Global Workforce GlossaryDisregarded Entity

Related Terms

Floating Holiday

Tax Identification Number

W2 Employee

Holiday Pay

Form I-9

Expanding globally often requires choosing the right business structure, and that’s where terms like disregarded entity can become confusing. Many companies encounter this concept while managing international taxes or setting up subsidiaries. Understanding how these entities function can help simplify reporting, improve compliance, and streamline cross-border operations. Let’s explore what a disregarded entity means for businesses operating internationally.

Table of Contents

- What is co-employment?

- What are co-employment laws?

- Why is co-employment a risk?

- What are co-employment rules

- Co-employment do’s and don’ts

- How does co-employment work?

- What is the difference between co-employment and joint employment?

- Co-employment vs PEO

- Co-employment vs employee leasing

- Is co-op considered a full-time employee?

- Is it illegal to work for two jobs in the same industry?

- Co-employment examples

- Practical Case Study Example

- PamGro and Co-employment: Your Global Partner

What is a Disregarded Entity?

A disregarded entity is a business structure, often a single-member LLC, that the IRS treats as separate from its owner for legal purposes but not for federal tax purposes. In simple terms, the entity exists legally but “disappears” when it comes to tax reporting. Instead, all income, losses, and liabilities flow directly to the owner’s personal tax return.

This structure, typically a limited liability company, appeals to entrepreneurs because it combines limited liability protection with simplified tax reporting. Instead of filing a corporate tax return, the business owner typically reports income and business expenses on Schedule C of their personal return. It’s one of the simplest ways to operate a legally protected business while avoiding unnecessary paperwork.

Is it Better to Be a Disregarded Entity?

Whether it’s “better” depends on your business goals, size, and long-term strategy. Many small business owners and freelancers, especially those who operate as a sole proprietorship or are a sole member, prefer a disregarded entity because it avoids corporate double taxation while still shielding personal assets from liability. Disregarded entities avoid double taxation, as profits are taxed only at the individual’s personal income tax rate and the owner must also pay personal income tax not at the corporate level.

However, for larger businesses or those seeking outside investors, a corporation may be more advantageous. Corporations can attract equity financing, offer stock options, and sometimes optimize taxes differently. Business owners need to weigh simplicity against scalability when making this choice. For lean startups and solopreneurs, though, the disregarded entity structure often strikes the right balance.

What is a Disregarded Entity for Tax Purposes?

For federal tax purposes, a disregarded entity is invisible. The IRS doesn’t tax it separately but instead taxes the owner directly. For example, a single-member LLC doesn’t file a corporate tax return. Instead, the owner’s federal tax return, specifically Form 1040, includes the entity’s profits or losses. A single-member LLC classified as a disregarded entity generally must use the owner’s social security number (SSN) or employer identification number (EIN) for federal income tax purposes.

This treatment makes compliance easier but also means the owner is personally responsible for paying federal income tax, income taxes, self-employment taxes, and excise taxes. An owner of a disregarded entity must pay self-employment tax on all business profits, regardless of withdrawals. Owners of disregarded entities are considered self-employed and responsible for the full 15.3% self-employment tax on business profits. If the owner doesn’t properly withhold or pay, the IRS can pursue them directly.

What are the Pros and Cons of a Disregarded Entity?

Pros of Disregarded Entity:

- Simpler tax reporting than a corporation

- Avoids double taxation (profits taxed only once)

- Provides limited liability protection (legal shield for personal assets)

- Flexible—can later elect to be taxed as an S-Corp or C-Corp

Cons of Disregarded Entity:

- Owner pays self-employment taxes on all net earnings

- Limited fundraising opportunities compared to corporations

- Liability protection can be pierced if corporate formalities aren’t maintained

- May not be suitable for multi-owner or growth-focused businesses

Overall, disregarded entities, which are a type of separate legal entity, are excellent for small-scale businesses, including sole proprietors, that value ease of administration, but they can become restrictive as growth and investor needs expand. Business owners may prefer the disregarded entity structure for its ease of maintenance compared to corporations.

