Global Workforce GlossaryA1 Certificate

Related Terms

Work Authorization

Residence Permit

EU Platform Work Directive (PWD)

Global Mobility

Visa Support Letter

When businesses send employees to work abroad across borders within Europe, one of the biggest challenges is managing social security obligations correctly. The A1 Certificate helps resolve that complexity by proving which country’s social security system applies during a temporary posting. Understanding how it works is crucial for companies planning European business travel or short-term assignments.

Table of Contents

- What is co-employment?

- What are co-employment laws?

- Why is co-employment a risk?

- What are co-employment rules

- Co-employment do’s and don’ts

- How does co-employment work?

- What is the difference between co-employment and joint employment?

- Co-employment vs PEO

- Co-employment vs employee leasing

- Is co-op considered a full-time employee?

- Is it illegal to work for two jobs in the same industry?

- Co-employment examples

- Practical Case Study Example

- PamGro and Co-employment: Your Global Partner

What is an A1 Certificate?

An A1 Certificate is an official document issued under EU Regulation (EC) No. 883/2004. It certifies which country’s social security legislation applies to an employee or self-employed person working temporarily in another EU or EEA member state, or Switzerland.

In short, it prevents double social security contributions and provides legal clarity on insurance coverage.

It’s a key compliance document for cross-border work, ensuring that employees and self employed people remain insured under their home country’s system while temporarily operating elsewhere in the EU.

What Does an A1 Certificate Do?

The A1 Certificate confirms that an employee continues to pay social insurance in their home country while on assignment abroad. This ensures there’s no overlap in contributions between the host and home countries, and that each employee covered is fully compliant with local regulation .

It also serves as official proof to foreign authorities during audits or workplace inspections that the worker’s social security obligations are already fulfilled in their origin country, which is especially important when meeting clients . Employers benefit by avoiding additional payments and administrative duplication.

How to Get an A1 Certificate

The application process involves employers or self-employed professionals who need to process applications by applying to the competent social security institution in their home country. The process involves submitting the official A1 application form, providing details of the assignment, and proof of ongoing insurance coverage.

Typical steps:

- Fill out the A1 or Statement of Applicable Legislation form.

- Attach the employment contract or business documentation.

- The authority reviews and issues the certificate — digitally or by mail.

Processing times vary by country, so early application is recommended, ideally before the posting begins.

How to Apply for an A1 Certificate

For employees, the employer usually submits the application. For self-employed workers, the process can be done individually through the national social security portal, which also may require immigration filings

Applications are generally free and can often be completed online. The form includes details such as the employee’s name, duration of assignment, type of work, and the host or destination country. It’s best to apply several weeks in advance to avoid delays.

What Does an A1 Cover?

The A1 Certificate specifies which country’s social insurance system applies to the worker. It covers various aspects including the maximum period of contribution to the social insurance system.

- The start and end dates of the coverage period

- The country responsible for pension, healthcare, and social security

- The worker’s personal and employer details

It confirms that contributions continue only in the issuing (home) country, protecting both employers and employees from double payments, including those of the employee abroad . The A1 also connects indirectly with benefits like the European Health Insurance Card (EHIC), ensuring that contributions are paid for continuous healthcare access abroad.

When is an A1 Certificate Required?

An A1 Certificate is required whenever an employee or self-employed person temporarily works in another EU/EEA country or Switzerland while maintaining ties with their home employer.

Common examples include cases of non compliance with social security regulations.

- Business trips or training in another EU country

- Temporary project work or short-term postings

- Remote work from another member state

- Cross-border roles between two or more EU countries

Even for brief visits, authorities may request proof of social security coverage. Without an A1, companies risk fines or dual contributions.

How Long Does It Take to Get an A1 Certificate?

Processing can take anywhere from a few days to several weeks depending on the country. Some systems, like the Netherlands’ SVB or Finland’s pension centre, issue certificates digitally within 10 days.

Delays often occur when additional documentation or verifications are required. Employers should plan ahead and apply well before the travel date. In urgent cases, authorities may issue confirmation of the application that can be presented during inspections.

What Is the Difference Between A1 and CoC?

The A1 Certificate is specific to the EU/EEA and Switzerland. It ensures coordination under EU social security law.

The Certificate of Coverage (CoC) serves the same purpose but applies outside the EU, usually under bilateral social security agreements (for example, the U.S. Social Security Administration issues CoCs for international assignments)

In essence, both documents confirm where contributions are due — A1 within the EU, CoC outside it

What Is the Purpose of the A1 Certificate?

The A1 Certificate provides legal certainty about which social security system applies when working temporarily abroad in many countries . It prevents dual contributions, ensures continuous benefits under certain conditions , and reduces administrative burdens for both employer and employee.

It also acts as documentary proof during audits or inspections that social insurance obligations are already met in the home country. Without it, companies could face unexpected costs or penalties.

Can the A1 Certificate Replace a Travel Visa or Work Permit?

No. The A1 Certificate cannot replace a visa or work permit. It only determines which country’s social insurance rules apply. Employers must still comply with host country immigration, labor, and tax regulations.

However, many EU states require the A1 as part of their posted-worker documentation. Having a valid certificate supports transparency during compliance checks, but it doesn’t authorize employment in the host country.

