Global Workforce GlossaryCommon Law Employee

The term Common Law Employee often comes up when distinguishing between different types of workers and their employment relationships. In many jurisdictions, it refers to an individual whose work is directed and controlled by an employer, but the specifics can vary. Understanding this concept helps organizations ensure compliance and maintain clear boundaries in workforce classification.

Table of Contents

- What is career mobility?

- What is internal career mobility?

- How could mobility play a part in choosing a career?

- What is career mobility partnership?

- What is career mobility program?

- What is the meaning of work mobility?

- What is another name for career mobility?

- Define job immobility

- What is employee mobility process?

- What are the types of career mobility?

- What is career mobility in a corporate hierarchy?

- Example of Career mobility

- Practical Case Study: Career Mobility in Action

- How PamGro Supports Career Mobility

What is a Common Law Employee?

A common law employee is a worker whose employer controls both what work is done and how it is performed.

Under IRS common law rules, the level of behavioral and financial control determines employee classification. Companies in the US, UK, and EU must follow employment law and payroll compliance when designating a common law employee.

This designation matters because misclassification can trigger penalties, unpaid taxes, and liability for back pay, affecting the employer employee relationship. Employers must ensure they withhold Social Security, Medicare, and income taxes properly when hiring under common law rules. Additionally, employers are responsible for paying local and federal taxes on behalf of their common-law employees.

What is Considered a Common Law Employee?

A common law employee is considered someone who performs services under the direction of a company, with the organization controlling the work schedule, tools, and methods. Unlike independent contractors, they do not run an independent business.

In the US, the IRS determines status using behavioral, financial, and relationship factors, including various business aspects . In the UK, HMRC applies similar tests under employment law, and the EU uses labor law protections. This classification impacts tax withholding, benefits eligibility, and social security contributions.

What are Common Law Employee Duties?

Common law employee duties are determined by the employer, not the worker. Tasks are assigned, schedules are managed, and performance is evaluated based on company policies.

In the US, law employees may be expected to follow company-specific procedures, report to supervisors, and meet organizational goals. In the UK and EU, duties include adhering to statutory employment rights, such as working time regulations and safety laws. The key point: duties are controlled by the employer, reflecting dependent rather than independent business work. Employers must obtain workers’ compensation insurance for common-law employees but may not need it for independent contractors.

What are the Common Law Employee Rights

Common law employees are entitled to statutory rights under employment law. In the US, rights include Social Security, unemployment insurance, and wage protections. In the UK, rights extend to holiday pay, sick leave, and protection under unfair dismissal laws. EU employees gain additional protections under GDPR and local labor regulations. Common-law employees are often granted benefits such as health insurance and retirement plans, which independent contractors do not receive.

Employers must comply with these rules when classifying staff, ensuring payroll, wages, and benefits are properly managed. Misclassifying an employee as self-employed denies them rightful protections and can create compliance risks. If an employer misclassifies a contractor as an employee, they may be responsible for paying back pay and back benefits.

What Are Common Law Employee Factors?

The IRS determines a common law employee by evaluating three primary factors: The IRS uses these three major factors as evidence to prove a worker’s employment status.

- Behavioral control – Does the company control how tasks are done?

- Financial control – Does the worker depend on the company for income?

- Relationship type – Is there a long-term employee classification?

In the UK, similar tests apply under HMRC guidance, and in the EU, courts look at economic dependence. These factors help distinguish between employees and independent contractors.

Common Law Employee vs Leased Employee: What’s the Difference

A common law employee works directly for the company, under its supervision. A leased employee, by contrast, is employed by a staffing agency but assigned to another organization.

In the US, leased employees are often managed through professional employer organizations (PEOs). In the UK and EU, these arrangements resemble agency work. While both perform tasks for the company, only common law employees are directly classified for payroll and tax withholding under IRS and HMRC rules.

Common Law Employee vs Statutory Employee: What Sets Them Apart?

A common law employee is under full employer control, while a statutory employee is technically self-employed but treated as an employee for tax purposes.

The IRS designates specific roles (e.g., certain sales agents, life insurance representatives) as statutory employees. They file taxes differently and can deduct business expenses. In the UK and EU, there’s no identical statutory employee category, but similar hybrid roles exist under labor law. Classification depends on both control and statutory definitions.

Common Law Employee vs Independent Contractor : How Do They Differ?

The main difference is control and independence. A common law employee works under employer direction, while an independent contractor operates a separate business, controls their work, and pays their own taxes.

The IRS determines this using common law rules, focusing on behavior and finances. In the UK, IR35 legislation addresses contractor vs employee classification. Across the EU, misclassification penalties include back taxes and fines. Getting this wrong can expose companies to severe compliance risks. Employers may be liable for employment taxes if they classify an employee as an independent contractor without reasonable basis.

Is a 1099 a Common Law Employee?

No. A 1099 worker is not a common law employee. Form 1099 is used for independent contractors or self-employed individuals, not employees. Common law employees instead receive a Form W-2 in the US, showing tax withholdings. Employers do not need to withhold taxes for independent contractors who are responsible for managing their own taxes.

This distinction is critical for compliance. Employers who incorrectly issue a 1099 when a worker meets employee classification rules risk IRS audits, penalties, and retroactive payroll tax liabilities. UK and EU employers face similar misclassification risks under local tax authorities.

