Global Workforce GlossaryPayroll Compliance

Managing payroll is more than just paying employees—it’s about ensuring accuracy, fairness, and compliance with ever-changing laws. Payroll compliance helps businesses navigate complex tax regulations, benefits administration, and labor rules without risking penalties. By prioritizing compliance, companies can focus on growth while keeping their workforce confident and satisfied.

Table of Contents

- What is Payroll Compliance?

- What is a Payroll Compliance Audit?

- What are Payroll Compliance Services?

- Payroll Compliance: Laws, Importance, and Best Practices

- Payroll Compliance Checklist

- Who is a Payroll Compliance Practitioner?

- What Does a Payroll Compliance Practitioner Do?

- What is the Difference Between Payroll Compliance Analyst and Payroll Compliance Practitioner?

- How Do You Ensure Payroll Compliance?

- Example Explaining Payroll Compliance

- How PamGro Helps with Payroll Compliance

- Frequently Asked Questions on Payroll Compliance

What is Payroll Compliance?

Payroll compliance refers to adhering to all federal, state, and local laws regarding employee compensation, deductions, and reporting.

This includes payroll taxes, benefits administration, employee classifications, and regulations like the Federal Insurance Contributions Act (FICA) and Equal Pay Act. Employers must ensure that their payroll practices are compliant with the Fair Labor Standards Act (FLSA). Ensuring payroll compliance prevents legal risks, financial penalties, and reputational damage.

Maintaining payroll compliance means using proper payroll software provided by experienced payroll providers, correctly classifying employees, timely tax filings, and meeting benefits obligations. Employers are responsible for accurately withholding federal income taxes from employees’ wages according to guidelines provided by the IRS. Companies that ignore compliance may face audits, fines, and employee disputes. A strong payroll compliance program ensures fairness, accuracy, and transparency in payroll processes, giving employers peace of mind while supporting business growth.

What is a Payroll Compliance Audit?

A payroll compliance audit is a systematic review of a company’s payroll processes, ensuring all payroll taxes, tax obligations deductions, and employee classifications comply with applicable laws. FICA taxes total 15.3%, with employees paying 1.45% for Medicare and 6.2% for Social Security, while employers match these contributions.

During an audit, auditors verify that payroll calculations are accurate, minimum wage requirements are met, overtime pay is properly paid, FICA contributions are correctly withheld, and benefits are correctly administered. Misclassifying employees and independent contractors can lead to fines, back taxes, and legal trouble. Payroll audits help identify misclassifying employees, underpayment issues, or gaps in payroll reporting, which can prevent costly penalties. Regular audits also highlight areas for process improvement and compliance automation.

