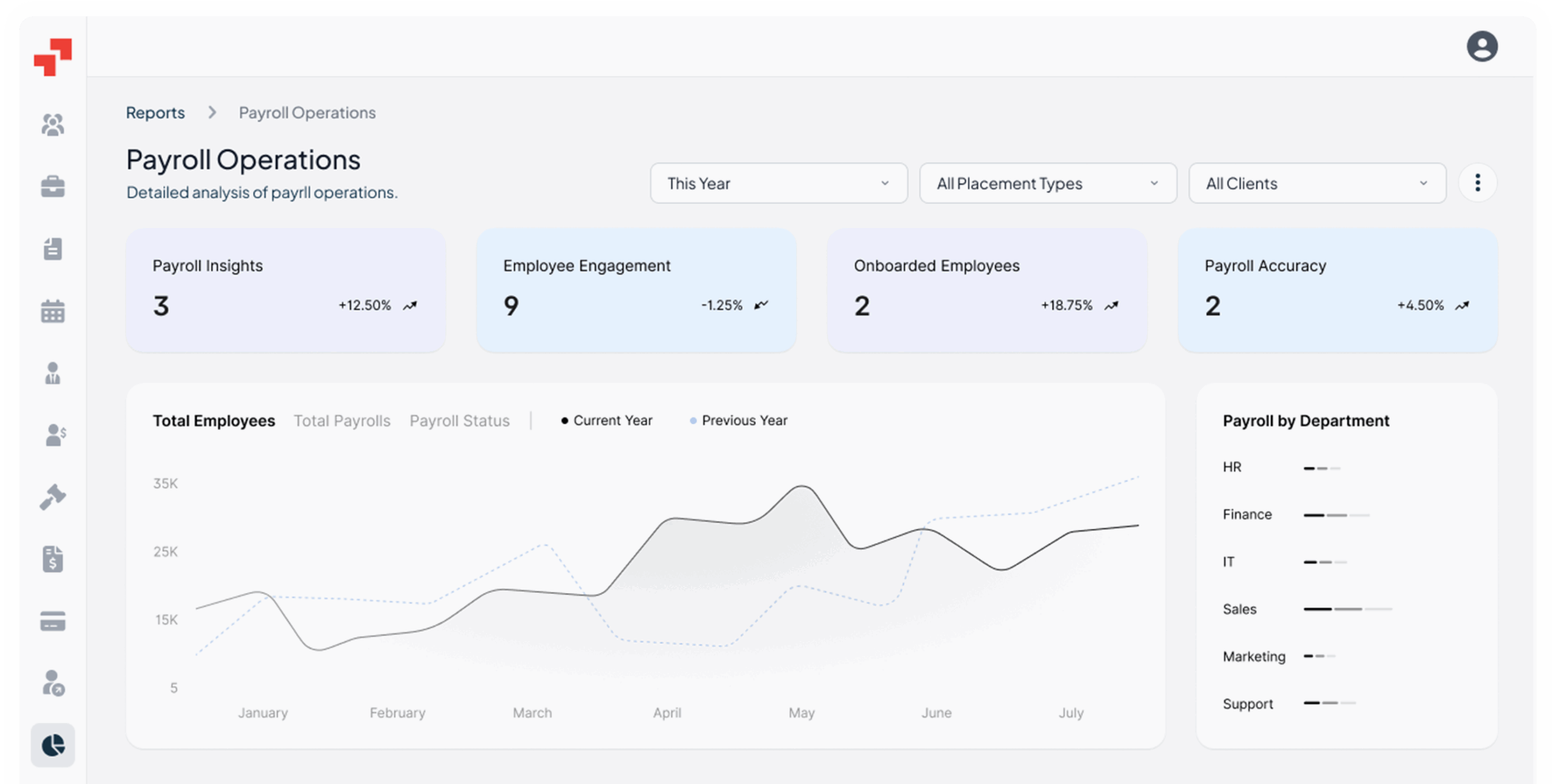

True Cost of Employee Calculator - Canada [2026]

Estimate the real cost of hiring in Canada – Use our free true cost to hire calculator to determine all employment-related expenses in just a few clicks.

What is an Employee Cost Calculator Canada?

