your income, your employer must include it in the 8% calculation.

However, certain payments are typically excluded:

-

Expense reimbursements

-

Travel allowances

-

End-of-year bonuses

-

Profit-sharing distributions

-

Profit distribution

Understanding what is included helps when using a holiday allowance Netherlands calculator or reviewing your payslip.

How Does Holiday Allowance Work for Part-Time or Zero-Hour Contracts?

Holiday allowance applies equally to part-time and zero-hour employees. The law does not reduce the percentage, it only applies the percentage to actual earnings. Employees on a zero hours contract are also entitled to holiday allowance, which is calculated based on the wages they actually earn, ensuring that even those with flexible or temporary contracts receive statutory holiday pay.

For example:

-

If you work part-time and earn €18,000 per year, your holiday allowance will be 8% of €18,000.

-

If you work on a zero-hour contract, holiday allowance accrues based on the wages you actually earned.

The system is proportional, not conditional. As long as you are employed under a Dutch employment contract, holiday allowance accrues.

How is Holiday Allowance calculated if you worked only part of the year?

Holiday allowance accrues from your first day of employment. You do not need to complete a full year to qualify.

If you worked four months and earned €12,000 gross, your holiday allowance would be 8% of €12,000, which equals €960. The holiday allowance is typically calculated based on your earnings from the previous year, especially if you worked only part of the year.

This pro-rata principle also applies if your employment ends before May. Any accrued holiday allowance must be included in your final salary.

Key takeaway:

-

No minimum service requirement

-

Always calculated on actual earnings, usually from the previous year

-

Paid proportionally upon termination

Related Newsletter Insight

Stay updated with the latest global hiring and compliance changes.

When is Holiday Allowance paid in the Netherlands?

Most employers pay holiday allowance once per year in May or June. This timing traditionally supports summer vacation planning.

However, Dutch law allows flexibility. Payment structure depends on:

-

Your employment contract

-

The applicable CAO

-

Written agreement between employer and employee

Holiday allowance can be paid as a separate salary payment, typically as a lump sum in May or June, or it may be included in your regular salary payments each month, depending on the agreement with your employer.

Some employers distribute holiday allowance monthly instead of as a lump sum.

Can you receive Holiday Allowance monthly instead of yearly?

Yes, but only if it is agreed in writing.

If paid monthly:

-

The 8% is added to each payslip

-

There is no large lump sum in May

-

The total annual amount remains unchanged

-

This results in a higher monthly salary compared to receiving the holiday allowance as a lump sum

Employees should review their contract to confirm whether holiday allowance Netherlands is structured monthly or annually.

What happens to Holiday Allowance when employment ends?

If your employment ends before the typical payout month, your employer must pay all accrued holiday allowance with your last salary payment.

This applies to:

-

Resignation

-

Dismissal

-

Expired fixed-term contracts

The amount must reflect 8% of the gross wages earned during your employment period.

Failure to pay accrued holiday allowance may allow employees to file a claim.

Does Holiday Allowance accrue during sick leave?

Yes, holiday allowance accrues over the portion of salary that continues to be paid during sick leave.

In the Netherlands, employers generally must pay at least 70% of salary during illness (for up to two years). Holiday allowance accrues over that continued wage.

If wage payments are reduced, the holiday allowance accrues proportionally to the paid amount.

Parental leave may also affect the accrual of holiday allowance. During parental leave, specific rules determine how holiday allowance is calculated, and accrual may be limited to the paid portion of the leave.

What is the difference between Holiday Allowance and Vacation Days?

Holiday allowance (vakantiegeld or vakantiebijslag) is a financial payment, while vacation days (vakantiedagen) are paid leave entitlements. In the Netherlands, ‘holiday days’ refer to the number of days an employee can take off as ‘holiday leave’, which is distinct from ‘public holidays’—officially recognized days such as King’s Day or Christmas, when businesses may close. ‘Paid holidays’ encompass both statutory holiday leave and public holidays, ensuring employees receive their salary during these absences.

Under Dutch law:

-

Holiday allowance = at least 8% of gross annual salary

-

Vacation entitlement = at least four times weekly working hours per year

For a full-time employee working 40 hours per week, this equals at least 20 paid holiday days per year.

Holidays in Dutch employment law include statutory and non-statutory holiday leave, public holidays, and the holiday allowance, all of which are key components of employee rights and workplace culture. Many employers provide more than the statutory minimum depending on the CAO.

Is Holiday Allowance Taxable in the Netherlands?

Yes, holiday allowance in the Netherlands is taxable.

