TABLE OF CONTENTS

The world is shrinking, at least in a sense that matters to businesses like yours. Businesses today can access talent from anywhere as long as it can be found on the globe. Thanks to the rise of remote work, companies now recruit top talent regardless of their geographical location.

The world of hiring overseas contractors comes with its own set of challenges, and navigating the intricacies of international contractor payments can be a major hurdle. This guide will provide you with the information and techniques needed to pay your international contractors smoothly, legally, and effectively.

What is an international contractor?

An international contractor is an independent contractor who lives outside the country where you conduct business. They are self-employed workers who perform specific services or complete projects for various companies.

Benefits of hiring foreign independent contractors

1. Access to a Global Talent Pool

-

Expand your search beyond geographical limitations and tap into a vast pool of skilled individuals. This allows you to find the best person for the job, regardless of location. You’re not restricted to the talent available in your local market.

2. Diverse perspectives

- Diverse perspectives from international contractors can spark innovation and creativity within your team.

- Exposure to different work styles and approaches can lead to new ideas and solutions. This can give your business a competitive edge in the global marketplace.

3. Cost savings

- Hiring overseas contractors can potentially offer cost savings compared to local talent, especially for specialized skill sets.

- This can be beneficial for startups and smaller businesses operating within constrained budgets. Explore cost-effective options while maintaining high-quality work.

What to consider before hiring foreign contractors?

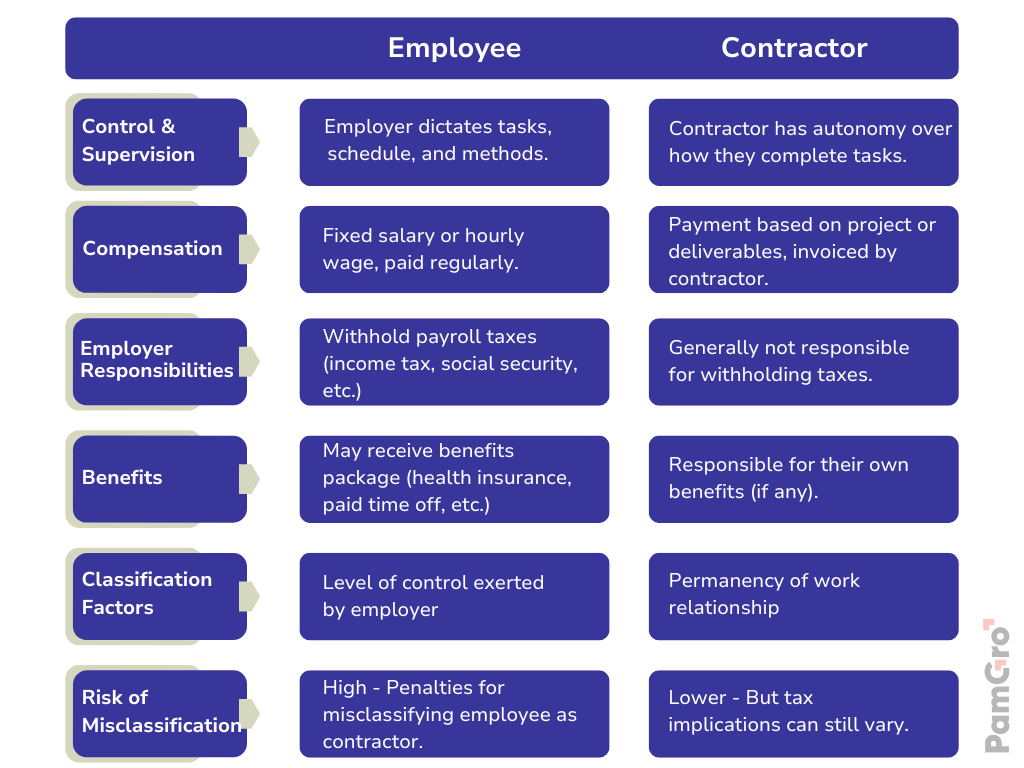

Risk of Misclassification

- Worker misclassification occurs when a worker’s daily responsibilities resemble those of an employee, yet they are hired as an independent contractor. If the IRS determines that you have misclassified an employee, you could face significant fines and even jail time.In the U.S., an independent contractor is typically someone who controls their own working schedule and methods, pays their own taxes, and has the flexibility to work for multiple companies simultaneously. Conversely, companies hiring foreign contractors often retain control over the final product or service delivered.