Can a Partnership Be a Disregarded Entity?

No. A partnership cannot be a disregarded entity because it has two or more owners, unlike community property owners . The IRS only allows single-owner businesses—such as a single-member LLC or a sole proprietorship—to be disregarded entities.

For married couples in community property states, however, there is an exception. They can elect to treat their jointly owned business as a disregarded entity for tax purposes, simplifying filing into one return.

What is the Tax Rate for a Disregarded Entity?

A disregarded entity itself doesn’t have a tax rate. Instead, the owner’s individual tax bracket determines the rate. This means all business income, including net income, “passes through” to the owner’s personal return, where it’s subject to federal income taxes and, in most cases, self-employment taxes (15.3% for Social Security and Medicare).

That said, not all income is taxed equally. Owners may qualify for certain deductions, credits, or the 20% Qualified Business Income (QBI) deduction, which can significantly reduce taxable income. Planning with a CPA or tax advisor regarding the entity classification election ensures the most efficient outcome.

Disregarded Entity vs Corporation: How do they Differ

A disregarded entity is simpler, taxed only once, and best suited for solo owners. A corporation is a separate taxpayer, can retain earnings, and has more complex compliance requirements.

- Disregarded entity: One owner, pass-through taxation, lower admin burden.

- Corporation (C-Corp): Separate tax return, subject to double taxation, but better for raising capital.

- Corporation (S-Corp): Pass-through taxation like LLCs but stricter ownership rules.

The choice depends on whether you value simplicity and direct control (disregarded entity) or scalability and investment potential (corporation).

What is the Difference Between LLC and Disregarded Entity?

An LLC (Limited Liability Company) is a legal structure recognized by state law. A Limited Liability Company (LLC) is an entity created by state statute. A disregarded entity, which is a common disregarded entity, is simply how the IRS treats certain LLCs (single-member only) for tax purposes. The owner of a single-member LLC uses their social security number (SSN) or employer identification number (EIN) for tax purposes.

- All single-member LLCs are disregarded entities by default, unless they elect otherwise.

- Multi-member LLCs are taxed as partnerships unless they elect corporate status.

- A single-member LLC does not need an EIN if it does not have employees or excise tax liability. A single-member LLC needs to obtain an EIN only if it has employees or is required to file excise tax returns.

So, while all disregarded entities can be LLCs, not all LLCs are disregarded entities. The distinction lies in tax classification, not legal form

Disregarded Entity Examples

- Single-Member LLC: Jane forms “Jane’s Consulting LLC.” Legally, it’s an LLC, but for taxes, Jane reports income on her Form 1040.

- Sole Proprietorship with Liability Protection: An independent contractor forms an LLC to shield personal assets but still reports taxes as an individual.

- Community Property Exception: A married couple in Texas runs a family business and elects to file as one disregarded entity.

These examples show how disregarded entities provide flexibility and simplicity, especially for entrepreneurs and freelancers

Practical Example: Disregarded Entity in Action

Imagine a U.S. startup founder, Ravi, who launches a software consulting firm. Instead of incorporating, he forms a single-member LLC to protect his personal assets. For the IRS, his LLC is a disregarded entity.

At tax time, Ravi reports all income and expenses directly on his personal return. This saves him from filing a corporate tax return, reducing admin costs. However, he must pay self-employment taxes on his net earnings. Later, when his business grows and he hires employees abroad, Ravi may consider how state tax law impacts his decision to elect S-Corp status or using an Employer of Record (EOR) like PamGro to simplify compliance.

