Imputed Income

Employee compensation today goes far beyond salaries and bonuses, including options like expense reimbursement . Businesses offer health benefits, education support, relocation packages, wellness perks, and more — especially when competing for talent globally. But while many perks feel “free,” tax laws often treat certain benefits as income. This is where imputed income comes in. It ensures taxable benefits are reported correctly, whether your team works onsite, remotely, or across borders. Understanding how imputed income works is essential for HR leaders, payroll teams, and companies scaling internationally through solutions like employers of record (EOR) and global mobility programs.

Table of Contents

- What is co-employment?

- What are co-employment laws?

- Why is co-employment a risk?

- What are co-employment rules

- Co-employment do’s and don’ts

- How does co-employment work?

- What is the difference between co-employment and joint employment?

- Co-employment vs PEO

- Co-employment vs employee leasing

- Is co-op considered a full-time employee?

- Is it illegal to work for two jobs in the same industry?

- Co-employment examples

- Practical Case Study Example

- PamGro and Co-employment: Your Global Partner

What is Imputed Income?

Imputed income is the taxable value of non-cash benefits employees receive, even if they don’t pay for them.

These benefits increase an employee’s taxable wages for payroll and tax reporting purposes. Imputed income is essentially the cash value of any non-cash, fringe benefits that employees receive.

Imputed income applies when an employee receives personal benefits — such as domestic partner health coverage or life insurance above IRS limits — that are not paid in cash but still have value. Employers must report this amount for tax purposes, ensuring compliance with IRS and payroll laws, as it is considered taxable income.

Imputed income often comes in the form of benefits like group-term life insurance or gym memberships, which can enhance quality of life. Across global workforces, other countries have similar “taxable benefits” rules, meaning international employers must manage imputed income across multiple tax systems.

How Imputed Income Works

Imputed income is added to the employee’s taxable wages, increasing the amount subject to federal, state, Social Security, and Medicare taxes. The employer determines the fair market value of a tax-free benefit, adds it to payroll, and taxes it accordingly. Additionally, imputed income is added to the employee’s gross income and reported on Form W-2. Employers are generally required to report imputed income on each employee’s W-2 form.

For example, if an employee receives $200 in taxable benefits in a month, their taxable wages increase by $200, even though no cash is paid.

For companies hiring globally through EOR services like PamGro, imputed income rules vary by country. The EOR handles valuation and taxation according to local compliance requirements.

Why is Imputed Income Deducted From Your Paycheck?

Imputed income shows up on paychecks because taxes must be withheld on the value of taxable benefits. You are not actually paying for the benefit — you are just paying the tax due on it.

This ensures payroll compliance and prevents tax under-reporting. For remote teams and international workers, correct reporting avoids problems during payroll audits and end-of-year filings.

What is the Purpose of Imputed Income?

The purpose of imputed income is to treat certain fringe benefits as taxable compensation, and in special circumstances, ensure all employees are taxed fairly, regardless of how compensation is structured.

It prevents high-value perks from being used to avoid taxes. For globally distributed teams, Correct handling of imputed income also supports transparent payroll processes across borders — essential as companies hire internationally and provide global benefits packages through EOR or employer-sponsored benefit plans, highlighting the tax implications for employers.

Is Imputed Income Good or Bad?

Imputed income is neither good nor bad — it’s simply a tax rule. The benefits provided are generally valuable and often cost employees far less than they would pay individually.

Although imputed income impact can result in slightly higher tax withholding, it still enables employees to enjoy benefits like health coverage, group-term life insurance, relocation support, or educational assistance.

From an employer perspective, properly managing imputed income — especially for global talent — helps reduce compliance risks and strengthen benefit programs, ultimately enhancing the overall compensation package for employees. Fringe benefits can improve employee engagement and attract and retain talent.

Where Can I Find Imputed Income on My Paycheck?

You can typically find imputed income listed under earnings or benefit sections, labeled as: Employers must report imputed income on an employee’s Form W-2 for tax purposes. Total imputed income earned by an employee during the calendar year is reported in box 14 on Form W-2.

-

Imputed Income

-

Taxable Benefits

-

GTL Imputed

-

Domestic Partner Benefit

-

Fringe Benefit Taxable Income

It increases taxable wages but isn’t shown as cash earnings. International employees — including those managed under an EOR platform — will see comparable entries aligned with local terminology like “taxable benefit value,” which pertains to taxable imputed income.

How Imputed Income Is Calculated

Employers calculate imputed income based on fair market value, minus any amount an employee contributes toward that benefit.