- If an employer dictates the entire work process, the worker is likely a full-time employee, necessitating the provision of employment benefits and the payment of payroll taxes.

- Worker misclassification rules differ by country. To mitigate the risk of misclassification when hiring foreign contractors, it’s essential to adhere to the labor laws and classification standards of the respective countries, which may vary significantly from those in your own country.

Complying with foreign tax laws

- Many startups and businesses hesitate to hire foreign contractors due to unfamiliar tax obligations and the additional paperwork involved. For instance, U.S. companies are not required to pay taxes or handle tax reporting for foreign contractors, as these contractors are self-employed and manage their own tax filings.

- However, U.S. companies must collect IRS Form W-8BEN or W-8BEN-E from contractors working outside the U.S. These forms verify the contractor’s foreign status and gather their individual taxpayer identification number (ITIN), which functions similarly to a social security number for non-U.S. citizens.

International payment processes and fees

-

Transferring money across international borders entails transaction fees, fluctuating currency exchange rates, and the possibility of unsupported payment methods in certain regions. Below, we outline some effective payment methods for compensating international contractors.

Permanent establishment risk

- When a global company neglects to clearly define its operational status in a foreign country, including the tax and income classification of its workers, the foreign government—typically through its tax authorities—will intervene and determine the worker designation based on permanent establishment regulations.

- If a local tax agency asserts that a business is continuously operating within its borders, it may categorize that business as a permanent establishment. Consequently, the company would be obligated to comply with local corporate tax laws and income reporting requirements, in addition to facing potential fees and penalties for non-compliance.

Best Practices For Paying Foreign Contractors

In this Guide to Global Expansion, we will be discussing essential insights and strategies for successfully expanding your business globally. Gain a comprehensive understanding of the complexities involved in international business growth.

Complete a KYC check

- Conducting a KYC (Know Your Customer) check is a crucial step in the hiring process and should be completed before onboarding a contractor and initiating payments. This process confirms the contractor’s identity, ensuring that you are not engaging with someone whose bank account is linked to criminal activity.

- Several international wire transfer services can perform KYC checks on your behalf, as can certain payment applications like Payoneer and freelance platforms such as Upwork.

Define the payment terms

- Once you’ve confirmed the contractor’s identity, work with the contractor to define their payment terms.

- The payment terms should include four factors: payment frequency, payment method, payment amount, and payment schedule.

Create a contract

- Finally, create an independent contractor agreement compliant with their local laws.

- The contract should include the following, at a minimum: scope of work, payment terms, and termination clause.

Get The Ultimate Playbook for US Tech Startups Looking to Expand in Europe

Europe awaits. But compliance, hiring, & market fit?

PamGro’s got you covered.

Payment Options for International Contractors

1. International Wire Transfer:

This traditional bank transfer method involves sending money electronically from your bank account directly to your contractor’s bank account. While widely available, international wire transfers can be expensive due to intermediary bank fees and potentially unfavorable exchange rates.

| Pros | Cons |

| Widely available and familiar | Expensive due to intermediary bank fees and exchange rates |

| Secure and reliable | Slow processing times (can take several business days) |

How it Works:

- Initiate a wire transfer request with your bank.

- Provide your contractor’s bank details, including account number, routing number, and bank address.

- Specify the amount and currency you want to transfer.

- Pay any applicable wire transfer fees charged by your bank.

- Your contractor receives the funds in their bank account minus any intermediary bank fees deducted along the way.

2. Online Payment Services:

Platforms like PayPal, Payoneer, and TransferWise offer convenient and often cost-effective solutions for international payments. These services typically charge transaction fees, but they can be significantly lower than traditional wire transfers. However, some platforms might have limitations on transaction amounts or may not operate in certain countries.

| Pros | Cons |

| Convenient and user-friendly online platforms | Transaction fees can add up, especially for large or frequent payments |

| Faster processing times compared to wire transfers | May have limitations on transaction amounts or supported countries |

Popular Options:

- PayPal: A widely recognized platform for online payments. Ensure both you and your contractor have verified accounts and that PayPal operates in both of your locations. The transaction fees tend to be higher for payments made internationally.