It is taxed under the special wage tax rate known as “bijzonder tarief.” This special tax rate applies to irregular payments such as bonuses, commissions, and vakantiegeld, and is different from the tax rate applied to your regular salary.

The tax percentage depends on your total annual income. The withholding may appear higher than your normal monthly salary tax, but the final amount is reconciled in your annual income tax return. Tax credits, such as the general tax credit and employment tax credit, can help reduce your overall tax liability on both your regular salary and holiday allowance.

Why Does Holiday Allowance Seem Taxed Higher?

Holiday allowance is often taxed at a higher withholding rate because it is treated as a special payment.

However:

-

It is not double taxed.

-

The rate is an advance withholding estimate.

-

Any overpayment is corrected during your annual tax filing.

This explains why many employees believe holiday allowance Netherlands tax is unusually high.

Can You Estimate Your Net Holiday Allowance?

You can estimate your net holiday allowance using a holiday allowance Netherlands tax calculator.

To estimate:

-

Calculate 8% of your gross annual earnings.

-

Apply the approximate bijzonder tarief percentage based on your income bracket.

-

The result is your estimated net holiday allowance.

For exact figures, consult your payroll provider or the Dutch Tax Authority (Belastingdienst).

Are There Specific Tax Rules for Holiday Pay in the Netherlands?

Yes. Holiday pay is treated as special income under wage tax rules.

Key points:

-

Taxed under bijzonder tarief

-

Subject to payroll tax (loonheffing)

-

Included in annual taxable income

-

Reconciled during income tax return

Employees who qualify for the 30% ruling (expat tax benefit) may see different net outcomes depending on their taxable base

