Total Remuneration

When businesses hire talent whether locally or across borders it’s easy to focus only on base salary. But for companies building competitive global teams, the real picture lies in total remuneration, which includes financial compensation.

This broader concept helps employers and employees see the true value of compensation, encompassing not just salary but every benefit and incentive tied to employment.

Table of Contents

What Is Total Remuneration?

Total remuneration refers to the complete pay package an employee receives from their employer, including base salary, bonuses, benefits, and indirect rewards.

It represents the total financial and non-financial value offered for a role. Total remuneration may include base salary, bonuses, commissions, stock options, and pension plans.

Commission is a percentage of sales revenue paid to employees, often used as an incentive in sales roles. Equity compensation, such as stock options or restricted stock units, is also included to align employee interests with company success.

For instance, a software engineer earning a $90,000 base salary might also receive health coverage, paid leave, additional benefits such as a performance bonus, and stock options all contributing to their total remuneration.

Companies calculate it to ensure fair pay, attract global talent, and maintain compliance with minimum wage laws and local employment regulations.

How to Calculate Total Remuneration?

To calculate total remuneration, add up all forms of compensation, both direct and indirect compensation.

Formula:

Total Remuneration = Base Salary + Bonuses + Benefits + Allowances + Employer Contributions + Perks

For example, if an employee earns $80,000 annually, receives a $5,000 bonus, $7,000 in benefits, and retirement savings, and $3,000 in company pension contributions, their total remuneration equals $95,000. Retirement benefits often include employer contributions to retirement savings accounts that enhance employees’ total remuneration. Paid time off (PTO) also has monetary value that contributes to the total remuneration calculation.

Employers use this calculation to benchmark pay against market value and maintain equity across international teams, a crucial function often managed by global EOR partners like PamGro, ensuring accuracy and compliance across borders.

U.S. Department of Labor – Wage and Hour Division offers useful wage resources for understanding legal compensation components.

What Is Remuneration Pay?

Remuneration pay simply refers to the compensation employees receive in exchange for their work. It can include salary, commissions, or benefits, depending on the role and country. An employee’s salary typically includes only the money they are paid for the work they do.

Unlike the narrower term “salary,” remuneration pay may involve both monetary and non financial benefits, as well as non-monetary rewards. For example, a remote employee working under an international contract might receive healthcare coverage, childcare assistance, or relocation package benefits as part of remuneration.

What Are the Types of Remuneration?

Remuneration is broadly categorized into direct and indirect forms:

- Direct remuneration: Base salary, overtime pay, incentives, and bonuses, which may include performance-based bonuses, annual bonuses, and signing bonuses for new hires.

- Indirect remuneration: Non-cash benefits such as insurance, paid leave, stock options, and work-life balance perks.

Companies use a mix of these, including incentive pay, to motivate employees and retain top global talent. Offering a comprehensive remuneration package is also an essential strategy for enhancing employee engagement and productivity.

Is Remuneration Better Than Salary?

Yes, remuneration is broader than salary. While salary only includes fixed pay or base pay , remuneration covers everything an employee receives as compensation. Various factors such as role responsibility and market standards determine base salary.

From an employer’s perspective, focusing on total remuneration helps present a more competitive offer, especially when hiring internationally, thereby enhancing overall job satisfaction.

For example, PamGro helps companies highlight the total value outlined in the employment contract for global employment packages, including employee benefits, statutory benefits, and additional perks making offers more attractive to candidates. Effective communication about total remuneration is critical during recruitment.

What Is Included in Total Remuneration?

A total remuneration package typically includes:

- Base salary or wages

- Bonuses and incentives

- Health and life insurance

- Retirement or pension contributions

- Paid time off (PTO), which encompasses all forms of paid leave, including vacation days, sick leave, and holidays.

- Equity or stock options

- Training or education support

- Allowances for specific work-related expenses, such as vehicle or phone allowances.

- Health and wellness benefits, which include health, dental, and vision insurance, along with wellness programs.