Common Law Employee Examples

Examples of common law employees include:

- A software engineer reporting to a manager at a tech company

- A marketing associate following company-set working hours

- A customer service agent using employer-provided systems

In all these cases, the organization directs how, when, and where work is performed. By contrast, an independent contractor, like a freelance web designer, controls their own workflow and client relationships. Understanding this distinction helps companies classify workers correctly for payroll and tax compliance

Practical Example / Case Study

A US SaaS startup expanding into the UK hires three developers. Instead of classifying them as contractors, the company treats them as common law employees because it dictates schedules, tools, and daily tasks. Under HMRC employment law, this requires payroll registration, tax withholding, and compliance with IR35 rules.

If misclassified, the company could face back taxes, penalties, and potential fines of $50,000+. By correctly designating them as common law employees and using an Employer of Record (EOR) like PamGro, the startup avoided legal risk, ensured compliance, and supported smooth global scaling.

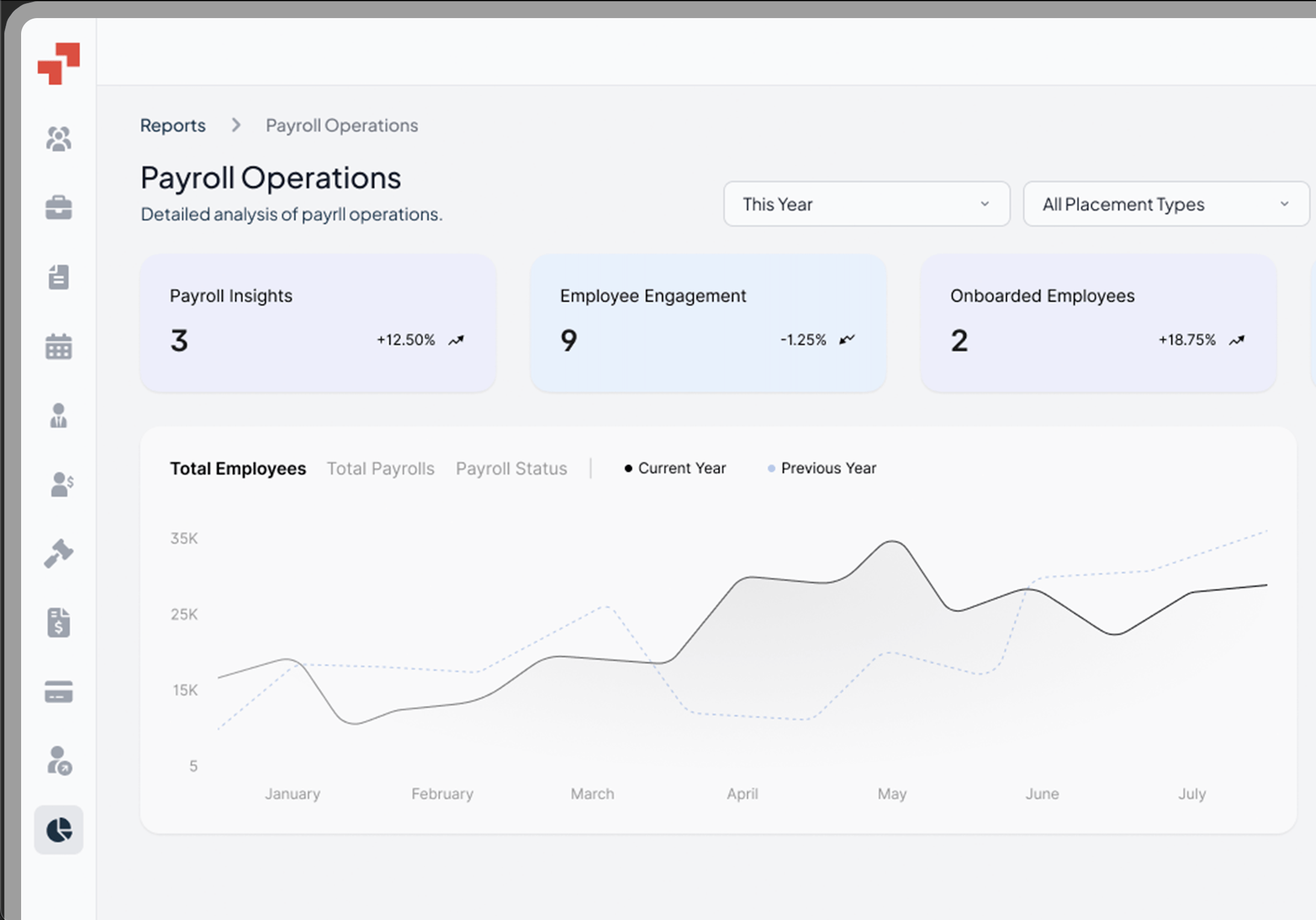

PamGro: Your Smarter Solution for Global Hiring

Hiring international talent shouldn’t create compliance headaches. Whether it’s understanding common law employee designation, handling payroll across borders, or navigating IRS and HMRC rules, PamGro makes it simple.

With PamGro’s Employer of Record services, your company can:

- Correctly classify workers across the US, UK, and EU

- Stay compliant with tax, Social Security, and labor law requirements

- Scale globally without setting up costly entities

Expand confidently with PamGro—the smarter way to build global teams.

Hire the Best Talent, Anywhere