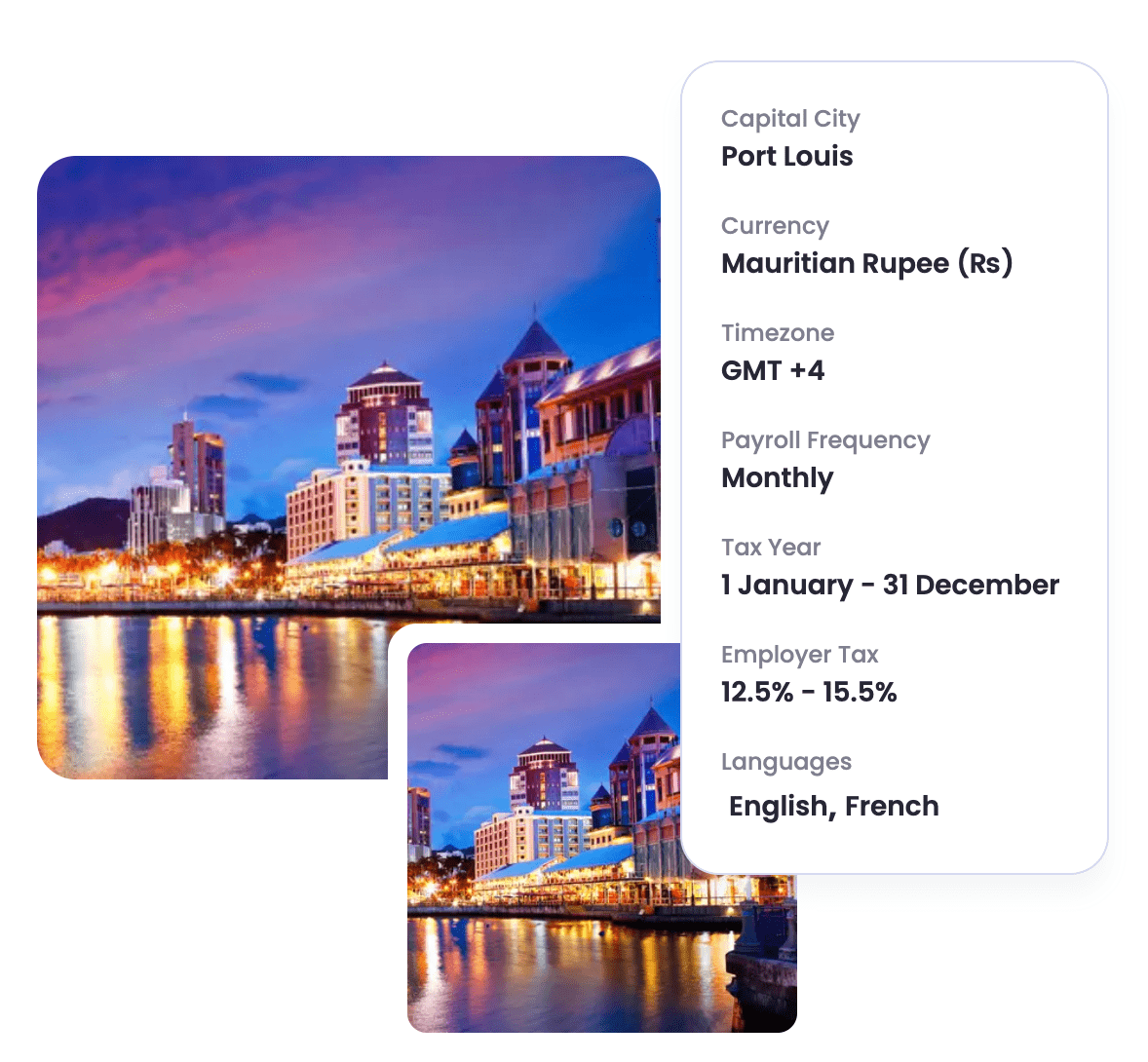

Employer of Record In MauritiusHiring in Mauritius with an Employer of Record

Your guide to hiring employees in Mauritius, covering employment and labor laws, payroll, benefits, onboarding and taxes. You can also manage and pay your contractors in Mauritius through PamGro.