Some organizations also include fringe benefits and non-monetary benefits like flexible work schedules or wellness programs, contributing to a better work-life balance. Work-life balance perks can include flexible work schedules and remote work options, which are increasingly valued by employees.

What Does a Total Remuneration Package Mean?

A total remuneration package is a detailed breakdown of all compensation elements offered to an employee. It gives a clear picture of the complete employment value.

When businesses expand internationally, understanding what to include in these packages, like flexible working arrangements, can be challenging. That’s why many rely on PamGro’s EOR services, which ensure each package aligns with local compensation norms, benefits requirements, and tax obligations reducing the risk of non-compliance.

Is Total Compensation Before or After Taxes?

Total remuneration (or total compensation) is generally calculated before taxes. It represents the gross value of all compensation elements before employee deductions such as income tax or social security contributions. Total remuneration is taxable, so the employer must withhold income taxes and other payroll taxes and report them on the employee’s W-2 form.

Employers and HR leaders often use pre-tax figures and the gross amount for monetary compensation consistency when comparing pay across geographies. Global payroll experts like PamGro simplify this by ensuring compliant tax handling for both employers and employees across multiple countries.

Total Remuneration vs Total Compensation

The terms total remuneration and total compensation are often used interchangeably, though there can be subtle differences based on region.

In many countries, remuneration emphasizes both financial and non-financial rewards, not just the base salary , whereas total compensation focuses more on monetary value. In practice, both represent the same holistic approach to understanding employee pay.

Is Total Remuneration and CTC the Same?

In concept, CTC (Cost to Company) is similar to total remuneration but not identical.

CTC includes every cost an employer bears for an employee including taxes, insurance, and employer contributions, whereas total remuneration focuses on what the employee actually receives as value, including retirement savings plans.

For instance, if a company contributes to government taxes on behalf of the employee, it might count in CTC but not in the total remuneration visible to the worker. PamGro helps companies clarify this distinction in international payroll structures.

What Are the Advantages of Total Remuneration?

Understanding and using a term remuneration approach offers several advantages: total remuneration.

- Transparency: Employees know the full value of their compensation.

- Competitiveness: Helps attract and retain top talent.

- Compliance: Ensures adherence to minimum wage laws and local standards.

- Engagement: Improves satisfaction through recognition of non-monetary benefits.

- Profit Sharing: Allows employees to participate in a company’s financial success through additional payments.

By structuring pay transparently, organizations can strengthen trust and global workforce alignment by offering fringe benefits, critical when scaling operations through an EOR partner like PamGro.

Example of Total Remuneration

A marketing manager in Germany employed through PamGro’s EOR solution earns:

- Base Salary: €60,000

- Annual Bonus: €6,000

- Health Insurance: €3,000

- Pension Contribution: €2,500

- Paid Leave: €2,000

- Learning Allowance: €1,500

Total Remuneration = €75,000

This holistic view helps both employer and employee understand the true value of employment, reinforcing transparency and satisfaction.

Frequently Asked Questions About Remuneration

1. Does remuneration include overtime?

Yes. If applicable, overtime pay is part of direct remuneration. Overtime pay is additional compensation at a higher rate for hours worked beyond the standard workweek.

2. Are stock options part of remuneration?

Yes, they are considered a long-term incentive under indirect remuneration.

3. How often is total remuneration reviewed?

Many organizations review it annually or during performance appraisals to ensure fairness and market alignment. Regular reviews help maintain competitiveness and adapt to changing market conditions.

