How can Indian Startups & SMBs Expand into the US Market?

Why the US Market Is a Strategic Move for Indian Startups?

01Greater access to venture capital

US investors actively fund scalable startups solving global, tech-driven business problems.

02Enhanced brand credibility

A US presence signals maturity, boosting your brand’s appeal to partners and customers.

03Proximity to Global Clients

Being in the US builds trust and fosters stronger relationships with enterprise clients.

04Faster Revenue Growth

Higher consumer spending and enterprise budgets allow for accelerated sales and market adoption.

The Hidden Challenges of US Market Entry

01Incorporation delays (2–6 months)

Setting up a US entity involves paperwork, legal hurdles, and extended processing timelines.

02Complicated state tax registration

Each US state has different tax laws, making registration slow, confusing, and risky.

03Employee misclassification risks

Hiring as contractors may violate US laws, exposing you to penalties and audits.

04Ongoing compliance costs

Maintaining a US entity requires continuous filings, audits, insurance, and legal expenses monthly.

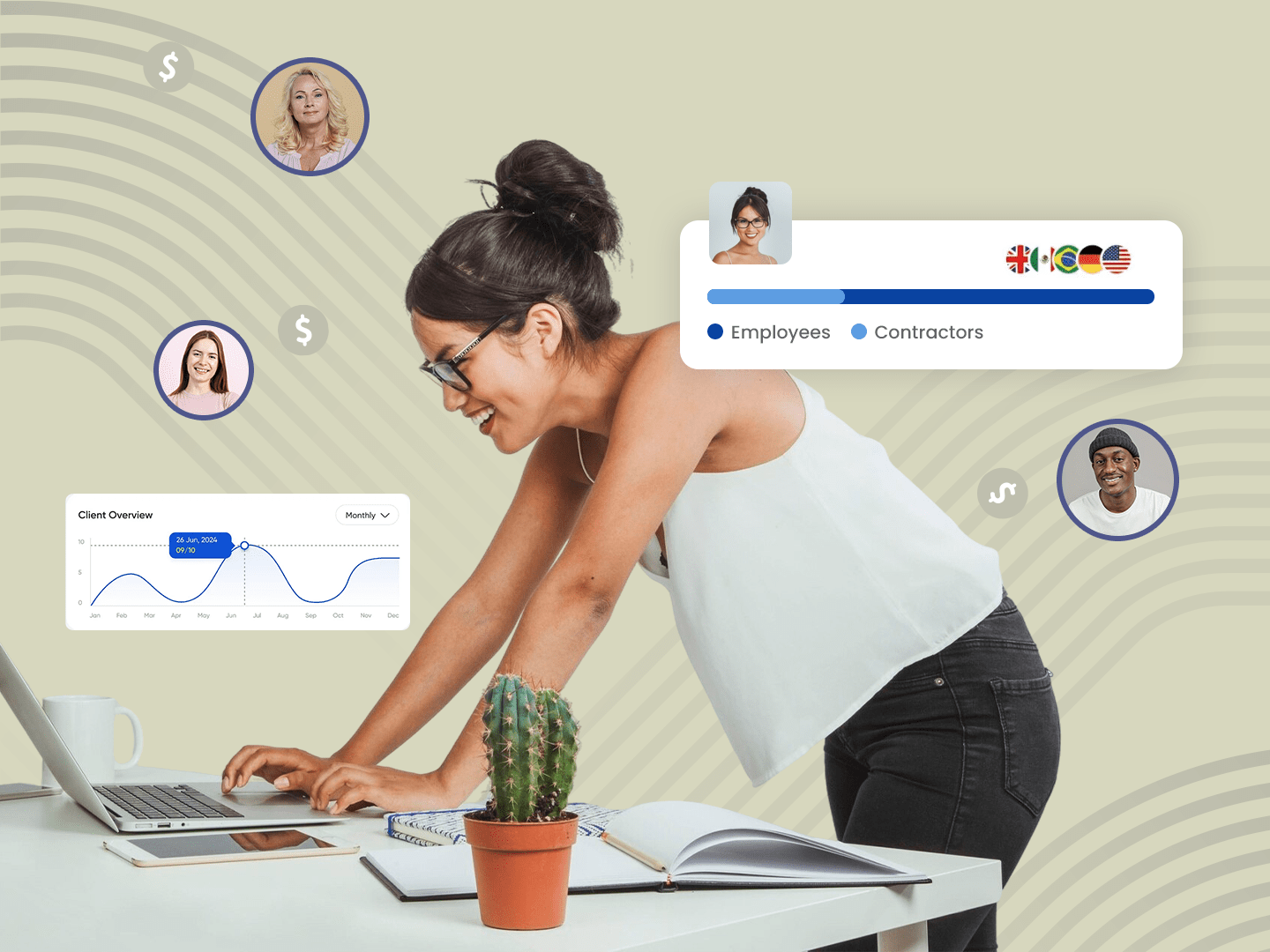

How EOR Empowers Indian Startups to Scale in the US Without Legal Headaches

Hire, pay, and manage US-based talent without incorporating

Seamlessly onboard and pay US employees without the cost and delay of forming a US entity.

Stay compliant with all US federal and state labor laws

EOR ensures your team adheres to evolving tax, labor, and HR laws across multiple states.

Avoid risks of contractor misclassification

Hiring as contractors? You could face penalties. An EOR classifies and protects both sides legally.

Reduce time-to-market by 80%

With entity setup eliminated, you can build and launch your US team in just 14 days.

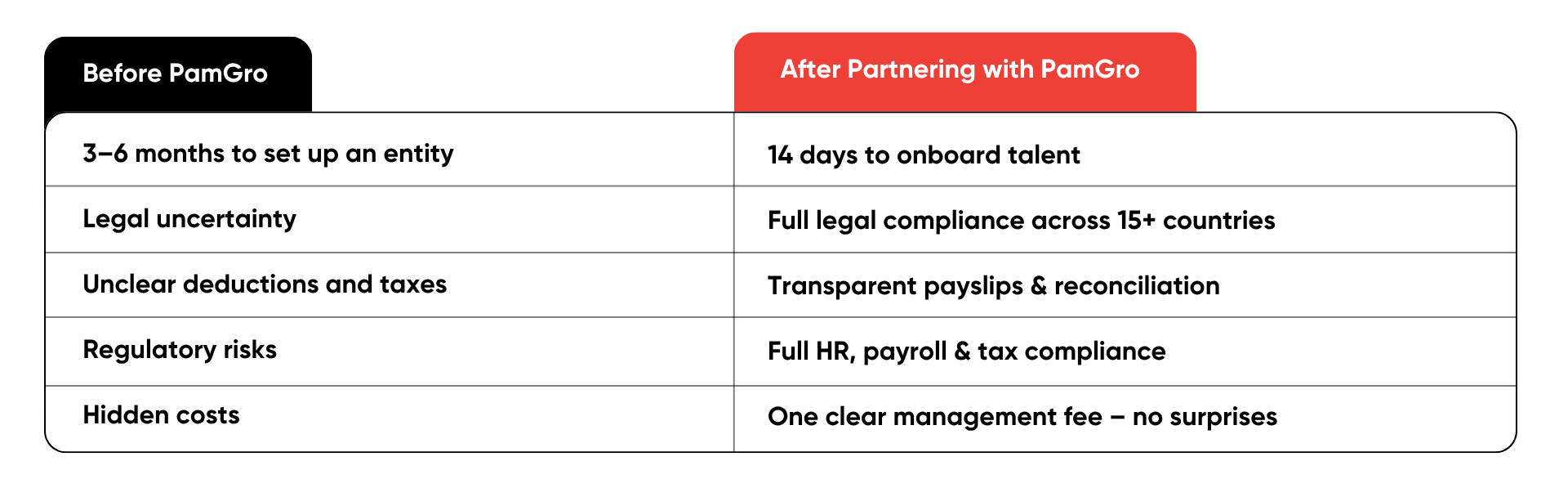

The PamGro Transformation

Why PamGro Is the EOR Built for Indian Startups & SMBs

We provide contractor illustrations before hiring

Only our management fee, no markup or surprise charges

Includes payslips + actual deductions

Get free, one-on-one guidance on all compliance matters

Global Workforce Management17+ Years

Presence in 15+ countries across Europe & MENA

Trusted byTop Chinese & Global tech brands

Compliant withUK and EU labor regulations