Capital CitySacramento

TimezonePST (GMT-8)

Paid LeaveNo Legal Requirement

Income Tax1% - 13.3%

Employer Tax7.65%

Leave The Hiring to a Local Expert

Hire in Mauritius with ease, our experts handle employment and compliance for you.

EOR In Germany

$299

/month

Employer of Record in Mauritius

What is an Employer of Record (EOR) Service in Mauritius?

An Employer of Record (EOR) in Mauritius is a third-party organization that legally employs workers on behalf of a foreign company. This allows businesses to hire and manage employees in Mauritius without setting up a local legal entity.

The EOR becomes the legal employer and takes responsibility for:

-

Payroll processing

-

Employment contracts

-

Tax and social security contributions

-

HR administration

-

Compliance with Mauritian labor laws

EORs also provide comprehensive payroll management, tax compliance, and benefits administration, ensuring employment compliance and managing employees in line with Mauritian regulations.

Meanwhile, the client company retains full control over the employee’s day-to-day work, performance, and responsibilities.

How to Hire Employees in Mauritius Using an Employer of Record

Expanding into Mauritius involves navigating detailed labor, tax, and corporate regulations. There are two primary ways to hire employees:

Option 1: Set Up a Local Entity in Mauritius

Establishing a local entity means creating a formal business presence in Mauritius. The most common entity types are:

-

Domestic Companies (DC)

Suitable for local operations. Non-residents can hold shares. Commonly used for trade, consultancy, and investment activities. -

Global Business Companies (GBC)

Licensed by the Financial Services Commission (FSC). Can operate locally and internationally. If substance requirements are met, GBCs benefit from double taxation treaties and reduced tax rates. -

Mauritius Authorized Companies (MAC)

Treated as non-resident for tax purposes. Exempt from corporate income tax, capital gains tax, and withholding tax. Often used for international holding or investment structures.

Setting up an entity provides full control but requires incorporation, accounting, audits, annual filings, and ongoing compliance.

Option 2: Hire Employees via an Employer of Record

Hiring through an EOR eliminates the need to establish a local entity.

A Mauritius Employer of Record:

-

Employs workers on your behalf

-

Manages payroll, benefits, and taxes

-

Ensures compliance with local labor laws

-

Handles contracts, onboarding, and terminations

Choosing the right EOR partner in Mauritius provides effective workforce management and compliance support, helping your business adhere to local regulations while streamlining HR processes.

This option significantly reduces complexity, cost, and time to hire.

Employer of Record vs Local Entity Setup in Mauritius [Pros and Cons]

| Criteria | Employer of Record (EOR) | Local Entity Setup |

|---|---|---|

| Legal entity required | ❌ No | ✅ Yes |

| Time to hire | Days | Several months |

| Upfront costs | Low | High |

| Payroll & HR setup | Handled by EOR | Employer-managed |

| Compliance responsibility | EOR | Company |

| Flexibility | High | Low |

| Long-term control | Limited (EOR is legal employer) | Full control |

Setting up a local entity only makes sense for companies planning a large, permanent presence. For most international companies entering Mauritius for the first time, an EOR is faster, safer, and more cost-effective. EOR solutions also support a flexible workforce, allowing companies to scale teams up or down as needed while maintaining compliance. This approach benefits both employer and employee by simplifying HR processes and ensuring regulatory requirements are met.

Benefits of Using an Employer of Record in Mauritius

Discover the key benefits of using an Employer of Record (EOR) for your business operations in Mauritius, making global expansion seamless and compliant.

Key advantages include:

-

Fast market entry – Hire employees in days, not months

-

Full legal compliance – Mauritian labor law is employee-protective and complex

-

Reduced legal risk – EOR manages contracts, payroll, and statutory obligations

-

Operational simplicity – No need to build local HR, payroll, or legal teams

-

Cost efficiency – Avoid incorporation and ongoing administrative expenses

EOR services not only streamline your business operations but also enhance employee satisfaction by providing efficient onboarding, payroll, and benefits management. The EOR also ensures full compliance with requirements such as the mandatory 13th-month salary, statutory leave, and termination protections.