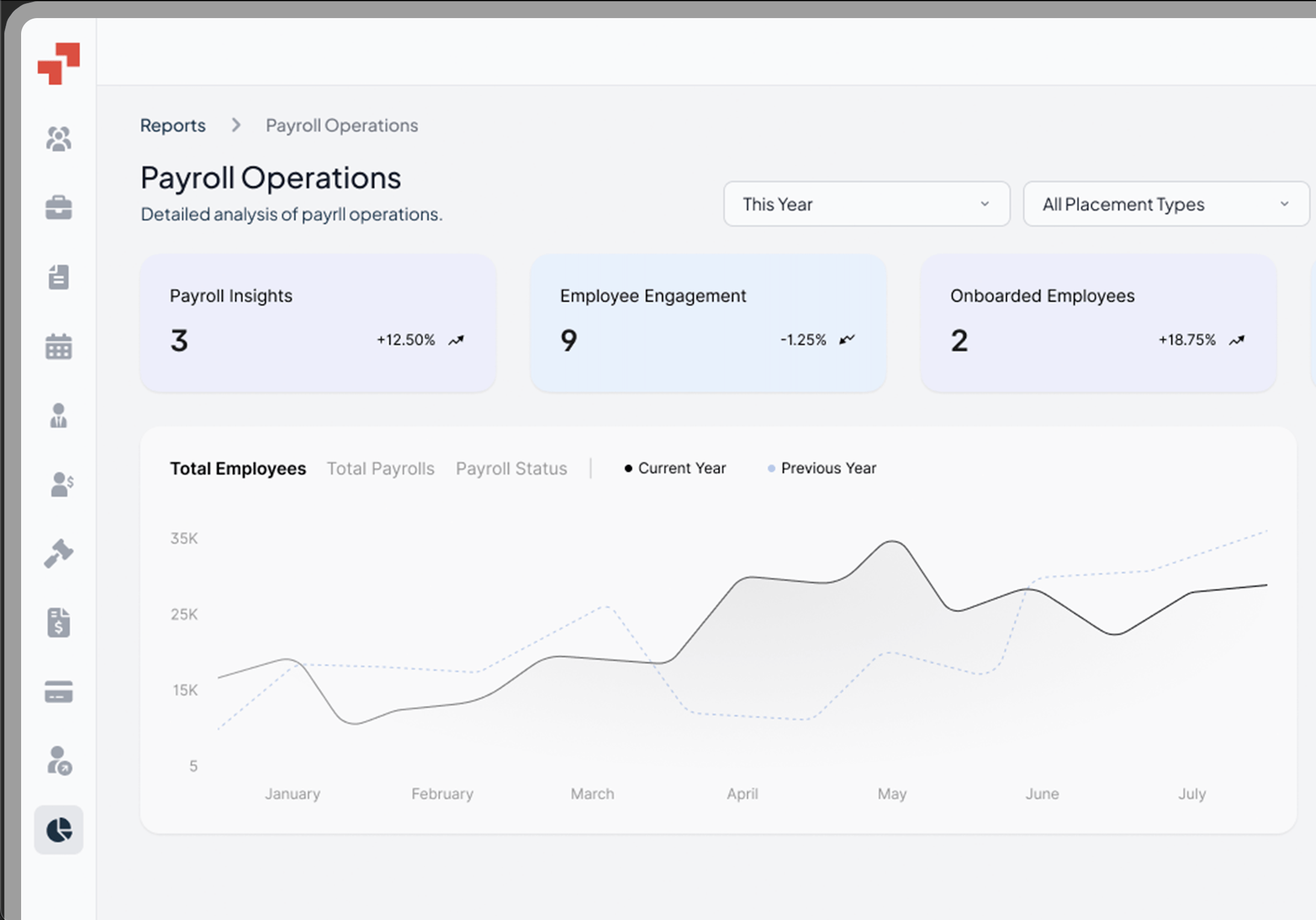

Proactive payroll audits can be integrated with PamGro’s payroll services, helping companies maintain global payroll compliance without overburdening internal teams. Automated reminders, reporting dashboards, and risk assessments are commonly used tools to ensure accuracy.

What are Payroll Compliance Services?

Payroll compliance services help businesses manage payroll processes and employee benefits while adhering to federal and local regulations. These services often include payroll processing, tax filing, benefits administration, employee classification review, and adherence to payroll regulations reporting assistance. Using payroll compliance software automates calculations, tax withholdings, and benefits deductions, significantly reducing the risk of human error.

Companies leveraging payroll compliance services, like PamGro, reduce risks of misclassifying employees or missing critical payroll deadlines by ensuring timely communications with tax authorities . They gain access to specialized expertise, automated tools, and real-time guidance on regulatory updates. For businesses expanding internationally, these services simplify compliance across jurisdictions, ensuring correct tax contributions and proper local benefits administration.

Payroll Compliance: Laws, Importance, and Best Practices

Payroll compliance laws include federal, state, and local regulations governing employee compensation, payroll taxes, overtime, and benefits. Examples include the Federal Insurance Contributions Act (FICA) and Equal Pay Act.

The importance of payroll compliance lies in reducing legal exposure, ensuring fair pay in accordance with federal law, and maintaining employee trust. Consulting with payroll specialists or employment law attorneys can aid businesses in navigating complex compliance issues. Best practices include:

- Accurate employee classification

- Timely payroll tax deposits

- Using certified payroll software

- Documenting payroll policies and updates

- Conducting regular internal audits

- Leveraging expert payroll services for complex operations

Organizations that ignore payroll laws, including relevant state laws, risk fines, audits, and low employee morale. Integrating compliance into every payroll cycle ensures smooth operations and mitigates potential risks.

Source:

Payroll Compliance Checklist

A comprehensive payroll compliance checklist includes:

- Verifying employee classifications

- Calculating payroll taxes accurately (FICA, federal, and state)

- Ensuring overtime and equal pay compliance

- Tracking paid leave and benefits administration

- Maintaining payroll records for at least 3–7 years

- Filing timely payroll tax returns

- Conducting periodic payroll audits

- Keeping up with new payroll laws and regulations

- Ensuring employee data security

- Training HR and finance teams on compliance updates

- Implementing a system to flag potential misclassification or benefits errors

Using this checklist reduces errors, improves reporting, and ensures that companies meet all regulatory requirements efficiently.

Who is a Payroll Compliance Practitioner?

A payroll compliance practitioner is a professional responsible for ensuring that a company’s payroll processes follow all applicable laws and regulations. They are skilled in payroll processing, tax filing, benefits administration, and employee classification compliance.

These practitioners act as internal experts, advising management on potential compliance risks, implementing payroll policies, and conducting audits. They also help companies understand multi-country payroll requirements, making them especially valuable for international expansion.