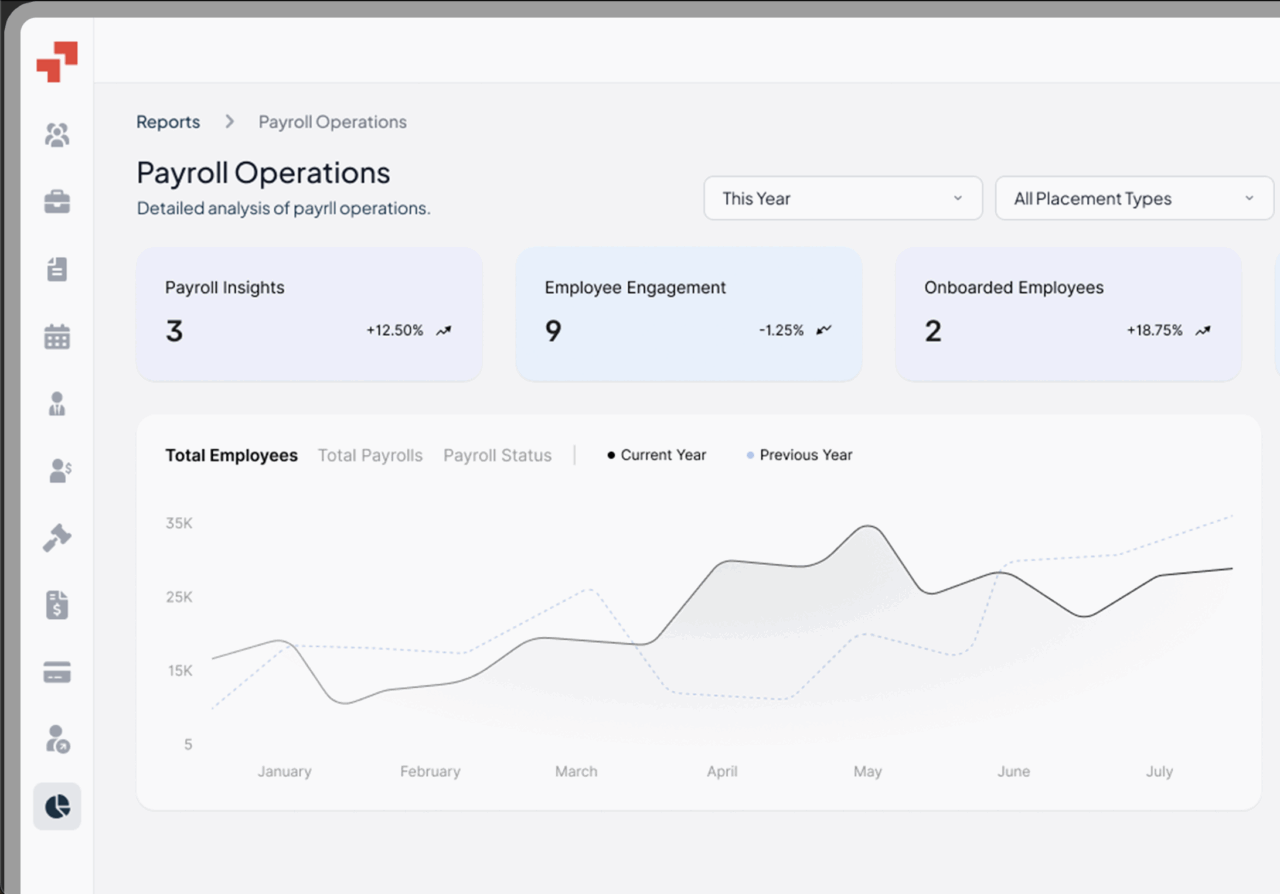

How PamGro Helps with Disregarded Entities and Global Hiring

While disregarded entities simplify U.S. taxes, expanding internationally introduces complex employment, payroll, and compliance challenges. A disregarded entity structure, which is a type of pass through entity, doesn’t exempt you from foreign labor laws or international tax obligations.

PamGro steps in to:

- Manage employment taxes for global hires

- Handle compliance across multiple countries without requiring you to set up a legal entity

- Simplify payroll while ensuring tax efficiency

- Provide expert guidance so your business avoids international tax pitfalls

- Allow entrepreneurs and startups to scale internationally without risk

If you own the most common disregarded entity, a single-member LLC, and want to expand beyond borders, PamGro ensures you can hire top talent anywhere while staying compliant.

👉 Ready to scale your disregarded entity into a global business? Talk to PamGro today and unlock international growth opportunities.

Hire the Best Talent, Anywhere