Example: How the A1 Certificate Works in Practice

A UK-based tech startup (with EU coverage through an Irish entity) sends an engineer to Germany for a 6-week system deployment project. Before departure, the company applies for an A1 Certificate through Ireland’s Department of Social Protection.

Once approved, the engineer continues contributing to Irish social insurance while working in Germany. The German authorities recognize the A1, eliminating double contributions.

The result? Seamless mobility, clear compliance, and uninterrupted employee benefits — all without setting up a German subsidiary. For companies managing global teams, this small document can save substantial cost and effort.

How PamGro Simplifies Global Compliance with the A1 Certificate

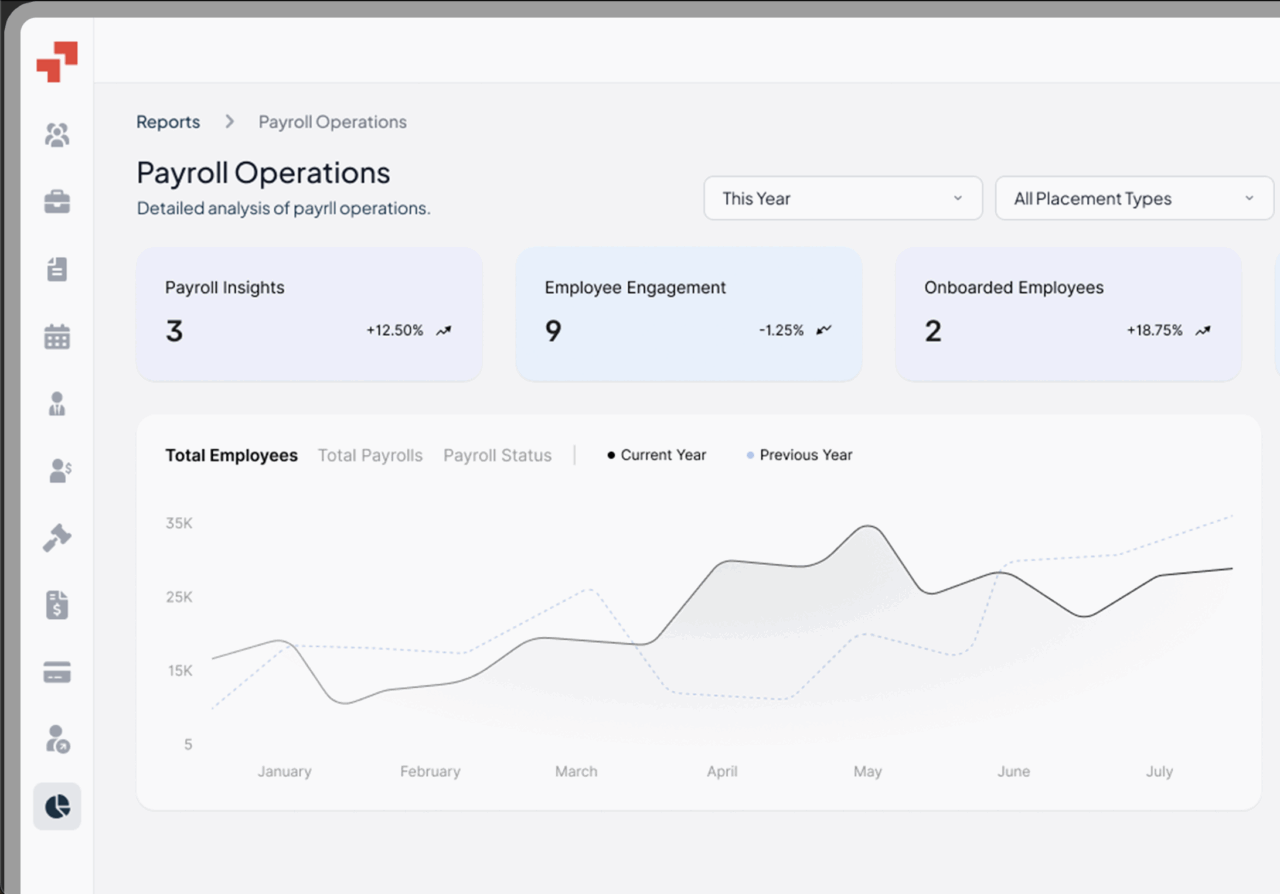

At PamGro, we help businesses expand internationally without the headaches of setting up entities or managing complex cross-border compliance. Our Employer of Record (EOR) services include complete handling of A1 Certificate processes on an all in one platform — from applications and renewals to compliance monitoring.

We coordinate with national authorities, ensure social security alignment, and integrate A1 coverage into broader payroll and benefits frameworks. Whether you’re sending employees on short-term EU assignments or managing distributed workforce across continents, PamGro makes it seamless.

Partner with PamGro to stay compliant, protect your workforce, and expand globally with confidence.

Frequently Asked Questions About the A1 Certificate

Typically up to 24 months, though this may vary by country. Extensions can be granted under specific conditions.

Yes, a separate certificate is generally needed for each defined period and destination.

You may face double contributions or fines from both the home and host country’s authorities

In some cases yes, but retroactive approval can complicate compliance. Apply before travel whenever possible.

No. For non-EU countries, a Certificate of Coverage under a bilateral agreement is required.

Hire the Best Talent, Anywhere