The employee cost calculator Canada is a powerful tool that helps employers estimate the true cost of hiring in any Canadian province. It goes beyond the base salary to include all mandatory employer contributions such as CPP, Employment Insurance (EI), workers’ compensation, and health taxes. The calculation covers employee costs, gross pay, and total compensation, ensuring employers have an accurate estimate.

Whether you’re hiring a full-time employee in Ontario or a contractor in British Columbia, this calculator provides a real-time, province-specific cost breakdown based on your selected pay frequency.

From payroll deductions to compliance costs, including certain costs that are compulsory or unavoidable expenses mandated by regulatory organizations, it simplifies complex Canadian employment laws, giving you a clear picture of the true cost of employee calculator Canada.

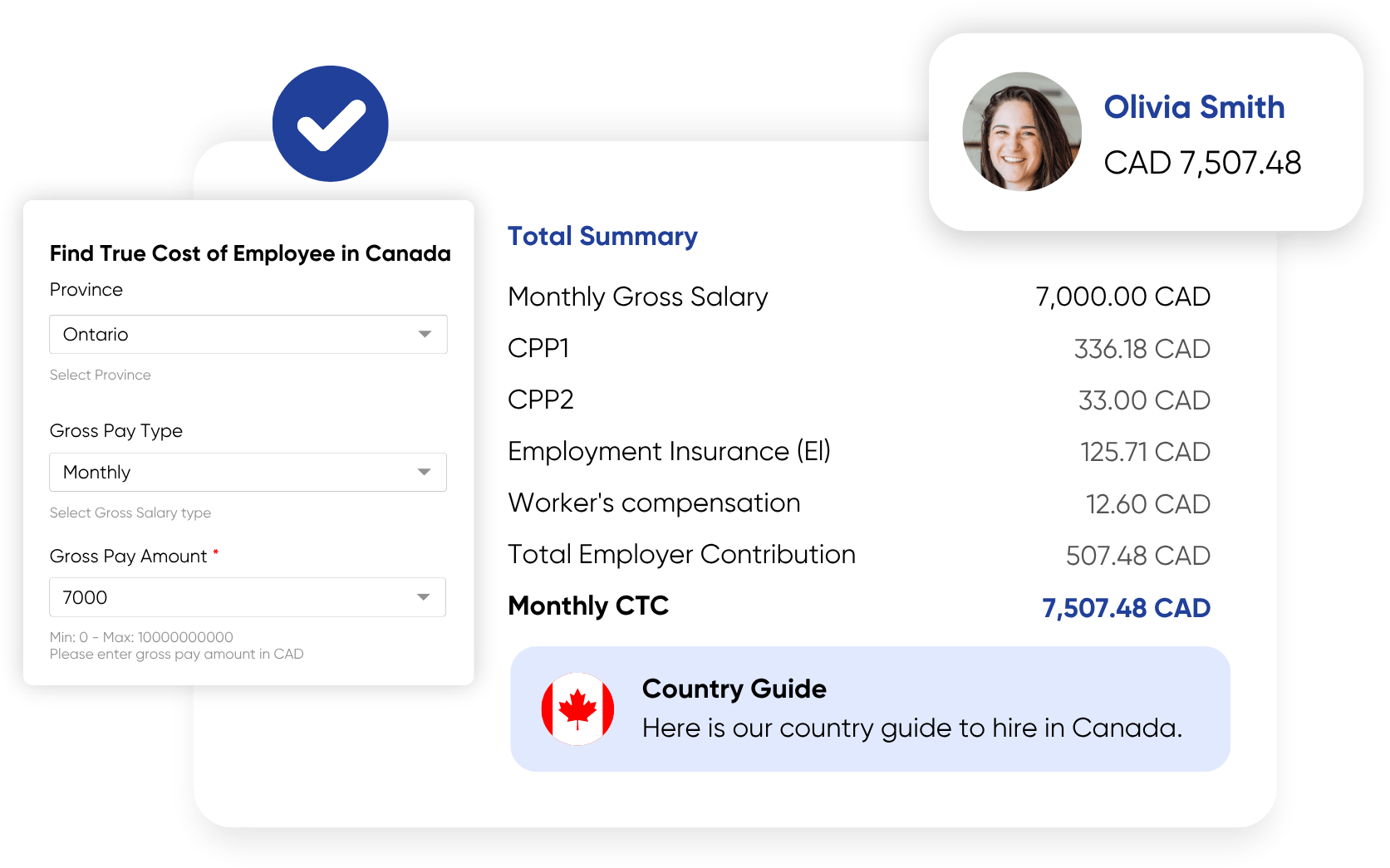

How to Use the Cost-to-Hire Calculator in Canada: Step-by-Step

Using the Canada Cost Calculator is quick and easy. Follow these steps to get an accurate estimate:

- Select the Province – Choose the province where your employee will be working.

- Select Gross Pay Type – Choose Hourly, Daily, Weekly, Biweekly, Monthly, or Annually.

- Enter the Employee’s Salary – Input the employee’s salary or wage rate you plan to offer as part of the calculation.

- Enter Your Details – Provide your Name, Phone Number, and Email Address to receive a personalized cost breakdown.

- Click Calculate – Get a detailed breakdown including:

- Monthly Gross Salary

- CPP1 & CPP2 Contributions

- Employment Insurance (EI)

- Workers’ Compensation (WSIB/WCB)

- Total Employer Contribution

- Monthly Cost to Company (CTC)

Note: This tool allows real-time estimates monthly or annually. Select your desired cycle and see instant results.

Factors Affecting Employee Costs

Employee costs in Canada can vary significantly depending on several key factors. The location where your business operates plays a major role—urban centers often come with higher expenses for office space and commuting, while rural areas may offer more cost-effective solutions. Industry standards also influence costs, as some sectors require employers to provide comprehensive health insurance or additional benefits, while others may offer more basic packages.