- Payoneer: A platform specifically designed for freelancers and businesses working internationally. Offers competitive fees and a global payment network.

- TransferWise: Known for its transparent pricing and focus on mid-market exchange rates. A good option for larger transactions due to its competitive fees.

How it Works:

- Sign up for your preferred online payment service.

- Connect your bank account/credit card for the setup.

- Add your contractor’s details, including their email address and any required bank information.

- Specify the amount and currency you want to transfer.

- Pay any applicable transaction fees charged by the platform.

- Your contractor receives the funds in their account or linked bank account, typically within 1-3 business days.

3. Global Employer of Record (EOR) Services:

For companies seeking a more comprehensive solution for international contractor payments, partnering with a Global EOR can be a game-changer. EOR companies like PamGro act as the legal employer of your overseas contractors, handling a variety of tasks, including:

- Payroll Processing: The EOR takes care of calculating and processing payroll for your overseas contractors, ensuring compliance with local regulations.

- Tax Withholding: The EOR withholds appropriate taxes from your contractor’s payments.

- Benefits Administration (Optional): Some EORs offer the option to provide benefits such as health insurance to your overseas contractors.

- Compliance Management: The EOR ensures adherence to all local employment and tax laws in the contractor’s country. This relieves you of a significant administrative burden.

| Pros | Cons |

| Streamlined onboarding process for overseas contractors | Typically, higher cost compared to other payment methods |

| Reduced administrative burden for payroll, taxes, and compliance | Less control over the employer-employee relationship as the EOR is the legal employer |

| Mitigated legal risks associated with employing overseas workers | – |

| Access to a wider talent pool without establishing legal entities in each location | – |

How it Works:

- Partner with a reputable Global EOR service provider.

- Discuss your specific needs and the location(s) of your overseas contractors.

- The EOR onboards your contractors as their legal employer.

- You provide the EOR with the agreed-upon compensation for your contractors.

- The EOR handles payroll processing, tax withholding, and compliance for your contractors.

- Your contractors receive their net pay after taxes and deductions.

Customer Success Story

Discover how Pamgro’s Expertise helped a recruiting company for a seamless cross-border expansion across the UK and Netherlands.

Choosing the Right Payment Method for Your Business

There’s no one-size-fits-all answer when it comes to best ways to pay for paying overseas contractors. The best method depends on several factors, including:

- Transaction Size & Frequency: For larger, frequent payments, an EOR service might offer cost savings and convenience, while online payment services might be sufficient for smaller, occasional transactions.

- Contractor Location: Ensure your chosen payment method operates in both your country and the contractor’s location. Some online payment services may have limitations in certain regions.

- Tax Implications: Research any potential tax implications associated with different payment methods. It’s strongly advised to consult with a tax advisor to ensure compliance and prevent penalties.

- Desired Level of Control: Consider the level of control you require over the employer-employee relationship. An EOR provides a more hands-off approach, while online payment services offer more direct interaction with your contractor.

Simplifying International Payments with PamGro

PamGro makes working with foreign contractors easy by taking care of the most time-consuming and complex tasks for you to pay international contractors.

By embracing the global marketplace and leveraging the diverse talent pool it offers, companies can unlock a world of opportunity. Understanding your options for paying overseas contractors, choosing the right payment method based on your specific needs, and following essential best practices are crucial for a smooth and successful experience. The world is waiting – go forth, build your dream team, and confidently conquer the global market!

Case Study - Utilizing Online Payment Services for Efficiency

Imagine “Aone Widgets,” a growing software development company in the United States. Aone needs to hire a talented full stack developer with expertise in a specific framework. Their search leads them to a highly skilled individual in Ukraine. However, establishing a legal entity in Ukraine seems like an overwhelming task for their small HR team.

Aone decides to utilize a reputable online payment service. It allows them to pay their Ukrainian developer securely and conveniently, with transparent fees and favorable exchange rate rates. The developer receives their payments on time and without hassle, fostering a positive working relationship. Aone benefits from the developer’s expertise and avoids the complexities of international payroll and tax regulations.

Payroll Solutions Unrivalled since 15 Years