Global Workforce GlossaryEquity Compensation

Related Terms

Stock Grants

Equity Incentive Plan

Global Equity Program

Total Remuneration

Compensation Package

Equity compensation has become a key tool for companies to attract, retain, and motivate top talent, especially in the global workforce. Startups and high-growth companies often use equity instead of—or alongside—cash to reward employees, incentivize long-term commitment, and align individual performance with company success. Managing equity for international teams, however, comes with legal, tax, and compliance complexities. Companies need to carefully design equity plans to ensure fairness, tax efficiency, and alignment with long-term business goals

Table of Contents

- What is co-employment?

- What are co-employment laws?

- Why is co-employment a risk?

- What are co-employment rules

- Co-employment do’s and don’ts

- How does co-employment work?

- What is the difference between co-employment and joint employment?

- Co-employment vs PEO

- Co-employment vs employee leasing

- Is co-op considered a full-time employee?

- Is it illegal to work for two jobs in the same industry?

- Co-employment examples

- Practical Case Study Example

- PamGro and Co-employment: Your Global Partner

What is Equity Compensation?

Equity compensation is a way companies give employees partial ownership of the business through stock, stock options, or other equity instruments.

It aligns employee incentives with company growth, giving them a stake in long-term success. Equity compensation plans often complement cash salaries and benefits to create a more attractive total rewards package.

Companies structure equity based compensation differently based on employee role, seniority, and business stage. Startups frequently rely on equity as a primary incentive for early hires, while larger corporations may use it to supplement standard cash-based pay. Understanding global legal frameworks and taxation is essential when designing equity plans for international teams

How Does Equity Compensation Work?

Equity compensation works by granting employees rights to acquire company shares or benefit from company value appreciation. Common instruments include stock options, restricted stock units (RSUs), and employee stock purchase plans (ESPPs). Employees may receive equity upfront or vest it over time according to a schedule, typically to encourage retention.

When employees exercise stock options, they buy shares at a predetermined stock price (the “exercise price”). For RSUs, employees receive shares automatically upon meeting vesting requirements. Global employees may have unique tax obligations depending on the country of residence. Companies need to carefully structure equity grants to comply with local regulations and manage employee expectations.

Does Equity Compensation Count as Income?

Yes, equity compensation generally counts as taxable income. The timing and type of tax depend on the specific instrument and jurisdiction. For example, exercising stock options may trigger income tax, while RSUs are taxed when they vest. Certain plans, like incentive stock options (ISOs) in the U.S., may receive favorable tax treatment if specific conditions are met (IRS.gov).

Understanding the income implications is critical for both employers and employees. Mismanaging equity taxation can result in penalties, overpayment, or underpayment. Companies often work with HR and payroll professionals to ensure proper reporting, including fair market value assessments and withholding for global teams.

What is Internal Equity Compensation?

Internal equity compensation refers to structuring pay and equity to ensure fairness within an organization. It ensures employees with similar roles, experience, and contributions receive comparable rewards, reflecting the fair market value of their contribution . Internal equity promotes transparency, reduces turnover, and improves morale.

Companies often audit their equity compensation practices to align with internal benchmarks. For instance, executives in comparable positions across regions should receive similar total compensation, adjusted for local laws. Maintaining internal equity requires a clear understanding of market standards, job responsibilities, employee expectations, and the potential tax consequences of those equity compensation packages.

How Does Equity Compensation Work in a Private Company?

In private companies, equity compensation usually comes in the form of restricted stock awards, stock options, or RSUs that grant employees rights to buy or receive shares once the company achieves liquidity events, such as an acquisition or IPO. Unlike public companies, private company shares are not readily tradable, so employees benefit when the company’s valuation grows or when exit events occur.

Managing private company equity internationally can be challenging due to differing securities laws and reporting requirements. Companies often rely on legal and tax advisors to structure equity programs correctly, taking into account capital gains taxes, and communicate effectively with international employees.

What are the Types of Equity Compensation

Common types of equity compensation include, but are not limited to, those that are subject to ordinary income tax :

- Stock Options: Rights to buy company shares at a fixed price after a vesting period.