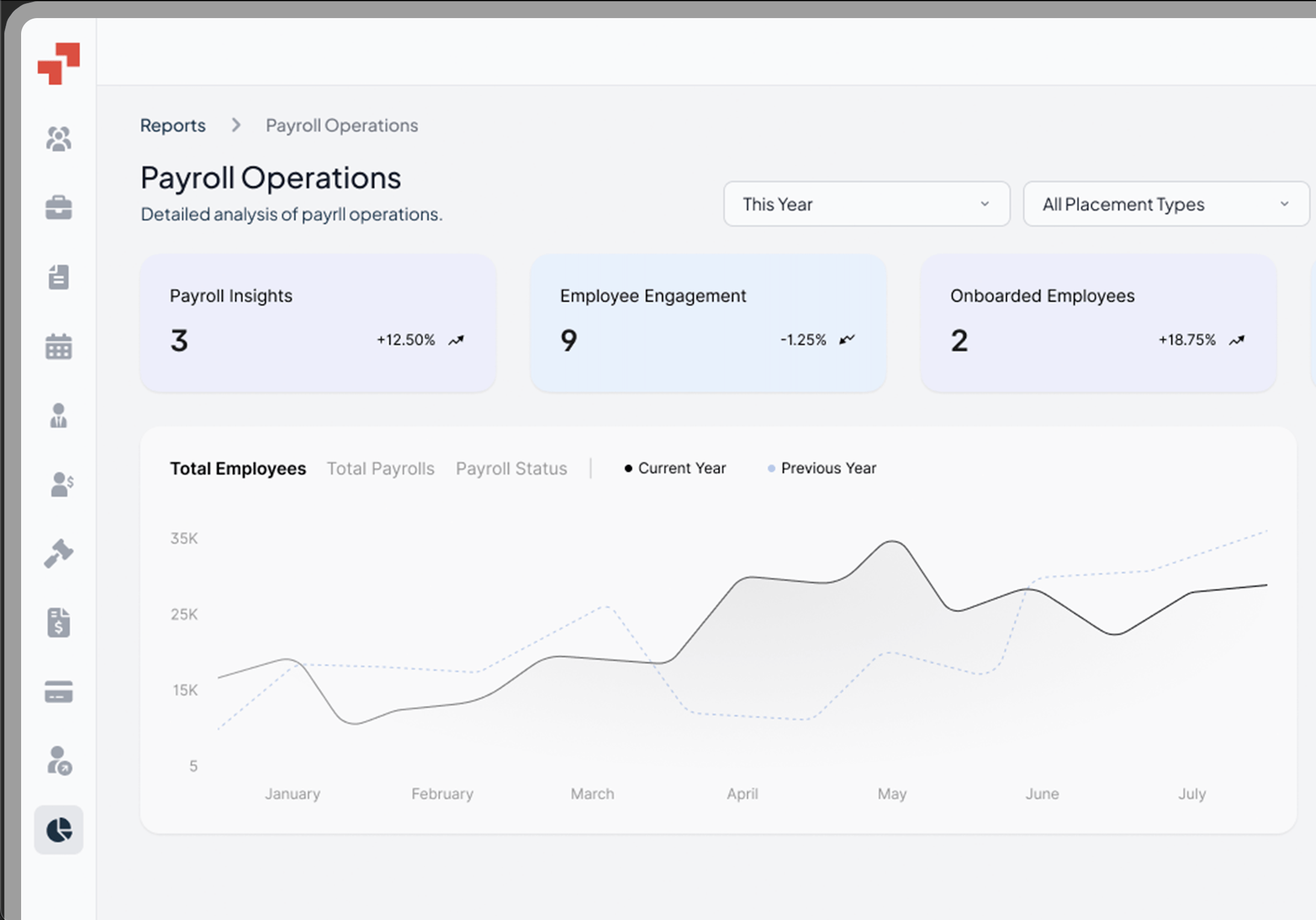

How PamGro Helps You Stay Compliant With Dutch Holiday Allowance Rules

Managing holiday allowance in the Netherlands requires precision — from applying the correct 8% or 8.33% rate to handling accrual, tax withholding under bijzonder tarief, and final settlement payments. Errors in payroll calculations or CAO application can quickly create compliance risks.

PamGro supports international companies by:

-

Drafting compliant Dutch employment contracts

-

Accurately calculating and accruing holiday allowance

-

Applying CAO rules, including ABU CAO where applicable

-

Managing payroll tax withholding and reporting

-

Handling termination payouts and statutory payments

Make £100 for You & £100 for Your Friend

Frequently Asked Questions About Holiday Allowance in the Netherlands

1. Can I receive my holiday allowance monthly instead of yearly?

Yes. Dutch law allows monthly payment if agreed in writing. The total annual amount remains the same.

2. How much tax is deducted from holiday allowance?

The tax percentage depends on your total annual income. Holiday allowance is withheld at a special rate, but final tax liability is adjusted during your annual tax return.

3. What happens to accrued holiday allowance upon termination of employment?

All accrued holiday allowance must be paid with your final salary. Employers cannot withhold earned amounts.

4. Do part-time employees receive holiday allowance?

Yes. Part-time employees receive 8% of their gross earnings. The percentage remains the same; only the earnings base changes.

5. Do zero-hour contract workers receive holiday allowance?

Yes. Employees on a zero hours contract are entitled to holiday allowance in the Netherlands. Holiday allowance accrues based on actual wages earned under a zero hours contract.

6. Do freelancers (ZZP) receive holiday allowance?

No. Freelancers and self-employed individuals are not legally entitled to holiday allowance. They must account for vacation savings independently.

7. Does holiday allowance accrue during sick leave?

Yes. It accrues over the portion of salary that the employer continues to pay during sickness.

8. Is overtime included in holiday allowance calculation?

Yes. Holiday allowance must also be calculated over overtime payments and certain wage-based allowances.

9. Can an employer refuse to pay holiday allowance?

No, unless specific legal conditions apply (such as 108% minimum wage structure or high-income agreements documented in writing).

10. How long can I claim unpaid holiday allowance?

Employees may generally claim unpaid holiday allowance for up to five years.

11. Is holiday allowance included in my gross salary?

Typically, no. It is paid separately unless explicitly stated in your employment contract.

12. How is holiday allowance calculated for employees on a fixed salary?

It is calculated as 8% of total gross salary earned during the accrual period, usually June to May.

13. Which payroll services manage holiday allowance in the Netherlands?

Most Dutch payroll providers automatically calculate and accrue holiday allowance as part of salary processing, ensuring compliance with Dutch employment law.

14. What happens if my employer underpays holiday allowance?

Employers must correct underpayments. Employees can request correction and may legally recover unpaid amounts within the statutory claim period.

15. Is holiday allowance mandatory for expats working in the Netherlands?

Yes. Expats employed under Dutch employment contracts are entitled to holiday allowance under Dutch law.

Need Clarity on Your Holiday Allowance Setup?

Whether you’re hiring your first employee in the Netherlands or reviewing your existing payroll structure, our Dutch compliance experts can help you ensure everything aligns with local labour law.

Hire the Best Talent, Anywhere

Mukul Dixit is a Growth Marketing Associate with 7+ years of experience creating impactful content in Innovative Tech, SaaS, and HR. A curious explorer at heart, he’s always on the lookout for new cultures to experience, fresh music to vibe, and innovative business ideas to dive. Passionate about entrepreneurship and digital marketing, Mukul brings a creative edge to everything he does.