For instance, the IRS provides valuation tables for group-term life insurance (Table I). Other benefits require reasonable valuation methods, documented consistently for payroll records. Employers need to track the value of each employee’s imputed income throughout the year to ensure accurate reporting and compliance.

For global employment, benefit valuation follows country-specific statutory rules, often managed automatically through an EOR to avoid miscalculation risks.

Fringe Benefits and Valuation

Fringe benefits are a key part of many compensation packages, offering employees non-cash benefits that can enhance their overall experience at work. These fringe benefits—such as company cars, housing allowances, or meals—often have significant tax implications because they may be considered imputed income. To accurately calculate imputed income, employers must determine the fair market value (FMV) of each fringe benefit provided. The FMV is the price an employee would pay to obtain the same benefit from a third party, reflecting its true economic value.

How Does Imputed Income Affect My Taxes?

Imputed income increases taxable earnings, which means an employee’s:

-

Federal income tax withholding increases

-

State taxes may increase (depending on state laws)

-

Social Security and Medicare contributions increase

While it results in slightly lower net pay, employees still gain access to valuable benefits, such as dependent care assistance.

For cross-border employees, taxation may differ based on local labor regulations — another reason global companies rely on Employer of Record solutions to administer payroll accurately

How Much Tax Will I Pay on Imputed Income?

Taxes are charged at your normal tax rate. For example, if you receive $2,400 annually in taxable benefits and are in a 22% bracket, tax owed is roughly $528 for the year.

Higher earners may pay more due to progressive tax brackets. If imputed income exceeds $1 million, a higher federal income tax rate is applied.

International workers may have additional tax rules — including social contributions — depending on the country where they are employed, complicating federal income tax purposes

What Is Excluded From Imputed Income?

Many employer benefits are excluded from imputed income because they support employee well-being or are considered business necessities. Common exclusions include various de minimis benefits provided to employees.

-

Standard employer health insurance (for employee + spouse/dependents)

-

Retirement plan contributions

-

Business travel reimbursements

-

Meals or snacks categorized as de minimis

-

Health Savings Account (HSA) employer contributions

-

Dependent care & adoption assistance (within IRS limits)

-

Qualified educational assistance programs

In other countries, benefit exclusions differ – meaning global hiring requires accurate country-specific benefit classification, particularly regarding what constitutes a de minimis benefit .

What Are Examples of Imputed Income?

Examples include:

| Benefit | Taxable Example |

|---|---|

| Domestic partner health coverage | Domestic partner not IRS-qualified dependent |

| Life insurance | Coverage above $50,000 |

| Company car | Personal/non-business use |

| Housing | Employer-provided housing or allowances |

| Education benefits | Tuition support above IRS limit |

| Relocation perks | Housing stipends, personal relocation support |

| Wellness perks | Gym memberships, club dues |

When hiring abroad, equivalent rules apply to perks like rent allowances, transportation subsidies, or employer-sponsored housing.

Benefits Experience and Imputed Income

The range of employee benefits—often called the benefits experience—directly impacts imputed income. Perks like gym memberships, wellness programs, tuition or adoption assistance, and dependent care may become taxable if they exceed IRS exclusion limits or don’t qualify as tax-exempt.

For example, a company-paid gym membership or education benefit above the IRS threshold may count as imputed income and be subject to tax. Employers should consult the IRS Employer’s Tax Guide to Fringe Benefits to ensure proper reporting. Understanding how benefits affect imputed income helps organizations design competitive, compliant benefits packages while minimizing unexpected tax liabilities for employees.

Case Study: Imputed Income for a Hybrid Global Workforce

A U.S.-based tech company provides domestic partner health coverage and $100,000 group-term life insurance to employees. An employee with a domestic partner receives $5,000 annual value in partner health benefits and $200 of taxable life insurance benefit.

Total imputed income = $5,200 annually

The employee pays tax on that value, but gains access to valuable coverage that would otherwise cost significantly more.

The same company hires engineers in the U.K., Philippines, and India using PamGro’s EOR solution. PamGro classifies taxable benefits in each country, applies fair market valuation, and ensures payroll filings comply with local laws.