- Restricted Stock Units (RSUs): Shares granted upon meeting certain conditions, usually vesting over time.

- Employee Stock Purchase Plans (ESPPs): Employees purchase company stock at a discount.

- Performance Shares: Granted based on achieving specific company goals.

- Nonqualified Stock Options (NSOs): Stock options that don’t meet ISO criteria and are taxed differently (SHRM.org).

Choosing the right type depends on company stage, employee expectations, and local regulations. Proper planning ensures compliance and creates equity based compensation plans that effectively incentivize employees.

Is Equity Compensation Taxable?

Yes, equity compensation is generally subject to taxation. The exact treatment depends on the type of award and local laws, which may classify it as ordinary income . For instance:

- Stock Options: Taxable when exercised (NSOs) or upon sale (ISOs).

- RSUs: Taxable when shares vest.

- ESPPs: Taxable at purchase or sale, depending on plan design.

International employees may face both local income taxes and social security obligations. Companies must carefully calculate tax withholding and provide clear guidance to employees regarding the tax advantages and potential pitfall to avoid penalties or confusion

What are the Benefits of Equity Compensation?

The potential increase in the company’s stock price is one of the multiple benefits of equity compensation:

- Attracting talent: Helps companies compete for top-tier candidates without overextending cash resources.

- Retention: Vesting schedules incentivize employees to stay longer.

- Alignment: Employees have a vested interest in company success.

- Cost-effective: Reduces upfront cash outflow while maintaining competitive total compensation.

Equity compensation is particularly appealing for startups and fast-growing companies looking to motivate teams across multiple locations. Clear communication about non qualified stock options and proper administration are key to maximizing these benefits.

Equity vs. Cash Compensation — Which Is Better?

Equity compensation complements or, in some cases, replaces cash compensation. While cash offers immediate liquidity, equity provides potential future wealth and aligns employee interests with company growth. Many organizations use a blend of cash and equity awards to balance risk and reward.

Global hiring adds complexity to this equation, as equity instruments may have different tax and reporting implications across countries. Companies must design compensation packages that are fair, motivating, and legally compliant for all employees, regardless of location, including those that offer non cash pay options.

Pros and Cons of Equity Compensation

Pros:

- Encourages long-term commitment

- Aligns employees with company goals

- Reduces upfront cash expenditure

Cons:

- Can be complex to administer, especially internationally

- Subject to tax implications that may confuse employees

- Value is not guaranteed until a liquidity event occurs

Careful planning and professional guidance are key to mitigating risks and ensuring equity programs deliver the intended results.

Equity Compensation Examples

Example 1: Stock Options

An early employee in a startup receives 10,000 stock options at $1 per share. Options vest over four years. If the company grows to a valuation where the stock is $10 per share, the employee gains substantial financial benefit.

Example 2: RSUs

A multinational company grants RSUs to employees worldwide. The units vest annually, providing employees a steady stake in the company’s growth. Proper administration ensures employees understand vesting schedules, taxation, and value

Practical Case Study on Equity Compensation

A SaaS startup expanded its team across Europe and Asia, offering stock options to key employees. By carefully structuring the equity plans, working with international tax advisors, and maintaining clear communication, the company ensured compliance in multiple countries. Employees understood vesting schedules, exercised options correctly, and benefited from the company’s growth, while the business retained top talent without legal or tax complications.