Cost to Use an Employer of Record Service in Mauritius

The total cost typically includes:

-

EOR service fee

-

Flat monthly fee per employee or

-

Percentage of gross payroll

-

Statutory employment costs, including:

-

Social security contributions

-

Mandatory benefits (e.g., 13th-month salary)

-

Payroll deductions as required by Mauritian law

-

Any additional employee benefits offered

An Employer of Record (EOR) also manages all tax obligations to ensure full legal compliance with Mauritian labor laws.

The final cost depends on salary level and benefits structure. In most cases, using an EOR remains significantly cheaper and more flexible than maintaining a local entity.

Employee Cost CalculatorGet an instant breakdown of the True Costs of Hiring Employees in Mauritius

Hiring in Mauritius

Employment Contracts in Mauritius

Employment contracts are mainly governed by:

-

Workers’ Rights Act 2019

-

Employment Rights Act 2008

Employment contracts in Mauritius must comply with Mauritius labor laws and clearly outline termination procedures to ensure legal compliance and fair treatment of employees.

It is important to regularly monitor the compliance status of employment contracts to ensure they remain up to date with any changes in local laws and regulations.

Common Contract Types

-

Indefinite-term contracts (most common)

-

Fixed-term contracts (projects or temporary roles)

-

Part-time contracts (with regulated hours and benefits)

Key Contract Terms

-

Job title and responsibilities

-

Working hours and overtime rules

-

Salary and benefits

-

Leave entitlements

-

Notice periods and termination clauses

Additional notes:

-

Standard workweek: 45 hours

-

Contracts must meet sector-specific minimum wages

-

Confidentiality clauses are common

-

Non-compete clauses must be reasonable and are limited in enforceability

Disputes typically proceed through internal procedures, mediation via the Commission for Conciliation and Mediation, or the Employment Relations Tribunal.

Minimum Wage in Mauritius

-

MUR 17,745 per month

-

This is an increase of MUR 635 over the 2025 rate to account for the cost of living.

-

Minimum wage is sector-specific

Working Hours & Overtime

- Working Hours

-

-

Standard workweek: 45 hours

-

Maximum: 8 hours per day (excluding breaks)

-

- Overtime Rules

-

1.5× normal pay on weekdays

-

2× normal pay on public holidays

-

Maximum overtime: 90 hours per month

-

Average Salary in Mauritius

-

Approx. MUR 43,488 per month

-

Equivalent to ~USD 1,015

Taxes in Mauritius

Mauritius has a relatively simple and business-friendly tax system. Payroll operates under the PAYE (Pay As You Earn) system, meaning employers are responsible for withholding and remitting income tax and statutory contributions on behalf of employees.

Payroll systems must accurately manage employee data to ensure correct tax withholding and reporting.

Employer Contributions

Employer Taxes: ~6% – 8% (approximate, depending on salary band)

-

CSG (Social Contribution): 3% or 6%,

-

3% if salary is less than MUR 50,000

-

6% if salary is more than MUR 50,000 (Replaces NPF).

-

-

National Savings Fund (NSF): 2.5% (applicable up to wage cap)

-

HRDC Training Levy: 1.5% (on basic salary)

Some contributions are capped and may vary slightly based on employee category and wage level.

Employee Contributions

Employee Contributions: 2.5%-4% (approximate, depending on salary band)

-

CSG (Social Contribution): 1.5% or 3%,

-

1.5% if salary is less than MUR 50,000

-

3% if salary is more than MUR 50,000 (replaces NPF)

-

-

National Savings Fund (NSF): 1% (up to wage cap)

Income Tax (PAYE)

Employees are required to pay a tax on their income in Mauritius. However, the tax rate levied on personal income is relatively low compared to other countries. The following tax rates are applicable to the income of the employees.

| Chargeable Income (Annual) | Income Tax Rate |

| First MUR 500,000 | 0% |

| Next MUR 500,000 | 10% |

| Remainder (above MUR 1,000,000) | 20% |

Following the Budget 2025/26, Mauritius has moved to a three-tier progressive system. This was a major reform intended to reduce the burden on low-to-middle income earners.