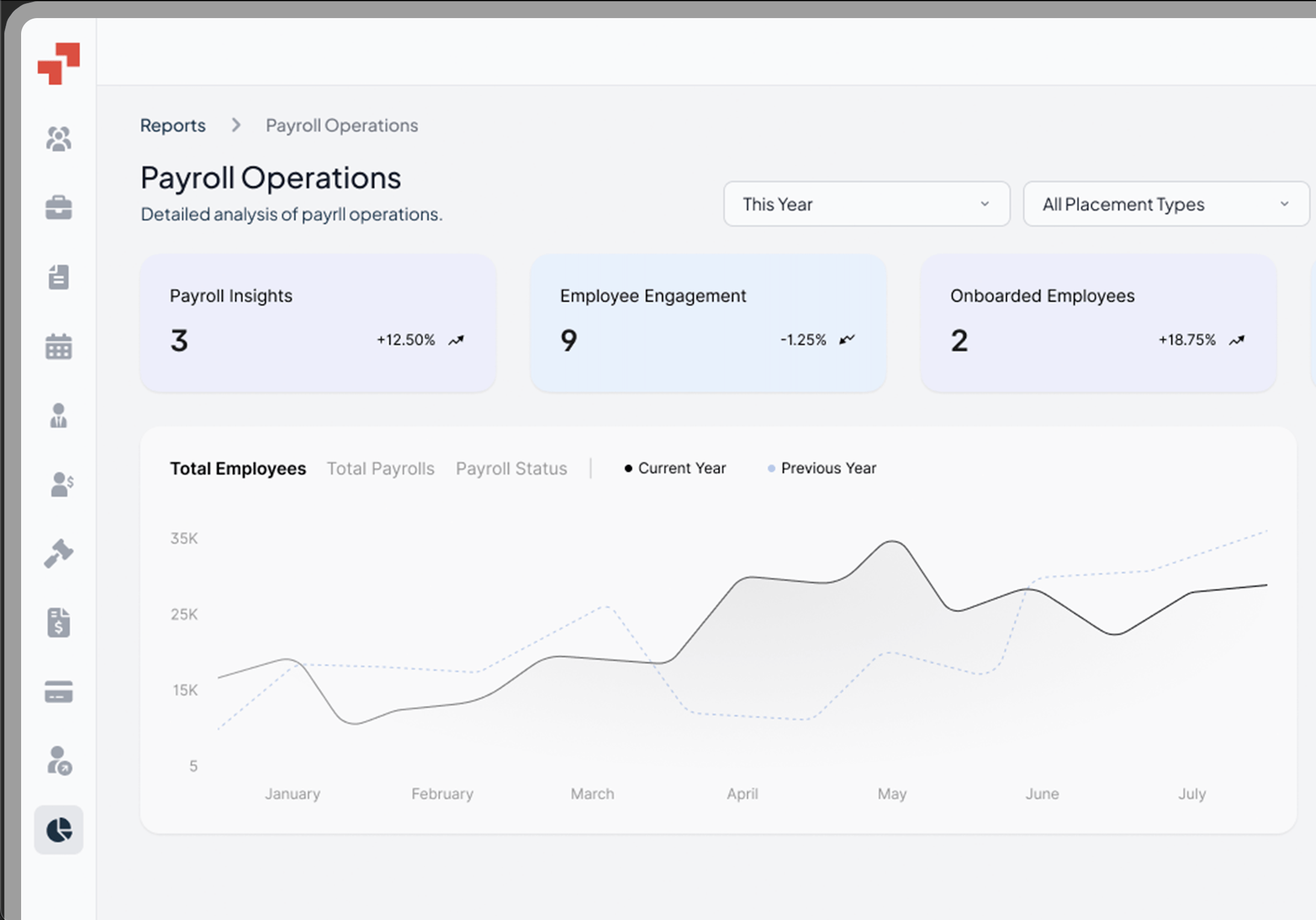

How PamGro Simplifies Global Remuneration Management?

Building compliant and competitive total remuneration packages, including hourly rate assessments, across countries can be complex. PamGro makes it effortless.

As a Global Employer of Record (EOR), PamGro manages international payroll, employee benefits, and tax compliance, so businesses can hire, pay, and support global employees without setting up local entities.

Whether you’re expanding to new markets or managing a distributed workforce, PamGro ensures your total remuneration packages are fair, compliant, and optimized for both cost and employee satisfaction. Professional development support, such as tuition reimbursement and training programs, can also be included to enhance employee growth and retention.

👉 Partner with PamGro to streamline your global compensation and benefits strategy today.

Hire the Best Talent, Anywhere