This prevents tax errors for business purposes , maintains compliance, and gives employees globally consistent benefit value

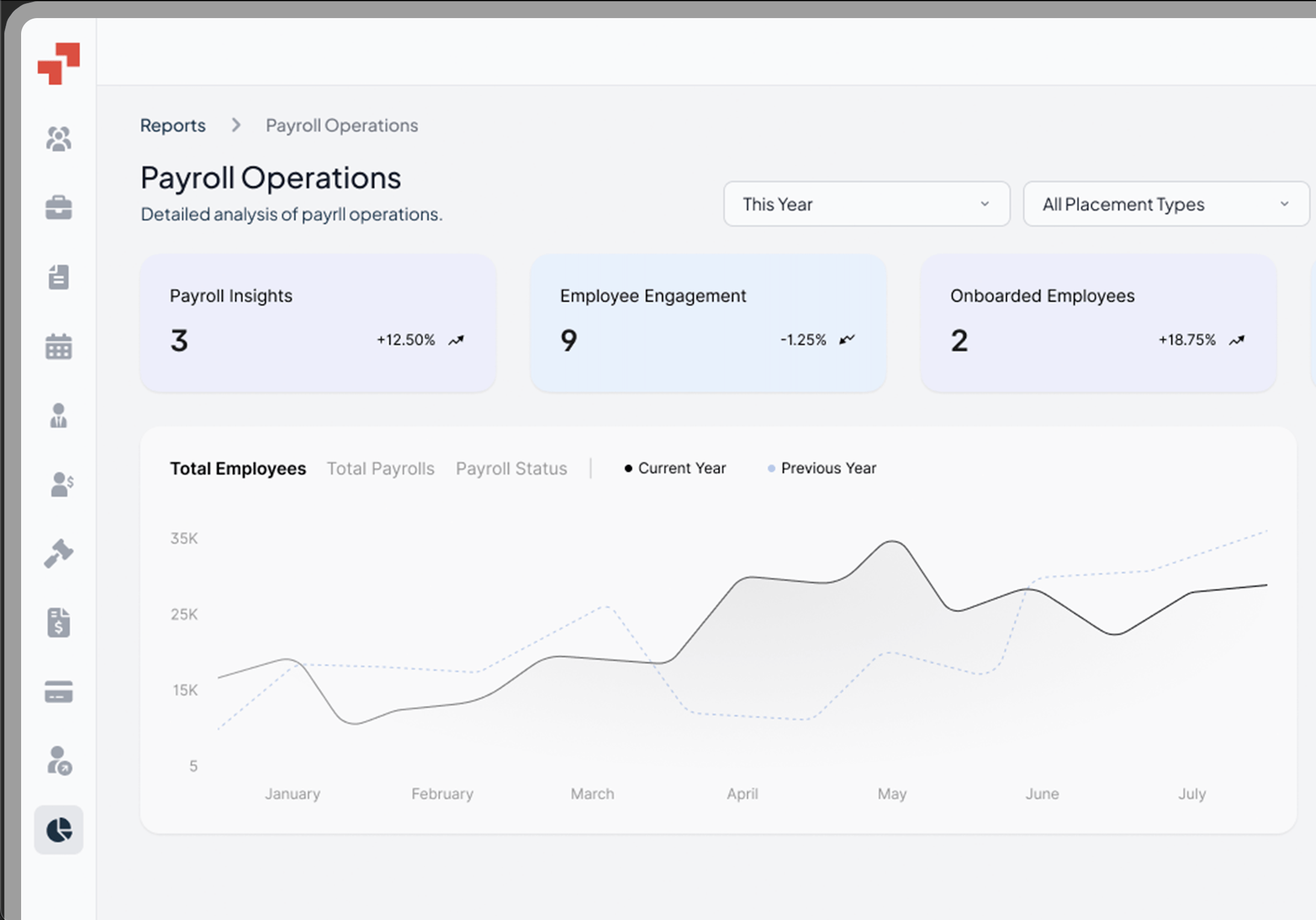

How PamGro Helps Employers Handle Imputed Income Globally

Managing taxable employee benefits across multiple countries can be complex, especially when determining low fair market values . PamGro simplifies it by:

-

Administering global payroll and benefits

-

Ensuring compliant valuation of taxable perks

-

Handling region-specific tax calculations

-

Supporting international hiring without setting up legal entities

-

Managing domestic partner, education, relocation & global mobility benefits under local rules

With PamGro as your EOR partner, you can hire globally, offer competitive benefits that are annually adjusted , and stay tax-compliant effortlessly — wherever your talent lives.

Scale your workforce globally — let PamGro manage payroll & benefit compliance across borders.

FAQs: Imputed Income and Its Effect on Taxes & Paychecks

Only indirectly — you pay taxes on the benefit value

Yes, unless the partner is an eligible IRS dependent

In some cases, it can increase taxable income enough to cross a bracket threshold

Yes, but taxed according to the laws of the country where the employee works

Yes — PamGro handles benefit taxation and compliance in each country, ensuring companies can report imputed income accuratel.

Hire the Best Talent, Anywhere