Work Permits & Visas in Mauritius

Foreign nationals must hold valid work authorization to be employed in Mauritius. Common options include Occupation Permits, Work Permits, Permanent Resident Permits, and the Premium Visa for remote workers. Employers must demonstrate compliance with local regulations and provide valid employment contracts when sponsoring foreign employees.

Employee Benefits in Mauritius

Mauritius has a structured employee benefits framework that includes mandatory paid leave, social security contributions, and family-related protections. Benefits administration is a key part of ensuring compliance with local laws, as it involves managing employee benefits processes in accordance with legal requirements.

Many employers also offer optional benefits such as private health insurance or enhanced retirement plans to attract and retain skilled workers. All benefits must align with local labor laws.

Mandatory Leave Entitlements in Mauritius

In Mauritius, employee leave entitlements are regulated under the Workers’ Rights Act 2019 and related regulations. Employers must comply with statutory leave requirements covering annual leave, public holidays, parental leave, sick leave, and special leave events.

Annual Leave Entitlement

Full-time employees in Mauritius are entitled to 20 working days of paid annual leave per year. This entitlement applies once an employee has completed 12 consecutive months of continuous service with the same employer. Public holidays may fall either within these 20 days or be granted separately, depending on employer policy and sector rules.

Public Holidays in Mauritius

Mauritius observes a mix of fixed-date and religious public holidays. Holidays falling on weekends may be shifted to a weekday at the government’s discretion. Religious holidays based on the lunar calendar are confirmed closer to the date.

| Public Holiday | Typical Date |

|---|---|

| New Year’s Day | 1 January |

| New Year Holiday | 2 January |

| Chinese New Year | January (date varies) |

| Abolition of Slavery | 1 February |

| Thaipoosam Cavadee | February (date varies) |

| Maha Shivaratree | February (date varies) |

| National Day | 12 March |

| Ugadi | March (date varies) |

| Eid al-Fitr | April (date varies) |

| Labour Day | 1 May |

| Ganesh Chaturthi | August (date varies) |

| Divali | October (date varies) |

| All Saints’ Day | 1 November |

| Arrival of Indentured Labourers | 2 November |

| Christmas Day | 25 December |

Paid Time Off (PTO)

Any full-time employee who has worked continuously for 12 months with the same employer is entitled to 20 working days of paid annual leave, funded by the employer. This forms the core PTO entitlement under Mauritian labor law.

Maternity Leave in Mauritius

As of 7 June 2024, maternity leave entitlements were expanded. Female employees are entitled to 16 weeks of fully paid maternity leave, provided they have completed at least 12 months of continuous service.

Key provisions include:

-

Up to 8 weeks may be taken before the expected delivery date

-

An additional 2 weeks is granted for multiple or premature births

-

The same 16-week entitlement applies in cases of stillbirth (with medical proof) or adoption of a child under 12 months

-

A maternity allowance of Rs 2,000 per month is paid for nine months from the third trimester

-

Employees are protected from dismissal during maternity leave

Paternity Leave in Mauritius

Paternity leave rules were expanded under reforms introduced in 2024. Fathers are now entitled to 4 consecutive weeks of fully paid paternity leave, subject to eligibility.

Key conditions:

-

Requires 12 months of continuous service

-

Employees with shorter service may still fall under the previous 5-day entitlement

-

Leave should be taken around the time of childbirth, with limited flexibility by agreement

-

Job protection applies during the leave period

Sick Leave Entitlement

Employees are entitled to up to 15 days of paid sick leave per year. Eligibility generally arises after 12 months of service, but employees with no absences in the first six months may qualify earlier. Sick leave is paid by the employer under the Workers’ Rights Act 2019

Marriage Leave

Employees are entitled to 6 days of paid leave for their first marriage, allowing time for ceremonies and related personal matters.

Bereavement Leave

In the event of the death of a close family member, employees are granted 3 days of paid bereavement leave to manage funeral arrangements and personal matters.

These statutory leave entitlements form a key part of employment compliance in Mauritius and must be applied correctly by employers or managed on their behalf through an Employer of Record.