What Does a Payroll Compliance Practitioner Do?

A payroll compliance practitioner oversees all aspects of payroll to maintain legal and regulatory compliance. Their responsibilities include:

- Ensuring proper employee classification

- Overseeing payroll tax calculations and filings

- Monitoring overtime, leave, and benefits compliance

- Conducting payroll audits and risk assessments

- Advising on payroll software implementation and process improvements

Employee misclassification occurs when a worker is incorrectly labeled as an independent contractor instead of an employee or vice versa.

- Ensuring proper employee classification

- Overseeing payroll tax calculations and filings

- Monitoring overtime, leave, and benefits compliance

- Conducting payroll audits and risk assessments

- Advising on payroll software implementation and process improvements

They may also train teams and provide guidance on emerging payroll laws, ensuring organizations stay ahead of compliance risks. Using their expertise can prevent penalties and protect a company’s reputation.

What is the Difference Between a Payroll Compliance Analyst and Payroll Compliance Practitioner?

A payroll compliance analyst primarily focuses on reviewing and analyzing payroll data to identify discrepancies, errors, or potential compliance gaps and risks. Their role is largely investigative, reporting findings to management.

A payroll compliance practitioner, however, has a broader scope, including implementing compliance policies, managing payroll processes, and ensuring adherence to employment laws like the FICA, Equal Pay Act, or regulations set by the equal employment opportunity commission. While analysts highlight risks, practitioners resolve them and maintain ongoing compliance.

How Do You Ensure Payroll Compliance?

Ensuring payroll compliance requires a combination of process, technology, and expertise:

- Use automated payroll software to calculate taxes and benefits accurately.

- Conduct regular internal payroll audits to detect errors early.

- Keep up-to-date with payroll compliance laws at federal, state, and local levels.

- Properly classify employees to avoid misclassification penalties.

- Train HR and finance teams on compliance best practices.

- Consider leveraging payroll compliance services from experts like PamGro to handle complex multi-country requirements.

Developing a compliance calendar helps businesses meet important deadlines for tax filings and payments.

- Use automated payroll software to calculate taxes and benefits accurately.

- Conduct regular internal payroll audits to detect errors early.

- Keep up-to-date with payroll compliance laws at federal, state, and local levels.

- Properly classify employees to avoid misclassification penalties.

- Train HR and finance teams on compliance best practices.

- Consider leveraging payroll compliance services from experts like PamGro to handle complex multi-country requirements.

Additional strategies include:

- Implementing a centralized payroll system for multi-country operations

- Using compliance dashboards to monitor tax deadlines and filings

- Regularly reviewing benefits administration practices to ensure accuracy

Proactive monitoring and continuous improvement are key to mitigating risks and ensuring compliance across all payroll activities.

Example Explaining Payroll Compliance

Scenario:

A U.S.-based SaaS startup hires remote employees in multiple states and internationally. Without proper payroll compliance, they risk misclassifying employees, underpaying taxes, and violating local labor laws and wage laws .

Solution:

By implementing a payroll compliance framework and leveraging PamGro’s EOR services, the company automates tax filings, ensures proper employee classification, and provides accurate benefits administration. Payroll audits detect minor discrepancies before they escalate.

Outcome:

The startup maintains compliance across jurisdictions, avoids penalties from government agencies , reduces administrative burden, and ensures employees are paid accurately and on time.

How PamGro Helps with Payroll Compliance

PamGro simplifies payroll compliance for companies expanding globally:

- Handles payroll processing, tax filings, and benefits administration across multiple countries

- Ensures accurate employee classification and adherence to Equal Pay Act regulations

- Provides payroll audits, checklists, and practitioner support

- Integrates payroll software solutions with real-time compliance updates

- Offers multi-country payroll management for international expansion

By partnering with PamGro, businesses focus on growth while leaving compliance complexities to experts.

Frequently Asked Questions on Payroll Compliance

Non-compliance can result in fines, penalties, legal disputes, and reputational damage. In severe cases, executives may face personal liability. Penalties for payroll non-compliance can include fines, back payments, and even legal action against the employer.

Audits should ideally be conducted quarterly or at least annually, depending on company size and risk profile.

Yes, with proper payroll software, expertise, and training, small businesses can manage compliance internally. However, outsourcing to a trusted provider reduces risk and administrative burden.

Misclassification can lead to underpayment of taxes, missed benefits, and potential legal penalties. Proper classification is critical for accurate payroll processing.

Automated payroll software, compliance checklists, and professional services like PamGro streamline adherence to payroll laws and reduce errors

Accurate and timely payroll builds trust, ensures fair compensation, and improves morale. Missteps can lead to disputes and lower engagement.

Hire the Best Talent, Anywhere