Company size is another important consideration. Larger companies may benefit from economies of scale but could also face higher payroll and administrative costs. Employer contributions, such as Canada Pension Plan (CPP) and Employment Insurance (EI) premiums, are mandatory and can impact your overall budgeting. Market conditions and the specific role you’re hiring for will also affect salary expectations and related expenses.

To accurately determine these costs, employers can use a payroll deductions online calculator. This tool helps businesses estimate payroll deductions, employer contributions, and other employment-related expenses, making it easier to plan and budget for new hires. By understanding these factors, employers can make informed decisions and ensure their employment costs align with their business goals.

Overview of Employment Costs in Canada (2026 – Ontario Example)

Are you hiring in Ontario or elsewhere in Canada? Here’s what you need to factor in beyond gross salary:

| Cost Type | Amount (CAD) | % of Gross Salary |

|---|---|---|

| Gross Salary | $5,000 | – |

| CPP Employer Share | $304.35 | ~5.45% |

| EI Employer Share | $126.00 | ~2.3% |

| Workers’ Compensation (WSIB)* | $60 | ~1.2% (industry-based) |

| Employer Health Tax (EHT)** | $97.50 | ~1.95% |

| Total Employer Cost | $5,587.85 | ~11.75% extra |

The total employer cost is the sum of gross salary, employer contributions, and other mandatory expenses.

WSIB rates depend on industry classification. EHT applicable only if total payroll exceeds provincial threshold. Ontario: $1M

Source: Government of Canada (CRA, WSIB), Ontario Ministry of Finance. Updated for 2025.

Breakdown of Employer Costs in Canada

- CPP Contributions – 5.95% (up to $3,867.50 annually per employee)

- EI Contributions – 1.66% for employees / 2.324% for employers (max employer share: $1,245.36)

- Social security contributions, which include CPP and EI, are a key part of mandatory government programs such as healthcare, retirement, and unemployment, and are automatically calculated as part of total employee costs.

- Workers’ Compensation – Varies by province and industry (ranges from 0.2% to 3.2%)

- Employer Health Tax – Varies by province; Ontario charges 1.95% for large employers

- Total Employer Liability: On average, employers in Canada contribute 10% to 15% above gross salary in mandatory employment costs.

Additional Costs to Consider

Beyond statutory costs, Canadian employers may need to cover:

- Paid Vacation – Minimum 2 weeks, often 3–5 depending on tenure or industry.