Onboarding in Mauritius

When hiring through an EOR, onboarding can usually be completed within one to two working days once all required information is submitted. Additional time may be required for foreign nationals due to right-to-work checks or immigration approvals. Payroll cut-off dates can also affect start timelines.

The onboarding process is designed to be user-friendly and does not require extensive technical expertise, making it accessible and efficient for all users.

Steps to Onboard Employees in Mauritius Through an Employer of Record

When using an EOR, the onboarding process is centralized and standardized. The EOR collects the necessary employee documents, prepares the employment contract, completes statutory registrations, and activates payroll and benefits. Only after these steps are completed does the employee formally start work.

This ensures that employment is compliant from the first working day.

Termination of Employment in Mauritius

Employment termination in Mauritius must follow strict legal procedures. Valid reasons include misconduct, poor performance, negligence, fraud, or genuine business needs. Proper termination procedures are essential for maintaining positive industrial relations.

Employers are required to provide written notice and, where applicable, conduct disciplinary hearings. Notice periods vary based on length of service, and employees with sufficient tenure may be entitled to severance payments.

How to Terminate Employees in Mauritius Using an Employer of Record

When an EOR is involved, the EOR manages the legal termination process, including notice calculations, final payroll, statutory settlements, and required documentation. This reduces the risk of procedural errors and legal disputes for the client company.

Why Use PamGro for Employer of Record in Mauritius?

If your business plans to hire employees in Mauritius without establishing a local legal entity, PamGro offers a reliable and fully compliant Employer of Record solution. PamGro supports business expansion in Mauritius by leveraging local expertise and specialized knowledge of Mauritian employment laws, regional employment dynamics, and island-specific business practices.

Mauritius has detailed employment and payroll tax regulations, and PamGro’s EOR service ensures you remain compliant at every stage while expanding your workforce quickly and confidently.

Key Advantages of Hiring Through PamGro’s EOR in Mauritius

Rapid market entry

PamGro enables you to hire talent in Mauritius within days, eliminating the long timelines typically associated with company incorporation and local registrations.

Complete compliance with local laws

Our EOR service ensures full adherence to Mauritian labor and payroll regulations, helping you avoid misclassification risks, penalties, and compliance gaps.

Streamlined payroll and tax management

We manage payroll processing end to end, including tax calculations, statutory deductions, and reporting. Our systems stay aligned with regulatory changes so you remain compliant without added effort.

Reduced operational costs

Setting up and maintaining a local entity in Mauritius involves incorporation fees, accounting, audits, and ongoing compliance costs. Using PamGro’s EOR removes these expenses and provides a more cost-efficient alternative.

Lower internal resource requirements

With HR administration, payroll, and compliance fully managed by PamGro, your internal teams can focus on strategic priorities and business growth rather than local administration.

In-House Expertise and Local Entity Ownership

PamGro owns and operates its own legal entity in Mauritius, allowing us to deliver all EOR services directly. This means no third-party dependencies, faster turnaround times, reduced costs, and a consistently positive employee experience. Our local specialists provide dedicated, on-the-ground support throughout the employment lifecycle.

To learn more and see how PamGro’s EOR platform works in practice, book a demo with our team today.

Top Employer of Record Companies in Mauritius [2026 List]

FAQs – Employer of Record in Mauritius

1. Which companies offer employer of record solutions in Mauritius?

Several international and regional providers offer employer of record Mauritius services, including multi-country EOR platforms and Africa-focused providers. They differ in pricing models, local compliance depth, and service scope.

2. What are the sources of employment law in Mauritius?

Mauritius employment law is mainly governed by the Workers’ Rights Act 2019, along with regulations and guidelines issued by the Ministry of Labor, Industrial Relations, Employment, and Training.

3. What is the 13th month salary in Mauritius?

The 13th month salary is a mandatory payment under the Workers’ Rights Act 2019, equal to one-twelfth of an employee’s annual earnings, typically paid as an end-of-year bonus.

4. Which companies offer Employer of Record solutions in Mauritius?

Several global and regional providers offer Employer of Record services in Mauritius, including multi-country EOR platforms and Africa-focused providers. One such provider is PamGro, which delivers EOR services through its own local entity in Mauritius.