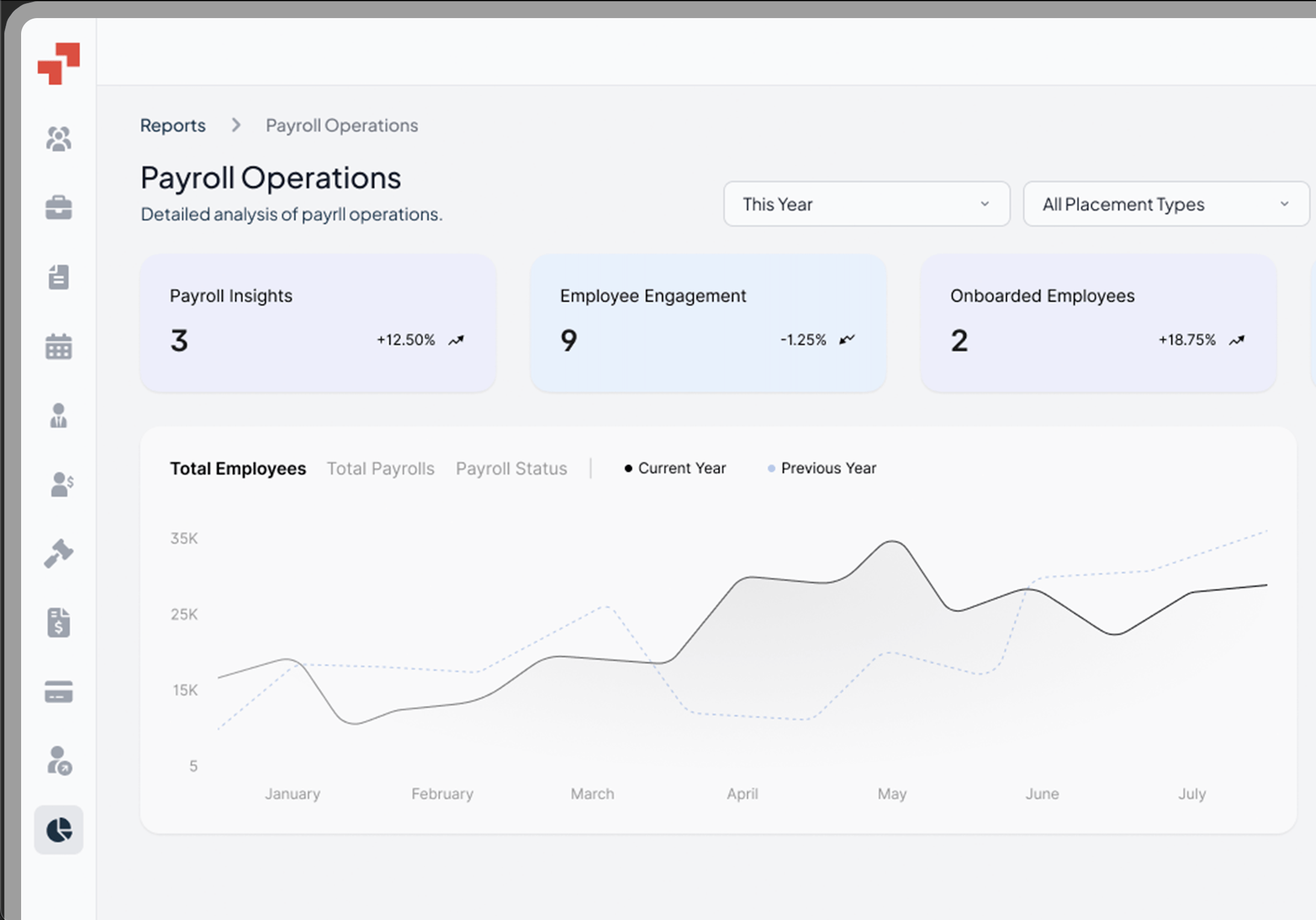

Simplify Global Hiring with PamGro

Expanding your team internationally comes with a host of challenges—compliance, payroll, taxes, and local employment laws can quickly become overwhelming. PamGro helps businesses navigate these complexities by providing a reliable Employer of Record (EOR) solution. Whether you’re hiring across Europe, Asia, or the Americas, our services ensure your global workforce is compliant, paid accurately, and managed efficiently.

Beyond payroll and compliance, PamGro enables companies to focus on growth while providing employees with a seamless onboarding experience and consistent benefits across countries. By leveraging our expertise, organizations can confidently scale their operations internationally without the need to establish local entities or navigate complicated legal frameworks.

Ready to streamline your global hiring? Discover how PamGro can help your business expand internationally today.

FAQs about Employee Equity Compensation

Usually not. Equity often vests over time and may require a liquidity event to convert to cash.

Rarely. Most employees expect a base salary for living expenses, with equity as supplemental compensation.

Employers must report equity as income in accordance with local and federal tax laws. Proper guidance helps employees comply and avoid unexpected liabilities.

Hire the Best Talent, Anywhere