- Public Holiday Pay – Based on 9–12 national/provincial holidays.

- Benefits & Insurance – Health, dental, vision (typically $3,000–$6,000/year per employee)

- Training & Development – 1% to 4% of payroll.

- Office Setup or Remote Allowances

All these items contribute to the overall expense of employing staff in Canada.

Example: Employment Costs for a $7,000 Monthly Salary in Ontario (2026)

| Cost Type | Amount (CAD) | % of Gross Salary |

|---|---|---|

| Gross Monthly Salary | $7,000 | – |

| CPP Employer Share | $304.35 | 4.35% |

| EI Employer Share | $126.00 | 1.8% |

| Workers’ Compensation (IT) | $84 | 1.2% |

| Employer Health Tax (EHT) | $136.50 | 1.95% |

| Total Employer Cost | $7,650.85 | +9.3% |

How to Hire Employees in Canada Without Setting Up a Local Entity

Setting up a legal entity in Canada requires CRA registration, payroll account setup, provincial registrations, and adherence to various labour laws. The process is time-consuming, complex, and costly.

With PamGro’s Employer of Record (EOR) services, you can:

- Hire employees across Canada without opening a local entity

- Get complete payroll and compliance support

- Avoid CRA, WSIB, and provincial registrations

PamGro’s EOR services also streamline the process of hiring and onboarding a new employee in Canada.

Cost Comparison: Setting Up an Entity vs. Using PamGro’s EOR

| Factor | Setting Up a Legal Entity | Using PamGro’s EOR |

|---|---|---|

| Initial Setup Time | 4–6 weeks | 7 Days |

| CRA/WSIB/Provincial Setup | Mandatory | Not Required |

| Payroll and Compliance | Handled internally | 100% managed |

| Legal & Admin Costs | High | Flat service fee |

PamGro’s EOR simplifies Canadian hiring. Just onboard, set salary, and we take care of the rest. Understanding all associated fees, including compulsory and service fees, is essential for accurate budgeting and cost assessment.

Cost Calculator Benefits

Using a cost calculator provides businesses with a clear and accurate picture of employee costs, enabling smarter budgeting and hiring decisions. By factoring in gross annual pay, payroll taxes, mandatory contributions, and overhead expenses, the calculator reveals the true cost of an employee—not just their salary, but the total annual cost to your company.

This comprehensive approach helps employers determine all relevant expenses, including employer contributions to government programs, benefits, and other overheads. With these detailed estimates, businesses can plan for new hires, manage payroll, and control costs more effectively. The cost calculator is especially useful for comparing different hiring scenarios, ensuring you make informed, cost-effective decisions that support your company’s growth.

Why PamGro’s EOR for Hiring in Canada?

- No registration delays

- Fully compliant with federal & provincial tax laws

- One-click payroll processing

- Localized employment contracts

Using PamGro’s EOR helps reduce the risk of non-compliance and unexpected costs when hiring in Canada.

FAQs

1. What are the mandatory employer contributions in Canada?

Employers must contribute to CPP, EI, Workers’ Comp, and Health Tax (if applicable).

2. How is CPP calculated?

Employers contribute 5.95% (2025 rate) on earnings between $3,500 and ~$68,500 (max $3,867.50).

Note: Gross wages are a key component of employee cost calculations, and the calculator uses up to date rates to ensure accuracy in cost estimates.

3. Are workers’ comp rates fixed across Canada?

No. Each province and industry has different rates. For IT in Ontario, the average is ~1.2%.

4. What is the Employer Health Tax (EHT)?

Ontario levies EHT of 1.95% on businesses with payroll above $1M annually. Other provinces have similar rules.

5. What is the total employer cost over salary?

On average, expect to pay 10% to 15% extra over the gross salary depending on region and role.

Note: This estimate includes gross wages and mandatory contributions. Costs may increase when hiring new employees due to onboarding and training expenses.

6. How does PamGro help with hiring in Canada?

PamGro acts as your EOR partner, managing payroll, contracts, compliance, and tax filings on your behalf.

7. How much does it cost to hire an employee in Canada in 2025?

Expect to pay 10% to 15% over the gross salary. This includes CPP, EI, workers’ compensation, and, in some provinces, health taxes.

Hiring new employees can increase costs due to onboarding and training.

8. What’s included in the total cost to company in Canada?

Besides base salary, employers must factor in CPP/QPP, EI, WCB/WSIB, vacation pay, statutory holiday pay, and benefits.

9. Do employee costs vary between provinces like Ontario and Quebec?

Yes. Quebec has QPP instead of CPP, different EI rates, and unique payroll taxes like the CNESST. Use a true cost of employee calculator Canada to compare.

Employee costs can vary depending on province, industry, and company policies.

10. Can I calculate contractor vs. employee costs using the same tool?

Yes. The employee cost calculator Canada works for both structures by adjusting based on pay type and frequency, hourly, monthly, or annual.

Costs may also vary depending on the employment structure and benefits provided.

11. Can PamGro help if I don’t want to set up a Canadian entity?

Yes. PamGro acts as your EOR in Canada, handling payroll, taxes, and compliance — so you can hire quickly without opening a local branch.

12. What should I consider when expanding into a new country?

Expanding into a new country involves additional complexities and cost considerations, such as compliance with local laws, payroll setup, and managing new employee onboarding in a foreign market.

Note: For specific payroll, tax, or legal questions, it is recommended to consult a professional advisor, as this tool provides estimates and general guidance only.

All-in-One Global Workforce Platform.

Manage global hiring, compliance, and payments with a single platform built for clients, contractors.

The Hidden Cost in Your Canadian Hiring Budget—Is It Cause for Concern?

Employee Cost Calculator: Frequently Asked Questions (FAQs)

Ans: Employer costs in Australia typically include:

- Superannuation contributions (mandatory employer retirement contributions).

- Payroll tax (varies by state or territory).

- Workers’ compensation insurance.

- Other employment benefits such as annual leave, sick leave, and parental leave (if applicable).

Ans: Employment tax is calculated based on:

- The gross salary of the employee.

- Mandatory superannuation contributions (currently 11% of gross salary in 2025).

State-based payroll tax varies depending on the employer’s annual payroll threshold and state-specific rates.

Ans: Yes, employers are required to contribute to employees’ superannuation at a minimum rate of 11% of their gross salary (as of 2025). This contribution is mandatory for all employees earning over $450 in a calendar month.

Ans: On average, employers can expect to pay an additional 15%–20% of an employee’s gross salary. This includes superannuation, payroll tax (varies by state), and workers’ compensation insurance.

Ans: No, health insurance is not a mandatory cost for employers. However, many employers offer private health insurance as part of employee benefits packages to attract talent.

Ans: Yes, employment costs may vary depending on the type of contract:

- Full-time/part-time employees: Employers must pay superannuation, leave entitlements, and other benefits.

- Casual employees: No leave entitlements, but casual loading (typically 25%) applies.

Contractors: Employment costs are generally lower as contractors are responsible for their taxes and superannuation unless deemed an employee under Australian law.

Ans: Yes, the Australian government offers tax incentives, such as:

- JobMaker Hiring Credits for hiring eligible young workers.

- Research and Development (R&D) Tax Incentives for innovation-focused businesses.

- Payroll tax rebates in certain states for hiring apprentices or trainees.

Ans: Australia’s employment costs are higher compared to many Asian countries but lower than in countries like the United States and some European nations due to its relatively straightforward taxation system and competitive superannuation rates.

Ans: The calculator estimates the total employment costs, including:

- Gross salary.

- Superannuation contributions.

- Payroll tax.

- Workers’ compensation insurance.

- Other relevant benefits or statutory costs.

Ans: Yes, the true cost of employee calculator provides an estimate of workers’ compensation costs, which vary by industry and state, helping employers plan accordingly.

Ans: Yes, the total employment cost calculator factors in all direct and indirect costs, giving a clear picture of the total cost of employing an individual.

Ans: Small businesses can use the calculator to:

- Estimate annual employment costs.

- Budget for new hires.

- Evaluate the financial viability of expanding their workforce.

Ans: While the cost per employee calculator doesn’t directly suggest cost-saving measures, it provides transparency into labour cost components. Employers can use this information to optimize benefits, payroll structures, or tax strategies.